Edge AI Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End-use Industry (Consumer Electronics, Smart Cities, Automotive), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-050-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Edge AI Market Size & Trends

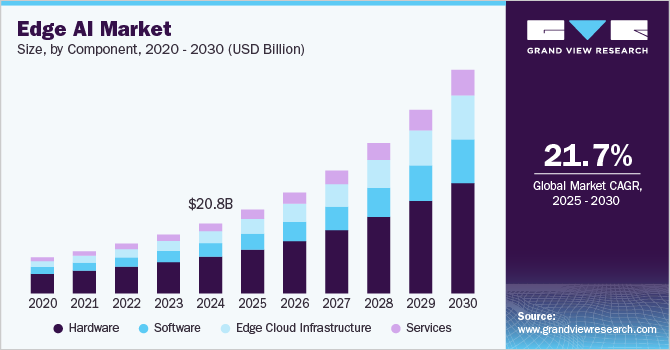

The global edge AI market size was estimated at USD 20.78 billion in 2024 and is anticipated to grow at a CAGR of 21.7% from 2025 to 2030. The market is experiencing significant growth, driven by the increasing demand for real-time data processing and analysis at the network's edge. This surge is propelled by industries such as healthcare, manufacturing, and telecommunications, which seek to enhance operational efficiency and reduce latency by processing data closer to its source. In healthcare, for instance, edge AI enables remote patient monitoring through on-device data analysis, facilitating timely medical interventions.

Recent developments have further underscored the transformative potential of edge AI. Chinese startup DeepSeek's release of its R1 AI model, developed at a fraction of the cost of comparable U.S. technologies, has challenged existing market leaders and highlighted the efficiency of edge AI solutions. This event has prompted a reevaluation of investment strategies and intensified discussions on the future landscape of AI leadership.

Edge AI enables real-time data processing on IoT devices by ensuring high-performance data computation. The data required to apply AI in edge devices is stored on the device or a nearby server instead of in the cloud in the case of edge AI, which reduces computation latency and returns processed data quickly. For instance, in March 2023, Minima Global Ltd, a Europe-based blockchain platform developer, collaborated with Inferrix Limited, a software company in the UK, by combining Minima's blockchain technology with Inferrix's IoT edge and AI offerings. This partnership aims to develop unique IoT solutions by ensuring efficient and secure communication between all sensors and protecting mission-critical data.

Multi-Access Edge Computing architecture offers storage, computation, and networking capabilities at the network's edge, close to end-users and end devices. In MEC Edge AI use cases, virtual devices are used rather than physical edge computers to process camera video streams over a 5G connection. For instance, in February 2023, Cellnex Ireland, an operator of wireless telecom infrastructure in Europe, and Dublin City University in Europe collaborated to create a 5G-enabled smart campus. Through this partnership, Cellnex installs a variety of telecommunication infrastructure to ensure 5G coverage across the main campus and to enable Mobile Edge Computing (MEC) capabilities on the campuses.

The use of artificial intelligence applications, including virtual diagnostics, robotics-assisted surgery, image analysis, and electroceuticals in the healthcare sector, is rapidly increasing because of the accurate output results provided by such solutions. Moreover, edge-based cybersecurity is used to protect sensitive health data. For instance, in September 2022, Nvidia Corporation, a U.S.-based software company, released the Nvidia IGX platform to expand edge AI tech for robotics and healthcare. This platform includes an AI-optimized computing system and device for edge AI in robotics. This initiative aimed to bring robotics to healthcare by combining imaging sensors with real-time, deep-learning computer vision.

Component Insights

The hardware segment dominates the edge AI industry, with a revenue share of 52.76% in 2024. The increasing adoption of 5G networks and the rising demand for IoT-based edge computing solutions to connect IT and telecom are responsible for the growth of the hardware segment. IoT devices make extensive use of dedicated AI processors for on-device image analytics. For instance, in May 2022, Habana Labs, an independent Intel company in Israel focusing on developing disruptive solutions for data center and cloud efficiency, announced the launch of its second-generation deep-learning processors. These new processors are intended to provide customers with high-efficiency, high-performance deep-learning computing options for inference deployments and training workloads in the data center.

The software segment is expected to rise significantly, with a CAGR of 24.5% during the forecast period. The 5G network enables establishing data centers at the edge and deploying industry-specific networks in a single framework using software-defined networking principles. Moreover, the proliferation of 5G networks in various applications is expected to increase the volume of data transferred to data centers, raising the need for intermediary servers or edge networks. Edge AI software offers users data in real-time because it does not require other systems or internet connections to connect to others, which leads to the growth of the software sector.

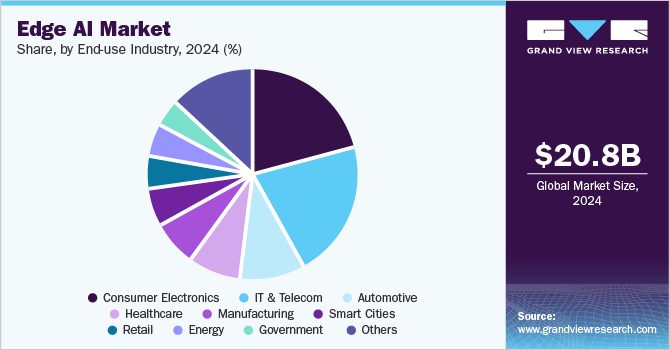

End-use Industry Insights

The IT & Telecom segment dominates the market, with a revenue share of 21.1% in 2024. The proliferation of connected IoT devices and the transition of telecom networks to 5G created new opportunities and challenges for telecom operators, which propels the IT & Telecom sector. For instance, in March 2023, HFCL limited, a telecom company in India, partnered with Microsoft Corporation, a U.S.-based technology company, to develop private 5G solutions for businesses in industries, including retail and warehouse, manufacturing, mining, etc. HFCL is implementing an Industry 4.0 solution in its factory, using Azure public multi-access edge compute (MEC). Operators are bringing their AI and ML capabilities much closer to the components in their IoT networks to develop next-generation telecom solutions that maximize network performance, security, and reliability.

Consumer Electronics is predicted to grow significantly during the forecast period because of the proliferation of smart wearables, smart speakers, and other digital devices. The Consumer Electronics industry has made AI chipsets widely available and affordable. Moreover, data processing on edge AI chips also improves consumer device privacy and security. The Consumer Electronics category is projected to evolve significantly with new inventions and ideas.

Regional Insights

North America dominated the edge AI industry with a revenue share of 37.7% in 2024. The region's growth is projected to continue with the advent of superior 5G network technology. North America's market growth is driven by a significant focus on adopting advanced technologies such as AI, deep learning, and machine learning by the region's enterprises. For instance, in September 2021, Synaptics Incorporated, a U.S.-based hardware company, partnered with Edge Impulse, a machine-learning development platform for edge devices in California, to integrate Synaptics' Katana edge AI and the edge software development platform. This collaboration is intended to enable developers to create production-ready models and accelerate low-power edge AI deployment.

U.S. Edge AI Market Trends

The edge AI industry in the U.S. is experiencing robust growth, driven by technological advancements and substantial investments in artificial intelligence across various industries. The proliferation of IoT devices necessitates real-time data processing, making edge AI solutions increasingly vital. Major tech companies, including NVIDIA and Intel, are at the forefront, developing advanced hardware and software to support edge AI applications. The healthcare sector benefits from edge AI through enhanced patient monitoring and diagnostics, while the automotive industry leverages it for autonomous driving features. The U.S. government's support for AI initiatives further propels market expansion, solidifying the country's leadership in edge AI innovation.

The edge AI market in Canada is experiencing significant growth, driven by a burgeoning tech ecosystem and supportive government policies fostering innovation. Canadian startups and established firms are increasingly focusing on integrating AI capabilities at the edge to enhance data privacy and reduce latency. The country's strong emphasis on research and development, coupled with collaborations between academia and industry, accelerates advancements in edge AI technologies. Sectors such as smart manufacturing, energy management, and healthcare are adopting edge AI solutions to improve operational efficiency and decision-making processes. Canada's commitment to building a digital economy positions it as a significant player in the global edge AI landscape.

Asia Pacific Edge AI Market Trends

Market revenue in Asia Pacific is anticipated to grow significantly throughout the forecast period. Many Asian countries, including China, India, and Japan, are using the benefits of information-intensive AI and ML technologies in various industries. For instance, in October 2021, Blaize, a semiconductor manufacturer in the U.S., partnered with NEXTY Electronics, a supplier of electronic components and equipment in Japan, to market AI edge computing products of Blaize in Japan’s industrial and automotive markets. This collaboration is intended to focus on innovation, analyzing customer needs across different industries, and driving the adoption of edge AI applications empowered by Blaize's low latency, low-power AI offering.

The edge AI market in China is experiencing robust growth, driven by significant investments in artificial intelligence and a rapidly expanding consumer electronics sector. Chinese tech giants like Huawei and Baidu are leading the development of edge AI applications, particularly in smart cities and autonomous vehicles. The government's strategic initiatives, such as the New Generation Artificial Intelligence Development Plan, provide substantial support for AI research and deployment. Additionally, China's vast population and extensive data generation offer a rich environment for training AI models, further accelerating edge AI adoption. The country's focus on integrating AI into various industries underscores its commitment to becoming a global leader in technology.

The India edge AI market is experiencing significant growth, driven by the increasing digitization across industries and a surge in smartphone usage. The government's initiatives, such as Digital India and Make in India, encourage the adoption of advanced technologies, including edge AI, to enhance service delivery and manufacturing processes. Indian startups are innovating in areas like agriculture, healthcare, and finance, utilizing edge AI to provide real-time analytics and solutions in regions with limited connectivity. The emphasis on developing smart cities and IoT ecosystems further propels the demand for edge AI applications, positioning India as a growing hub for AI innovation.

Europe Edge AI Market Trends

The edge AI industry in Europe is experiencing significant growth, driven by stringent data privacy regulations and a strong focus on industrial automation. European companies are investing in edge AI to process data locally, ensuring compliance with the General Data Protection Regulation (GDPR) while reducing latency. The automotive industry, a cornerstone of Europe's economy, is integrating edge AI for advanced driver-assistance systems and autonomous driving capabilities. Collaborative initiatives, such as the European AI Alliance, foster cross-border cooperation in AI research and development. Europe's commitment to ethical AI and sustainability also influences the design and deployment of edge AI solutions across various sectors.

The edge AI market in Germany is experiencing significant growth, driven by its leadership in manufacturing and the adoption of Industry 4.0 practices. German industries are leveraging edge AI to enhance production efficiency, predictive maintenance, and supply chain optimization. The automotive sector, with companies like Volkswagen and BMW, is at the forefront, implementing edge AI for smart manufacturing and autonomous vehicle technologies. Germany's emphasis on high-quality engineering and innovation, supported by government initiatives like the High-Tech Strategy 2025, accelerates the integration of edge AI across various applications, reinforcing its position as a technological leader.

The France edge AI market is experiencing significant growth, driven by government support and a dynamic tech startup ecosystem. Initiatives such as the National AI Strategy aim to position France as a leader in artificial intelligence by fostering research and development. French companies are adopting edge AI to improve energy management, transportation systems, and healthcare services. The country's focus on data sovereignty and ethical AI aligns with the deployment of edge AI solutions that process data locally, ensuring compliance with European regulations. Collaborations between academia and industry further stimulate innovation, contributing to the market expansion.

Key Edge AI Company Insights

Some of the key players operating in the edge AI industry include Amazon.com, Inc. and Intel Corporation.

-

Amazon’s AWS Greengrass and AI-driven cloud services have positioned the company as a leader in edge AI solutions. Its primary competitive advantage lies in its vast cloud computing ecosystem, enabling seamless integration of edge AI for businesses. Amazon competes with Microsoft Azure and Google Cloud in providing AI-enhanced IoT services, while also facing competition from specialized AI hardware providers like Intel and NVIDIA. The company’s deep learning models and AI-powered Alexa devices showcase its innovation in real-time edge processing. However, concerns over cloud data security and increasing regulatory scrutiny on AI usage remain challenges. Continued investment in AI chips and edge security solutions will be critical for Amazon’s long-term growth in the sector.

-

Intel is a major player in the edge AI landscape, leveraging its AI accelerators, OpenVINO toolkit, and FPGA-based solutions to compete with NVIDIA and AMD. Its competitive strength lies in its ability to integrate AI processing with high-performance computing, catering to industries like healthcare, automotive, and industrial automation. Intel’s Xeon processors and AI-optimized chips provide real-time edge computing capabilities, making it a preferred choice for enterprises requiring high-speed AI inference. However, the company faces challenges from NVIDIA’s dominance in GPU-based AI computing and Apple’s shift to in-house chips. Continuous advancements in AI chip efficiency and strategic acquisitions will be key for Intel to maintain its leadership in the edge AI market.

Viso.ai and Synaptics Incorporated are some of the emerging companies in the global market

-

Viso.ai is an emerging player in the edge AI market, specializing in AI vision platforms for real-time data processing. The company’s cloud-independent AI model deployment capabilities differentiate it from traditional AI firms. Viso.ai competes with Google, AWS, and Microsoft in AI-powered video analytics and IoT applications. Its focus on privacy-centric AI and edge-based deep learning solutions provides a competitive edge in industries like retail, security, and healthcare. However, limited brand recognition and competition from larger firms with established AI ecosystems pose challenges. Expanding its global partnerships and enhancing AI model efficiency will be key to Viso.ai’s long-term growth.

-

Synaptics specializes in AI-powered edge processing, offering solutions for IoT, automotive, and human-interface technologies. The company’s competitive advantage lies in its expertise in AI-driven touch, voice, and biometric processing solutions. It competes with Qualcomm, NVIDIA, and Intel in AI-powered embedded systems. Synaptics’ focus on low-power AI chips for smart devices and wearables gives it a niche market advantage. However, challenges include supply chain constraints and competition from semiconductor giants with larger R&D budgets. Continued innovation in AI-powered edge inference and partnerships with smart device manufacturers will be critical for Synaptics to sustain its competitive position.

Key Edge AI Company Companies:

The following are the leading companies in the edge AI market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Alphabet Inc.

- Amazon.com, Inc

- Gorilla Technology Group

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Nutanix, Inc.

- Synaptics Incorporated

- Viso.ai

Recent Developments

-

In February 2023, Cellnex Ireland and Dublin City University collaborated to develop a 5G-enabled smart campus. The initiative included the deployment of advanced telecommunications infrastructure to ensure full 5G coverage and Multi-Access Edge Computing (MEC) capabilities. This collaboration demonstrated the practical application of edge AI by enabling real-time processing of camera video streams over a 5G connection.

-

In October 2022, Synaptics Incorporated acquired Emza Visual Sense, an Israel-based company specializing in ultra-low-power AI for visual sensing. This acquisition strengthened Synaptics’ edge AI capabilities by integrating Emza’s expertise in energy-efficient vision AI technology. The move positioned Synaptics as a leader in AI-powered human-interface solutions for IoT and smart device applications.

-

In July 2022, Gorilla Technology collaborated with SUNTEL to enhance its sales and expand its AI-driven solutions in the Japanese market. This partnership aimed to strengthen Gorilla Technology’s presence in Japan by leveraging SUNTEL’s network and market expertise. As a result, the company improved its ability to deliver edge AI solutions for security, surveillance, and enterprise applications.

Edge AI Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 24.90 billion |

|

Revenue forecast in 2030 |

USD 66.47 billion |

|

Growth rate |

CAGR of 21.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market revenue in USD million/billion & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, end-use industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

ADLINK Technology Inc.; Alphabet Inc.; Amazon.com, Inc.; Gorilla Technology Group; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; Nutanix, Inc.; Synaptics Incorporated; Viso.ai |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Global Edge AI Market Report Segmentation

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global edge AI market report based on component, end-use industry, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Edge Cloud Infrastructure

-

Services Video

-

-

End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Smart Cities

-

Manufacturing

-

Automotive

-

Government

-

Healthcare

-

IT & Telecom

-

Energy

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global edge AI market size was estimated at USD 20.78 billion in 2024 and is expected to reach USD 24.90 billion in 2025.

b. The global edge AI market is expected to grow at a compound annual growth rate of 21.7% from 2025 to 2030 to reach USD 66.47 billion by 2030.

b. North America dominated the edge AI market with a share of 37.7% in 2024. The region growth is driven by a significant focus on adopting advanced technologies such as AI, deep learning, and machine learning by the region's enterprises.

b. Some key players operating in the edge AI market include ADLINK Technology Inc., Alphabet Inc., Amazon.com, Inc., Gorilla Technology Group, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Nutanix, Inc., Synaptics Incorporated, Viso.ai

b. Key factors driving the edge AI market growth include the growing use of edge AI applications such as Smart AI Vision, Smart Energy, AI Healthcare, Smart Factory, and Intelligent transportation systems is attributed to the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."