Educational Robot Market Size, Share & Trends Analysis Report By Product (Humanoid, Non-Humanoid), By Application (Primary Education, Secondary Education, Higher Education), By Region (North America, Europe, APAC), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-714-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Educational Robot Market Size & Trends

The global educational robot market size was valued at USD 1.37 billion in 2024 and is estimated to grow at a CAGR of 28.8% from 2025 to 2030. The increase in the adoption of advanced technologies across the educational sector, coupled with continuous innovations in the field of robotics, is driving the expansion of the industry. Educational robots are important in modern education systems as they help students develop critical thinking and problem-solving skills. Additionally, the ongoing trend of robotics education to teach students how to create, apply, analyze, and operate robots positively impacts the market's growth. Educational robots promise to transform learning experiences by equipping students with valuable skills for their future careers. Thus, teachers, as well as parents, are emphasizing the adoption of educational robots.

Educational robotics has become popular in science, technology, engineering, and mathematics (STEM) fields due to their innovative ability to interact with students through human-like facial features and emotion-perceiving technology. According to a National Education Association survey, 55% of its members plan to leave the teaching profession early. In such times, teachers are projected to receive a much-needed boost from educational robots. Thus, educational robotics is expected to become an effective and inclusive tool for classrooms around the globe.

Growth in the educational robots industry continues because technology is constantly helping us approach things in a new manner and perform daily tasks in an absolutely innovative way. Educational robots upgrade STEM education by providing hands-on experiences for students to explore concepts in areas of science, technology, engineering, and mathematics. The growing educational robots market is supported by how people increasingly demand modern tools that make learning more engaging and practical. By incorporating robotics into classrooms, educational robots are fostering creativity, critical thinking, and problem-solving skills, which are essential for future job markets. As the demand for STEM education rises, the market is expanding to meet the need for tools that promote deeper understanding and retention.

Moreover, the industry is evolving to offer personalized learning experiences. These robots are designed to adapt to each student's individual learning pace and style, creating a more inclusive environment that supports diverse learning needs. The market is also shifting towards collaboration, with many robots designed for group-based projects that help students develop teamwork and communication skills. As robotics becomes accessible, the market caters for a wider educational setting, including primary schools, to higher learning institutions. Increasingly, educational robots are adopting gamified learning, which holds students' interest while developing core skills in an entertaining and motivational manner. This market continues to grow, not only changing the face of education but also preparing the next generation for technology-driven futures.

Product Insights

The non-humanoid robot segment offers the biggest share in the educational robotics industry because of its affordability and versatility in teaching concepts of STEM. Non-humanoid robots are highly applied in schools and educational institutions for practicing education, coding, robotics competitions, and engineering projects. These robots are highly modular and affordable, thereby making them the most sought-after in a very wide range of educational settings. From primary school to higher education, they fit into any available setting. This is due to their practical application in technical education, such as programming, automation, and solving problems.

In contrast, the humanoid robot segment is expected to register the fastest growth in the coming years. Humanoid robots are gaining traction for their ability to engage students emotionally and socially, making them particularly valuable in early childhood education and special education environments. Their human-like design facilitates interactive learning experiences, helping students develop essential soft skills such as communication, empathy, and teamwork. As advancements in robotics technology make humanoid robots more accessible and affordable, their adoption is expected to increase, particularly in areas that focus on emotional and social development. The growing interest in humanoid robots for creating immersive learning environments is fueling the rapid growth of this segment, making it a key area of expansion within the educational robotics industry.

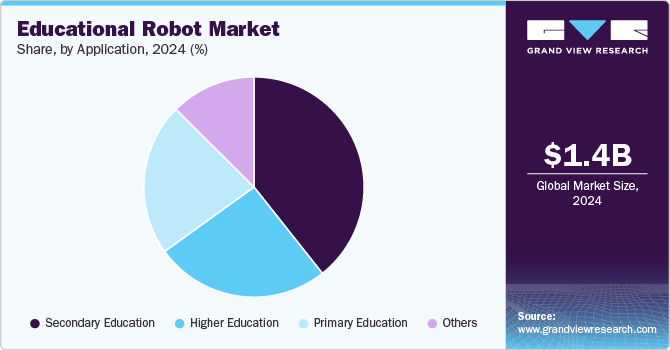

Application Insights

The secondary education segment held the largest share of 39.3% in 2024. This segment keeps leading because middle and high schools use more educational robots, where students learn complex STEM concepts, including robotics, coding, engineering, and artificial intelligence. Secondary education is a crucial stage for preparing students for higher education or careers in technology and engineering. For example, robots like LEGO Mindstorms and VEX Robotics are frequently used in robotics clubs, coding competitions, and hands-on workshops to help students build, program, and test their own robots. These activities encourage students to work in teams, solve real-world problems, and develop essential skills in technology and problem-solving. The growing focus on STEM education globally is also pushing secondary schools to integrate robotics into the curriculum, making it a critical driver of market growth.

While secondary education holds the largest market share, primary education is the fastest-growing segment of the educational robotics market. The increasing integration of robots in elementary and early childhood classrooms is transforming how young students engage with foundational subjects like math, science, and technology. Robots designed for primary education, such as Bee-Bot and KIBO, help young learners explore early programming concepts through interactive play. These robots are often used in simple tasks that require children to program the robot to move, turn, or navigate through mazes, fostering creativity, critical thinking, and a basic understanding of logic and sequencing. By introducing robotics at an early age, primary education sets the foundation for future STEM learning and prepares students for more advanced robotics concepts later on. The rapid growth in this segment is also supported by the increasing availability of affordable, user-friendly robots designed specifically for younger learners.

The higher education segment is also witnessing growth, with universities and colleges adopting educational robots for advanced learning in fields like robotics engineering, artificial intelligence, and computer science. In higher education, robots are used for research, hands-on training, and as teaching assistants. For example, universities like MIT and Stanford use advanced robotics platforms like the NAO robot and Baxter to teach students about human-robot interaction, programming, and autonomous systems. These robots enable students to gain practical, real-world experience in building, programming, and testing robotics systems, bridging the gap between theoretical knowledge and applied skills.

The others category, which includes applications in vocational training, special education, and extracurricular activities, is also expanding. In vocational training, robots are used to teach skills in automation, manufacturing, and industrial robotics. For instance, in technical colleges, there is the use of robots, like the ABB Robotics Kit, in training students on what is being done in an assembly line, programming, and robotic automation. Special education makes use of humanoid robots such as socially engaging Milo that help children with autism improve skills such as social skills, communication, and emotional recognition. Additionally, robotics clubs, after-school programs, and summer camps provide students with opportunities to explore robotics in a more informal, engaging setting, often using tools like LEGO Robotics or the Ozobot to teach basic programming and logic.

Regional Insights

North America educational robot market is growing as the country is home to many leading robotics and technology companies developing advanced educational robot. These robots offer interactive and engaging learning experiences, incorporating features such as artificial intelligence, coding capabilities, and sensors.

Governments at the region's federal, state, and local levels have been investing in educational technology, including robots, to enhance the quality of education. Initiatives such as the White House’s Computer Science for All have spurred the integration of robotics and coding in schools. Collaboration between educational institutions and industry partners has played a significant role in driving the adoption of educational robot. Partnerships with companies specializing in robotics software development and educational content creation have helped integrate robots into curricula and provide support for teachers and students.

U.S. Educational Robot Market Trends

The educational robot market in the U.S. is driven by the importance of STEM education to prepare students for careers in science, technology, engineering, and mathematics. Educational robots provide a practical and engaging way to teach these subjects and develop essential skills like problem-solving, critical thinking, and collaboration. Various federal programs, such as Every Student Succeeds Act and the National Robotics Initiative, allocate funding and resources to integrate robotics and technology in classrooms.

Educational robot has become more accessible and affordable, allowing a more comprehensive range of schools and educational institutions to incorporate them into their programs. Manufacturers and startups have introduced diverse robots specifically designed for educational purposes, catering to different age groups and learning levels. As automation and robotics play an expanding role in various industries, there is a growing recognition of the importance of equipping students with the skills needed for the future job market. Educational robot helps students develop the technical expertise and problem-solving abilities necessary for careers in robotics, engineering, and related fields.

Europe Educational Robot Market Trends

The educational robot market in Europe has been at the forefront of robotics research and development, leading to significant advancements in robot capabilities. Educational robots have become more sophisticated, featuring advanced sensors, artificial intelligence, and interactive interfaces. This progress has enabled robots to engage in meaningful interactions with students., facilitating personalized and adaptive learning experiences. European governments have recognized educational robots' transformative potential and have implemented various initiatives to promote their adoption in schools. Funding programs, grants, and partnerships with educational institutions and technology companies have incentivized the integration of educational robots into the curriculum. These initiatives aim to equip students with the skills necessary for the digital age and enhance Europe’s competitiveness in the global knowledge economy.

Germany educational robot market is growing as the German government has recognized the potential of educational robots and has introduced several initiatives to promote their integration into classrooms. For instance, the DigitalPakt Schule initiative aims to equip schools with digital infrastructure and resources, including educational robots, to support modern learning environments. Collaboration between the robotics industry and academic institutions has played a vital role in driving the growth of the educational robot Industry in Germany. Universities and research centers actively engage with robotics companies to develop innovative educational robot solutions and foster research and development in this field.

The U.K. educational robot industry has been experiencing steady growth. It is no exception in the country as they are designed to enhance learning experiences by incorporating interactive and hands-on activities into classrooms and homes. There has been a growing focus on STEM education in the country. Educational robots provide a practical and engaging way to teach these subjects, promoting critical thinking, problem-solving, and creativity. The U.K. government has been actively promoting the adoption of technologies in education, and various initiatives have been launched to encourage schools and educational institutions to integrate robotics and coding into their curricula, which has contributed to the growth of the educational robot industry.

The educational robot market in France is growing as STEM education has been a priority in the country. Educational robots provide hands-on learning experiences that engage students in these subjects. The French government has shown support for integrating technology into education, and initiatives promoting digital learning and innovation in schools have created opportunities for the adoption of educational robots. The development of more affordable and user-friendly educational robots has made them accessible to a broader range of educational institutions. These robots often combine programming, robotics, and other educational components, making them versatile tools for different subjects. Educational robots offer interactive and engaging learning experiences, fostering critical thinking, problem-solving, and teamwork skills. As education recognizes the benefits, there is an increased demand for such tools.

Asia Pacific Educational Robot Market Trends

The educational robot market in Asia Pacific is estimated to observe a significant CAGR over the forecast period due to increasing investments from governments and Non-Government Organizations (NGOs) toward robotics. For instance, Robotex India is a non-profit organization that provides STEAM, Artificial Intelligence (AI), Machine Learning (ML), and IoT skills to students across the urban and rural parts of India. The initiative has been supported by Digital India, NSDC, MSH, Ministry of IT & Electronics (Govt. of India), UNEP, FICCI FLO, European Union, and other national and international organizations. The awareness about the benefit of educational robot is increasing among educators, parents, and students in the region. The demand for robots that can facilitate interactive and personalized learning experiences is rising, leading to the market's growth. The region is also known for its technological advancements, and this has facilitated the development and deployment of educational robot in the region, companies in countries like China, Japan, and South Korea rea the forefront of creating innovative educational robot solutions, engaging from humanoid robots to coding and programming platforms.

China educational robot market has been experiencing significant growth. The country has been actively investing in educational technology and robotics as part of its broader efforts to enhance its educational systems and promote innovation. The Chinese government has recognized the potential of educational robots to transform the learning experience and has implemented various initiatives to promote their use in schools and educational institutions. These initiatives include pilot projects, policy support, and funding for research and development.

The growth emphasizes STEM education; the government has intensely focused on science, technology, engineering, and mathematics education to nurture a future workforce equipped with the necessary skills for technological advancement. Educational robot is a valuable tool to engage students in these subjects and develop their problem-solving and critical-thinking abilities. Furthermore, the Chinese market has witnessed the emergence of numerous companies specializing in educational robotics. These companies offer a wide range of robots designed specifically for educational purposes, catering to different age groups and learning objectives. The robots vary in functionality, from basic programming and coding to more advanced robots with artificial intelligence capabilities. In addition to schools, educational robots are also being used in various other educational settings such as training centers, museums, and STEM-focused events. They provide an interactive and hands-on learning experience, enabling students to apply theoretical knowledge practically and engagingly.

India educational robot market has been driven by various factors, including the government's focus on digital education, innovative teaching methods, and the rising demand for STEM education. The Indian government has launched several initiatives to promote digital learning and technology integration in education. For example, the Digital India campaign and the National Education Policy (NEP) 2020 emphasize the importance of technology-enabled learning and using robotics and artificial intelligence in education. These initiatives have created a favorable environment for the growth of the educational robot market in India.

Furthermore, there is an increasing recognition of the importance of STEM education in India. Robotics and coding are recognized as essential skills for the future workforce, and educational robot provide a hands-on and interactive way for students to learn these skills. As a result, many schools, educational institutions, and coaching centers in India are incorporating educational robot into their curriculum. To enhance students' learning experiences. Both international and domestic manufacturers support the market for educational robot in India. Various companies offer a range of educational robot designed to teach programming, robotics concepts, problem-solving, and critical thinking. These robots often have sensors, motors, and programming interfaces that enable students to interact and learn through practical applications.

The educational robot market in Japan is growing as the country has a strong focus on technological advancements and has been actively promoting the integration of robotics in education to enhance the learning experience. In Japan, an educational robot is used in various settings, including schools, universities, and educational institutions. These robots are designed to support and complement the teaching and learning process by providing interactive and engaging student experiences—for example, using humanoid robots like Pepper, developed by SoftBank Robotics. Pepper is designed to interact with students, assist teachers and compellingly deliver educational content. It has been deployed in classrooms and educational environments to teach math, science, and foreign language subjects. Another famous educational robot in Japan is NAO, a programmable humanoid robot that supports STEM education and offers hands-on learning opportunities. Students can program it to perform various tasks and engage in educational activities.

Latin America Educational Robot Market Trends

The educational robot market in Latin America has been experiencing growth. Several factors contribute to this growth, such as the increasing emphasis on technology integration in education, the need for interactive and engaging learning experiences, and the recognition of the benefits of robotics in education. Latin America has been investing in educational technology to enhance its educational systems, and robotics is one of the emerging technologies incorporated into schools and educational institutions. Governments, educators, and organizations in Latin American countries have recognized the potential of Educational robot to enhance STEM education, promote critical thinking skills, and provide hands-on learning experiences. Additionally, various initiatives and programs have been launched in the region to promote the adoption of educational robot in schools. These initiatives aim to equip students with the necessary skills for the future job market and to foster innovation and creativity in education.

Middle East & Africa Educational Robot Market Trends

The Middle East and African governments and educational institutions have increasingly invested in educational technology to enhance their education systems. This investment includes initiatives to incorporate robotics and other emerging technologies into the curriculum to improve learning outcomes and prepare students for the future job market. There is a growing emphasis on equipping students with skills necessary for the digital age, such as critical thinking, creativity, collaboration, and technological literacy. Educational robots provide an interactive and engaging platform for developing these skills, making them valuable asset in educational settings. As more educators and stakeholders recognize the potential benefits of educational robot, the adoption of these technologies is increasing, which includes the use of robots for coding, programming, robotics competitions, and other STEM-related activities.

Key Educational Robot Company Insights

Some of the key players in the Educational Robot Market include Aisoy Robotics, LEGO Systems A/S, and LEGO Systems A/S.

-

Aisoy Robotics creates interactive humanoid robots that are specifically designed to help children improve their emotional, social, and cognitive skills. Its flagship product, Aisoy1, is a robot that interacts with children through conversations and games, thereby teaching them vital life skills, such as emotional intelligence and communication. Aisoy Robotics integrates artificial intelligence and machine learning, making its robots capable of recognizing and responding to the emotions of users in a highly personalized learning experience. Their products have increasingly been being used in the educational sector because they are able to act both as teaching aids and companions to children, with the growing interest in social robots in education.

-

LEGO Systems A/S is one of the best-stablished companies, especially with its LEGO Mindstorms and LEGO Boost kits, in the robotics educational market. LEGO approach rests on hands-on learning, whereby the students have the chance to either build or program robots from familiar building blocks. With LEGO Mindstorms kits, which allow the students to go on a fun journey of programming, mechanics, and even robotics, many learning places around the world have used these kits in teaching their students. The LEGO Boost series is designed for much younger children and includes elements such as early coding skills and more accessible robotics. LEGO's strong brand recognition, its expression of creativity, and learning were significant factors for the dominance of educational robotics.

-

Modular Robotics - with the development of Cubelets - is the development of highly modular approaches to robotics that ask students to design and build robots by the connections between several distinct items having different functions. Their flagship product is called Cubelets, a modular robot that can be used to create multiple forms of robots while teaching learners the rudiments of engineering and coding. Modular Robotics puts simple flexibility at the heart of its philosophy, allowing even younger learners to dive into STEM without the need for complex technical skills. The ease of use and the focus on creative design make this company stand out from others, especially in elementary and middle school classrooms.

Pitsco Education LLC, ROBOTIS Inc., and The SoftBank Robotics Group are some of the emerging market participants in the market.

-

Pitsco Education LLC is one of the largest companies that provides hands-on STEM education tools, including robotics kits like TETRIX and VEX Robotics. It is highly used in schools to teach engineering, robotics, and programming. Pitsco also offers curriculum-aligned products on a large scale, providing educators with the means to implement robotics into their classrooms. The widespread adoption of these solutions in K-12 schools has been the result of their focus on producing educational and cost-effective products. Their robotics solutions stress problem-solving, teamwork, and engineering concepts that help the students build very important skills for their future careers in technology.

-

ROBOTIS Inc. is a leading company in the educational robotics world. They provide kits and platforms with the objective of introducing students to robotics, programming, and AI. ROBOTIS's products, including the ROBOTIS DREAM kits, are designed to be used for learning at various levels, from beginner to advanced. Their systems are widely used in schools for teaching simple and complex robotic concepts. The company also offers open-source platforms that users can modify and customize for specific projects or experiments. ROBOTIS emphasizes accessibility and affordability with high-quality, low-priced robotics tools for schools.

-

The SoftBank Robotics Group has been on the list of a leading player in educational robotics, with its popular robots: NAO and Pepper. NAO, which is more of a humanoid robot, is used quite extensively in classrooms to teach programming, robotics, and social interaction. It engages students in learning key STEM concepts. Another well-known contribution from SoftBank Robotics is Pepper, as the robot was designed with an advanced AI system to interact with people who can provide personalized learning experiences. A joint focus on the integration of AI and robotics will help position SoftBank as a leader in transforming how students will engage with technology in the classroom. In addition to simply teaching STEM curriculum, their robots are used to support social and emotional learning.

Key Educational Robot Companies:

The following are the leading companies in the educational robot market. These companies collectively hold the largest market share and dictate industry trends.

- Aisoy Robotics

- Blue Frog Robotics

- LEGO Systems A/S

- Modular Robotics (including Cubelets)

- PAL Robotics

- Pitsco Education LLC

- ROBOTIS Inc.

- SoftBank Robotics Group

- RM Educational Resources Ltd. (TTS)

- Learning Resources

- Educational Insights

Recent Developments

-

Kawasaki Robotics (USA) Inc. showcased Astorino, a new educational robotics platform, at the 2024 IMTS Smartforce Student Summit in Chicago. Designed for industrial and technical education providers, Astorino is the capabilities of a modern industrial robot, so it makes teaching real-world robotics skills easier for educators. This features a 1kg payload, 6-axis robot with control system, safety functions, and the ability to 3D-print replacement parts for students to use. In this way, it allows students to have interactive, hands-on learning experiences as well as being prepared for further careers in manufacturing.

-

In September 2023, ABB Robotics announced the IRB 1090, a new industrial education robot authenticated by STEM.org, designed to upskill future students for future workforce needs. The robot operates on ABB's OmniCore E10 controller and includes robotics functionality, motion control, and power grid feeding energy-saving solutions. It also comes with 100 free RobotStudio premium licenses that provide students with virtual practice programming prior to using actual robots. It promotes ABB's vision for an education future in which robotics becomes more mainstream.

Educational Robot Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.64 billion |

|

Revenue forecast in 2030 |

USD 5.84 billion |

|

Growth rate |

CAGR of 28.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Saudi Arabia; Brazil; South Africa; UAE |

|

Key companies profiled |

Aisoy Robotics; Blue Frog Robotics; LEGO Systems A/S; Modular Robotics (including Cubelets); PAL Robotics; Pitsco Education LLC; ROBOTIS Inc.; SoftBank Robotics Group; RM Educational Resources Ltd. (TTS); Learning Resources; Educational Insights |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Educational Robot Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global educational robot market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Humanoid

-

Non-Humanoid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Education

-

Secondary Education

-

Higher Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Rest of Latin America

-

-

Middle East & Africa (MEA)

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Frequently Asked Questions About This Report

b. The global educational robot market size was estimated at USD 1.37 billion in 2024 and is expected to reach USD 1.65 billion in 2025.

b. The global educational robot market is expected to grow at a compound annual growth rate of 28.2% from 2025 to 2030 to reach USD 5.84 billion by 2030.

b. North America dominated the educational robot market with a share of over 35% in 2024. This is attributable to rising educational awareness coupled with cloud-based technology acceptance and constant research and development initiatives.

b. Some key players operating in the educational robot market include ABB (Switzerland), FANUC (Japan), YASKAWA (Japan), KUKA (Germany), Universal Robots (Denmark), SoftBank Robotics Group (Japan), Hanson Robotics (China), ROBOTIS (South Korea), Robolink (US), and Probiotics America (US)

b. Key factors that are driving educational robot market growth include the increase in the adoption of advanced technologies across the educational sector and ongoing technological advancement in the field of robotics.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."