- Home

- »

- Advanced Interior Materials

- »

-

Elastomeric Membrane Market Size, Industry Report, 2030GVR Report cover

![Elastomeric Membrane Market Size, Share & Trends Report]()

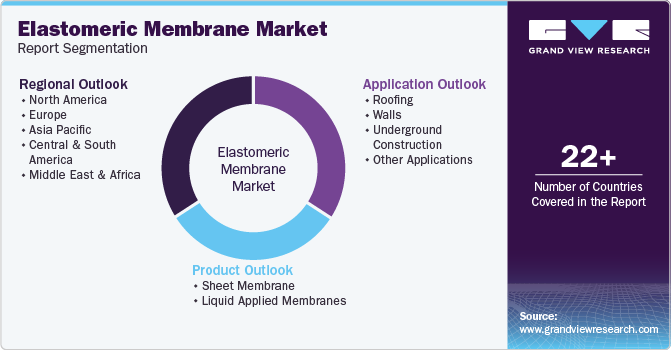

Elastomeric Membrane Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Roofing, Walls), By Product (Sheet Membrane, Liquid Applied Membranes), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-522-1

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Elastomeric Membrane Market Summary

The global elastomeric membrane market size was estimated at USD 12.76 billion in 2024 and is projected to reach USD 17.30 billion by 2030, growing at a CAGR of 5.2% from 2025 to 2030, driven by the increasing demand for durable and waterproof roofing solutions in the construction industry.

Key Market Trends & Insights

- Asia Pacific elastomeric membrane industry dominated globally and accounted for the largest revenue share of about 31.5% in 2024.

- Based on application, the roofing segment led the market and held the largest revenue share of 46.5% in 2024.

- Based on product, the liquid applied membranes segment dominated the market and held the largest revenue share of 65.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.76 Billion

- 2030 Projected Market Size: USD 17.30 Billion

- CAGR (2025-2030): 5.2%

- Asia Pacific: Largest market in 2024

The growth of urbanization and infrastructure development, particularly in emerging economies, has led to a surge in commercial and residential construction projects. Elastomeric membranes are widely preferred due to their superior flexibility, weather resistance, and longevity, making them ideal for roofing and waterproofing applications.

In addition, stringent building codes and regulations emphasizing energy efficiency and sustainability have further propelled the adoption of elastomeric membranes in modern construction practices.

Technological advancements in elastomeric membrane manufacturing have significantly boosted market growth. The development of advanced polymer formulations and reinforced membranes has enhanced their performance characteristics, such as improved adhesion, tear resistance, and ease of application. Self-adhesive and liquid-applied elastomeric membranes have gained traction due to their ease of installation and seamless waterproofing capabilities. In addition, the growing emphasis on eco-friendly and recyclable materials has led manufacturers to introduce sustainable elastomeric membrane solutions, aligning with global environmental goals and green building initiatives.

The increasing investments in infrastructure projects, particularly in the transportation and energy sectors, are also fueling the demand for elastomeric membranes. Roadways, bridges, tunnels, and underground structures require high-performance waterproofing solutions to prevent deterioration and extend their service life. Similarly, the renewable energy sector, including solar and wind power plants, relies on elastomeric membranes for protecting critical components from environmental damage. With governments and private entities allocating substantial budgets for infrastructure development, the elastomeric membrane industry is expected to witness steady growth.

Another key driver is the rising awareness regarding the benefits of elastomeric membranes in reducing maintenance costs and enhancing building lifespan. These membranes offer excellent resistance to temperature fluctuations, UV radiation, and moisture, preventing structural damage and leaks over time. Their high elasticity allows them to accommodate structural movements, making them particularly beneficial for regions prone to extreme weather conditions. As a result, industries such as commercial real estate, industrial facilities, and residential housing are increasingly integrating elastomeric membranes into their building envelopes to ensure long-term durability and cost savings.

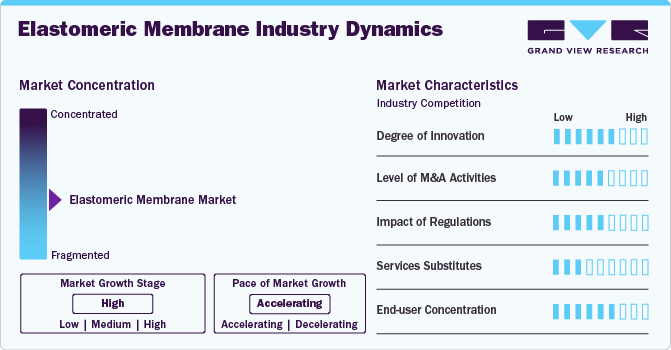

Market Concentration & Characteristics

The elastomeric membrane industry exhibits a moderate-to-high level of market concentration, dominated by established global players such as Sika AG, BASF SE, and Carlisle Companies Inc., alongside regional manufacturers. These key players benefit from economies of scale, advanced R&D capabilities, and strong distribution networks, allowing them to maintain market leadership. The degree of innovation is a crucial factor, with companies continuously developing advanced formulations, eco-friendly solutions, and high-performance membranes to meet stringent industry demands. Regulatory impact is significant, as strict environmental and safety regulations drive manufacturers to invest in sustainable and energy-efficient products, particularly in developed markets. Compliance with green building certifications, such as LEED and BREEAM, further influences product development strategies.

In terms of market dynamics, the presence of substitutes such as bituminous membranes, PVC, and TPO membranes impacts competitiveness, requiring elastomeric membrane manufacturers to differentiate their offerings through enhanced durability, flexibility, and weather resistance. End-user concentration is another defining characteristic, with demand primarily driven by the construction, roofing, and infrastructure sectors. Large-scale commercial and industrial projects, as well as government initiatives promoting resilient and energy-efficient structures, contribute significantly to market growth. In addition, regional variations play a critical role, with North America and Europe witnessing stable demand due to well-established construction sectors, while rapid urbanization and infrastructural investments in Asia-Pacific create lucrative expansion opportunities for market participants.

Application Insights

The roofing segment led the market and held the largest revenue share of 46.5% in 2024, driven by the increasing demand for durable, weather-resistant, and energy-efficient roofing solutions across residential, commercial, and industrial construction. The superior waterproofing and flexibility of elastomeric membranes make them an ideal choice for roofing applications, particularly in regions experiencing extreme weather conditions such as heavy rainfall, high temperatures, and strong winds.

The underground construction segment is expected to grow at the fastest CAGR of 5.6% over the forecast period. As metropolitan areas grow, governments and private entities are investing in subway systems, underground parking facilities, and utility tunnels, necessitating high-performance elastomeric membranes to prevent water ingress and structural deterioration. The rising demand for sustainable and long-lasting waterproofing solutions has further bolstered the adoption of elastomeric membranes, which offer superior flexibility, chemical resistance, and crack-bridging capabilities, ensuring the longevity of underground structures in diverse environmental conditions.

Product Insights

The liquid applied membranes segment dominated the market and held the largest revenue share of 65.0% in 2024, driven by its superior waterproofing capabilities, ease of application, and adaptability to complex surface geometries. Unlike sheet-based membranes, liquid-applied elastomeric membranes offer seamless coverage, reducing the risk of water ingress and improving overall structural integrity. The increasing demand for cost-effective and long-lasting waterproofing solutions in commercial, residential, and industrial construction projects is fueling the adoption of these membranes.

The sheet membrane segment is expected to grow significantly at a CAGR of 4.9% over the forecast period. Increasing demand for advanced waterproofing solutions in commercial, residential, and industrial construction is driving the demand for sheet membranes. As infrastructure development continues to expand worldwide, particularly in urban areas, the need for reliable and high-performance waterproofing materials has intensified. In addition, technological advancements in polymer formulations have enhanced the performance characteristics of sheet membranes, improving their elasticity, UV resistance, and thermal stability.

Regional Insights

North America elastomeric membrane market is driven by the expanding construction industry, particularly in commercial and residential infrastructure. Rising investments in urban redevelopment, sustainable building initiatives, and energy-efficient construction projects have significantly increased the demand for advanced waterproofing and roofing solutions. In addition, stringent building codes and regulations, including LEED (Leadership in Energy and Environmental Design) certification and ENERGY STAR guidelines, have encouraged the use of high-performance waterproofing materials, further supporting market growth.

U.S. Elastomeric Membrane Market Trends

The elastomeric membrane industry in the U.S. is driven by the increasing focus on technological advancements and regulatory compliance. Manufacturers are investing in R&D to develop eco-friendly and high-performance elastomeric membranes that align with stringent environmental regulations, such as those set by the U.S. Environmental Protection Agency (EPA) and state-level building codes. The market is also influenced by the rising adoption of energy-efficient roofing solutions that enhance insulation and reduce overall energy consumption in buildings.

Asia Pacific Elastomeric Membrane Market Trends

Asia Pacific elastomeric membrane industry dominated globally and accounted for the largest revenue share of about 31.5% in 2024, primarily driven by rapid urbanization and infrastructure development across key countries such as China, India, and Southeast Asia. As these regions experience growing populations and increased demand for residential, commercial, and industrial construction, the need for durable, efficient, and cost-effective building materials has surged. Elastomeric membranes, known for their waterproofing and weather-resistant properties, are widely adopted in roofing, waterproofing, and protective coatings for buildings and infrastructure projects. This growing infrastructure development, coupled with the rise in residential and commercial construction projects, significantly boosts the demand for elastomeric membranes.

China elastomeric membrane industry is driven by expanding manufacturing sector, which supports local production capabilities and reduces dependency on imports. Leading domestic and international players are investing in R&D to develop advanced formulations, including self-adhesive and liquid-applied membranes, catering to diverse industry needs. The growth of the automotive and industrial sectors also influences market expansion, as elastomeric membranes are used for waterproofing applications beyond construction.

Europe Elastomeric Membrane Market Trends

The elastomeric membrane industry in Europe is primarily driven by technological innovation and product diversification. Market players are increasingly focusing on developing self-adhering, spray-applied, and reinforced elastomeric membranes to enhance ease of application, durability, and overall performance. The market is also witnessing a growing preference for bio-based and solvent-free elastomeric membranes, as sustainability and environmental concerns push manufacturers to develop greener alternatives.

The elastomeric membrane industry in Germany is driven by the expansion of the residential housing sector, fueled by population growth, urbanization, and increasing demand for modern, energy-efficient living spaces. Government initiatives such as the KfW Energy-Efficient Construction and Renovation Program promote the use of advanced waterproofing and insulation materials, including elastomeric membranes, in both new construction and renovation projects.

Latin America Elastomeric Membrane Market Trends

Latin America elastomeric membrane industry is driven by the growing adoption of energy-efficient roofing systems, which is driving the demand for elastomeric membranes. With rising concerns over energy consumption and heat island effects in urban areas, developers are increasingly integrating reflective and cool roofing technologies. Elastomeric membranes with reflective coatings help reduce heat absorption, lower indoor cooling costs, and improve overall building energy efficiency, making them a preferred choice for modern construction projects.

Middle East & Africa Elastomeric Membrane Market Trends

The Middle East & Africa elastomeric membrane industry is anticipated to grow over the forecast period. Rising awareness of energy efficiency and sustainability is a key driver, with stringent environmental regulations promoting the use of eco-friendly elastomeric membranes. Green building certifications and regulatory frameworks, such as Estidama in the UAE and South Africa’s SANS energy codes, are compelling construction companies to adopt sustainable solutions. Additionally, the increasing demand for high-performance waterproofing and roofing solutions in residential, commercial, and industrial sectors is driving market penetration.

Key Elastomeric Membrane Company Insights

Some of the key players operating in the market include Versico Roofing Systems and Owens Corning.

-

Versico Roofing Systems is a provider of commercial roofing solutions specializing in single-ply roofing membranes. Versico offers a range of elastomeric membrane products, including TPO (thermoplastic polyolefin), EPDM (ethylene propylene diene monomer), and PVC roofing membranes. These products provide excellent weather resistance, energy efficiency, and ease of installation, making them popular choices for commercial and industrial buildings.

-

Owens Corning offers modified bitumen roofing membranes, underlayments, and waterproofing solutions designed for enhanced durability and weather protection in the elastomeric membrane segment. Its roofing membranes are commonly used in both residential and commercial applications, providing superior resistance to UV exposure, moisture, and extreme temperatures.

Sika AG and Johns Manville Corporation are some of the emerging market participants in the elastomeric membrane industry.

-

Sika AG offers a comprehensive range of elastomeric membranes under its Sarnafil and Sikaplan product lines, which include TPO, PVC, and bituminous membranes. These membranes are widely used for roofing, waterproofing, and structural protection in commercial, industrial, and infrastructure applications.

-

Johns Manville Corporation offers EPDM, TPO, and PVC membranes designed for commercial and industrial roofing applications. Johns Manville's membranes are recognized for their exceptional durability, ease of installation, and energy efficiency. The company also provides liquid-applied roofing systems, adhesives, and insulation solutions, ensuring a complete roofing system for various climate conditions and building requirements.

Key Elastomeric Membrane Companies:

The following are the leading companies in the elastomeric membrane market. These companies collectively hold the largest market share and dictate industry trends.

- Versico Roofing Systems

- Owens Corning

- Sika AG

- Johns Manville Corporation

- Polyglass U.S.A., Inc.

- Tremco Incorporated

- SOPREMA

- PABCO Building Products, LLC

- CertainTeed Corporation

- Carlisle Companies Incorporated

- Firestone Building Products

- GAF

- Sarnafil Roofing Systems

- Bauder Ltd.

Recent Developments

-

In February 2023, Kamdhenu Paints launched 'Kamo Damp Proof,' an advanced waterproof coating designed for roofs and walls, further strengthening its presence in the elastomeric membrane industry. This high-performance coating is formulated with cutting-edge elastomeric technology, providing superior protection against water seepage, moisture damage, and harsh weather conditions. 'Kamo Damp Proof' offers excellent flexibility, crack-bridging capabilities, and UV resistance, making it an ideal solution for long-lasting waterproofing in residential, commercial, and industrial structures.

Elastomeric Membrane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.43 billion

Revenue forecast in 2030

USD 17.30 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Versico Roofing Systems, Owens Corning, Sika AG, Johns Manville Corporation, Polyglass U.S.A., Inc., Tremco Incorporated, SOPREMA, PABCO Building Products, LLC, CertainTeed Corporation, Carlisle Companies Incorporated, Firestone Building Products, GAF, Sarnafil Roofing Systems, Bauder Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elastomeric Membrane Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global elastomeric membrane market report based on application, product, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Roofing

-

Walls

-

Underground Construction

-

Other Applications

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sheet Membrane

-

Liquid Applied Membranes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global elastomeric membrane market size was estimated at USD 12.76 billion in 2024 and is expected to reach USD 13.43 billion in 2025.

b. The global elastomeric membrane market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 17.30 billion by 2030.

b. Based on application, the roofing accounted for the largest revenue share of 46.58% in 2024. Rapid urbanization and increasing investments in commercial complexes, residential buildings, and industrial facilities worldwide are driving the demand for high-performance roofing membranes.

b. Some of the key players operating in the elastomeric membrane market include Versico Roofing Systems, Owens Corning, Sika AG, Johns Manville Corporation, Polyglass U.S.A., Inc., Tremco Incorporated, SOPREMA, PABCO Building Products, LLC, CertainTeed Corporation, Carlisle Companies Incorporated, Firestone Building Products, GAF, Sarnafil Roofing Systems, Bauder Ltd.

b. The key factors that are driving the elastomeric membrane market include rising demand for advanced waterproofing solutions in residential, commercial, and industrial construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.