- Home

- »

- Electronic & Electrical

- »

-

Electric Iron Market Size, Share And Growth Report, 2030GVR Report cover

![Electric Iron Market Size, Share & Trends Report]()

Electric Iron Market Size, Share & Trends Analysis Report By Function (Automatic, Non-Automatic), By Product, By Application, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-195-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Electric Iron Market Size & Trends

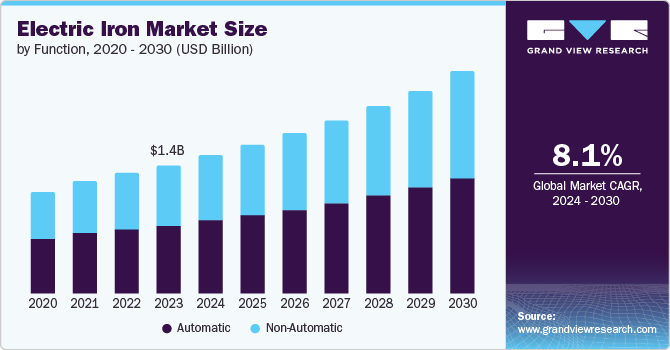

The global electric iron market size was valued at USD 1.36 billion in 2023 and is projected to grow at a CAGR of 8.1% from 2024 to 2030. Ironed clothes make one look smarter and leave a better impression. The use of ironing extends the life of the fabric over time as it prevents the clothes from fraying. Furthermore, it is much better than the alternative to dry cleaning, which uses harmful chemical perchloroethylene. Ironing helps in removing the smell of bleach from the clothes. Furthermore, technological advancements in irons, such as steam and cordless options, along with a wider product range, attract diverse consumers. Expanding electricity access in developing regions and the growth of e-commerce further boost market potential.

People are becoming more conscious about personal grooming and appearance, leading to a higher demand for irons. Individuals are increasingly aware of the importance of looking well-dressed, which often necessitates the use of an iron to maintain wrinkle-free clothing. With rising awareness about the environmental impact of dry cleaning chemicals and the cost associated with it, many consumers prefer home laundering solutions that include ironing their clothes at home using electric irons.

Continuous innovations in electric iron technology, such as steam generation capabilities, energy efficiency features, and smart heating functions, have made these appliances more appealing to consumers. Modern steam irons can remove wrinkles quickly and efficiently, enhancing user convenience and satisfaction. Online platforms have made electric irons more accessible, contributing to market growth. As people have more money to spend, they are willing to invest in better quality and more convenient appliances such as electric irons.

Function Insights

The automatic segment accounted for the largest market revenue share of 53.1% in 2023. Automatic irons often feature smart sensors that adjust temperature settings based on fabric type, reducing the risk of burns or damage to clothing. In addition, many models come equipped with self-cleaning functions and anti-drip systems, which not only improve performance but also extend the lifespan of the appliance. The growing trend towards smart home devices has further propelled this segment, as consumers seek integrated solutions that offer ease of use and energy efficiency. As lifestyles become busier, the appeal of automatic features that save time and effort continues to drive market growth.

The non-automatic segment is expected to register the fastest CAGR of 8.4% during the forecast period due to their affordability and simplicity. Many consumers still prefer traditional electric irons for their straightforward functionality without the complexities associated with automated features. This segment appeals particularly to budget-conscious buyers who prioritize cost-effectiveness over advanced technology.

Product Insights

The steam segment dominated the market with 54.2% of revenue share in 2023. This is due to its efficiency and effectiveness in removing wrinkles from fabrics. Steam irons utilize water vapor to penetrate fabric fibers, making it easier to smooth out creases compared to traditional dry irons. This functionality appeals particularly to consumers who prioritize convenience and time-saving solutions in their daily routines. Furthermore, innovations such as vertical steaming capabilities and advanced temperature controls have enhanced user experience, making steam irons more appealing for both domestic use and professional settings.

The dry segment is anticipated to witness a significant CAGR of 8.5% over the forecast period. This is due to its simplicity, affordability, and reliability. Many consumers appreciate the straightforward design of dry irons, which often come at a lower price point compared to their steam counterparts. This makes them an attractive option for budget-conscious buyers or those who do not require the additional features. Moreover, dry irons are favored for their lightweight nature and ease of use, particularly among individuals who may find handling heavier appliances difficult.

Application Insights

The commercial segment accounted for the largest market revenue share of 54.9% in 2023 due to the expansion of the laundry and hospitality industries. Hotels, dry cleaners, and commercial laundries rely on efficient and durable irons to handle large volumes of garments. The need for consistent quality and speed in these sectors drives the demand for high-performance commercial irons. Moreover, the increasing popularity of online laundry and dry cleaning services is contributing to the market's expansion as these businesses require reliable ironing equipment to meet customer expectations.

The residential segment is expected to register the fastest CAGR of 8.3% during the forecast period. The growth is driven by the increasing emphasis on personal grooming and maintaining a professional appearance. Rising disposable incomes, coupled with the growing nuclear family structure, have led to increased demand for efficient household appliances. The preference for ready-to-wear clothing, while requiring less ironing overall, has also contributed to market growth as consumers often need to touch up wrinkles.

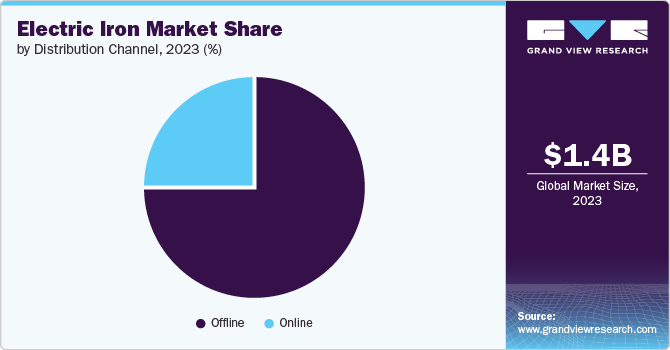

Distribution Channel Insights

The offline segment dominated the market having 75.1% share in 2023. This is due to the tangible product experience it offers customers. Physical stores provide opportunities for customers to examine product features, compare different models, and seek sales assistance. The widespread availability of electric irons in traditional retail outlets, such as electronics stores, department stores, and general merchandise stores, ensures easy accessibility for a broad consumer base.

The online segment is projected to grow at fastest CAGR of 9.4% over the forecast period driven by the increasing adoption of e-commerce and the convenience it offers. Online platforms provide a vast selection of products, detailed product descriptions, customer reviews, and competitive pricing, empowering consumers to make informed purchasing decisions. In addition, the ability to purchase electric irons from the comfort of their homes, often with faster delivery options, has attracted a growing number of online shoppers.

Regional Insights

North America electric iron market was identified as a lucrative region in 2023 due to factors such as high disposable income, a burgeoning fashion industry, and a focus on maintaining a professional appearance.

U.S. Electric Iron Market Trends

The electric iron market in the U.S. held a significant market share in 2023 due tothe rising awareness about personal grooming and presentation among consumers. The country's diverse population with varying fashion preferences and lifestyles drives demand for a wide range of electric iron models.

Europe Electric Iron Market Trends

Europe market is anticipated to witness significant growth during the forecast period due to the rising consumer demand for home appliances that enhance convenience and efficiency in household chores. Another contributing factor to the growth is individuals prioritizing well-pressed clothing as an essential aspect of their daily lives.

The UK electric iron market is expected to grow rapidly in the coming years due to growing awareness about fashion and personal presentation, leading individuals to prioritize well-ironed clothing as an essential aspect of their daily lives.

Asia Pacific Electric Iron Market Trends

Asia Pacificelectric iron market dominated with 31.9% market share in 2023. This growth is attributed to the rapid urbanization and rising disposable income in countries such as India, China, and South Korea. Furthermore, the focus on personal grooming and a shift towards formal attire in many Asian countries are driving the adoption of electric irons.

The significant market share of electric iron in China in 2023 can be attributed to the rapidly increasing population with a growing middle class and changing lifestyles.

Key Electric Iron Company Insights

Some of the key companies in the electric iron market include Bajaj Electricals Ltd, BSH Hausgeräte GmbH, Crompton Greaves Consumer Electricals Limited, and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry.

- Bajaj Electricals Ltd is a prominent company specializing in consumer appliances and lighting solutions. The company’s operations are divided into two main segments. The consumer products segment includes a wide range of appliances such as fans, cookware, and other household items. The lighting solutions segment focuses on both consumer and professional lighting applications.

Key Electric Iron Companies:

The following are the leading companies in the electric iron market. These companies collectively hold the largest market share and dictate industry trends.

- Bajaj Electricals Ltd

- BCL Electronic

- BLACK+DECKER

- BSH Hausgeräte GmbH

- Crompton Greaves Consumer Electricals Limited

- Eveready Industries India Ltd.

- Groupe SEB India

- Hamilton Beach Brands, Inc

- Koninklijke Philips N.V.

- Panasonic Corporation

- Transform SR Brands LLC (Kenmore)

- Orient Electric

Recent Developments

-

In February 2024, GM Modular announced the launch of new line of dry irons including Artin, Evon, Alpha, G-wave, G-Cruise, FERRO and ORCA. They can be purchased from appliances & electrical stores and e commerce platforms including Flipkart and Amazon.

Electric Iron Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.15 billion

Revenue forecast in 2030

USD 7.01 billion

Growth Rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 – 2022

Forecast period

2024 – 2030

Report updated

September 2024

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Function, product, application, distribution channel region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, Saudi Arabia

Key companies profiled

Bajaj Electricals Ltd, BCL Electronic, BLACK+DECKER, BSH Hausgeräte GmbH, Crompton Greaves Consumer Electricals Limited, Eveready Industries India Ltd., Groupe SEB India, Hamilton Beach Brands, Inc., Koninklijke Philips N.V., Panasonic Corporation, Transform SR Brands LLC (Kenmore), Orient Electric

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Iron Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric Iron market report based on function, product, application, distribution channel and region.

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Non-Automatic

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Steam

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."