- Home

- »

- Automotive & Transportation

- »

-

Electric Cargo Bikes Market Size And Share Report, 2030GVR Report cover

![Electric Cargo Bikes Market Size, Share & Trends Report]()

Electric Cargo Bikes Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Two-Wheeled, Three-Wheeled), By Application (Personal, Commercial), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-365-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Cargo Bikes Market Summary

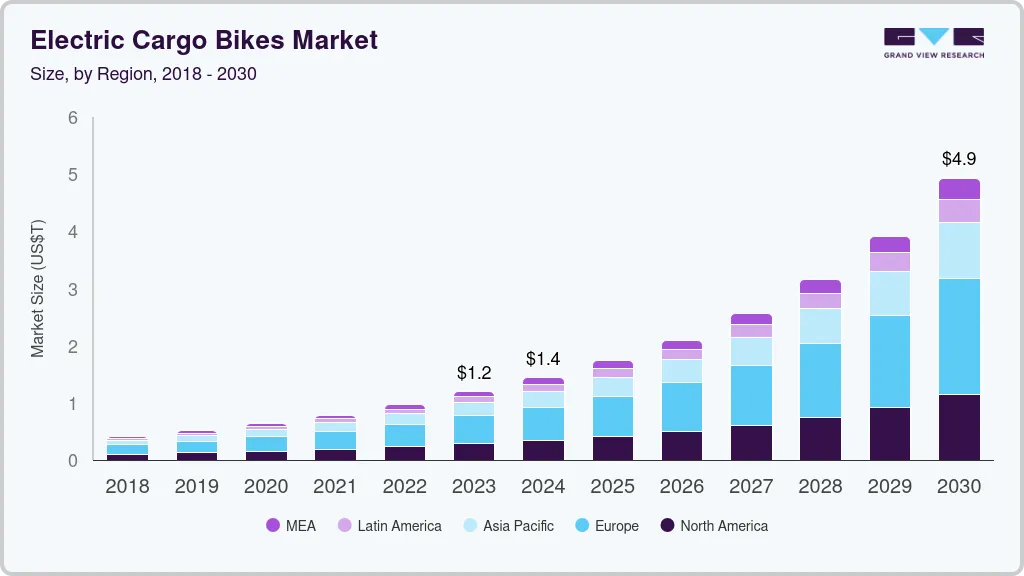

The global electric cargo bikes market size was estimated at USD 1.20 billion in 2023 and is projected to reach USD 4.93 billion by 2030, growing at a CAGR of 22.8% from 2024 to 2030. The market is majorly driven by the growing preference for bicycles as a convenient form of exercise to ensure a healthy life.

Key Market Trends & Insights

- Europe is accounted for a 40.5% share in 2023.

- Asia Pacificis expected to grow at the fastest CAGR during the forecast period.

- The U.S. is expected to grow at a significant CAGR from 2024 to 2030.

- Based on product, the two-wheeled electric cargo bikes segment dominated the market in 2023 and accounted for a more than 42% share of global revenue.

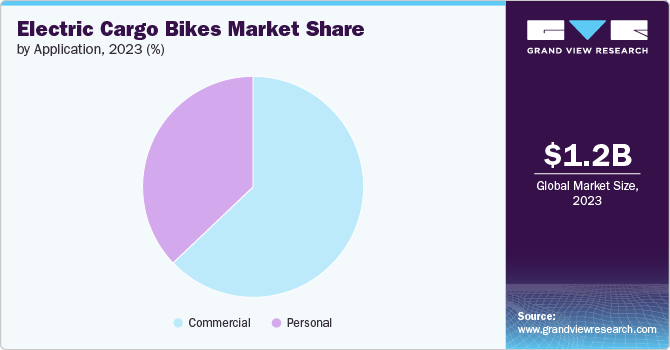

- In terms of application, the commercial use segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.20 Billion

- 2030 Projected Market Size: USD 4.93 Billion

- CAGR (2024-2030): 22.8%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

People have started realizing the importance of staying fit and having a healthy life. They have also started realizing that regular bicycling can keep disorders, such as obesity, at bay. The market is expected to grow as more and more people are resorting to bicycling as a regular form of exercise. Moreover, the growth is attributed to the combination of factors such as a rise in disposable income and the benefits offered by electric bicycles over conventional variants in terms of operation. Electric bicycles can also ensure faster journeys as compared to their conventional counterparts.The market is experiencing robust growth driven by several key trends and factors. Urbanization and the increasing demand for sustainable and efficient transportation solutions are major drivers, as cities worldwide seek to reduce traffic congestion and lower carbon emissions. Governments and municipalities are offering incentives and supportive regulations to encourage the adoption of eco-friendly vehicles, including electric cargo bikes.

The rise of e-commerce and the need for last-mile delivery solutions also fuel demand, as businesses look for cost-effective and agile delivery options.Technological advancements, such as improved battery life and load capacity, enhance the appeal of electric cargo bikes. Opportunities abound in expanding urban delivery services, promoting green logistics, and catering to niche markets like food delivery and family transportation.

The growing penetration of smartphones and internet connectivity in emerging economies, including Brazil, China, India, and Mexico, will further boost consumer engagement in online stores. Moreover, the internet's increasing penetration is encouraging vendors to sell their products in untapped markets through online platforms such as Ali Express, Amazon, and Flipkart. Besides, online channels provide attractive discounts on every product, which attracts consumers to purchase online.

The outbreak of COVID-19 is certainly expected to favor market growth in coming years as several governments around the globe are significantly promoting bicycles as one of the safest modes of transportation, which helps people maintain social distancing. Besides, governments across key countries, such as the UK and Italy, are providing subsidies for the purchase of new bicycles during the pandemic. Therefore, government support in the form of initiatives and subsidies coupled with growing awareness regarding benefits offered by bicycles further propels the growth of the market.

Product Insights

The two-wheeled electric cargo bikes segment dominated the market in 2023 and accounted for a more than 42% share of global revenue. Two-wheeled electric cargo bikes are the dominant segment in the electric cargo bikes market, primarily due to their versatility, cost-effectiveness, and ease of maneuverability in urban environments. These bikes are particularly favored for their ability to navigate through congested city streets and narrow lanes, making them ideal for last-mile deliveries and personal use. Their relatively lower cost compared to four-wheeled counterparts and simpler design make them accessible to a broader range of consumers and businesses.

The increasing popularity of e-commerce and the need for efficient delivery solutions have significantly boosted demand for two-wheeled electric cargo bikes. Additionally, their lighter weight and compact size contribute to lower energy consumption and operational costs, which appeal to environmentally conscious consumers and businesses aiming to reduce their carbon footprint. Companies are continuously innovating in this segment, offering improved battery life, greater load capacities, and enhanced safety features, further driving market growth. With the ongoing trend towards sustainable urban mobility, the dominance of two-wheeled electric cargo bikes is expected to persist, supported by favorable government policies, increasing urbanization, and the growing awareness of environmental issues.

The four-wheeled electric cargo bikes segment is projected to witness significant growth from 2024 to 2030. The four-wheeled electric cargo bikes segment is emerging as the fastest-growing segment in the market, driven by their higher load capacity, stability, and versatility. These bikes are particularly well-suited for commercial use, including logistics, retail, and delivery services that require the transportation of larger and heavier goods. The robust construction and enhanced stability of four-wheeled electric cargo bikes make them an attractive option for businesses looking to streamline their operations and improve efficiency. Innovations in design and technology have led to the development of models with advanced features such as improved battery performance, increased range, and smart connectivity options, which cater to the needs of modern logistics and delivery services.

The growing focus on sustainable logistics solutions and the need to reduce the environmental impact of urban transportation are key factors driving the adoption of four-wheeled electric cargo bikes. Moreover, supportive government policies and incentives aimed at promoting green transportation solutions are encouraging businesses to invest in this segment. As cities continue to grapple with traffic congestion and pollution, the demand for efficient, eco-friendly cargo transportation options like four-wheeled electric cargo bikes is expected to rise, making this segment a key area of growth in the market.

Application Insights

The commercial use segment dominated the market in 2023. The commercial use segment dominates the market, driven by the rising demand for efficient and sustainable logistics solutions in urban areas. Businesses, especially in the e-commerce, retail, and food delivery sectors, are increasingly adopting electric cargo bikes for last-mile deliveries due to their cost-effectiveness, reliability, and ability to navigate through congested city streets. These bikes offer a practical solution to the growing need for quick and eco-friendly delivery options, helping companies reduce their carbon footprint and operational costs. The enhanced load capacity and durability of commercial electric cargo bikes make them ideal for transporting goods over short distances.

Technological advancements, such as improved battery performance and integration with logistics management systems, are further enhancing their appeal to businesses. Governments and municipalities are also playing a crucial role by implementing supportive regulations and incentives to promote the use of electric cargo bikes in commercial applications. As urban centers continue to face challenges related to traffic congestion and pollution, the demand for sustainable delivery solutions is expected to rise, solidifying the dominance of the commercial segment in the market. This trend is likely to continue as businesses increasingly recognize the economic and environmental benefits of integrating electric cargo bikes into their logistics operations.

The personal use segment is projected to witness significant growth from 2024 to 2030. The personal use segment of electric cargo bikes is experiencing rapid growth, driven by increasing consumer awareness of sustainability, urban mobility challenges, and the benefits of green transportation. Individuals are increasingly opting for electric cargo bikes as a practical and eco-friendly alternative to cars for daily commuting, grocery shopping, and transporting children. The rise in urban populations has led to heightened traffic congestion and parking difficulties, making electric cargo bikes an attractive solution for short-distance travel. Innovations in design, such as improved battery life, enhanced safety features, and greater cargo capacity, are making these bikes more appealing and accessible to a wider audience.

Supportive government policies, including subsidies and incentives for electric bike purchases, are boosting adoption rates. The COVID-19 pandemic has also contributed to this growth, as people seek safer, socially distanced modes of transportation. Moreover, the increasing availability of bike-sharing programs and rental services is facilitating access to electric cargo bikes for personal use. As cities continue to prioritize sustainable transportation and infrastructure, the personal use segment of electric cargo bikes is poised for significant expansion, driven by the demand for efficient, environmentally friendly, and versatile mobility solutions.

Regional Insights

North America is expected to witness steady growth from 2024 to 2030. The North American market is experiencing steady growth, driven by increasing awareness of sustainable transportation and rising demand for eco-friendly delivery solutions. Urban areas are particularly adopting these bikes for last-mile deliveries and personal use. Government incentives and initiatives promoting green transportation further boost market growth. The region's strong e-commerce sector also contributes significantly to the demand for electric cargo bikes, as businesses seek efficient and cost-effective delivery methods to meet consumer expectations.

U.S. Electric Cargo Bikes Market Trends

The U.S. is expected to grow at a significant CAGR from 2024 to 2030. The U.S. market is growing steadily, fueled by increasing awareness of environmental sustainability and the need for efficient urban transportation solutions. Major cities are seeing a rise in the adoption of these bikes for last-mile deliveries and personal use. Government incentives and initiatives aimed at promoting green transportation also support market growth. The robust e-commerce sector in the U.S. drives demand for electric cargo bikes as businesses seek to enhance delivery efficiency and reduce operational costs. Furthermore, advancements in battery technology and design innovations contribute to the market's expansion.

Asia Pacific Electric Cargo Bikes Market Trends

Asia Pacificis expected to grow at the fastest CAGR during the forecast period. Asia Pacific is a rapidly growing market for electric cargo bikes, driven by the region's high population density, urbanization, and rising environmental concerns. Countries like China, Japan, and India are witnessing increased adoption due to government initiatives supporting sustainable transportation and the need to reduce traffic congestion and pollution. The region's strong manufacturing base and advancements in battery technology also contribute to market growth. Additionally, the expanding e-commerce sector and the need for efficient last-mile delivery solutions are key factors propelling the demand for electric cargo bikes in this region.

Europe Electric Cargo Bikes Market Trends

Europe is accounted for a 40.5% share in 2023. Europe is a leading market for electric cargo bikes, characterized by strong environmental policies, supportive government regulations, and a high level of environmental consciousness among consumers. Countries such as Germany, the Netherlands, and Denmark are at the forefront of adoption, driven by well-developed cycling infrastructure and urban mobility initiatives. The region's emphasis on reducing carbon emissions and promoting sustainable transportation solutions significantly boosts market growth. Additionally, the rise of e-commerce and the demand for efficient urban logistics further drive the adoption of electric cargo bikes across Europe.

Key Electric Cargo Bikes Company Insights

The key companies in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Electric Cargo Bikes Companies:

The following are the leading companies in the electric cargo bikes market. These companies collectively hold the largest market share and dictate industry trends.

- Smart Urban Mobility B.V.

- Cervelo

- Rad Power Bikes

- Yuba Bicycles LLC

- Riese & Müller

- Butchers & Bicycles

- Cero Bikes

- Douze Cycles

- Urban Arrow

- Tern Bicycles

- Carla Cargo

- Rad Power Bikes

Recent Developments

-

In February 2024, Riese & Müller has introduced a new entry-level platform for its premium brand. While the starting price of £5,469 is still a significant investment, this bike offers several unique features. Most notably, it boasts a frame made in Portugal from 81% recycled aluminium.

-

In May 2021, CERO Bikes has opened preorders for its award-winning CERO One Compact Electric Cargo Bike. The CERO One is designed for individuals seeking a versatile bike for commuting, running errands, transporting kids to school, and leisurely rides. It is the ultimate compact electric cargo bike, perfectly balancing a nimble size with wide-ranging capabilities.

Electric Cargo Bikes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.44 billion

Revenue forecast in 2030

USD 4.93 billion

Growth rate

CAGR of 22.8% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Smart Urban Mobility B.V.; Cervelo; Rad Power Bikes; Yuba Bicycles LLC; Riese & Müller; Butchers & Bicycles; Cero Bikes; Douze Cycles; Urban Arrow; Tern Bicycles; Carla Cargo; Rad Power Bikes

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Cargo Bikes Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric cargo bikes market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Two-Wheeled

-

Three-Wheeled

-

Four-Wheeled

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personal

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric cargo bikes market size was estimated at USD 1.20 billion in 2023 and is expected to reach USD 1.44 billion in 2024.

b. The global electric cargo bikes market is expected to grow at a compound annual growth rate of 22.8% from 2024 to 2030 to reach USD 4.93 billion by 2030.

b. Europe dominated the electric cargo bikes market with a share of over 40.0% in 2023. Europe is a leading market for electric cargo bikes, characterized by strong environmental policies, supportive government regulations, and a high level of environmental consciousness among consumers.

b. Some key players operating in the electric cargo bikes market include Smart Urban Mobility B.V., Cervelo, Rad Power Bikes, Yuba Bicycles LLC, Riese & Müller, Butchers & Bicycles, Cero Bikes, Douze Cycles, Urban Arrow, Tern Bicycles, Carla Cargo, Rad Power Bikes.

b. Key factors driving market growth include growing urbanization and the increasing demand for sustainable and efficient transportation solutions are major drivers, as cities worldwide seek to reduce traffic congestion and lower carbon emissions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.