- Home

- »

- Medical Devices

- »

-

Elder Care Assistive Robots Market, Industry Report, 2033GVR Report cover

![Elder Care Assistive Robots Market Size, Share & Trends Report]()

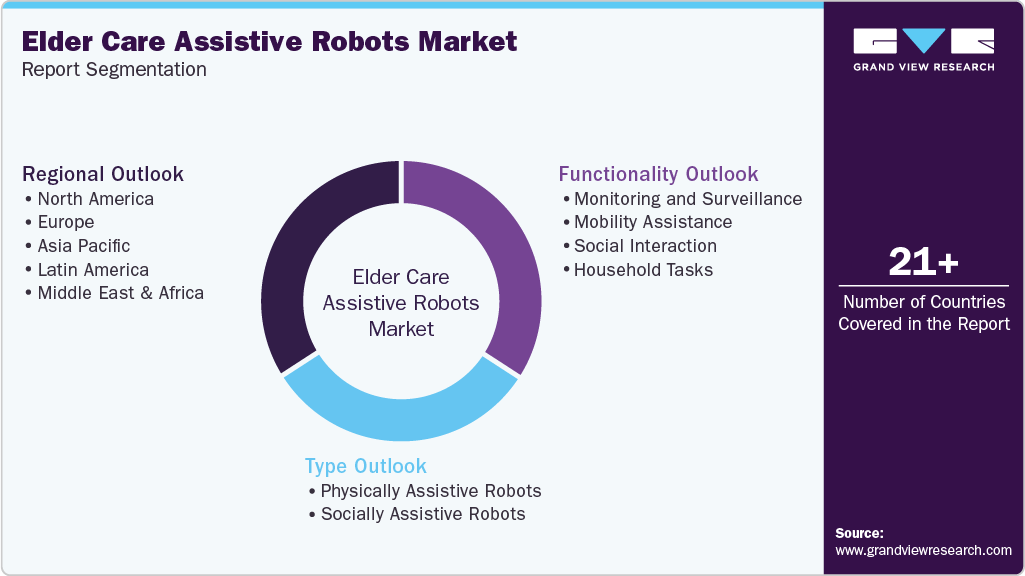

Elder Care Assistive Robots Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Physically Assistive Robots, Socially Assistive Robots), By Functionality (Monitoring & Surveillance, Mobility Assistance, Social Interaction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-332-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Elder Care Assistive Robots Market Summary

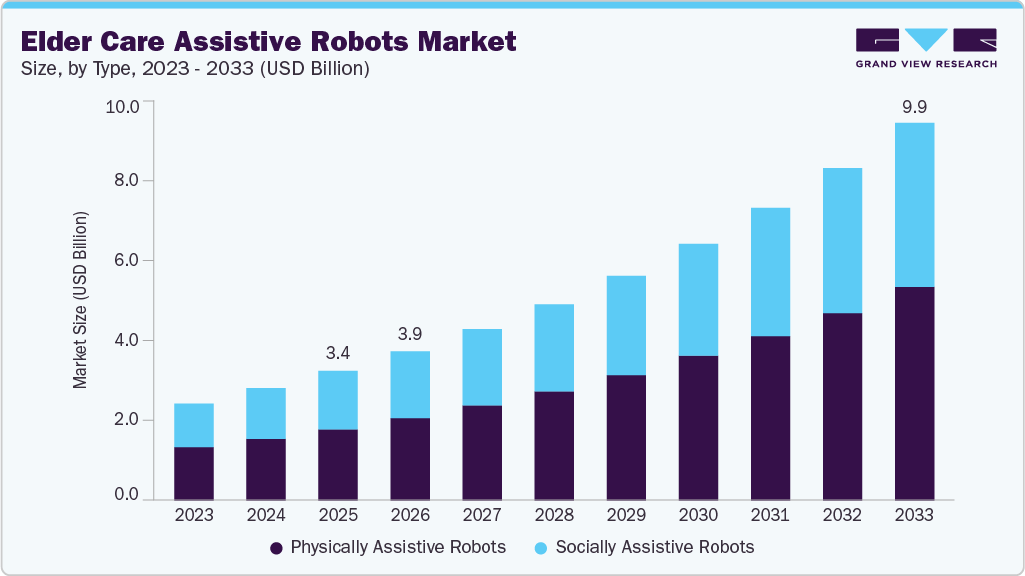

The global elder care assistive robots market size was estimated at USD 3.38 billion in 2025 and is projected to reach USD 9.85 billion by 2033, growing at a CAGR of 14.20% from 2026 to 2033. The rising geriatric population, growing investments, and increasing shortage of care givers is driving the demand for elder care-assistive robots.

Key Market Trends & Insights

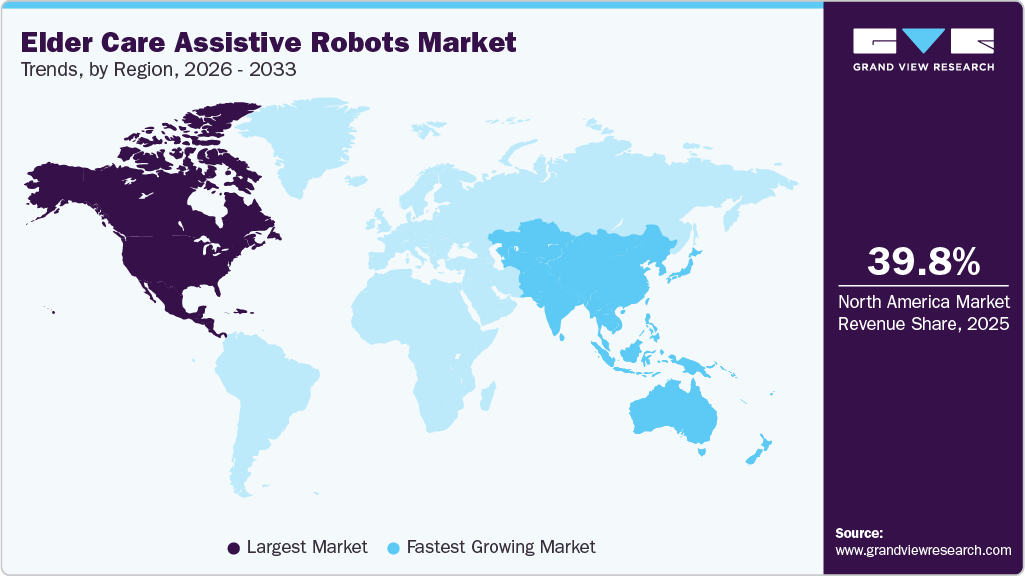

- North America elder care assistive robots market held the largest share of 39.77% of the global market in 2025.

- The elder care assistive robots market in the U.S. held the largest share of 83.37% in 2025.

- By type, the physically assistive robots segment held the highest market share of 55.12% in 2025.

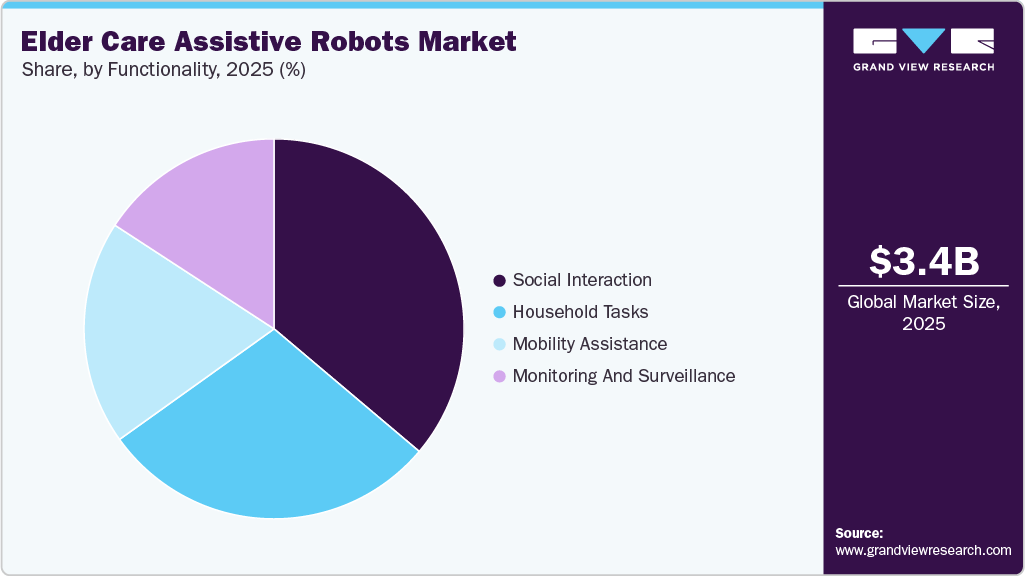

- By functionality, the social interaction segment held the highest market share of 36.16% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.38 Billion

- 2033 Projected Market Size: USD 9.85 Billion

- CAGR (2026-2033): 14.20%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

As populations across the globe continue to age at an unprecedented rate, the demand for elder care services is surging. With advancements in healthcare leading to increased life expectancy, many countries particularly those within the OECD are facing significant pressure to provide adequate care and support for their growing elderly populations. This demographic shift is reshaping social and economic structures and exposing critical gaps in healthcare systems. For instance, according to the Global Coalition on Aging Report in 2021, there will be a shortage of 13.5 million care workers by 2040 across OECD countries alone, which represents a 60% increase needed in the current workforce to maintain the present ratio of caregivers to patients. This growing gap is propelling the need for innovative solutions to support the elderly, thereby fostering market growth.

The growing investment by government and non-government bodies will boost market growth. In August 2023, Intuition Robotics, a company specializing in technology for seniors, raised USD 25 million to address the increasing interest in ElliQ, its conversational AI-powered robot designed for seniors. The device uses generative AI and large language models (LLMs) to facilitate ongoing conversational interactions between the robot and its user. Furthermore, increasing integration of artificial intelligence (AI) in the eldercare robots are enhancing their features, thereby fostering its adoptions. In March 2024, a South Korean company called Hyodol created a robot that utilizes AI to interact with elderly individuals living with dementia. This robot has advanced language-processing abilities, emotional recognition, and can talk and play music, providing companionship to lonely individuals.

Growing elderly population across the globe is driving the market growth. According to the United Nations Population Fund’s India Ageing Report 2023, the population of individuals aged 60 and above is projected to double from 10.5% or 14.9 crore (as of July 1, 2022) to 20.8% or 34.7 crore by 2050. In addition, the World Health Organization in 2025 cited that the number of people aged 60 and above is expected to grow from 1.1 billion in 2023 to 1.4 billion by 2030. This demographic trend significantly drives demand in the elder care assistive robots market, as healthcare systems face rising pressure to provide continuous and efficient care.

Rising research and development activities in robotics are further fueling market growth. For instance, in January 2024, researchers at Cornell University's EmPRISE Lab introduced the RABBIT system, a robot-assisted bed bathing solution utilizing RGB and thermal imaging to identify skin conditions. It employs a compliant end-effector, "Scrubby," for gentle care, enhancing comfort and safety in personal hygiene tasks. A user study with 12 participants, including one with severe mobility limitations, demonstrated its effectiveness and perceived comfort. In addition, regulatory support and policy initiatives play a crucial role in fostering market growth. Supportive policies, such as funding for research and development, subsidies for technology adoption, and regulatory frameworks that ensure safety and efficacy, are boosting market growth.

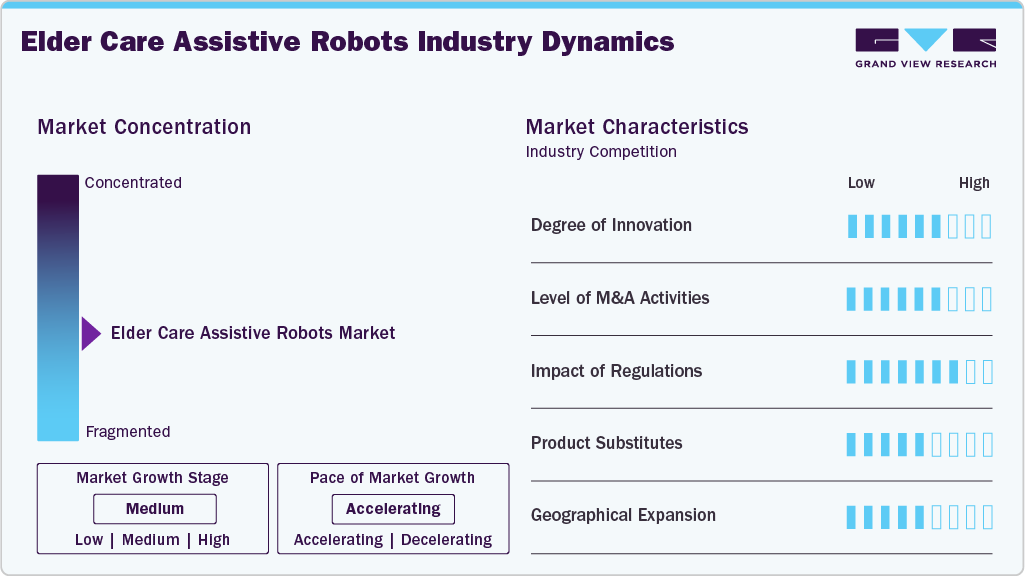

Market Concentration & Characteristics

The field of eldercare assistive robots is rapidly advancing due to the growing demand for solutions to address the needs of the aging population. These robots incorporate cutting-edge technologies such as artificial intelligence, machine learning, and advanced sensor systems to carry out a range of tasks. For instance, at CES 2024, Intuition Robotics introduced ElliQ 3, an enhanced AI robot designed to be a companion for seniors. This new version uses advanced AI to have more natural and friendly conversations, remember things from past chats, and even help seniors do creative things like painting and writing poetry. The robot is lighter and smaller, making it easier for older people to use. It also helps care for their health by checking in daily and offering mental health support. ElliQ 3 is made to help seniors live on their own and feel less lonely.

The elder care assistive robots market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to expand the business to cater to the growing demand for nanorobots. In November 2022, KEENON Robotics, a leading global intelligent service robotics company, signed a strategic partnership with SGP, marking its official entry into the senior living and healthcare industries in Canada.

Key regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), are increasingly focused on creating guidelines that address the unique challenges posed by assistive robotics, including issues related to user safety, data privacy, and the reliability of autonomous systems.

Product substitutes for eldercare assistive robots include a range of traditional and emerging solutions that cater to the needs of the elderly. Traditional substitutes encompass human caregivers such as family members, professional in-home aides, and staff in nursing homes or assisted living facilities. These human caregivers provide personalized attention, emotional support, and hands-on assistance with daily activities.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising collaboration will create more opportunities for elder care assistive robots. For instance, in September 2023, Robotics Venture and Donuts Robotics Inc. have signed a preliminary agreement for a business collaboration. The goal of the collaboration is to tackle issues related to senior care by creating care robots capable of holding conversations adjusted to the individual's health condition.

Type Insights

The physically assistive robots segment dominated the elder care assistive robots market with a share of 55.12% in 2025 and is anticipated to register the fastest growth over the forecast period. The global increase in the elderly population and the growing prevalence of age-related disabilities are fueling market expansion. Life expectancy continues to rise, the demand for assistance with daily activities such as mobility, bathing, and feeding also increases. These robots are increasingly being adopted in home and institutional settings to support seniors with limited mobility. They ensure that seniors get steady and reliable care. New features such as smart navigation, talking ability, and tracking health in real time make these robots even better at understanding and meeting each person's needs.

The socially assistive robots segment in the elder care assistive robots market is anticipated to witness lucrative growth over the forecast period. Growing recognition of social isolation and loneliness as critical issues among the elderly population are fostering market growth. The study published by the National Library of Medicine in September 2024 cited that most professionals supported their use for non-intimate tasks such as meal and toileting assistance. Key factors for successful adoption included user-friendly design, proper training, stakeholder education, and addressing ethical and financial concerns. These insights will help create guidelines for designing and implementing such robots in elderly care settings. Socially assistive robots are designed to provide companionship, cognitive stimulation, and emotional support to the geriatric population, thereby augmenting market growth.

Functionality Insights

The social interaction segment held the largest revenue share of 36.16% in 2025. The growing awareness of mental health challenges faced by the elderly population is driving the demand for social interaction robots. These robots are designed to engage seniors in conversations, games, and activities, helping to reduce feelings of loneliness and social isolation. Samarth Life Management Pvt Ltd., India’s no.1 elder care organization, stated in 2024 that robots transform elderly care by offering companionship, aiding in daily tasks, and enhancing mobility. Smart robots such as Stevie and PARO use advanced technology to reduce feelings of loneliness and help older adults live more independently, especially those who live alone or far from their families. These new tools improve their lives by mixing helpful technology with kind, caring support. These factors will contribute to market growth.

Monitoring and surveillance segment in elder care assistive robots market is anticipated to register the fastest growth over the forecast period. The rising number of falls among older people contributes to market growth. The article titled "New Eldercare Robot with Path-Planning and Fall-Detection Capabilities" presents the design and development of an eldercare robot aimed at addressing two primary challenges faced by older people: continuous indoor tracking and fall detection. The robot integrates advanced hardware and software components, including sensors and control systems, to monitor the movements of elderly individuals within indoor environments. Furthermore, advancements in sensors, cameras, and AI have significantly improved the capabilities of these robots, making them more accurate and reliable. These factors are contributing to market growth.

Regional Insights

North America dominated the elder care assistive robots market in 2025 and accounted for the largest revenue share of 39.77%, owing to its advanced healthcare infrastructure and significant investments in healthcare technology. The high rate of adoption of innovative technologies and a strong focus on improving the quality of life for the elderly are accelerating regional growth. In addition, leading tech companies and startups specializing in robotics and AI contribute to the development and commercialization of advanced elder care robots.

U.S. Elder Care Assistive Robots Market Trends

The elder care assistive robots market in the U.S. held the largest share of 83.37% in 2025. Increasing adoption of robots in the U.S. is fostering market growth. In a report published in Forbes in 2022, it was revealed that New York State is preparing to introduce a new program aimed at providing "companion robots" to its elderly population. The state has partnered with Intuition Robotics, an Israel-based company, to distribute these robots to around 800 individuals.

Europe Elder Care Assistive Robots Market Trends

Europe elder care assistive robots market is anticipated to register the fastest growth during the forecast period. The European Commission's Horizon 2020 and Horizon Europe programs have granted significant funding for projects aimed at improving the use of robotics in healthcare.In addition, public awareness campaigns and advocacy groups highlight the significance of assistive technologies, promoting widespread acceptance and use of elder care robots.

Germany elder care assistive robots market is projected to register a considerable growth rate during the forecast period. The number of people needing care is increasing rapidly, and it is estimated that 670,000 caregiver positions will remain unfilled in Germany by 2050. As a result, researchers are working diligently to develop robots that can assist with some of the tasks currently performed by nurses, caregivers, and doctors.

Asia Pacific Elder Care Assistive Robots Market Trends

Asia Pacific elder care assistive robots market is anticipated to register the fastest growth rate during the forecast period. The economic growth in countries such as China and India is leading to increased disposable income, allowing more families to invest in assistive technologies for their elderly members. In addition, the declining workforce and the high cost of human caregivers in these countries are driving the demand for automated solutions to support the elderly.

China elder care assistive robots market is experiencing significant growth, driven by demographic shifts, technological advancements, and supportive government policies. The Chinese government is advancing elderly care by promoting humanoid robots, brain-computer interfaces, and AI technologies. New guidelines aim to develop intelligent home systems, enhance safety, and create a national elderly care information platform. The goal is to provide accessible, high-quality, and sustainable services for the aging population.

Latin America Elder Care Assistive Robots Market Trends

Latin America elder care assistive robots market is anticipated to register significant growth during the forecast period owing to the rising awareness of the benefits of assistive technologies. Furthermore,government initiatives aimed at improving healthcare infrastructure and access to medical technologies are helping to drive market growth. Additionally, the increasing prevalence of chronic diseases and mobility impairments among the elderly population are escalating regional growth.

Brazil elder care assistive robots market is anticipated to positively grow during the forecast period. The growing elderly population is escalating market growth. For instance, according to a report from the Pan American Health Organization published in 2022, Brazil has over 30 million people aged 60 years and older, making up 13% of the country's population. By 2030, this age group is expected to reach around 50 million, representing 24% of the total Brazilian population.

Middle East & Africa Elder Care Assistive Robots Market Trends

MEA elder care assistive robots market is anticipated to grow lucratively during the forecast period.Significant investments in healthcare infrastructure and technology are propelling market growth. Countries such as the UAE and Saudi Arabia are heavily investing in smart city projects and advanced healthcare infrastructure, which includes the integration of robotic solutions in elder care.

South Africa elder care assistive robots market is expected to register the fastest growth during the forecast period. Increasing prevalence of dementia among geriatric population is fostering market growth. For instance, as per an article published in JAMA Network in 2022, studies conducted in South Africa suggest that the prevalence of dementia among adults aged 65 years or older ranges from 3.8% to 11.0%. Proper care for dementia patients contributes to the growth of the market.

Key Elder Care Assistive Robots Company Insights

Key participants in the elder care assistive robots market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Elder Care Assistive Robots Companies:

The following are the leading companies in the elder care assistive robots market. These companies collectively hold the largest market share and dictate industry trends.

- Intuition robotics

- Toyota (GB) PLC.

- SoftBank Robotics UK Ltd.

- Blue Frog Robotics

- KOMPAÏ robotics

- Zorarobotics NV

- YUJIN ROBOT Co., Ltd.

- Panasonic Holdings Corporation

- PARO Robots U.S., Inc.

Recent Developments

-

In May 2025, UBTech Robotics launched a USD 20,000 consumer-grade humanoid home robot, marking a major step forward in the integration of robotics into elder care. Designed to assist with everyday tasks such as loading dishwashers, folding laundry, and providing companionship, the robot is part of UBTech’s broader strategy to address the growing shortage of caregivers

-

In May 2025, MIT engineers announced that it has developed the Elderly Bodily Assistance Robot (E-BAR), a mobile device designed to aid seniors in daily movements and prevent falls. E-BAR follows users, offering support during walking, sitting, and standing. It features inflatable airbags that deploy rapidly to catch individuals if they begin to fall, eliminating the need for wearable harnesses.

-

In February 2024, Researchers at Universidad Carlos III and Robotnik developed ADAM, an advanced eldercare robot designed to assist seniors with daily tasks. Equipped with vision systems and dual arms, ADAM can perform activities such as setting tables, sweeping, and retrieving items. Its modular design and learning capabilities allow it to adapt to various home environments, enhancing safety and independence for the elderly.

-

In January 2024, Intuition Robotics launched the latest enhancements to its AI companion ElliQ, designed to have a positive impact on the health and independence of seniors. With a recent USD 25 million funding round, ElliQ 3 marks a significant advancement in the integration of generative AI into daily life, aiming to enhance human-AI relationships. The updates broaden ElliQ's availability and accessibility, with the goal of improving the independence and well-being of older adults while reducing feelings of loneliness.

-

In December 2023, SoftBank Robotics America (SBRA), the North American branch of the robotics solutions industry leader, partnered with Formant, the top robot management system (RMS) provider. This collaboration aimed to enhance the integration of SoftBank Robotics' range of solutions.

-

In January 2023, Aeolus Robotics unveiled aeo, a dual-arm humanoid robot designed for various service tasks such as eldercare, security, kiosk operation, ultraviolet germicidal disinfection, and delivery.

Elder Care Assistive Robots Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.89 billion

Revenue forecast in 2033

USD 9.85 billion

Growth rate

CAGR of 14.20% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, functionality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Intuition Robotics Inc; Toyota (GB) PLC.; SoftBank Robotics UK Ltd.; Blue Frog Robotics; KOMPAÏ robotics; Zorarobotics NV; YUJIN ROBOT Co., Ltd.; Panasonic Holdings Corporation; PARO Robots U.S., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elder Care Assistive Robots Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2021 to 2033. For the purpose of this study, Grand View Research, Inc. has segmented the global elder care assistive robots market report on the basis of type, functionality, and region:

-

Type Outlook (Revenue USD Million, 2021 - 2033)

-

Physically Assistive Robots

-

Socially Assistive Robots

-

-

Functionality Outlook (Revenue USD Million, 2021 - 2033)

-

Monitoring and Surveillance

-

Mobility Assistance

-

Social Interaction

-

Household Tasks

-

-

Regional Outlook Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global elder care assistive robots market size was estimated at USD 3.38 billion in 2025 and is expected to reach USD 3.89 billion in 2026.

b. The global elder care assistive robots market is expected to grow at a compound annual growth rate of 14.20% from 2026 to 2033 to reach USD 9.85 billion by 2033.

b. The physically assistive robots segment dominated the elder care assistive robots market with a share of 55.12% in 2025. The global increase in the elderly population and the growing prevalence of age-related disabilities are fueling market expansion.

b. Some key players operating in the market include Intuition Robotics Inc, Toyota (GB) PLC., SoftBank Robotics UK Ltd., Blue Frog Robotics, KOMPAÏ robotics, Zorarobotics NV, YUJIN ROBOT Co., Ltd., Panasonic Holdings Corporation, PARO Robots U.S., Inc.

b. The increasing shortage of care givers will drive the demand for elder care-assistive robots. For instance, according to human resources expert Paul Osterman, there will be a national shortage of 151,000 paid direct care workers and 3.8 million unpaid family caregivers in the U.S. by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.