- Home

- »

- Medical Devices

- »

-

Electric Bed Market Size, Share And Growth Report, 2030GVR Report cover

![Electric Bed Market Size, Share & Trends Report]()

Electric Bed Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Semi-Automatic Electric Bed, Fully Automatic Electric Bed), By Procedure (General Bed, Intensive Care Bed, Bariatric Beds), By End Use (Hospitals, Home Care), By Region, And Forecasts

- Report ID: GVR-4-68039-271-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Bed Market Size & Trends

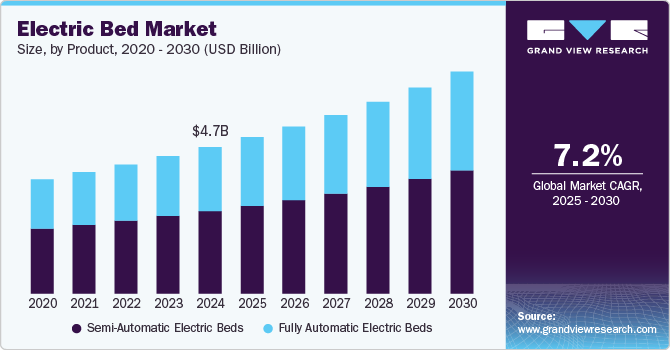

The global electric bed market size was estimated at USD 4.74 billion in 2024 and is projected to grow at a CAGR of 7.25% from 2025 to 2030. The growth can be attributed to the growing geriatric population base, rising prevalence of chronic diseases, increasing surgical procedures, and technological advancements in the electric bed. According to the World Population Prospects 2022, the global elderly population share is expected to reach around 16% of the total population in 2050, increasing from 10% in 2022. As the elderly population increases globally, the demand for electric bed has significantly increased to serve the rising patient pool.

Electric bed, designed for enhanced patient comfort and medical support, have become essential in various healthcare settings, particularly in hospitals, nursing homes, and in-home care. These beds come equipped with controls, allowing for adjustments in height, headrest, and leg support, which improve patient comfort and reduce strain on caregivers. The development of such features offers comfort to patients who have limited mobility, addressing complications related to prolonged immobilization. Moreover, the companies operating in the market are further developing innovative solutions to address the evolving needs of the patients. For instance, in December 2023, Magniflex launched its innovative product, Ergo Tre Electric Bed, in India, designed for enhanced comfort and convenience. The bed features customizable positions and can be operated through remote control, allowing users to adjust their sleeping posture easily.

Moreover, the increasing healthcare expenditure globally is allowing more healthcare providers to adopt this equipment in their healthcare settings. For instance, according to the World Economic Forum, global healthcare spending reached around USD 9.8 trillion, accounting for 10.3% of the global Gross Domestic Product (GDP). These increased investments from both government and private sectors in healthcare infrastructure are aimed at improving patient outcomes and enhancing service delivery. This financial support allows healthcare providers to allocate larger budgets to improve patient comfort, safety, and recovery outcomes, leading to increased adoption of these equipment in hospitals, long-term care facilities, and home care settings.

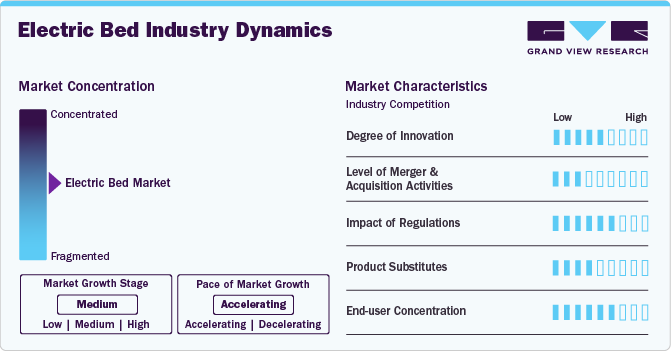

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The electric bed market is characterized by a high degree of growth owing to the rising number of surgical procedures, growing geriatric population base, and rising prevalence of chronic conditions globally.

The degree of innovation is a crucial factor in the market, significantly influencing its growth. As healthcare demands evolve with an aging population and rising chronic illnesses, the need for advanced medical equipment has increased. Innovative bed, equipped with features such as remote monitoring capabilities, enhance patient comfort and safety, thereby improving patient outcomes.

The level of mergers and acquisitions is a significant factor in the market as companies use this strategy to diversify their product offerings, enter new geographical markets, and address the increasing demand for electric bed, thereby increasing their presence.

The market is significantly influenced by regulatory frameworks that ensure the safety, quality, and effectiveness of these medical devices. Regulatory bodies such as the FDA in the U.S. and the EMA in Europe establish stringent guidelines about design, production, labeling, and safety standards for this equipment. Compliance with these regulations is crucial for manufacturers to gain market access and maintain consumer trust.

The threat of product substitutes is moderate in the market. As the demand for comfort and health-oriented sleep solutions rises, consumers can consider alternatives that fulfill similar needs. However, the unique benefits offered by the electric bed, such as adjustable positioning for medical needs, position this equipment over their alternatives.

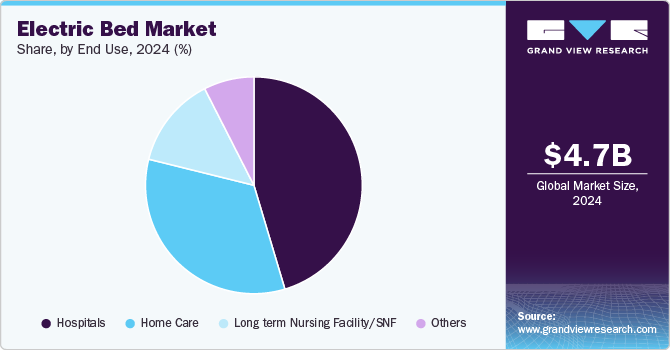

The market has several end users such as hospitals, home care, long/short-term nursing facilities and others. The increasing number of patient admissions, rise in the number of surgical procedures globally, and growing preference for home care increase the demand for these beds in different healthcare facilities as this bed offer enhanced comfort and functionality for patient care.

Product Insights

The semi-automatic electric bed segment dominated the market in 2024. This can be attributed to their affordability and functionality. These beds often feature motorized adjustments for the backrest and leg elevation, allowing patients to achieve comfortable positions without the complexity or cost associated with fully automatic models. As healthcare facilities, particularly smaller clinics and nursing homes, seek to optimize patient care while managing budgets, semi-automatic electric bed offer a convenient solution. Their user-friendly controls make them accessible to both patients and caregivers, enhancing their demand in various healthcare settings.

The fully automatic electric bed segment is expected to register the fastest growth with a CAGR of 7.60 % during the forecast period. This growth is driven by the increasing demand for advanced patient care solutions that prioritize comfort, safety, and ease of use. Moreover, fully automatic electric bed offer a comprehensive suite of advanced features that allow users to adjust the bed's position effortlessly. This capability is beneficial for patients with limited mobility or chronic conditions, as it reduces the inconvenience for caregivers and enhances patient independence.

Procedure Insights

The general bed segment dominated the market with a revenue share of 28.76% in 2024. This can be attributed to the increasing number of patient admissions in hospitals and healthcare facilities. General bed offer adjustable features that enhance patient comfort and facilitate better medical care, increasing their importance for managing diverse patient needs. The ability to modify the bed's position helps improve patient comfort, which is significantly beneficial for elderly or immobile patients who are often admitted for longer periods due to chronic conditions or recovery from surgeries.

The intensive care bed segment is expected to witness the fastest growth from 2025 to 2030 owing to the increasing demand for specialized care due to an aging population and the rising prevalence of chronic diseases. As the healthcare sector develops, the focus on providing critical care that meets the complex needs of patients requiring intensive monitoring and treatment also increases. Moreover, intensive care bed are designed to address these needs, offering advanced features such as adjustable height and positioning, which enhance patient comfort and allow better medical interventions during critical situations.

End Use Insights

The hospitals segment dominated the market in 2024. This growth can be attributed to the increasing demand for enhanced patient care and safety. Hospitals are increasingly adopting this bed due to their advanced features that improve patient comfort and assist medical procedures. These beds allow for easy adjustments in height and position, which is crucial for patients with limited mobility or those recovering from surgery. The integration of smart technology, such as remote monitoring and automated adjustments, enhances both patient safety and caregiver efficiency, making these products a preferred choice in hospital settings.

The home care segment is expected to witness the fastest growth from 2025 to 2030 owing to the increasing preference towards home care among the elderly population, which is more vulnerable to chronic diseases. As more individuals seek to manage their health conditions from the comfort of their homes, there is a rising demand for electric beds that provide enhanced comfort, mobility, and safety. Moreover, the bed designed for home care is equipped with features such as adjustable height and user-friendly features, which allow easier patient transfers and improve overall care quality.

Regional Insights

North America electric bed market held the largest revenue share of 44.23% in 2024 due to the increasing number of surgical procedures and hospital admissions. The demand for electric bed has increased as healthcare facilities focus on enhancing patient care and comfort, particularly for individuals undergoing surgeries or requiring long-term care. Moreover, the aging population in North America is also leading to a rise in chronic conditions that require hospitalization. According to Statistics Canada, around 18.9% of the country’s population was aged 65 years and above in 2023. The geriatric demographic often requires specialized care and electric bed offer features that are particularly beneficial for elderly patients.

U.S. Electric Bed Market Trends

The electric bed market in the U.S. is witnessing significant growth driven by the aging population, which is increasingly susceptible to chronic conditions requiring hospitalization and specialized care. According to the National Council on Aging (NCOA), around 57.8 million population in the country were aged 65 years and above in 2022. This demographic shift is significantly increasing hospital admissions and surgeries, which increases the demand for more advanced medical equipment that offer enhanced comfort and adjustability for patients undergoing treatment or recovery.

Europe Electric Bed Market Trends

The Europe electric bed market is driven by the increasing demand for healthcare solutions that enhance patient comfort and recovery, and the aging population that needs advanced medical equipment. These beds improve patient mobility and facilitate better care in both hospital and home settings. The integration of smart technology into this equipment has further contributed to this growth, allowing for features such as remote-control adjustments, which appeal to both healthcare providers and patients.

The growth of the electric bed market in the UK is driven by an increasing demand for healthcare services and the rising geriatric population. According to the 2021 census by the Government of the UK, around 24.4% of the country’s population, or 14.5 million people in the country, were aged 60 years and above. As the UK’s population ages, the need for specialized medical equipment, such as electric bed, has increased. Moreover, technological advancements have also played a crucial role in market growth as the integration of smart technologies into this equipment has made them more adaptable to both healthcare facilities and consumers.

The growth of the France electric bed market is driven by an aging population, which has increased the demand for healthcare services tailored to elderly patients. In addition, hospitals and clinics are increasingly investing in advanced equipment to enhance patient management, especially in intensive care units where comfort and accessibility are important. As healthcare facilities adapt to new challenges, the demand for electric bed is further expected to rise.

The electric bed market in Germany is driven by the increasing prevalence of chronic diseases such as cardiovascular issues, diabetes, and obesity, which has increased the demand for specialized medical equipment. As healthcare facilities improve the quality of care to provide better patient care, the adoption of electric bed is further expected to increase, thereby driving market growth.

Asia Pacific Electric Bed Market Trends

Asia Pacific region is anticipated to grow significantly over the forecast period. This can be attributed to the increasing elderly population in countries such as Japan and China, where the aging demographic is leading to a higher prevalence of chronic diseases. Moreover, the increasing medical tourism coupled with the developing healthcare structure further contributes to market growth.

The electric bed market in China is expected to grow over the forecast period owing to the growing demand for advanced instruments in the healthcare sector, the aging population and the rising prevalence of chronic diseases. According to the Government of Shanghai data, around 75% of the population aged 60 years and above has at least one chronic disease, while approximately 43% suffer from at least two chronic conditions.

Japan electric bed market is projected to expand during the forecast period due to several key factors, including an increasing number of surgeries in the country and a growing elderly population. According to the World Bank data, around 30% of the country’s population was aged 65 years and above. Moreover, the increasing adoption of advanced technologies in the country’s healthcare sector further contributes to market growth.

Middle East and Africa Electric Bed Market Trends

The electric bed market in Middle East and Africa is expected to witness significant growth in the coming years owing to the growing healthcare expenditure, increasing number of surgical procedures, and the growing geriatric population base.

Saudi Arabia electric bed market is expected to grow over the forecast period owing to the growing number of surgical procedures and increasing health expenditures in the country, coupled with the increasing efforts by the healthcare sector to adopt advanced equipment in healthcare facilities.

Latin America Electric Bed Market Trends

The Latin America electric bed market is expected to grow over the forecast period due to the developing healthcare sector, increasing focus on healthcare tourism, and growing adoption of advanced technologies in the region’s healthcare sector of the region.

Key Electric Bed Company Insights

Arjo; Hillrom Services, Inc.; Medline Industries, LP; PARAMOUNT BED CO., LTD.; Invacare Corporation; Stryker; Malvestio Spa; Gendron; and Midmark India Pvt Ltd. are major market players. Companies operating in the industry are using various strategies to increase their presence in the market.

Key Electric Bed Companies:

The following are the leading companies in the electric bed market. These companies collectively hold the largest market share and dictate industry trends.

- Arjo

- Hillrom Services, Inc.

- Medline Industries, LP

- PARAMOUNT BED CO., LTD.

- Invacare Corporation

- Stryker

- Malvestio Spa

- Gendron

- Midmark India Pvt Ltd.

Recent Developments

-

In July 2024, Yongxin launched its five-function electric hospital bed. This advanced bed offers five adjustable functions, providing maximum comfort and therapeutic support for patients. Designed with intuitive controls and multi-positioning capabilities, the bed enhances caregivers' ease of use. Its construction ensures durability and reliability, making it a valuable addition to medical facilities seeking to elevate patient care standards.

-

In January 2024, Joerns Healthcare introduced new 2024 models of their EasyCare and UltraCare beds, designed for the long-term care continuum. These enhanced models feature improved clinical capabilities for personalized resident care, simplified caregiver usability, and new accessories that increase their functionality.

-

In November 2023, Xiaomi launched its 8H Find Smart Electric Bed, in China in partnership with 8H. This innovative bed features a sleek, frameless design and offers eight different comfort modes to cater to individual preferences. Moreover, it supports smart connectivity through an app and voice control and allows customers to choose from various mattress options, enhancing the overall sleeping experience with personalized comfort.

Electric Bed Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.05 billion

Revenue forecast in 2030

USD 7.17 billion

Growth rate

CAGR of 7.25% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product, procedure, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Arjo; Hillrom Services, Inc.; Medline Industries, LP; PARAMOUNT BED CO., LTD.; Invacare Corporation; Stryker; Malvestio Spa; Gendron; Midmark India Pvt Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

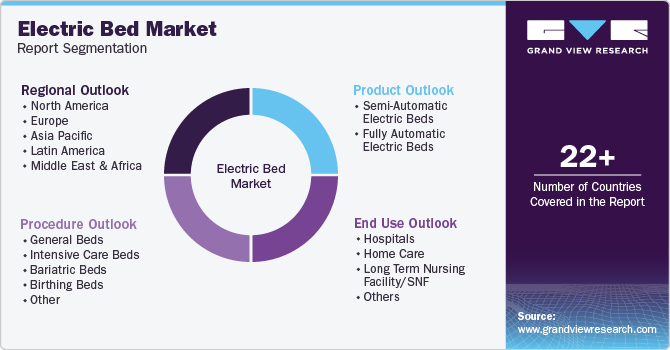

Global Electric Bed Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric bed market report based on product, procedure, end use, and region.

-

Product Outlook (Revenue, Million, 2018 - 2030)

-

Semi-Automatic Electric Beds

-

Fully Automatic Electric Beds

-

-

Procedure Outlook (Revenue, Million, 2018 - 2030)

-

General Beds

-

Intensive Care Beds

-

Bariatric Beds

-

Birthing Beds

-

Other

-

-

End Use Outlook (Revenue, Million, 2018 - 2030)

-

Hospitals

-

Home Care

-

Long Term Nursing Facility/SNF

-

Others

-

-

Regional Outlook (Revenue, Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electric bed market size was estimated at USD 4.74 billion in 2024 and is expected to reach USD 5.05 billion in 2025.

b. The global electric bed market is expected to grow at a compound annual growth rate of 7.25% from 2025 to 2030 to reach USD 7.17 billion by 2030.

b. North America dominated the electric bed market with the highest share in 2024. This is attributable to rising healthcare awareness and constant research and development initiatives.

b. Some key players operating in the electric bed market include Arjo, Hill-Rom Services Inc., Medline, PARAMOUNT BED CO., LTD., Invacare Corporation, Stryker, LINET, and Gendron Inc.

b. Key factors driving the electric bed market growth include an increasing number of road accidents and surgeries across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.