Education Technology SaaS Tools Market Size, Share & Trends Analysis Report By Software (Learning Management System, Classroom Management System), By Sector (Preschool, K-12), By End Use (Business, Consumer), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-451-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

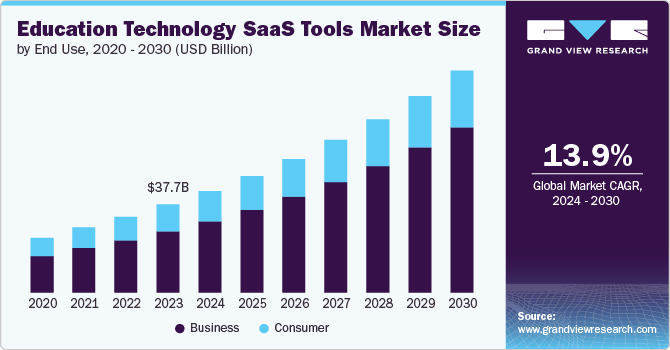

The global education technology SaaS tools market size was valued at USD 37.74 billion in 2023 and is projected to grow at a CAGR of 13.9% from 2024 to 2030. The post-pandemic demand for digital learning solutions continues as institutions embrace remote and flexible learning environments. AI-driven tools for personalized learning, automated grading, and predictive analytics are gaining widespread adoption, enhancing student engagement and outcomes. As internet connectivity expands globally, especially in emerging markets, more institutions are adopting SaaS models for scalable, cost-effective solutions. Additionally, the rising need for lifelong learning is driving demand for Education Technology (EdTech) solutions catering to adult education and corporate training.

Governments worldwide are driving Education Technology (EdTech) growth by investing in the digitization of education, promoting digital literacy, and funding technology integration in classrooms to improve access to quality education. Mobile learning is becoming increasingly accessible due to the widespread use of smartphones and tablets, enabling students to access educational resources on the go. The shift towards hybrid learning models is further fueling demand for SaaS tools that support blended learning environments, boosting both teacher productivity and student outcomes. The rise of microlearning and gamification in Education Technology (EdTech) platforms is enhancing student engagement, particularly for younger learners and corporate training programs. Additionally, institutions are increasingly using data analytics to track performance and personalize learning, driving further market growth.

Education Technology (EdTech) adoption is also expanding in developing regions such as Asia-Pacific, Latin America, and Africa, where a focus on improving education access and quality is creating significant opportunities. With government support, technological advances, and the flexibility of mobile and hybrid learning, Education Technology (EdTech) tools are becoming vital components in both formal education and corporate training. The increasing focus on creating engaging, data-driven learning experiences is contributing to the continued growth of the market. SaaS models continue to be widely favored by educational institutions due to their scalability, cost-effectiveness, and ability to support diverse learning environments.

Software Insights

The Learning Management System (LMS) segment led the market and accounted for over 54.0% of the global revenue in 2023. LMS platforms are widely used across educational institutions and corporations, providing centralized systems for managing, delivering, and tracking content in both academic and professional settings. Their scalability, flexibility, and ability to integrate with other Education Technology (EdTech) tools, such as video conferencing and analytics, make them highly versatile for diverse learning environments. The growing demand for continuous learning, personalized experiences, and efficient content management drives the strong adoption of LMS solutions.

The student collaboration system segment within the Education Technology (EdTech) SaaS tools market is experiencing substantial growth due to increased emphasis on interactive learning. Collaboration tools that support group discussions, peer-to-peer interactions, and teamwork are becoming essential as education moves toward more engaging and participatory formats. The rise of remote and hybrid learning models, accelerated by the pandemic, has enhanced the need for effective virtual collaboration platforms. Many of these systems now feature real-time communication tools such as chat, video conferencing, and file sharing, enhancing the online learning experience.

Sector Insights

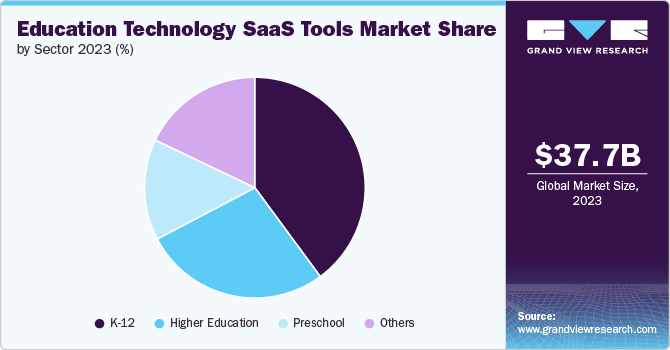

The K-12 segment led the market in 2023, driven by a growing demand for digital learning solutions that enhance educational experiences. Increased government and institutional funding is supporting the adoption of these technologies, fueling market growth. Personalized learning features, adaptive assessments, and early intervention tools cater to diverse student needs, making Education Technology (EdTech) solutions highly valuable in primary and secondary education. The expansion of online and blended learning models, accelerated by the pandemic, has further boosted the use of digital tools in the K-12 sector.

The preschool segment is experiencing significant growth due to increased emphasis on early childhood education and its role in laying a strong foundation for future learning. Investment in digital tools that support development stages and interactive learning is rising, with solutions incorporating games, animations, and multimedia to engage young learners. Education Technology (EdTech) SaaS tools for preschools are also enhancing parental involvement through features that track progress and facilitate communication between parents and educators. The push for early digital literacy is leading to the adoption of tools that introduce basic technology skills from a young age.

End Use Insights

The business segment accounted for the largest market revenue share in 2023, driven by the growing investment in employee training, onboarding, and professional development. Companies increasingly use Learning Management Systems (LMS) to manage training programs, track progress, and ensure regulatory compliance, contributing significantly to the segment's revenue. The focus on upskilling and reskilling in response to evolving industry needs has increased the demand for specialized training modules and certifications. SaaS tools' integration with business operations, scalability, cost efficiency, and advanced analytics add considerable value, enhancing training effectiveness and decision-making. Additionally, the rise of remote and hybrid work models has increased the need for digital training solutions that support virtual learning and collaboration.

The consumer segment in the market is poised for significant growth due to rising demand for self-learning and personal development outside traditional education. The proliferation of online learning platforms and subscription-based services has made accessing diverse educational content more convenient for individuals seeking to enhance their skills or explore new interests. The need for continuous skill development drives consumers toward Education Technology (EdTech) solutions to remain competitive. Additionally, affordable subscription models and a wide range of content options make these tools increasingly compelling to a broad audience.

Regional Insights

North America represented a significant market share of over 36.0% in 2023, driven by its advanced technological infrastructure and widespread use of digital devices. The region's educational institutions are early adopters of technology, investing heavily in digital learning solutions to enhance teaching and support remote learning. North America boasts a strong presence of leading Education Technology (EdTech) companies and startups, fostering innovation and contributing to its market dominance. Government support and funding, along with policies promoting digital learning, further boost the adoption of Education Technology (EdTech) tools.

U.S. Education Technology (EdTech) SaaS Tools Market Trends

The Education Technology (EdTech) SaaS tools market in the U.S. is poised for significant growth due to substantial investments in digital infrastructure from both the public and private sectors, including cloud-based solutions and advanced tools. The ongoing shift toward hybrid and remote learning, accelerated by the COVID-19 pandemic, continues to drive demand for solutions that support virtual classrooms, collaboration, and content delivery. Government support, through initiatives such as Every Student Succeeds Act (ESSA) and Federal STEM funding, further enhances the market’s expansion.

Europe Education Technology (EdTech) SaaS Tools Market Trends

The Education Technology (EdTech) SaaS tools market in Europe is gaining significant traction, driven by a growing emphasis on personalized and adaptive learning solutions that cater to individual needs with customized experiences and real-time feedback. The region boasts a vibrant Education Technology (EdTech) startup ecosystem, where innovative companies are continuously developing new tools and technologies, fueling market growth. Increased investment and strategic partnerships between startups and educational or corporate entities further accelerate the adoption of these tools.

Asia Pacific Education Technology (EdTech) SaaS Tools Market Trends

The Asia Pacific Education Technology (EdTech) SaaS tools market is poised for significant growth, fueled by a strong push towards digital transformation in education across the region. Governments and educational institutions are increasingly adopting Education Technology (EdTech) solutions to modernize teaching and learning processes. Various government initiatives and policies aimed at promoting digital education and improving technology access in schools further drive market expansion. The rising number of students and the growth of educational institutions in the region create a demand for scalable and efficient technology tools.

Key Education Technology (EdTech) SaaS Tools Company Insights

Key players in the industry have strengthened their market presence through a strategic mix of product launches, expansions, mergers and acquisitions, contracts, partnerships, and collaborations. These initiatives serve as vital tools for enhancing market penetration and strengthening their competitive edge within the industry. For instance, in July 2024, D2L Corporation acquired H5P Group, a global SAAS solutions provider. The acquisition aims to enhance D2L Corporation's content creation capabilities by integrating H5P's technology, which offers over 60 interactive content types. D2L Corporation plans to maintain and support the H5P open-source community while using its resources to drive further innovation in interactive learning content.

Key Education Technology (EdTech) SaaS Tools Companies:

The following are the leading companies in the education technology (EdTech) SaaS tools market. These companies collectively hold the largest market share and dictate industry trends.

- Anthology Inc.

- Brightwheel

- Coursera Inc.

- eduZilla

- Google LLC

- Instructure, Inc.

- Kahoot!

- Microsoft

- McGraw Hill

- PowerSchool.

Recent Developments

-

In August 2024, The University of South Wales (USW) is upgrading its Student Information System (SIS) using the Ellucian SaaS platform to modernize operations and enhance the student experience. This new system aims to streamline administrative processes, improve data integration across departments, and support data-driven decision-making. It aligns with USW's strategic goals for 2030, focusing on increasing operational efficiency and student success while providing a more user-friendly experience.

-

In April 2024, Ellucian Company L.P. launched Ellucian Intelligent Processes (EIP), a new SaaS workflow solution for higher education institutions. EIP automates and simplifies business workflows across various departments like Finance, HR, and Registrar, helping administrators prioritize tasks, reduce reliance on IT teams, and enhance communication. The no-code platform enables the creation of custom workflows and automates approvals, making processes more efficient.

-

In March 2024, Avallain AG, a Swiss Education Technology (EdTech) company, acquired TeacherMatic, an AI startup providing advanced generative AI tools for educators. This acquisition aligns with Avallain AG's AI strategy, enhancing its existing tools like Avallain Author and its new SaaS Learning Management System, Avallain Magnet. The company also launched the Avallain Lab to advance AI applications in education.

Education Technology SaaS Tools Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 43.50 billion |

|

Revenue forecast in 2030 |

USD 94.82 billion |

|

Growth rate |

CAGR of 13.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered Application |

Software Type, sector, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; UAE; KSA; South Africa |

|

Key companies profiled |

Anthology Inc.; Brightwheel; Coursera Inc.; eduZilla; Google LLC; Instructure, Inc.; Kahoot!; Microsoft; McGraw Hill; PowerSchool. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Education Technology SaaS Tools Market Report Segmentation

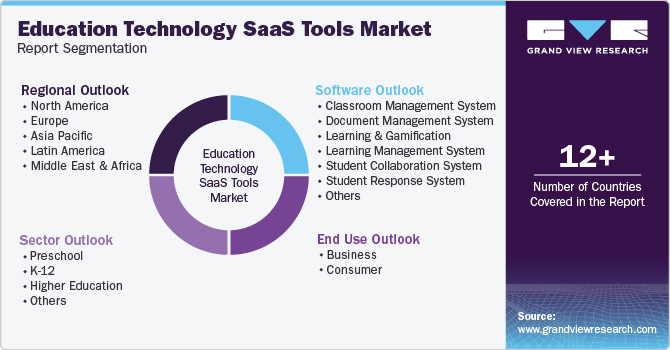

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global Education Technology (EdTech) SaaS tools market report based on software type, sector, end use, and region:

-

Software Outlook (Revenue, USD Million, 2017 - 2030)

-

Classroom Management System

-

Document Management System

-

Learning and Gamification

-

Learning Management System

-

Student Collaboration System

-

Student Information and Administration System

-

Student Response System

-

Talent Management System

-

Test Preparation

-

-

Sector Outlook (Revenue, USD Million, 2017 - 2030)

-

Preschool

-

K-12

-

Higher Education

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Business

-

Consumer

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global education technology SaaS tools market size was estimated at USD 37.74 million in 2023 and is expected to reach USD 43.50 million in 2024.

b. The global education technology SaaS tools market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 94.82 million by 2030.

b. North America dominated the EdTech SaaS tools market with a share of 36.1% in 2023. The region's educational institutions are early adopters of technology, investing heavily in digital learning solutions to enhance teaching and support remote learning. North America boasts a strong presence of leading EdTech companies and startups, fostering innovation and contributing to its market dominance.

b. Some key players operating in the education technology SaaS tools market include Anthology Inc.; Brightwheel; Coursera Inc.; eduZilla; Google LLC; Instructure, Inc.; Kahoot!; Microsoft; McGraw Hill; PowerSchool.

b. Key factors that are driving the education technology SaaS tools market growth include growing adoption of digital and hybrid learning models, and rising focus on personalized learning.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."