Earthmoving Equipment Market Size, Share & Trends Analysis Report By Product (Dozer, Excavator, Loader, Motor Grader, Dump Truck), By Engine Capacity, By Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-512-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Earthmoving Equipment Market Size & Trends

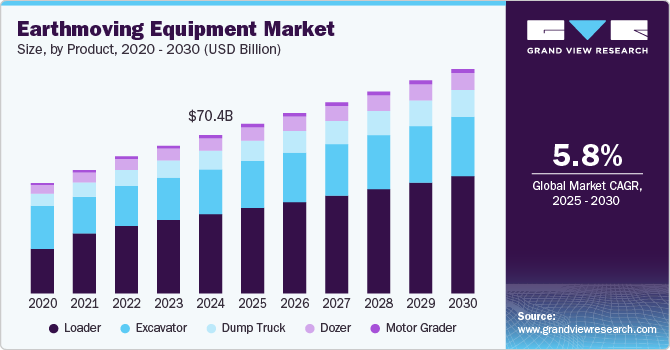

The global earthmoving equipment market size was estimated at USD 70.44 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. Increasing infrastructure development activities in developing countries and a rise in commercial and industrial construction projects are the primary factors driving the growth of the global earthmoving equipment market. Countries such as India, China, and Australia are focused on improving the existing infrastructure by initiating multiple projects related to roadway development, airport development, etc. This increasing infrastructure development activities and industrial construction projects call for heavy earthmoving equipment, such as excavators, loaders, dump trucks, etc. This machinery aids foundation digging, land leveling, and transporting heavy materials, providing contractors with an edge to overcome operational and time limitations.

The global demand for earthmoving equipment is also fueled by rapid urbanization. Urbanization involves the growth and expansion of cities and urban areas, which creates the need for infrastructure development and other construction activities. These population changes lead to different land use, economic activity, and cultural changes. Various government initiatives undertaken for infrastructure development and increasing investments in the construction industry are projected to drive consumption. For instance, in July 2022, the UAE government planned to invest AED 6,262.8 million (USD 23 billion) in infrastructure development. Hence, the rapid urbanization and population growth in various regions require the construction of residential and commercial buildings to accommodate the expanding population. As a result, these factors contribute to the growing demand for the earthmoving equipment market.

However, the high costs associated with purchasing and maintaining earthmoving equipment machines can deter potential buyers, especially Small and Medium-sized Enterprises (SMEs). The capital-intensive nature of the earthmoving equipment market restricts its growth and limits the accessibility of earthmoving equipment for these players. Furthermore, the increasing popularity of renting earthmoving equipment poses a significant challenge for OEMs. Renting offers access to high-quality equipment without substantial initial investments, reducing financial risks. Customers prefer flexible rental options that eliminate long-term ownership and maintenance costs. As rentals become more cost-effective and available, customers opt for them instead of outright purchases, decreasing sales volume and revenue for OEMs. Adapting to these changing customer preferences is crucial for OEMs to meet evolving earthmoving equipment market demands.

The growing emphasis on environmental concerns and stricter regulations fuels the demand for eco-friendly earthmoving equipment market. The industry is experiencing a notable transition towards electric and hybrid-powered equipment, effectively reducing carbon emissions and minimizing noise pollution at construction sites. Manufacturers actively invest in research and development endeavors to enhance earthmoving equipment's energy efficiency and sustainability. This trend presents a significant opportunity for companies to provide greener alternatives and distinguish themselves in the market. For instance, in June 2023, Volvo Group announced a collaboration with Heidelberg Materials, a building materials company. The partnership aims to reduce carbon emissions in the construction industry by collaboratively researching and innovating approaches to address loading and hauling requirements using electric vehicles and associated solutions.

Product Insights

The loader segment dominated the earthmoving equipment market with a revenue share of 50.2% in 2024. The loader segment encompasses various types, such as wheeled loaders and skid-steer loaders. Urbanization and limited working spaces in congested areas drive the demand for compact and versatile loaders. These machines offer enhanced maneuverability, agility, and the ability to operate in confined spaces, which is expected to drive demand. The construction industry, landscaping, and urban maintenance sectors are particularly significant markets for compact loaders. Manufacturers can capitalize on this opportunity by developing innovative designs, attachments, and technology solutions that cater to these specialized requirements.

The dump trucks segment is anticipated to expand at a significant CAGR during the forecast period. As economies grow and urbanize, there is a consistent demand for new infrastructure, such as roads, bridges, and buildings. The mining industry heavily relies on dump trucks to transport minerals and ores from mining sites to processing facilities. Technological advancements in dump truck design, including increased payload capacities, improved fuel efficiency, and enhanced safety features, also contribute to the segment’s growth by offering more efficient and cost-effective solutions for industries that require heavy material transport.

Engine Capacity Insights

Up to 250 HP segment accounted for the largest market share in 2024. Machines with a power range of up to 250 HP are commonly utilized for medium-scale projects that require a balance between power and maneuverability. These machines are designed to deliver adequate power to handle various tasks such as digging, lifting, and transporting materials while maintaining operational efficiency. Within the up to 250 HP range, the machines are typically designed to be compact and versatile, enabling easy transportation and maneuvering in confined spaces. It is crucial for the engine's capacity to align with the overall size and weight of the machine, ensuring optimal balance, stability, and efficient performance.

250-500 HP segment is expected to register the significant CAGR during the forecast period. In forestry and logging operations, the need arises for machinery that can effectively navigate rough terrain and manage heavy loads. Earthmoving equipment with engine capacities ranging from 250 to 500 HP is highly useful in tasks such as land clearing, road construction, and timber handling. These machines offer the power and versatility to operate efficiently and safely in challenging forest environments, enabling improved productivity and enhanced safety measures.

Type Insights

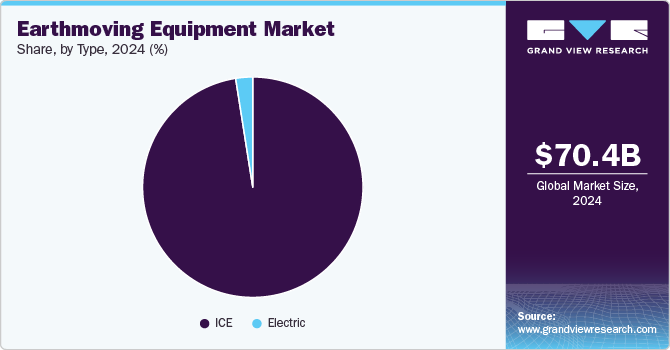

ICE accounted for the largest market share in 2024, the growth primarily driven by the need to meet these power and torque demands while ensuring optimal performance. Engine manufacturers provide a variety of engine models with different power outputs and torque capacities, allowing equipment manufacturers to select an engine that aligns with their machinery's performance needs. Additionally, ICE engines have seen notable advancements in fuel efficiency, incorporating technologies such as direct injection, turbocharging, and electronic control systems. Equipment manufacturers conduct thorough evaluations of various engine options to choose the one that offers the most favorable fuel economy while maintaining high performance levels, thereby minimizing operational costs.

Electric is anticipated to register the fastest CAGR over the forecast period. The integration of electric engines in earthmoving equipment presents numerous opportunities and benefits. One key advantage of electric engines is their contribution to environmental sustainability. By substituting ICEs with electric motors, earthmoving equipment can substantially decrease greenhouse gas emissions and air pollution. Electric engines generate zero tailpipe emissions, enhancing air quality, particularly in densely populated regions. This transition aligns with worldwide endeavors to combat climate change and minimize carbon footprints. As a result, such factors are expected to drive the growth for the segment over the forecast period.

Regional Insights

Asia Pacific earthmoving equipment market dominated globally with a revenue share of 40.8% in 2024. This is attributed to growing infrastructure development projects initiated by governments and organizations in countries such as China, India, and others. The earthmoving equipment is also extensively used by construction industry participants for ongoing projects. The Asia Pacific region has been experiencing significant infrastructure development and enhancement growth.

Earthmoving equipment market in India held a significant revenue share of the regional industry in 2024. The growing demand from the construction industry and government-initiated structure projects mainly drive this market. In addition, significant demand from the industrial and commercial construction market is adding lucrative opportunities to the industry.

China earthmoving equipment market is anticipated to experience substantial growth from 2025 to 2030. The presence of multiple manufacturing companies that deliver advanced earthmoving equipment to global customers plays a vital role in this market's growth. Demand for large earthmoving equipment from the domestic mining industry contributes to the opportunities for this market.

Europe Earthmoving Equipment Market Trends

Europe was identified as one of the key global earthmoving equipment market regions in 2024. This is attributed to factors such as substantial investments by the government in the region for infrastructural developments and enhancements. Growing urbanization also plays a vital role in the projected growth of this market. The increasing focus on sustainability and versatility offered by equipment such as excavators also influences this regional market.

The earthmoving equipment market in Germany held a noteworthy revenue share of the regional market in 2024. This market is mainly driven by the presence of earthmoving equipment manufacturing facilities in the country and its ease of availability. Infrastructure developments and construction industry projects primarily drive the demand for earthmoving equipment in the country.

The UK earthmoving equipment market is expected to experience substantial growth over the forecast period. This is attributed to the number of infrastructure projects initiated in the country and the demand for industrial and commercial construction projects. Trends such as sustainability and emission control also play vital roles in this market.

North America Earthmoving Equipment Market Trends

North America earthmoving equipment market is expected to experience significant growth over forecast period. This market is mainly driven by the growth experienced by the construction industry, ongoing infrastructure projects, and demand associated with facility enhancements and other industrial construction applications of earthmoving equipment. The presence of multiple key companies in the region also adds to the growth of this market.

The U.S. earthmoving equipment market accounted for the largest revenue share of the regional industry in 2024. The U.S. is home to multiple earthmoving equipment manufacturers and has been experiencing continuous growth in construction associated with residential, commercial, and industrial requirements. These aspects are expected to add lucrative growth opportunities to this market over the next few years.

Key Earthmoving Equipment Company Insights

Some of the key companies operating in the earthmoving equipment market are AB Volvo, Caterpillar, Komatsu Ltd., LIEBHERR, Hitachi Construction Machinery Co., Ltd. and others. To address growing competition and increasing demand from various regions, the key companies are embracing strategies such as portfolio expansions, launch of used products, collaborations and others.

-

AB Volvo, a global manufacturer of mobility solutions, including heavy construction and earthmoving equipment, offers various products associated with the category. Its construction equipment business portfolio features electric machines, excavators, wheel loaders, articulated haulers, attachments, parts, and services. The company offers unique products and services in different regions according to the domain's common requirements.

-

Caterpillar, one of the key market participants in the earthmoving equipment market, provides an extensive range of construction and earthmoving equipment featuring advanced technology capabilities, the addition of modern technologies, and versatile models with different capacities and types. The portfolio features excavators, dozers, backhoe loaders, drills, motor graders, and track loaders.

Key Earthmoving Equipment Companies:

The following are the leading companies in the earthmoving equipment market. These companies collectively hold the largest market share and dictate industry trends.

- AB Volvo

- BEML LIMITED.

- Bobcat Company

- Caterpillar

- CNH Industrial N.V.

- Deere & Company

- Doosan Corporation

- Hitachi Construction Machinery Co., Ltd.

- Hyundai Construction Equipment Co., Ltd.

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery Co. Ltd

- Komatsu Ltd.

- LIEBHERR

- SANY Group

- Sumitomo Heavy Industries, Ltd.

- Terex Corporation

- XCMG Group

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Recent Developments

-

In March 2025, Liebherr-Australia, one of the key market participants in the earthmoving equipment industry, and Roy Hill, one of the largest mining operations in Western Australia, announced a new partnership. The partnership was marked with the ceremonial handover of 800-tonne R 9800 excavators.

-

In January 2025, SANY Group launched the ST230V Compact Track Loader, which is specially targeted for North America and Europe markets. Equipped with significant efficiency and maneuverability capabilities, this addition to the portfolio is expected to strengthen the company’s position in related markets.

-

In January 2025, Bobcat Company launched the new Bobcat B760 backhoe loader and a diverse product lineup comprising mini-track loaders, compact excavators, portable power equipment, and skid-steer loaders.

-

In January 2025, Volvo Construction Equipment launched a newly designed articulated hauler lineup with additional capabilities ranging in size from A25-A60. This was part of Volvo’s largest portfolio renewal over the last few decades.

-

In January 2025, Hyundai Construction Equipment announced it had secured an order for medium-sized excavators tendered by the Philippines Department of Public Works and Highways (DPWH). The order comprises 122 units, including 74 '22-ton' excavators and 48 '21-ton' excavators.

Earthmoving Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 75.46 billion |

|

Revenue forecast in 2030 |

USD 99.90 billion |

|

Growth rate |

CAGR of 5.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, engine capacity, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

AB Volvo; BEML LIMITED; Bobcat Company; Caterpillar; CNH Industrial N.V.; Deere & Company; Doosan Corporation; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Kobelco Construction Machinery Co. Ltd; Komatsu Ltd.; LIEBHERR; SANY Group; Sumitomo Heavy Industries, Ltd.; Terex Corporation; XCMG Group; Zoomlion Heavy Industry Science&Technology Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Earthmoving Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global earthmoving equipment market report based on product, engine capacity, type, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dozer

-

Vehicle Weight

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Type

-

Wheel

-

Crawler

-

-

Drive Type

-

ICE

-

Electric

-

-

-

Excavator

-

Vehicle Weight

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Type

-

Wheel

-

Crawler

-

-

Drive Type

-

ICE

-

Electric

-

-

-

Loader

-

Type

-

Backhoe Loaders

-

Skid Steer Loaders

-

Crawler/Track Loaders

-

Wheeled Loaders

-

-

Drive Type

-

ICE

-

Electric

-

-

-

Motor Grader

-

Vehicle Weight

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Drive Type

-

ICE

-

Electric

-

-

-

Dump Truck

-

Engine Capacity

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Vehicle Type

-

Rigid Frame

-

Articulated Frame

-

-

Drive Type

-

ICE

-

Electric

-

-

-

-

Engine Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global earthmoving equipment market size was estimated at USD 70.44 billion in 2024 and is expected to reach USD 75.46 billion in 2025.

b. The global earthmoving equipment market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 99.90 billion by 2030.

b. Asia Pacific dominated the earthmoving equipment market with a share of 40.8% in 2024. This is attributable to rising heavy investments in rural and urban infrastructure including the building of residential areas, ports, roads, and IT parks in India.

b. Some key players operating in the earthmoving equipment market include AB Volvo; BEML LIMITED.; Bobcat Company; Caterpillar; CNH Industrial N.V.; Deere & Company; Doosan Corporation; Hitachi Construction Machinery Co., Ltd.; Hyundai Construction Equipment Co., Ltd.; J C Bamford Excavators Ltd.; Kobelco Construction Machinery Co. Ltd; Komatsu Ltd.; LIEBHERR; SANY Group; Sumitomo Heavy Industries, Ltd.; Terex Corporation; XCMG Group; and Zoomlion Heavy Industry Science&Technology Co., Ltd.

b. Key factors that are driving the market growth include the emergence of advanced products with eco-friendly features and low maintenance and technological advancements leading to the facilitation of real-time monitoring.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."