- Home

- »

- Automotive & Transportation

- »

-

Electric Earthmoving Equipment Market Size Report, 2030GVR Report cover

![Electric Earthmoving Equipment Market Size, Share & Trends Report]()

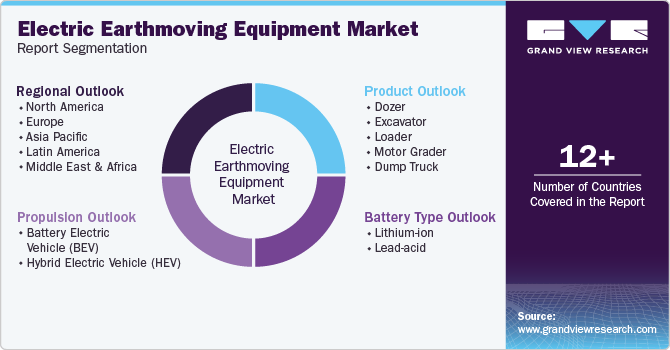

Electric Earthmoving Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dozer, Excavator, Loader, Motor Grader, Dump Truck), By Propulsion, By Battery Type, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-352-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Earthmoving Equipment Market Summary

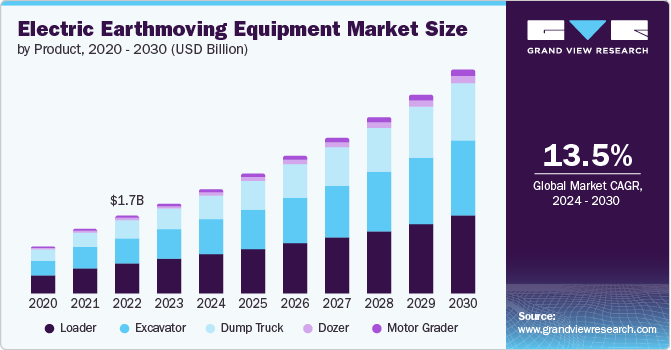

The global electric earthmoving equipment market size was valued at USD 1.98 billion in 2023 and is projected to reach USD 4.88 billion by 2030, growing at a CAGR of 13.5% from 2024 to 2030. The growth of the market can be attributed to the increasing adoption of electric earthmoving equipment, such as dozers, excavators, and loaders, owing to their numerous benefits.

Key Market Trends & Insights

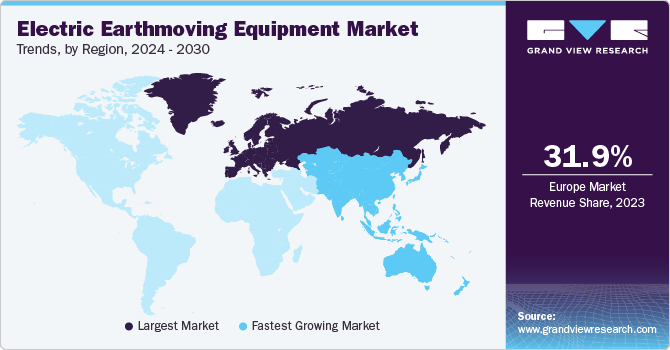

- Europe region dominated the market in 2023 and accounted for a 31.93% share of the global revenue.

- U.S. is expected to grow at the fastest CAGR of 13.1% from 2024 to 2030.

- By product, the loader segment dominated the market in 2023 and accounted for a 38.94% share of the global revenue.

- By propulsion, the Hybrid Electric Vehicle (HEV) segment dominated the market in 2023.

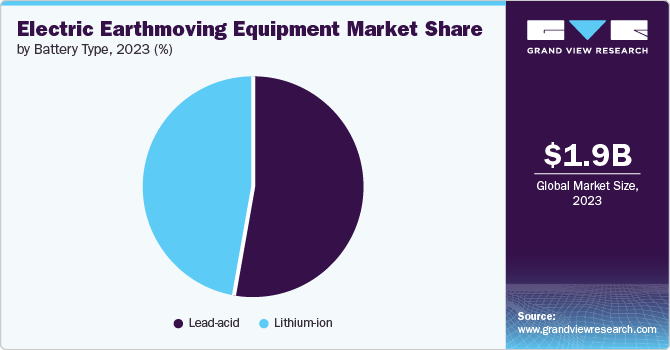

- By battery type, lead-acid batteries segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.98 Billion

- 2030 Projected Market Size: USD 4.88 Billion

- CAGR (2024-2030): 13.5%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Some of the benefits include zero emissions at the point of use, improved air quality on construction sites, reduced noise pollution, and lower operational costs. The emergence of electric earthmoving equipment has introduced various features that distinguish it from traditional diesel-powered machinery. The most prominent advantage of these electric machines is their ability to operate without any emissions, effectively eliminating the release of harmful pollutants and greenhouse gases at the point of use. By eliminating the release of these pollutants, electric earthmoving equipment contributes to significantly cleaner air quality on construction sites, providing a sustainable work environment for operators and surrounding communities. Thus, factors such as rising construction projects across the globe and the demand for electric construction equipment to reduce air pollution are boosting the market’s growth.The stringent government regulations aimed at curbing carbon emissions and reducing pollution levels have encouraged construction companies to actively seek out and adopt low-emission construction and earthmoving equipment. Furthermore, the construction industry has long been recognized as a significant contributor to air pollution, particularly for large-scale projects situated near residential areas. To address this pressing environmental concern, the California Air Resources Board has taken a pioneering step by implementing regulations specifically targeted at cleaning up emissions from off-road construction equipment, including bulldozers, graders, and backhoes. Such initiatives are expected to contribute to the market's growth.

Furthermore, prominent companies in the market are focused on promoting the use of electric earthmoving equipment to help reduce carbon emissions. For instance, in March 2023, LiuGong Construction Machinery N.A., LLC showcased the LiuGong 856H-E MAX electric wheeled loader in the North America 2023 CONEXPO-CON/AGG show. The loader has gained prominence worldwide, with more than 2,000 LiuGong 856H-E MAX operating in the toughest conditions. The loaders are reinforced with an IP67-rated wiring harness, a waterproof integrated battery package, and a 10,000-hour warranty for the battery, motor, and controller. Such initiatives are expected to bode well for the growth of the market.

The high initial purchase cost of electric earthmoving equipment could hamper the growth of the market to a certain extent. The development of adequate charging infrastructure, especially for large-scale construction projects, is another challenge that is expected to hamper market growth. Electric earthmoving machines typically come with a higher initial cost compared to traditional diesel-powered machines. However, when considering the total cost of ownership, including potential tax incentives for green machinery, fuel, and maintenance, electric earthmoving equipment becomes an economically attractive option in the long run, contributing to the growth of the market.

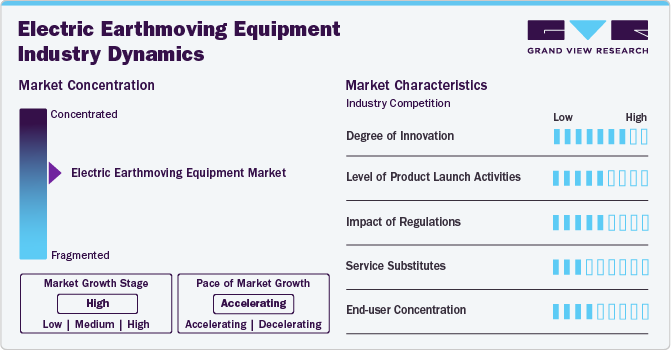

Market Concentration & Characteristics

The industry's growth stage is high, and it is accelerating in pace. The electric earthmoving equipment industry can be characterized by a high degree of innovation. The growing trend of automation and the integration of innovative technologies such as Global Positioning System (GPS) and telematics into electric earthmoving equipment are expected to drive the growth of the market.

The electric earthmoving equipment industry is also characterized by a moderate level of new product launch activities by key companies. Manufacturers are making significant investments in research and development to enhance their flagship product lines that focus on the construction equipment industry.

The regulatory trends play a substantial role in influencing the electric earthmoving equipment industry. Government stringent regulations to reduce carbon emissions promote the adoption of electric earthmoving equipment, thus driving the growth of the market.

There are no direct substitutes for the electric earthmoving equipment in the market. However, the introduction of electric earthmoving equipment as an alternative to traditional diesel-powered equipment has gained substantial traction owing to its eco-friendly and cost-effective nature. With a growing emphasis on sustainability, these alternative vehicle models offer reduced emissions, lower operational costs, and improved energy efficiency, making them an attractive choice for environment-conscious construction projects.

The electric earthmoving equipment industry has a moderate concentration of end users. The increasing shift of end users toward sustainable and eco-friendly solutions across various industries has led to a growing demand for electric earthmoving equipment.

Product Insights

The loader segment dominated the market in 2023 and accounted for a 38.94% share of the global revenue. Electric loaders have become increasingly popular due to their ability to deliver enhanced performance while also minimizing their environmental impact. A key advantage of electric wheel loaders is their eco-friendly nature. By reducing exhaust emissions and minimizing noise levels and vibrations, these machines help create a healthier, cleaner, and more pleasant working environment. Owing to these benefits, the demand for electric or battery-powered loaders is anticipated to rise from 2024 to 2030.

The dump truck segment is projected to witness significant growth from 2024 to 2030. Electric dump trucks play a vital role in various industries globally due to the thriving construction sector, which necessitates efficient and reliable material transportation, including gravel, sand, and debris. With ongoing urbanization and the rise of infrastructure projects, there is a growing demand for electric dump trucks to facilitate the transportation of construction materials to and from job sites. In addition, electric dump trucks are transforming the construction industry by providing a sustainable, cost-effective, and high-performance alternative to traditional diesel-powered dump truck fleets.

Propulsion Insights

The Hybrid Electric Vehicle (HEV) segment dominated the market in 2023. Hybrid earthmoving equipment combines a traditional internal combustion engine with an electric motor and battery pack. Hybrid electric earthmoving equipment technology is an effective and essential solution for the global environmental impact of pollution and impending energy shortages. Earthmoving contractors have been at the forefront of adopting diesel-electric hybrid construction equipment, with several models effectively operating in the field. Among the pioneering hybrid machines are Komatsu Ltd.’s HB215LC-1 hybrid crawler excavator, Deere and Company’s 644K electric hybrid wheel loader, and Caterpillar Inc.’s D7E dozer. Thus, the vast availability of hybrid earthmoving equipment in the market can be attributed to the segment’s growth.

The Battery Electric Vehicle (BEV) segment is projected to witness significant growth from 2024 to 2030. Advancements in battery technology have transformed the performance and capabilities of electric earthmoving equipment. Battery-powered earthmoving equipment is capable of matching, and in some cases even surpassing, the power and performance of traditional diesel-powered or hybrid equipment. This increased performance and efficiency, coupled with the lower operating costs and reduced environmental impact, have made battery-powered earthmoving equipment an attractive option for construction companies and governments looking to modernize their fleets and operations while reducing their carbon footprint, which in turn propels the segment’s growth.

Battery Type Insights

Lead-acid batteries dominated the market in 2023. They have been a common power source for various types of electric earthmoving equipment, including excavators, loaders, and dump trucks. The key advantages of using lead-acid batteries in these applications include cost-effectiveness, high power output, and reliability. For instance, lead-acid batteries are a relatively inexpensive battery technology compared to lithium-ion batteries. Thus, the adoption of lead-acid batteries in earthmoving equipment, owing to their abovementioned benefits, can contribute to the segment’s growth.

The lithium-ion segment is projected to witness significant growth from 2024 to 2030. Lithium-ion batteries are relatively new and advanced battery technology that utilizes lithium ions as a crucial component of power. These batteries offer numerous advantages when utilized in earthmoving equipment. Their high-power output, rapid charging capabilities, enhanced safety, long cycle life, and wide temperature range make them a reliable and efficient power source. Such benefits are making them more demandable in earthmoving equipment, ultimately driving the market’s growth.

Regional Insights

The electric earthmoving equipment market in North America is expected to witness considerable growth from 2024 to 2030. The market is experiencing a rising focus on technology integration and automation, particularly within the construction and industrial sectors. This trend is driving the demand for more advanced and innovative earthmoving equipment in the region.

U.S. Electric Earthmoving Equipment Market Trends

The electric earthmoving equipment market in the U.S. is expected to grow at the fastest CAGR of 13.1% from 2024 to 2030. The market is witnessing substantial growth, driven by the increasing investment in a wide range of infrastructure development projects. The federal government's strong emphasis on building new infrastructure, such as railroads, bridges, and tunnels, is fueling the demand for electric earthmoving and material handling equipment, which are essential for the various applications commonly undertaken at construction sites.

The electric earthmoving equipment market in Canada is expected to register a steady growth rate from 2024 to 2030. The market is set to expand due to robust infrastructure development and a shift towards more sustainable and technologically advanced earthmoving equipment.

Asia Pacific Electric Earthmoving Equipment Market Trends

The Asia Pacific regionis expected to register the fastest CAGR of 15.2% from 2024 to 2030. The growth of the market can be attributed to the growing infrastructure development projects across various countries in the region. Manufacturers in the Asia Pacific market are responding to the situation by offering a wide range of electric loader, excavator, and dump truck models suitable for the diverse construction needs in the region.

The electric earthmoving equipment market in China is expected to witness a moderate growth rate of 15.0% from 2024 to 2030. China's proactive measures to stimulate economic growth and bolster domestic consumption have led to increased infrastructure investments, fostering a favorable market environment. The presence of diverse excavators, loaders, and dump trucks streamlines a wide array of construction tasks, further driving the expansion of the Chinese electric earthmoving equipment market.

The India electric earthmoving equipment market is anticipated to grow at the fastest CAGR from 2024 to 2030. The growth market can be attributed to the continued development of transportation networks, public facilities, and urban areas, with a particular focus on highway development, road construction, and urban renewal projects.

The electric earthmoving equipment market in Japan is expected to grow at a considerable CAGR from 2024 to 2030. Prominent players in the Japanese market are working on developing technologically advanced solutions. For instance, in June 2023, AB Volvo introduced the L25 Electric compact wheel loader and ECR25 Electric compact excavators at the Construction & Survey Productivity Improvement Expo (CSPI-EXPO) convened in Tokyo, Japan. Such initiatives are expected to bode well for the market’s growth in the country.

Europe Electric Earthmoving Equipment Market Trends

Europe region dominated the market in 2023 and accounted for a 31.93% share of the global revenue. The market's growth can be attributed to the growing emphasis on continued urbanization and subsequent infrastructure development. This increased the demand for electric earthmoving equipment owing to its versatility to undertake various tasks, such as loading and unloading, earthmoving, and pallet handling, integral to infrastructure development.

The electric earthmoving equipment market in the UK is expected to grow at the fastest CAGR from 2024 to 2030. The market is poised for growth due to an increased focus on infrastructure development and construction projects. For instance, in February 2024 , the UK government planned an investment of up to GBP 775 billion (USD 983 billion) on infrastructure and construction projects across both public and private sectors over the next decade. According to the National Infrastructure and Construction Pipeline released by the Infrastructure and Projects Authority (IPA), this investment will encompass 660 projects planned over the next ten years. Increasing construction activities across the country could drive the demand for electric earthmoving equipment from 2024 to 2030.

The Germany electric earthmoving equipment market is expected to grow at a notable CAGR from 2024 to 2030.The rapid growth of Germany's construction industry is a major factor behind the growth of the electric earthmoving equipment market. Germany's growing construction industry benefits from a stable economy and investment climate, as well as a continuing focus on energy efficiency supported by both the market and the federal government.

MEA Electric Earthmoving Equipment Market Trends

The electric earthmoving equipment market in MEA is anticipated to witness a considerable CAGR of 11.1% from 2024 to 2030. The upsurge in construction activity is driving the demand for loaders and excavators, given the ability of these machines to play a crucial role in various construction tasks. The increasing focus on infrastructure development aligns with the efforts being pursued by governments across the region to enhance connectivity, boost economic growth, and meet the evolving needs of the citizens. As a result, the MEA electric earthmoving equipment market is poised to witness significant growth from 2024 to 2030.

The KSA electric earthmoving equipment market is expected to witness a moderate growth rate from 2024 to 2030. The growth can be attributed to a strategic shift in the government's focus towards economic expansion and diversification. The Saudi Vision 2030 initiative, a comprehensive plan aimed at transforming the country's economic, cultural, and social landscape, has been a key factor in this growth.

Key Electric Earthmoving Equipment Company Insights

Some of the key companies operating in the market include Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment AB, Doosan Corporation, Liebherr-International AG, Caterpillar Inc., and CNH Industrial N.V.

-

Hitachi Construction Machinery Co., Ltd. Engaged in manufacturing, sales, and service of transportation machinery, construction machinery, and other machines and devices. The company offers demolition equipment, wheel loaders, cranes, foundation machines, mini and medium excavators, large excavators/loading shovels, demolition equipment, metal recycling equipment, rigid dump trucks, forest machines, compaction equipment, mine management systems, and mini loaders, as well as various used equipment and attachments.

-

Caterpillar Inc. manufactures and sells mining and construction equipment, industrial gas turbines, diesel and natural gas engines, and diesel-electric locomotives for the construction, energy and resource, and transportation industries. The company operates through three primary segments: construction, resources, and energy and transportation.

MultiOne, Hydrema, and Sany Heavy Industry Co., Ltd. are some of the emerging companies in the market.

-

Hydrema manufactures innovative earthmoving equipment and specialized defense solutions. Its innovative construction machines, such as backhoe loaders, dumpers, excavators, wheeled excavators, and rail machines, provide improved performance, efficiency, and durability in the most demanding conditions.

-

Sany Heavy Industry Co., Ltd. is engaged in the research and development, manufacturing, and sales of engineering machinery worldwide. The company offers concrete machinery, hydraulic excavators, hoisting machinery, road construction machinery, piling machinery, wind turbines, port machinery, and mining machinery.

Key Electric Earthmoving Equipment Companies:

The following are the leading companies in the electric earthmoving equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar Inc.

- CNH Industrial N.V.

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hydrema

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- Liebherr-International AG

- Sany Heavy Industry Co., Ltd.

- Volvo Construction Equipment AB

Recent Developments

-

In April 2024, Firstgreen Industries, a manufacturer of zero-emission electric skid-steer loaders, introduced Rockeat, an innovative line of cabinless electric skid-steer loaders. These innovative machines are equipped with low clearance, a 360-degree camera, remote operability, and a load capacity ranging from 1,500 to 3,300 lbs.

-

In July 2023, Komatsu Ltd. launched a lithium-ion battery-operated new, 3-ton class electric mini excavator to the European market. The new excavator is an entirely modernized version of the “PC30E-5” 3-ton class electric mini excavator.

-

In June 2023, J C Bamford Loader Ltd. introduced an electric wheeled loader, which provides improved performance and full working day use with zero-emission and low-noise operation for customers. It features a 20kWh lithium-ion battery pack, a 33.4kW drive motor, and a 20kW hydraulic pump.

Electric Earthmoving Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.28 billion

Revenue forecast in 2030

USD 4.88 billion

Growth rate

CAGR of 13.5% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Product, propulsion, battery type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Volvo Construction Equipment AB, Doosan Corporation, Liebherr-International AG, Caterpillar Inc., CNH Industrial N.V., Hitachi Construction Machinery Co., Ltd., Komatsu Ltd., Hydrema, J C Bamford Excavators Ltd., and Sany Heavy Industry Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Earthmoving Equipment Market Report Segmentation

The report forecasts revenue & volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric earthmoving equipment market based on product, propulsion, battery type, and region.

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Dozer

-

Excavator

-

Loader

-

Motor Grader

-

Dump Truck

-

-

Propulsion Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)

-

-

Battery Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Lithium-ion

-

Lead-acid

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric earthmoving equipment market size was estimated at USD 1.98 billion in 2023 and is expected to reach USD 2.28 billion in 2024.

b. The global electric earthmoving equipment market is expected to grow at a compound annual growth rate of 13.5% from 2024 to 2030, reaching USD 4.88 billion by 2030.

b. The loader segment dominated the market in 2023 and accounted for a 38.94% share of the global revenue. Electric loaders have become increasingly popular due to their ability to deliver enhanced performance while also minimizing their environmental impact.

b. Some of the key companies operating in the market include Hitachi Construction Machinery Co., Ltd., Volvo Construction Equipment AB, Doosan Corporation, Liebherr-International AG, Caterpillar Inc., and CNH Industrial N.V.

b. The growth of the electric earthmoving equipment market can be attributed to the increasing adoption of electric earthmoving equipment, such as dozers, excavators, and loaders, owing to their numerous benefits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.