- Home

- »

- Consumer F&B

- »

-

Edible Flakes Market Size & Share, Industry Report, 2030GVR Report cover

![Edible Flakes Market Size, Share & Trends Report]()

Edible Flakes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Corn Flakes, Oat Flakes, Wheat Flakes, Others), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-213-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Edible Flakes Market Size & Trends

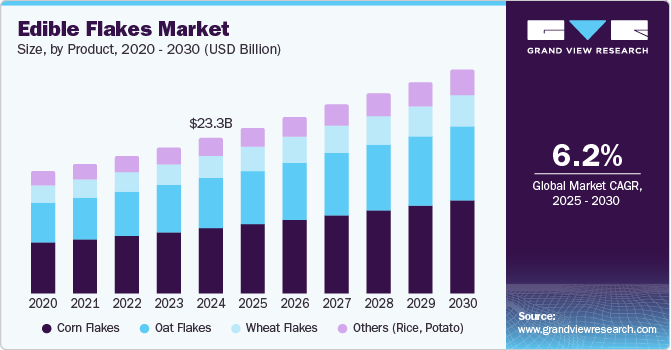

The global edible flakes market size was valued at USD 23.35 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. The growth of this market is primarily influenced by factors such as changing consumer behavior associated with breakfast cereals and food products and shifts in dietary preferences with increased focus on healthier food consumption. Growing demand for ready-to-make breakfast products from urban consumers has developed growth opportunities for this market in recent years.

Changing lifestyles, extensive work hours, and increased travel times before and after work shifts have stimulated the demand for convenient food options in urban areas. However, a large number of consumers have been shifting their dietary preferences to healthier food products, nutrition-rich meals, trail mixes, and more. Fitness trends and increasing awareness regarding the role of nutritional habits in overall well-being have generated greater demand for low-calorie meals and products with comparatively lesser sugar content. These aspects are expected to create demand for edible flakes in the approaching years.

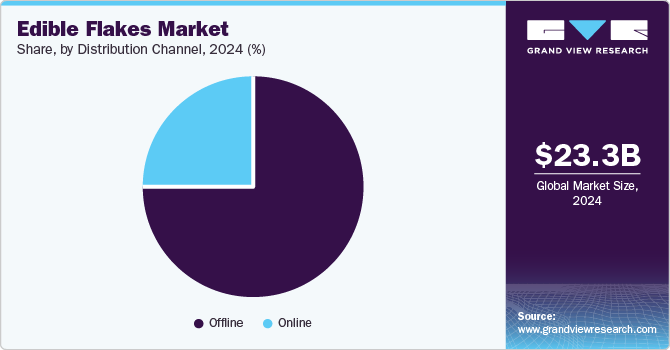

Availability of products through chains of supermarkets & hypermarkets, grocery stores, convenience stores, and other offline points of sale has significantly influenced this market. Additionally, accessibility to the flake products through online grocery portals, e-commerce websites, and more has added growth opportunities to this market. New product launches, innovation-based product development, and effective distribution strategies embraced by the companies have also contributed to growth.

Ready-to-eat cereal-based food products such as oats, corn, wheat, and rice flakes have excellent nutritional properties, which are required to be fulfilled on a daily basis for proper working of the body. For instance, corn flakes are rich in iron and vitamin B6 content, oat flakes are rich in antioxidants and soluble fiber, wheat flakes are rich in dietary fiber, and rice flakes are rich in carbohydrates. These edible flakes appeal to consumers who have less or no time to cook food at home and want whole-nutritional foods.

The low-fat contents of corn flakes, higher bran, fiber content in wheat flakes, and high-quality protein content offered by the oat flakes are some of the key benefits provided by the products in this category. Edible flakes, launched by key consumer goods and food products brands operating across multiple regions, have gained significant customer attention driven by effective marketing, endorsements, and target-oriented content delivery. The existing customer base of popular breakfast cereals offered by the popular brands also contributes to moderate growth experienced by the market.

New product launches and innovations also drive the growing demand experienced by this market. Growing utilization by manufacturers in the formulation of breakfast cereals, protein bars, and other recipes is expected to enhance the growth of this market. For instance, in August 2024, Kellogg's, a brand by WK Kellogg Co., launched Two Scoops Raisin Bran, a crunch cereal product characterized by multi-grain flakes, oats clusters, and juicy raisins. Significant utilization by industries such as bakery & confectionery, ice creams, packaged food products, and others is likely to generate a surge in demand for edible flakes in the next few years.

Product Insights

The corn flakes segment dominated the global edible flakes industry with a revenue share of 42.0% in 2024. This market is primarily influenced by factors such as increasing utilization in the formulation of breakfast cereals, convenience and ease of consumption associated with cornflakes, and effective marketing and brand recognition accomplished by the key market participants. The versatility offered by the products, when coupled with other ingredients or foods, such as raisins, fruits, nuts, and others, has also been contributing to the growth experienced by this segment.

The oat flakes segment is projected to experience the highest CAGR during the forecast period. The growth of this segment is mainly influenced by the growing awareness regarding benefits offered by the oat flakes and increasing utilization by consumer brands in ready-to-make or ready-to-eat products such as breakfast cereals, protein bars, and others. Significant growth in demand by urban consumers has been driven by factors such as nutritional value offered by the product, trends such as veganism or plant-based diets, convenience, and enhanced awareness.

Distribution Channel Insights

The offline distribution segment dominated the global edible flakes industry with the largest revenue share in 2024. This segment is highly influenced by the growing availability of breakfast cereals and related products in supermarkets, hypermarkets, grocery stores, convenience stores, and local shops. Brands prefer effective offline distribution as it ensures added brand visibility and enhances customer engagement in every smallest market.

The online distribution segment is projected to experience the fastest CAGR during the forecast period. Increasing availability through online portals, e-commerce websites, online grocery delivery platforms, and the quick-commerce industry is primarily driving the growth of this segment. In recent years, brands have focused on enhancing their digital footprint and accessibility through online marketplaces to address growth in competition and changing consumer behavior trends, especially in urbanized areas. This market is also driven by the services associated with online shopping experiences, such as free and quick deliveries, improved customer assistance, display of reviews shared by previous customers, and more.

Regional Insights

North America dominated the edible flakes industry, with a revenue share of 38.1% in 2024. This market is primarily influenced by factors such as large groups of existing customers, increasing demand from urban consumers, multiple product offerings, and the affordability associated with these products. Additionally, growing awareness regarding calorie intake and sugar consumption and their implications for the human body has also been driving the growth experienced by this segment.

U.S. Edible Flakes Market Trends

The U.S. edible flakes market held the largest revenue share of the regional edible flakes industry in 2024. This is attributed to the presence of multiple companies in the breakfast cereals industry, large-scale production of corn in the country, significant use by households over multiple decades, and noteworthy market penetration accomplished by the key brands. Versatility in product availability and a large number of brands accessible through numerous offline points of sale are expected to drive the growth experienced by this market in the coming years.

Europe Edible Flakes Market Trends

Europe edible flakes market was identified as one of the key regions of the global edible flakes industry in 2024. This market is primarily influenced by the increasing awareness regarding the health benefits offered by edible flakes, such as corn flakes, oat flakes, and others. The growing availability of breakfast cereals, protein bars, and similar products is adding to the growth experienced by this market. The significant increase in demand from application industries such as confectionary also contributes to the growth.

The UK edible flakes market held the largest revenue share of the regional edible flakes industry in 2024. This market is mainly influenced by factors such as increasing demand from young urban consumers, brands' growing focus on enhancing customer engagements and increasing availability facilitated by online accessibility. The popularity of oat flakes in the country primarily drives the growth of this market.

Asia Pacific Edible Flakes Market Trends

Asia Pacific edible flakes industry is expected to experience the highest CAGR from 2025 to 2030. This is attributed to increasing demand from countries such as India and China, increasing availability of global brand products in the region, and growing popularity of quick commerce platforms in prime cities of the region. The large number of young consumers in the region also influenced the growth by significantly increasing consumption of products such as breakfast cereals made with corn flakes.

China edible flakes market held the largest revenue share of the regional edible flakes market in 2024. This market is mainly driven by the increasing number of customers shifting towards Westernized dietary habits, growing consumer health consciousness, and the availability of convenient breakfast products in the country. The presence of large distribution networks and the deployment of effective strategies are also adding growth opportunities.

Key Edible Flakes Company Insights

Some of the key companies in the global edible flakes market are Nestlé, WK Kellogg Co, General Mills Inc., Bagrry's, The Quaker Oats Company (PepsiCo Inc.) and others. To address the growing demand from urban consumers and significant growth in competition, multiple market participants have adopted strategies such as portfolio diversification, portfolio enhancements, effective distribution, improved digital footprint and more.

-

The Quaker Oats Company (PepsiCo Inc.) is a brand offering a range of products, such as oats and oatmeal, breakfast cereals, rice snacks, snack bars, grits, barley, corn meal, and more. The brand has an extensive distribution network and a large customer base in the U.S.

-

WK Kellogg Co, a company that specializes in breakfast cereals, provides multiple brands such as FROSTED FLAKES, FRUIT LOOPS, Frosted Mini-Wheats, SPECIAL K, RICE KRISPIES, Raisin Bran, CORN FLAKES, CORN POPS, Cracklin’ Oat Bran, and more. Its CORN FLAKES product features cornflakes cereals, and FROSTED FLAKES features milled corn-based products in different flavors and forms.

Key Edible Flakes Companies:

The following are the leading companies in the edible flakes market. These companies collectively hold the largest market share and dictate industry trends.

- Nestlé

- WK Kellogg Co

- General Mills Inc.

- The Quaker Oats Company (PepsiCo Inc.)

- Dr. August Oetker KG

- Bagrry's

- Marico Ltd.

- The Brüggen Group

- Nature's Path

Recent Developments

-

In November 2024, FUEL10K, one of the brands by Premier Foods plc, introduced a multigrain flakes product with high protein contents and two distinct flavors, including Red Berry and Chocolate. The latest addition to its portfolio by FUEL10K is targeted to address the growing demand for healthier breakfast products with less sugar content and enhanced nutritional benefits.

-

In October 2024, Tata Soulfull, one of the brands operated by Tata Consumer Products Limited, launched Tata Soulfull Corn Flakes+. The newly introduced product is available in two variants, including the original and honey almond versions. Every flake in the packet is marketed as a distinctive blend of Jowar and Corn.

-

In August 2024, Mars, Incorporated, one of the global brands specializing in snacking & food and pet care, announced that it has entered a definitive agreement to acquire Kellanova, an international cereals & noodles market participant. The acquisition is expected to strengthen Mars' existing portfolio, which features multiple food products.

Edible Flakes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.87 billion

Revenue forecast in 2030

USD 33.59 billion

Growth Rate

CAGR of 6.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia Brazil, UAE

Key companies profiled

Nestlé; WK Kellogg Co; General Mills Inc.; The Quaker Oats Company (PepsiCo Inc.); Dr. August Oetker KG; Bagrry's; Marico Ltd.; The Brüggen Group; Nature's Path

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edible Flakes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edible flakes industry report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Corn Flakes

-

Oat Flakes

-

Wheat Flakes

-

Others (Rice, Potato)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.