- Home

- »

- Homecare & Decor

- »

-

Education Furniture Market Size And Share Report, 2030GVR Report cover

![Education Furniture Market Size, Share & Trends Report]()

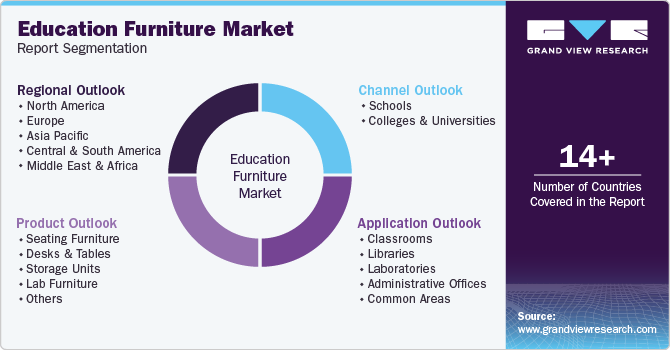

Education Furniture Market Size, Share & Trends Analysis Report By Product (Seating Furniture, Desks & Tables), By End Use (Schools, Colleges & Universities), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-423-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Education Furniture Market Size & Trends

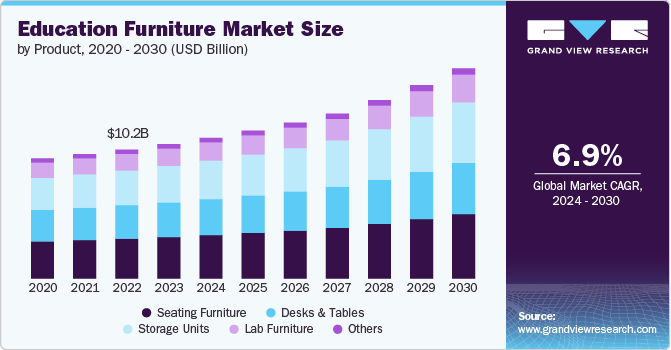

The global education furniture market size was estimated at USD 10,727.5 million in 2023 and is projected to grow at a CAGR of 6.9% from 2024 to 2030. The market has experienced significant growth over the past few years, driven by a combination of increasing enrollment in schools, colleges, and universities, as well as the expansion of private and charter schools. This growth has been further fueled by the rising demand for customizable and personalized furniture solutions that cater to the evolving needs of students and educators. In addition, recent government initiatives aimed at improving educational infrastructure and enhancing learning environments have contributed to the market's expansion.

One of the primary drivers of the market is the steady increase in student enrollments across various educational institutions. The global rise in population, coupled with a growing emphasis on education as a critical component of socioeconomic development, has led to higher enrollment rates in schools, colleges, and universities. For instance, in countries such as India and China, where education is highly valued, the number of students enrolling in primary and secondary schools has seen a consistent upward trend.

Similarly, higher education institutions worldwide have reported increasing enrollments, particularly in STEM (Science, Technology, Engineering, and Mathematics) disciplines, as students seek to acquire skills relevant to the modern job market. This surge in student numbers has created a demand for more educational spaces, which in turn has driven the need for innovative and functional furniture solutions.

The expansion of private and charter schools has also played a significant role in the growth of the market. These schools often seek to differentiate themselves by offering state-of-the-art facilities and learning environments that cater to the specific needs of their students. As a result, there is a strong emphasis on designing and furnishing classrooms, libraries, and common areas with high-quality, ergonomic furniture that supports both academic and extracurricular activities.

For example, many private schools are investing in flexible seating arrangements that allow for collaborative learning and can be easily reconfigured to accommodate different teaching methods. This trend is particularly prevalent in charter schools, which often have the autonomy to implement innovative educational practices and create customized learning spaces that reflect their unique educational philosophies.

In recent years, there has been a noticeable shift towards customizable and personalized furniture in educational settings. As educational institutions strive to create environments that foster creativity, collaboration, and critical thinking, the need for furniture that can be tailored to specific needs has become increasingly important. Customizable furniture allows schools and universities to design spaces that are adaptable and can evolve with changing educational requirements. For instance, modular furniture systems, which can be reconfigured to create different layouts, are becoming increasingly popular in classrooms and lecture halls. These systems enable educators to quickly adapt the learning environment to suit various activities, such as group work, presentations, or individual study.

The demand for personalized furniture is rising, with schools seeking to create environments that reflect the diverse needs of their student populations. This includes furniture that is adjustable in height and size, ensuring that students of all ages and abilities can use the same pieces comfortably.

The demand for eco-friendly and sustainable furniture is another trend gaining momentum in the education sector. As awareness of environmental issues grows, educational institutions are increasingly seeking to incorporate sustainable practices into their operations. This includes the procurement of furniture made from eco-friendly materials, such as recycled wood, bamboo, and low-VOC (volatile organic compound) finishes.

Many schools are also opting for furniture that is designed to last longer and can be easily refurbished or recycled at the end of its life cycle, reducing the overall environmental impact. This trend is supported by government initiatives and certifications, such as LEED (Leadership in Energy and Environmental Design), which encourage schools to adopt sustainable practices in their facilities.

Government initiatives have also played a crucial role in shaping the market. In many countries, governments have launched programs aimed at improving educational infrastructure, including modernizing classrooms and providing high-quality furniture.

For instance, in the U.S., the government has allocated significant funding for the renovation and upgrading of public schools, with a focus on creating safe and conducive learning environments. Similarly, the Indian government's Samagra Shiksha Abhiyan initiative aims to provide holistic education by upgrading school infrastructure, including the provision of modern furniture and equipment. These initiatives not only drive the demand for new furniture but also encourage the adoption of innovative designs that enhance the overall learning experience.

Technological advancements have also influenced market growth, particularly in the development of smart furniture. As digital learning becomes more prevalent, there is a growing need for furniture that can integrate with technology and support digital devices. Smart desks and tables, equipped with charging ports, adjustable surfaces, and built-in storage for laptops and tablets, are becoming increasingly common in classrooms and libraries. This trend reflects the broader shift towards digitalization in education, where technology is seen as a critical tool for enhancing learning outcomes. Educational institutions are investing in furniture that not only accommodates technology but also enhances its use, ensuring that students and teachers can seamlessly integrate digital tools into their daily activities.

The rise of collaborative learning environments is another trend driving the market growth. Traditional classroom layouts, with rows of desks facing the front, are being replaced by more dynamic and flexible arrangements that encourage interaction and collaboration among students. This shift is particularly evident in higher education, where project-based learning and group work are becoming more common. Educational institutions are increasingly opting for furniture that supports these activities, such as round tables, movable chairs, and whiteboards that can be easily relocated. These flexible setups allow for a more interactive and engaging learning experience, where students can work together and share ideas more freely.

Moreover, the importance of ergonomics in educational furniture cannot be overstated. As students spend long hours sitting and studying, there is a growing awareness of the need for furniture that supports good posture and reduces the risk of musculoskeletal issues. Ergonomic chairs and desks, which can be adjusted to suit the user's body size and shape, are becoming standard in classrooms and study areas. Schools and universities are increasingly recognizing that investing in ergonomic furniture not only promotes student health but also improves concentration and productivity, leading to better academic outcomes.

Product Insights

Seating furniture held a revenue share of around 30% in 2023. This crucial segment within the market is driven by the increasing focus on ergonomics and student well-being. Schools, colleges, and universities are prioritizing the purchase of ergonomic chairs that provide proper support and promote good posture, especially as students spend long hours seated.

The demand for storage units is projected to grow at a CAGR of 7.8% from 2024 to 2030. Storage units are gaining traction as educational institutions seek to maximize space efficiency while maintaining an organized environment. With the growing adoption of digital devices and materials, schools, and universities are investing in multifunctional storage solutions that accommodate both traditional books and modern gadgets. This includes storage units with built-in charging ports for laptops and tablets, as well as modular lockers that can be customized based on specific storage needs.

Application Insights

Classroom furniture accounted for a revenue share of around 49% in 2023. Classroom furniture is evolving rapidly, driven by the need for adaptable and multifunctional solutions that cater to diverse teaching methods. The trend towards collaborative learning has spurred demand for modular desks and tables that can be easily rearranged to suit different group sizes and activities.

Laboratories furniture is estimated to grow at a CAGR of 7.2% from 2024 to 2030. The demand for laboratory furniture is influenced by the growing emphasis on STEM education, which requires specialized furnishings that support hands-on learning and experimentation. Lab tables, stools, and storage solutions designed for safety, durability, and ease of maintenance are in high demand. In addition, there is a trend toward flexible lab setups that can accommodate various types of experiments and equipment. For instance, universities are investing in mobile lab stations that can be easily reconfigured to support different research activities or group projects, allowing for a more versatile and dynamic learning environment.

End Use Insights

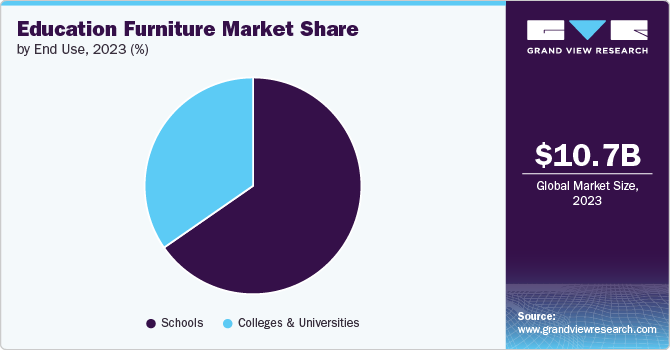

The demand for furniture in schools accounted for a revenue share of around 65% in 2023. School furniture is characterized by the demand for furniture that supports both traditional and modern teaching methods. Schools are increasingly investing in flexible and adaptable furniture solutions that can be easily reconfigured to suit different classroom activities. This includes adjustable desks and chairs that accommodate students of various ages and sizes, as well as collaborative tables that promote group work.

The demand for furniture in colleges & universities is projected to grow at a CAGR of 8.1% from 2024 to 2030. The demand for education furniture in colleges and universities is driven by the need for high-quality, durable furniture that can withstand intensive use while supporting advanced learning environments. This segment is particularly influenced by trends toward sustainability and technology integration.

Regional Insights

The education furniture market in North America held 41% of the global market revenue in 2023. In North America, the market is heavily influenced by the integration of technology in educational settings. Schools and universities are increasingly adopting smart furniture that supports digital learning, such as desks with built-in charging stations and cable management systems.

U.S. Education Furniture Market Trends

The education furniture market in the U.S. accounted for a revenue share of around 84% of the North America region in 2023. The U.S. market is characterized by a strong emphasis on innovation and customization. Educational institutions are investing in furniture that not only meets functional requirements but also enhances the learning experience through innovative designs. For example, there is a growing trend towards ergonomic seating that supports student health and well-being, as well as tech-integrated furniture that facilitates digital learning.

Asia Pacific Education Furniture Market Trends

The Asia Pacific education furniture market had a revenue share of around 31% in 2023. The region is seeing a growing interest in ergonomic furniture, particularly in urban areas where educational institutions are focused on improving student comfort and productivity. The integration of technology in education is also influencing the market, with a rising demand for smart furniture solutions.

Europe Education Furniture Market Trends

The education furniture market in Europe is projected to grow at a CAGR of 6.8% from 2024 to 2030. The market in Europe is driven by craftsmanship and design, with a strong emphasis on sustainability and functionality. Educational institutions in the region are increasingly opting for furniture made from sustainable materials, reflecting broader societal trends towards environmental responsibility.

Key Education Furniture Company Insights

The market features both established global firms and emerging players. Key industry leaders prioritize product innovation, differentiation, and distinctive designs in line with evolving consumer preferences. Leveraging extensive global distribution networks, these major players effectively reach diverse customer bases and tap into emerging markets.

Key Education Furniture Companies:

The following are the leading companies in the education furniture market. These companies collectively hold the largest market share and dictate industry trends.

- KI (Krueger International)

- Virco

- The HON Company

- Artcobell

- WB Manufacturing LLC

- Smith System

- Haskell Education

- VS America, Inc.

- Fleetwood Group

- Haworth Inc.

Recent Developments

-

In May 2023, the HON Company unveiled its Roll Call lectern, a versatile solution for educational spaces. This lectern features ample height adjustability, allowing users to find the ideal position. Additionally, it is equipped with smooth casters for easy mobility. The Roll Call lectern offers a wide range of options for vibrant laminates, as well as Colorway edge bands, providing both a visually appealing and easy-to-clean surface.

-

In August 2024, KI (Krueger International) was honored with the 2024 Wisconsin 75 Distinguished Performer Award in the Sustainability category. This accolade recognized the company for its economic and community impact. KI’s award in Sustainability highlights its leadership in environmental responsibility and commitment to promoting a sustainable future.

Education Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11,234.9 million

Revenue forecast in 2030

USD 16.78 billion

Growth Rate

CAGR of 6.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, Indonesia, Brazil, South Africa

Key companies profiled

KI (Krueger International); Virco; The HON Company; Artcobell; WB Manufacturing LLC; Smith System; Haskell Education; VS America, Inc.; Fleetwood Group; Haworth Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Education Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the education furniture market based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Seating Furniture

-

Student Seating

-

Lounge Seating

-

Others

-

-

Desks & Tables

-

Student Desks

-

Multi-purpose Tables

-

Makerspace Tables

-

Others

-

-

Storage Units

-

Lab Furniture

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Classrooms

-

Libraries

-

Laboratories

-

Administrative Offices

-

Common Areas

-

-

End Use Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Schools

-

Colleges & Universities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global education furniture market was estimated at USD 10,727.5 million in 2023 and is expected to reach USD 11,234.9 million in 2024.

b. The global education furniture market is expected to grow at a compound annual growth rate of 6.9% from 2024 to 2030 to reach USD 16.78 billion by 2030.

b. North America dominated the education furniture market with a share of around 41% in 2023. There is a strong focus on creating flexible learning environments, leading to the demand for modular and mobile furniture solutions that can be easily reconfigured.

b. Some of the key players operating in the education furniture market include KI (Krueger International); Virco; The HON Company; Artcobell; WB Manufacturing LLC; Smith System; Haskell Education; VS America, Inc.; Fleetwood Group; Haworth Inc.

b. The education furniture market is experiencing robust growth, driven by increasing student enrollments, the expansion of private and charter schools, and the rising demand for customizable, eco-friendly, and ergonomic furniture solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."