- Home

- »

- Medical Devices

- »

-

Edema Clinical Trials Market Size And Share Report, 2030GVR Report cover

![Edema Clinical Trials Market Size, Share & Trends Report]()

Edema Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II), By Participant (Pediatrics, Adults), By Study Design (Interventional Trials, Observational Trials), By Type (Systemic Edema, Localized Edema), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-117-8

- Number of Report Pages: 175

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Edema Clinical Trials Market Size & Trends

The global edema clinical trials market size was estimated at USD 830.0 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Several market-related factors influence clinical trials for edema, the buildup of extra fluid in bodily tissues. Increasing diseases linked to edema, such as heart failure, kidney disease, and several inflammatory disorders, drive the market growth. In addition, developments in medical research and technology, including new therapeutic targets and creative edema therapies, are further expected to propel the market growth. For instance, in March 2022, Otsuka Pharmaceutical Co., Ltd. (Otsuka) declared the regulatory approval of SAMTASU 8mg and 16mg intravenous infusion for treating cardiac edema in Japan.

There has been an increase in research activities and clinical trials to better understand the intricate nature of edema in connection with the underlying illnesses and to identify novel therapeutic approaches that can reduce the burden on affected individuals and healthcare systems. The pharmaceutical industry's commitment to precision medicine and the development of targeted medications facilitate clinical trial processes. In August 2023, to offer better options for the treatment of diabetic macular edema (DME), diabetic retinopathy (DR), and wet age-related macular degeneration (WAMD), the U.S. Food and Administration Department approved an 8 MG injection EYLEA HD (AFLIBERCEPT). The need for edema clinical trials is expected to rise shortly due to a growing patient population seeking these therapies.

Clinical studies for edema are progressing rapidly owing to the collaborations and partnerships within the healthcare sector. To combine resources, knowledge, and data, academic institutions, pharmaceutical firms, and healthcare organizations are working together. These partnerships make it possible to conduct edema research in a more thorough and multidisciplinary manner, which results in creative trial designs and quicker development times. BYOOVIZ, the first biosimilar from the collaboration between Biogen and Samsung Bioepis, was introduced in the U.S. in June 2022. It has previously been approved as the top ophthalmology biosimilar in Canada (2022), Europe (2021), and the UK (2021). This demonstrates the Biogen-Samsung Bioepis partnership's worldwide influence and positions BYOOVIZ as a noteworthy development in expanding access to biosimilar therapies across international borders.

Phase Insights

The phase-II segment accounted for the largest revenue share of 35.7% in 2022. Phase II trials are crucial in advancing our understanding of potential treatments and interventions. During this stage, experimental therapies undergo more extensive testing in a larger group of patients to assess efficacy and safety. In edema-related conditions such as heart failure, diabetic macular edema, or renal disorders, phase II trials aim to refine the dosage, identify adverse effects, and gather preliminary evidence of the treatment's effectiveness. In March 2019, the safety and effectiveness of faricimab were evaluated in the BOULEVARD phase II trial. In contrast to ranibizumab, this novel bispecific antibody targets vascular endothelial growth factor-A (VEGF-A) and angiopoietin-2 in patients with diabetic macular edema (DME).

The phase-III segment is expected to grow at a CAGR of 5.5% during the forecast period. These trials often employ randomized, controlled designs and may compare the investigational treatment with standard therapies or substitutes. Phase III studies enable the detection of uncommon side events and further establishment of the intervention's overall benefit-risk profile. Phase III trial successes are essential for regulatory submissions since they are the basis for marketing authorization requests. For instance, faricimab, a VEGFxAng2 bispecific antibody, performed similarly to Eylea, the top-selling drug of the company, in two phase-III clinical trials for diabetic macular edema conducted by Regeneron and Roche, respectively.

Study Design Insights

The interventional trials segment accounted for the largest revenue share of 48.2% 2022. This strategy often requires participants from multiple countries and regions to use a multicenter approach to ensure the study population. By adopting a global perspective, researchers can account for changes in genetics, demography, and environmental factors that may alter treatment outcomes. Through the development of evidence-based practices, regulatory decisions, and internationally applicable edema medicines, the results of these interventional trials have the potential to enhance patient care and outcomes.

The drug RO7200220 delivered through the eye to individuals with diabetic macular edema, is evaluated for efficacy, safety, tolerability, pharmacokinetics, and pharmacodynamics in the National Institutes of Health (NIH) project BP43445. This is an active comparator-controlled, phase II, multicenter, randomized, double-masked study. This segment is estimated to register the fastest CAGR of 5.8% over the forecast period. To treat the wide range of edema, including that caused by heart failure, diabetic macular edema, and renal disorders, scientists are progressively examining novel treatment modalities, including pharmaceuticals, biologics, and advanced medical technologies.

Type Insights

The localized edema segment accounted for the largest revenue share of 63.5% in 2022. The frequency and extent of localized edema in some people would increase its significance in clinical trials for particular geographic areas or healthcare settings. Additionally, clinical studies target specific types of edema, such as lymphedema or post-surgical edema, to assess the effectiveness of a treatment for that particular illness. This therapy is estimated to register the fastest CAGR of 5.8% over the forecast period.

The emphasis on personalized medicine is expanding, accelerating research into the distinct causes and processes of localized edema and opening the door for more specialized and efficient treatment approaches. Systemic edema, on the other hand, is anticipated to account for a sizable portion of the market during the forecast period. Swelling that affects the entire body, known as systemic edema, is frequently linked to underlying medical disorders such as heart failure, kidney illness, or liver disease.

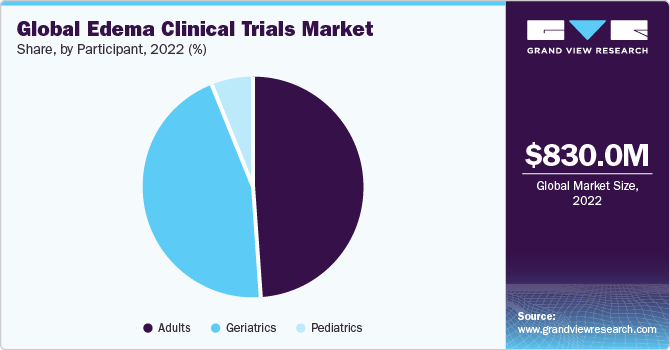

Participant Insights

The adult segment accounted for the largest revenue share of 48.9% in 2022 and is expected to grow at the fastest CAGR of 5.8% over the forecast period. By enrolling as participants, adults become integral to the research process, helping researchers evaluate the safety and efficacy of novel therapies. This collaborative effort across diverse populations enhances the applicability of study findings and ensures that the interventions are adequate across different demographic and geographical contexts.

Moreover, participants in the global edema clinical trials may benefit from close medical monitoring, access to expert healthcare professionals, and early exposure to innovative treatments that have the potential to improve their health outcomes and contribute to the broader understanding of edema management on a global scale. It is anticipated that the geriatrics category is expected to hold a sizable portion of the market in the coming years. The geriatric population section is more susceptible to edema due to age-related changes to the body's lymphatic system, circulation, and fluid management systems. Therefore, this age group is an important target demographic for therapeutic trials.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 41.4% in 2022. The research infrastructure in North America, especially in the U.S., is sophisticated and well-developed, and consists of academic institutions, research facilities, and clinical trial locations. These organizations are qualified, equipped, and experienced to carry out clinical studies successfully. Other funding sources for research include private foundations, pharmaceutical firms, and American government agencies. With the help of this funding, clinical trials are started and supported in the area. In cases of DR, which was identified as the leading cause of blindness among Americans under 65 in April 2022, DME was found to be the primary cause of vision loss. Research revealed that compared to non-hispanic white Americans, black Americans had a higher incidence, prevalence, and severity of DR.

Asia Pacific is expected to grow at the fastest CAGR of 6.1% during the forecast period. The rising incidences of edema have been a significant driver of this region's market expansion. In the region, the prevalence of chronic diseases is rising, the population is aging, and lifestyle changes are having an impact on how many individuals are impacted by edema. In addition, the pharmaceutical sector is expanding quickly, with China and India serving as significant centers for pharmaceutical production and research. According to a 2022 NIH report, variations in MIR17HG contribute to the Chinese population's susceptibility to high-altitude pulmonary edema.

Key Companies & Market Share Insights

The market for edema clinical trials is very competitive, with many producers holding most of the market share. A few of the crucial company tactics employed by industry players to preserve and expand their worldwide reach are product releases, approvals, strategic acquisitions, partnerships, research & developments and innovations.

Key Edema Clinical Trials Companies:

- Otsuka Holdings

- F. Hoffmann-La Roche Ltd.

- Novartis Pharmaceuticals

- Bayer

- Genentech, Inc

- Biogen

- Johnson & Johnson

- Inflammasome Therapeutics

- Sanofi S.A.

- OcuTerra Therapeutics

Edema Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 866.4 million

Revenue forecast in 2030

USD 1.27 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Phase, participant, study design, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Otsuka Holdings; F. Hoffmann-La Roche Ltd.; Novartis Pharmaceuticals; Bayer;Genentech, Inc; Biogen; Johnson & Johnson; Inflammasome Therapeutics; Sanofi S.A.; OcuTerra Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Edema Clinical Trials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global edema clinical trials market report based on phase, participant, study design, type and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Participant Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatrics

-

Adults

-

Geriatrics

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Trials

-

Observational Trials

-

Expanded Access Trials

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Systemic Edema

-

Localized Edema

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global edema clinical trials market size was estimated at USD 830.0 million in 2022 and is expected to reach USD 866.4 million in 2023.

b. The global edema clinical trials market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 1.27 billion by 2030.

b. North America dominated the edema clinical trials market with a share of 41.44% in 2022. North America, particularly the U.S., has an advanced and robust research infrastructure, which includes academic institutions, research centers, and clinical trial sites. These institutions have the expertise, resources, and experience to effectively conduct clinical trials.

b. Some key players operating in the edema clinical trials market include Otsuka Holdings, Hoffmann-La Roche, Novartis Pharmaceuticals, Bayer, Genentech, Inc, Biogen, Johnson & Johnson, Merck & Co., Inc., Sanofi S.A. AstraZeneca plc., Bristol Myers Squibb Company, GlaxoSmithKline plc., AbbVie Inc.

b. Key factors that are driving the market growth include the high burden of Edema, growing healthcare expenditure, and advancements in medical research.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."