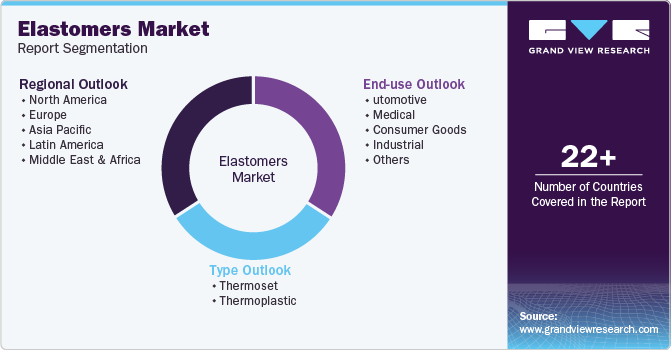

Elastomers Market Size, Share & Trends Analysis Report By Type (Thermoplastics, Thermosets), By End Use (Automotive, Medical, Consumer Goods, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-786-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Elastomers Market Size & Trends

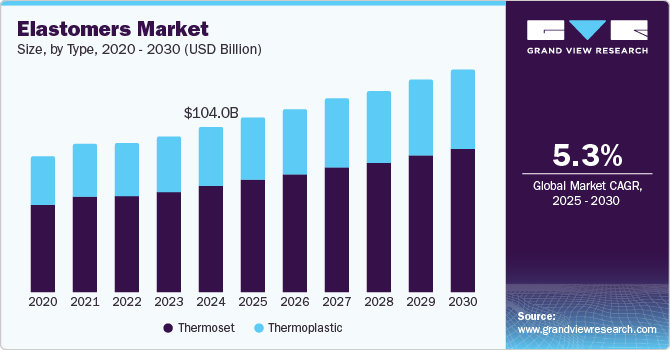

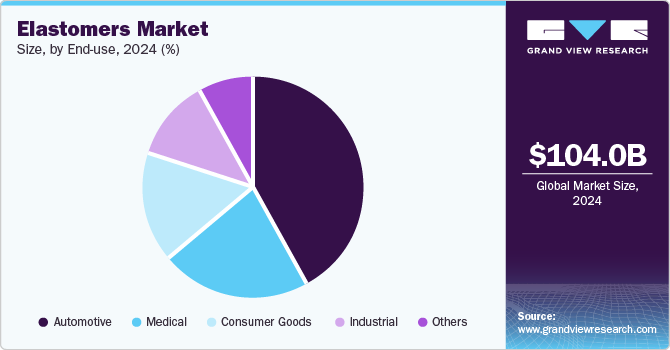

The global elastomers market size was valued at USD 104.0 billion in 2024 and is anticipated to grow at a CAGR of 5.3% from 2025 to 2030. This growth can be attributed to the rising demand from the automotive industry for lightweight and high-performance materials is significant, as elastomers provide essential properties such as durability and chemical resistance. In addition, advancements in processing technologies and increased applications in the construction, medical, and consumer goods sectors contribute to market expansion. Furthermore, the shift towards sustainable materials, including bio-based elastomers, further enhances growth prospects as industries seek to reduce their environmental impact.

Elastomers are rubber-like materials known for their elasticity and durability, making them essential in various industries. The construction sector's increasing demand significantly influences the growth of the elastomers market. As urbanization accelerates and infrastructure projects expand globally, the need for high-performance materials that offer flexibility, durability, and weather resistance becomes critical. Elastomers are widely used in sealants, adhesives, and waterproofing applications, effectively fulfilling these requirements.

Furthermore, the rising emphasis on sustainability within the construction industry has led to an increased preference for eco-friendly elastomeric materials derived from renewable sources. This shift addresses environmental concerns and aligns with the industry's goal of reducing reliance on fossil fuels. Innovations in renewable elastomers have emerged, providing properties comparable to traditional synthetic options while promoting biodegradability and a lower carbon footprint.

Moreover, technological advancements play a vital role in this market's expansion as ongoing research and development efforts yield innovative elastomer products with enhanced performance characteristics. These developments cater to diverse applications across various sectors, including automotive and consumer goods. As the demand for sustainable construction materials continues to grow, elastomers are poised to capture a significant share of this evolving market landscape.

Type Insights

The thermoset elastomers dominated the market and accounted for the largest revenue share of 67.4% in 2024. This growth can be attributed to their exceptional properties, including high-temperature resistance, chemical stability, and durability. These characteristics make thermosets ideal for demanding automotive, aerospace, and construction applications. In addition, their ability to maintain structural integrity under extreme conditions enhances their appeal for products such as tires and seals. Furthermore, the increasing focus on sustainability and the development of advanced formulations are further propelling the demand for thermoset elastomers in various applications.

The thermoplastic elastomers (TPE) segment is expected to grow at a CAGR of 6.5% in 2024, owing to their versatility and ease of processing. TPEs are increasingly favored in automotive applications for their lightweight and flexible nature, which contributes to fuel efficiency and performance. In addition, the rise of electric vehicles also boosts TPE demand, as these materials are essential for components requiring durability and impact resistance. Furthermore, the growing consumer electronics sector seeks TPEs for their aesthetic appeal and functional properties, driving further growth in this segment of the elastomers market.

End Use Insights

The automotive segment led the market and accounted for the largest revenue share of 41.7% in 2024, primarily driven by the increasing demand for lightweight and durable materials that enhance vehicle efficiency and performance. In addition, as automakers focus on reducing emissions and improving fuel economy, elastomers provide essential properties such as flexibility, heat resistance, and chemical stability. Furthermore, stringent government regulations to ensure passenger safety and reduce environmental impact further boost the adoption of elastomers in various automotive applications.

The medical segment is expected to grow at a CAGR of 6.3% from 2025 to 2030, owing to the rising demand for high-quality, biocompatible materials propelling elastomers' growth. These materials are crucial for manufacturing medical devices, seals, and gaskets that require excellent durability and flexibility. In addition, the ongoing advancements in healthcare technology and the increasing emphasis on patient safety drive the need for innovative elastomer solutions. Furthermore, the trend towards minimally invasive procedures and personalized medicine necessitates the development of specialized elastomers that meet stringent regulatory standards, fostering market expansion in this sector.

Regional Insights

The Asia Pacific elastomers market dominated the global market and accounted for the largest revenue share of 43.0% in 2024, primarily driven by rapid industrialization and urbanization, leading to increased demand for lightweight and durable materials across various sectors, including automotive and construction. In addition, the region's expanding infrastructure projects further enhance the need for elastomers in applications such as sealants and adhesives. Furthermore, advancements in manufacturing technologies and a growing focus on sustainability are propelling the adoption of eco-friendly elastomers, catering to both environmental regulations and consumer preferences.

The elastomers market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, owing to its robust manufacturing sector and significant investments in the automotive and construction industries. In addition, the government's stringent environmental policies promote the use of eco-friendly elastomers, which are increasingly favored for their recyclability and lower environmental impact. Furthermore, China's booming electronics industry demands high-performance elastomers for applications requiring flexibility and heat resistance.

Middle East & Africa Elastomers Market Trends

Middle East & Africa elastomers market is expected to grow at a CAGR of 6.6% over the forecast period, driven by increasing infrastructure development and urbanization initiatives. Countries in this region are investing in construction projects that require durable and weather-resistant materials, driving demand for elastomers. Furthermore, expanding the oil and gas sector necessitates specialized elastomer products for applications such as seals and gaskets. Moreover, the region's focus on diversifying economies beyond oil dependency further encourages investment in various industries that utilize elastomers.

North America Elastomers Market Trends

The elastomers market in North America held a significant revenue share of 24.8% in 2024, owing to the advancements in automotive technology, particularly with the rise of electric vehicles that require lightweight materials for improved efficiency. In addition, the region's strong emphasis on innovation drives demand for high-performance elastomers in various applications, including medical devices and consumer goods. Furthermore, stringent emissions and safety standards regulations propel manufacturers to adopt advanced elastomer solutions that meet these requirements.

U.S. elastomers market led the North American market and accounted for the largest revenue share in 2024, primarily driven by a strong automotive sector that increasingly seeks lightweight materials to enhance fuel efficiency and performance. In addition, the growing healthcare industry demands biocompatible elastomers for medical devices, further driving market expansion. Moreover, innovations in manufacturing processes also contribute to improved product quality and cost-effectiveness, making U.S.-based manufacturers competitive on a global scale. As sustainability becomes a priority, the shift towards eco-friendly elastomer solutions is expected to shape future growth.

Europe Elastomers Market Trends

The elastomers market in Europe is expected to grow significantly over the forecast period, driven by stringent environmental regulations that encourage the use of sustainable materials across industries. In addition, the automotive sector's transition towards electric vehicles significantly boosts demand for lightweight and high-performance elastomers. Moreover, advancements in technology facilitate the development of innovative elastomer products that meet diverse application needs, from construction to medical devices.

Key Elastomers Company Insights

Key players in the global elastomers industry include DuPont de Nemours, Inc., ASF SE, INEOS, and others. These companies are adopting various strategies to enhance their competitive edge. Partnerships and agreements are being formed to leverage technological advancements and expand product portfolios. In addition, companies are focusing on new product developments to meet evolving consumer demands and regulatory standards. Furthermore, market expansions into emerging regions are also a priority, enabling players to tap into growing markets.

-

LANXESS AG specializes in producing polyurethane elastomers, which are utilized in various applications, including automotive components, industrial machinery, and consumer goods. The company operates primarily in the Advanced Intermediates, Specialty Additives, and Consumer Protection segments, offering a diverse range of products designed to meet the specific needs of different industries while ensuring high quality and performance standards.

-

LG Chem manufactures thermoplastic elastomers (TPEs) and other specialty elastomers used across multiple sectors, including automotive, electronics, and consumer goods. Operating within the advanced materials segment, the company focuses on innovation and sustainability, developing high-quality elastomers that cater to industries' evolving demands while enhancing performance and environmental responsibility.

Key Elastomers Companies:

The following are the leading companies in the elastomers market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont de Nemours, Inc.

- BASF SE

- INEOS

- Asahi Kasei Corporation

- LANXESS AG

- Huntsman Corporation

- LG Chem

- Chemtura Corporation

- Mitsui Chemicals, Inc.

- JSR BST Elastomer Co., Ltd

- Zeon Chemicals L.P.

- Kuraray Co., Ltd.

- Wacker Chemie AG

- ExxonMobil

- Arkema

Recent Developments

-

In March 2024, Dow introduced a new polyolefin elastomer (POE)--based alternative to leather, targeting the automotive industry’s shift toward animal-free products. This innovation, developed in partnership with HIUV Materials Technology, offers advantages such as enhanced softness, color stability, and resistance to aging and low temperatures. Furthermore, it is lighter than PVC leather and free from hazardous chemicals. Dow anticipates expanding this elastomer-based solution into various consumer sectors, including fashion and furniture.

-

In March 2023, Borealis announced the launch of its new line of circular plastomers and elastomers, named Renewable. Produced at its Geleen facility in the Netherlands using renewable feedstock, these products aimed to meet the increasing demand for sustainable materials without compromising performance. The Bornewables line is ISCC PLUS certified and utilizes waste-derived feedstock, including used cooking oil.

-

In February 2023, Kuraray Co., Ltd. announced the completion of a new plant for isoprene-related businesses. Located in the WHA Eastern Industrial Park in Rayong Province, Thailand, this facility was expected to enhance the global supply chain for products such as 3-Methyl-1.5-Pentanediol (MPD) and SEPTON hydrogenated styrenic block copolymers (HSBC), both of which are key elastomers. The investment aimed to meet rising global demand and supports Kuraray's medium-term management plan, "PASSION 2026," focusing on sustainable growth and innovation in specialty chemicals.

Elastomers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 109.2 billion |

|

Revenue forecast in 2030 |

USD 141.5 billion |

|

Growth Rate |

CAGR of 5.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, China, India, Japan, South Korea, Thailand, Germany, France, UK, Italy, Brazil, and Saudi Arabia |

|

Key companies profiled |

DuPont de Nemours, Inc.; BASF SE; INEOS; Asahi Kasei Corporation; LANXESS AG; Huntsman Corporation; LG Chem; Chemtura Corporation; Mitsui Chemicals, Inc.; JSR BST Elastomer Co., Ltd; Zeon Chemicals L.P.; Kuraray Co., Ltd; Wacker Chemie AG; ExxonMobil; Arkema. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Elastomers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the elastomers market report based on type, end use, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Thermoset

-

Thermoplastic

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Consumer Goods

-

Industrial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."