- Home

- »

- Medical Devices

- »

-

Elastomeric Infusion Pumps Market Size, Share Report, 2030GVR Report cover

![Elastomeric Infusion Pumps Market Size, Share & Trends Report]()

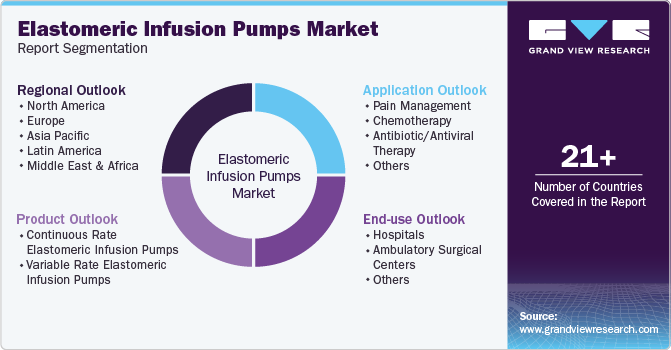

Elastomeric Infusion Pumps Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Continuous Rate Elastomeric Infusion Pumps, Variable Rate Elastomeric Infusion Pumps), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Elastomeric Infusion Pumps Market Trends

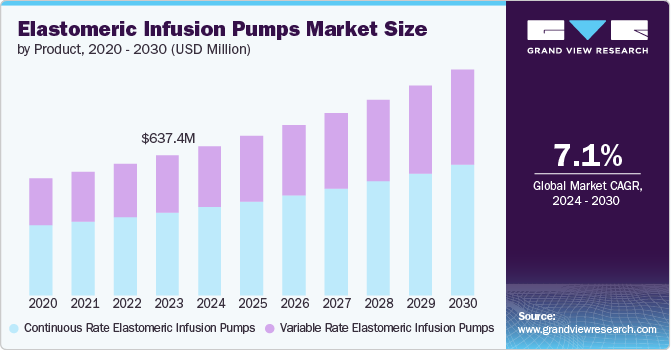

The global elastomeric infusion pumps market size was estimated at USD 679.8 million in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. The rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders is a significant driver for market growth. According to statistics from the World Health Organization (WHO), chronic diseases are the leading cause of mortality worldwide, accounting for 71% of all deaths globally. This led to a higher demand for continuous drug delivery systems such as elastomeric pumps to ensure effective treatment and management of these conditions.

The growing demand for home healthcare solutions is a crucial factor driving the elastomeric infusion pumps industry. Patients prefer therapies that enable them to administer medications at home, and the portability and user-friendliness of elastomeric pumps cater to this need. This trend is amplified by the aging population's increasing requirement for long-term treatment of chronic conditions. According to a study published in October 2024, Osteomyelitis affects around 50,000 people annually in the U.S., with higher incidence in children, older adults, and males. Vertebrae and long bones are the most commonly involved sites. It also shows that males are more susceptible to Osteomyelitis than females, as evidenced by the current research and other published data on the disease.

Manufacturers are focusing on enhancing elastomeric infusion pump technologies to drive market growth. These advancements involve greater accuracy, longer infusion durations, developing pumps with improved features, and accessible designs. These innovations aim to cater to the diverse needs of patients and healthcare providers, enhancing the efficiency of elastomeric infusion pumps and making them dependable and secure. In September 2024, research published in the Journal of Biosciences and Medicines presented a theoretical model for elastomeric pumps, which deliver medications through a catheter. The study accurately reproduced clinical flow rates and identified a toxicity bump related to the sphere's radius. The researchers concluded that by optimizing pump properties, infusion times can be controlled while minimizing toxicity effects.

The increasing push to reduce opioid dependence and improve patient access to alternative pain management solutions has been a major driver in healthcare policy changes. In November 2024, Avanos Medical, Inc. reported that the Centers for Medicare and Medicaid Services has finalized its Medicare Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System regulations for 2025, set to take effect on January 1, 2025. This update introduces the NOPAIN Act, which requires Medicare to provide distinct payments for eligible non-opioid medications and devices to improve patient access to pain management solutions in hospital outpatient and surgical center environments.

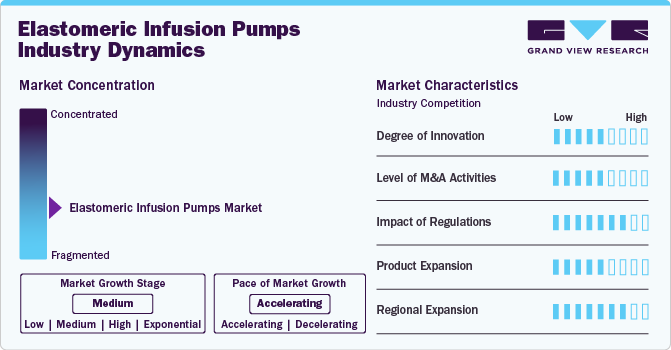

Market Concentration & Characteristics

The degree of innovation in the elastomeric infusion pumps industry is medium. While advancements in pump design, user interfaces, and drug delivery accuracy continue, the overall technology is relatively mature. Companies are innovating to enhance patient comfort, portability, and ease of use, but these innovations mainly focus on incremental improvements rather than major technological breakthroughs. Key innovations include wireless connectivity, smarter alarms, and better integration with hospital systems, but the pace of disruption in this space is slower compared to more dynamic sectors like wearable devices or diagnostics.

The level of mergers and acquisitions in the elastomeric infusion pumps industry is medium. Companies in this market often pursue mergers, acquisitions, and partnerships to enhance their technological capabilities, expand into new geographic regions, or diversify their product offerings. While these activities can lead to improved manufacturing efficiency and access to new markets, the consolidation is not as rapid as in other medical device sectors. The market remains competitive but largely dominated by a few major players, and M&A is driven by the need for specialized technologies, such as better drug delivery systems or improved patient monitoring features

Regulations play a significant role in the elastomeric infusion pumps industry, and their impact is high. The market is heavily influenced by strict regulations set by bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), which govern product safety, efficacy, and quality standards. These regulations affect every stage of product development, from design to manufacturing and post-market surveillance. Companies must invest significant resources in ensuring compliance, which can lead to longer time-to-market for new products and limit the introduction of new features until they meet all regulatory requirements.

Product expansion in the elastomeric infusion pumps industry is medium, and companies are expanding their product lines by introducing new models with improved functionalities, such as enhanced battery life, better precision, and more adaptable flow rates. Some players offer complementary services, including maintenance contracts and integration with hospital IT systems. However, given the high regulatory and technical requirements of the industry, the expansion of entirely new products or services is typically slow and requires substantial R&D investment. As the market matures, companies focus more on upgrading existing products than introducing entirely new product categories.

Regional expansion in the elastomeric infusion pumps industry is high. With growing healthcare infrastructure in emerging markets, such as Asia-Pacific, Latin America, and the Middle East, there is an increasing demand for advanced medical technologies like elastomeric infusion pumps. Companies are focusing on expanding their footprint in these regions to capture new opportunities and meet the rising demand for affordable and efficient healthcare solutions. In addition, these regions offer significant growth potential due to the increasing prevalence of chronic diseases, better access to healthcare services, and government investments in health systems.

Product Insights

The continuous rate elastomeric infusion pumps segment led the market with the largest revenue share of 59.13% in 2024, as these pumps provide a steady, controlled flow of medications, making them well-suited for treatments that necessitate constant and regulated drug delivery, such as antibiotic therapies and pain management. Their simplicity and operational efficiency made them a preferred choice across various healthcare settings, driving their significant market share. For instance, in April 2024, Baxter International Inc. received clearance from the FDA for its Novum IQ large-volume infusion pump that includes Dose IQ Safety Software. This enhancement integrates the LVP with Baxter’s existing Infusion Platform, which also features a syringe infusion pump with the same software, enabling healthcare providers to use a unified system across various patient care settings.

The variable rate elastomeric infusion pumps segment is anticipated to grow at the fastest CAGR over the forecast period. These pumps can deliver medications at varying flow rates, making them well-suited for applications that require more complex or customized infusion profiles, such as pain management, chemotherapy, and antibiotic/antiviral treatments. The increasing demand for flexible and personalized drug delivery solutions is a crucial driver fueling the rapid expansion of the variable rate elastomeric pumps segment.

Application Insights

Based on application, the pain management segment led the market with the largest revenue share of 37.44% in 2024. The increasing prevalence of chronic pain conditions globally leads to a growing demand for effective pain management solutions. The rising geriatric population prone to various chronic illnesses requiring pain management contributes significantly to the market growth in this segment. Elastomeric infusion pumps are widely used to manage pain in acute and chronic settings, enabling patients to self-administer medications as needed and providing effective and convenient pain relief. In November 2023, a study evaluated the effectiveness of intercostal cryonerve block (CryoNB) compared to ropivacaine elastomeric infusion pump (EIP) in managing pain for patients undergoing surgical stabilization of rib fractures. Results showed that CryoNB significantly reduced opioid consumption and pain scores and shortened hospital stays without increasing costs or complications. This technique may enhance multimodal pain management in trauma patients.

The antibiotic/antiviral therapy segment is anticipated to grow at the fastest CAGR over the forecast period. The rising prevalence of infectious diseases and the growing need for effective and convenient delivery of antibiotics and antiviral medications drive the demand for elastomeric pumps in this segment. In September 2024, an article in the Journal of Antimicrobial Chemotherapy emphasized the growth of outpatient parenteral antimicrobial therapy (OPAT) due to infection management needs and home care preferences. While OPAT can effectively treat infections, it faces challenges like medication complications and patient adherence. Future research is needed to enhance its effectiveness.

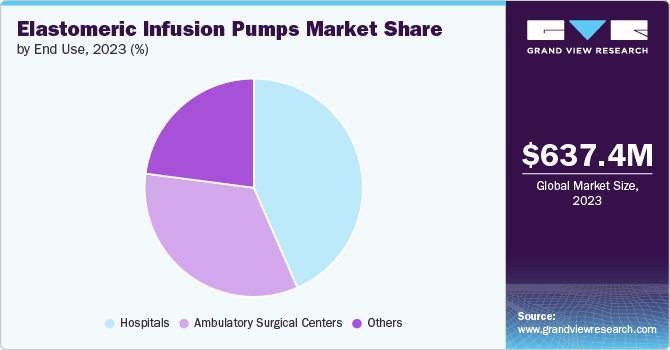

End-use Insights

Based on end use, the hospital segment led the market with the largest revenue share of 43.24% in 2024. This dominance can be attributed to the widespread adoption of these pumps in various hospital settings, such as surgical wards, intensive care units, and oncology departments. Hospitals require reliable and accurate drug delivery solutions to manage diverse patient needs, from post-operative pain management to chemotherapy administration. Elastomeric infusion pumps are well-suited for these applications, as they offer consistent medication delivery, ease of use, and reduced risk of medication errors compared to traditional IV infusion methods. For instance, a study published in the Journal of Pain Research in 2022 found that using elastomeric infusion pumps for post-operative pain management improved patient satisfaction and reduced opioid consumption, highlighting the growing preference for these devices in pain management applications.

The ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing shift towards outpatient surgical procedures and the growing preference for minimally invasive surgeries drive the adoption of elastomeric pumps in ASCs. These pumps provide a convenient and cost-effective solution for delivering continuous infusions of pain medications and antibiotics to patients following same-day surgeries, enabling faster recovery and reducing hospital burden. In December 2024, Enfermedades Infecciosas y Microbiología Clínic published a study on outpatient antibiotic therapy with portable elastomeric pumps (pEP). From 2020 to mid-2023 at a Rome hospital, 94 of 490 patients treated with pEP showed an 88.3% infection cure rate, with 12.8% experiencing adverse events. The study concludes that pEP is a safe and effective outpatient option for antibiotic therapy, supporting personalized medicine and antibiotic stewardship.

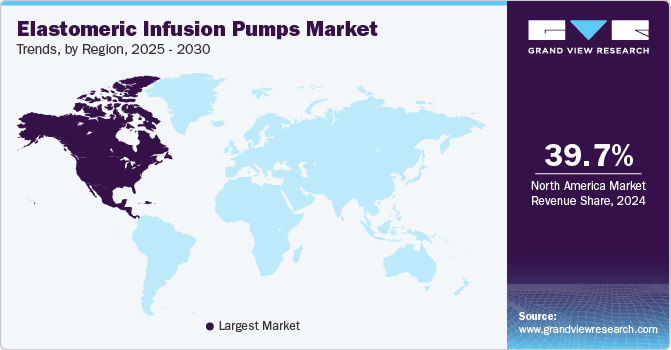

Regional Insights

North America dominated the elastomeric infusion pumps market with the largest revenue share of 39.7% in 2024, and is primarily driven by the increasing prevalence of chronic diseases, rising demand for home healthcare services, and technological advancements. The region has a well-established healthcare infrastructure, and favorable reimbursement policies further contribute to the market expansion. Moreover, the growing geriatric population in North America is boosting the demand for infusion pumps, including elastomeric pumps. in October 2024, the Clinical UM Guideline (CG-DME-09) from Amerigroup addressed the use of elastomeric infusion pumps for continuous local delivery of analgesia during the post-operative period. The guideline stated that this method was considered not medically necessary for post-operative pain control due to insufficient evidence supporting its effectiveness.

U.S. Elastomeric Infusion Pumps Market Trends

The elastomeric infusion pumps market in the U.S. accounted for the largest revenue share in North America in 2024. In the U.S., the adoption of elastomeric infusion pumps is supported by the country's robust healthcare infrastructure, favorable reimbursement policies, and the presence of key market players. The U.S. Food and Drug Administration (FDA) implemented stringent regulations to ensure the safety and efficacy of infusion pumps, which led to the development of innovative products with advanced features. In August 2023, a review article in Therapeutic Advances in Infectious Disease examined the longstanding use of Outpatient Parenteral Antimicrobial Therapy (OPAT) for its cost savings and reduced hospital stays. It highlighted the challenges and opportunities presented by new drug delivery methods, particularly the rise of continuous infusion (CI) of antimicrobials and elastomeric devices.

Europe Elastomeric Infusion Pumps Market Trends

The elastomeric infusion pump market in Europe is experiencing steady growth supported by factors such as a rising geriatric population, increasing prevalence of chronic diseases, and favorable healthcare policies. According to the European Union's (EU) estimates, the EU population was 448.8 million people, with more than one-fifth (21.3%) of the population aged 65 years and older. The region boasts a well-established healthcare system with high adoption rates of advanced medical technologies. Regulatory bodies, including the European Medicines Agency (EMA), ensure strict compliance with quality standards for medical devices, including infusion pumps.In January 2024, a case study from the British Journal of Nursing highlighted advancements in elastomeric pump technology, specifically the Surefuser + elastomeric infusion pump. This device enables intravenous (IV) therapy to be delivered at the bedside, allowing for patient mobility during treatment. It is effective for both home use and in acute healthcare settings, providing reliability and promoting independence for patients.

The UK elastomeric infusion pumps market has been growing, driven by increasing demand for post-operative pain management solutions that minimize opioid use and systemic side effects. These pumps are used primarily in hospital settings for procedures requiring localized analgesia, such as orthopedic, urological, and post-surgical recovery. In August 2023, a review published in Antibiotics examined the feasibility, effectiveness, and safety of using elastomeric infusion pumps (EMPs) for administering intravenous antimicrobials in inpatient settings. The study found strong preferences among both patients and nurses for EMPs, though only one study with six patients was included.

The elastomeric infusion pumps marketin Germany is well-established, driven by a strong healthcare infrastructure and advanced medical technology adoption. The country has a high demand for reliable, efficient drug delivery systems, particularly in hospitals and home care settings. The market benefits from stringent regulatory frameworks, ensuring product quality and safety. In June 2024, the Generics and Biosimilars Initiative published a study evaluating the physicochemical stability of Fluorouracil Accord solutions in three types of elastomeric infusion pumps: Surefuser+ (Nipro), Easypump (B Braun), and Folfusor SV 2.5 mL/h (Baxter). The study showed that Fluorouracil solutions remained stable for 42 days under various storage conditions, including refrigeration and room temperature, supporting the use of elastomeric infusion pumps for extended storage and preparation of Fluorouracil for infusion.

Asia Pacific Elastomeric Infusion Pumps Market Trends

The elastomeric infusion pumps market in Asia Pacific is rapidly expanding, driven by rapidly expanding healthcare infrastructure, increasing disposable income levels, and growing awareness about advanced medical treatments. Manufacturers are also tapping into the expansion of the healthcare market in emerging economies of China and India, where improving access to medical technologies is supporting the adoption of advanced solutions such as smart elastomeric pumps with features including remote monitoring. In May 2024, the National Medical Products Administration (NMPA) of China highlighted the current state of its medical device standards, with a total of 1,974 effective standards as of December 31, 2023. This includes 271 national and 1,703 industry-specific standards. The NMPA's continued efforts aim to enhance medical device safety and industry oversight, improving both regulatory practices and patient access to essential health products.

The China elastomeric infusion pumps market is growing due to expanding healthcare infrastructure, a rising middle class, and an increasing focus on quality healthcare. As chronic diseases like diabetes and cancer become more prevalent, the demand for effective drug delivery systems, including elastomeric infusion pumps, is expected to rise. The Chinese government’s healthcare reforms are increasing access to advanced medical technologies, creating a favorable environment for market growth. In March 2024, a BMC Public Health article highlighted the growing burden of chronic diseases in southern China. The study, based on a survey of 7,430 residents, found that 66.9% reported chronic conditions with low utilization of community health services. Key factors influencing service use included personal characteristics, health status, service accessibility, and knowledge of chronic diseases.

The elastomeric infusion pumps market in Japan is a leader in adopting elastomeric infusion pumps, with the country’s highly advanced healthcare system and aging population, which has led to a rise in demand for chronic disease management and home healthcare solutions. In September 2024, Japan's Ministry of Internal Affairs and Communications reported that approximately 29.3 percent of the population is elderly, marking the highest percentage of seniors in any nation or region with over 100,000 residents. The market benefits from Japan's strict regulatory standards, ensuring high-quality medical devices. Innovation in Japan focuses on precision, safety features, and compact designs that cater to the unique needs of elderly patients.

The India elastomeric infusion pumps market is growing due to the growing prevalence of chronic diseases, increased healthcare awareness, and improved healthcare infrastructure. As a large and diverse market, India presents significant opportunities for elastomeric infusion pumps, especially in hospitals and home care settings. The country is also witnessing a shift toward affordable, high-quality medical devices, with elastomeric pumps being a cost-effective alternative to electronic infusion pumps. For instance, elastomeric infusion pumps can deliver continuous infusions of analgesics, chemotherapy, and cardiology treatments safely and accurately without needing a power source by utilizing pressure generated by an elastomeric balloon.

Latin America Elastomeric Infusion Pumps Market Trends

The elastomeric infusion pumps market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. Brazil is driving the adoption due to improvements in healthcare infrastructure, increasing healthcare access, and rising chronic disease rates. Countries like Argentina and Colombia are witnessing higher demand for advanced drug delivery systems due to expanding healthcare needs. The market is fueled by an increasing focus on cost-effective healthcare solutions, and elastomeric infusion pumps offer a viable option for hospitals and home care settings. In March 2024, a chapter in the ESPE journal from Banco de la República (the Central Bank of Colombia) projected that by 2030, the total costs of chronic non-communicable diseases (NCDs) in Colombia could reach trillions of pesos, depending on the scenario. While prevention measures may reduce these costs, their impact is not expected before 2030.

The Brazil elastomeric infusion pumps market is agrowing healthcare sector due to a large and diverse patient population, rising incidences of chronic diseases, and increased government investment in healthcare. Brazil has a well-developed healthcare system in urban areas, which is expanding access to advanced medical devices like elastomeric infusion pumps. In addition, Brazil's focus on improving the quality and affordability of healthcare drives demand for cost-effective drug delivery solutions. In November 2024, the journal Public Health published a study assessing the burden of non-communicable diseases (NCDs) in Brazil from 1990 to 2021. It found that premature deaths from NCDs increased until 2019 but declined in 2021. While mortality rates and years of life lost decreased, years lived with disabilities increased.

Middle East And Africa Elastomeric Infusion Pumps Market Trends

The elastomeric infusion pumps market in the Middle East and Africais experiencing growing demand for elastomeric infusion pumps, especially in Saudi Arabia and Kuwait, due to improved healthcare infrastructure, increased government spending, and rising healthcare awareness. The region is experiencing a growing demand for advanced medical devices, including elastomeric infusion pumps, driven by the prevalence of chronic diseases, especially diabetes and cancer. In May 2024, a new elastomeric pain pump was introduced, designed for controlled, continuous delivery of medication at rates between 2 to 10 ml/hour. This device minimizes pain after surgery and during childbirth by providing ongoing pain relief without the need for external power sources. It utilizes a flow restrictor to ensure precise dosage, adhering to the principles of fluid dynamics.

The Saudi Arabia elastomeric infusion pumps market is expanding due to the country’s investment in healthcare infrastructure and rising demand for advanced drug delivery systems. The country’s Vision 2030 initiative focuses on improving healthcare services, which is expected to lead to increased adoption of medical technologies like elastomeric infusion pumps. With a rising incidence of chronic diseases and an aging population, Saudi Arabia is seeing a growing need for reliable and cost-effective drug delivery systems in both hospital and home care settings. In December 2024, the General Authority for Statistics (GASTAT) reported that 97.4% of the Saudi population aged 15 and older had good or better health. However, 18.95% of adults were diagnosed with chronic diseases, with diabetes (9.1%) and high blood pressure (7.9%) being the most prevalent.

Key Elastomeric Infusion Pumps Company Insights

Some of the key market players operating in the elastomeric infusion pumps industry include Baxter, Fresenius Kabi AG, B. Braun SE, and Ambu A/S. These companies are making significant infrastructure investments, which enable them to develop, manufacture, and commercialize a high volume of pumps worldwide. In addition, to increase their presence globally, companies engage in several strategic partnerships with distributors and other companies.

Key Elastomeric Infusion Pumps Companies:

The following are the leading companies in the elastomeric infusion pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Baxter

- Fresenius Kabi AG

- B. Braun SE

- Ambu A/S

- Leventon, S.A.U.

- NIPRO

- Terumo Corporation

- AVNS

- Vygon Group

- Smiths Group plc

Recent Developments

-

In August 2024, the U.S. Food and Drug Administration (FDA) revealed that Smiths Medical is performing a corrective recall of its CADD-Solis Ambulatory Infusion Pump due to various concerns linked to obsolete software. According to the FDA, this recall focuses on remedying certain devices without removing them from operation or sale.

-

In January 2024, Hospital at Home has launched a new elastomeric pump pathway for heart failure patients in East and North Hertfordshire. This initiative enables earlier hospital discharge and reduces admissions by allowing continuous treatment at home. The device allows for 24-hour medication delivery and significantly cuts down nursing visits.

-

In October 2023, China's National Medical Product Administration (NMPA) approved 221 medical device products, including 176 domestic Class III devices, 28 imported Class III devices, 16 imported Class II devices, and one from Hong Kong, Macau, or Taiwan. This diversification of approved products signals a growing medical device ecosystem in China.

-

In January 2022, ICU Medical acquired the Smiths Medical Division, a division of Smiths Group Plc, to strengthen its infusion therapy product range and enter new clinical care markets.

Elastomeric Infusion Pumps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 726.0 million

Revenue forecast in 2030

USD 1028.3 million

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Baxter; Fresenius Kabi AG; B. Braun SE; Ambu A/S; Leventon, S.A.U.; NIPRO; Terumo Corporation; AVNS; Vygon Group; Smiths Group plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elastomeric Infusion Pumps Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global elastomeric infusion pumps market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous Rate Elastomeric Infusion Pumps

-

Variable Rate Elastomeric Infusion Pumps

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain Management

-

Chemotherapy

-

Antibiotic/Antiviral Therapy

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global elastomeric infusion pumps market size was estimated at USD 679.8 million in 2024 and is expected to reach USD 726.0 million in 2025

b. The global elastomeric infusion pumps market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 1.03 billion by 2030.

b. North America dominated the elastomeric infusion pumps market with a share of 39.7% in 2024. This is attributable to the increasing prevalence of chronic diseases, the growing geriatric population, and technological advancements in elastomeric infusion pumps.

b. Some of the players operating in this market are Baxter, Fresenius Kabi AG, B. Braun SE, Ambu A/S, Leventon, S.A.U., NIPRO, Terumo Corporation, AVNS, Vygon Group, and Smiths Group plc.

b. Key factors that are driving the elastomeric infusion pumps market growth include the rising incidence of chronic diseases such as cancer, diabetes, and cardiovascular disorders, rising geriatric population prone to various chronic illnesses, and increasing shift towards outpatient surgical procedures and the growing preference for minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.