- Home

- »

- Next Generation Technologies

- »

-

E-liquid Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![E-liquid Market Size, Share & Trends Report]()

E-liquid Market (2025 - 2030) Size, Share & Trends Analysis Report By Flavor (Menthol, Tobacco, Dessert, Fruits & Nuts, Chocolate, Others), By Type (Pre-Filled, Bottled), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-319-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-liquid Market Summary

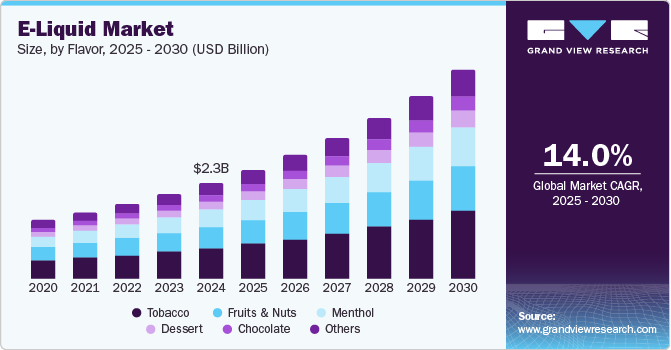

The global e-liquid market size was estimated at USD 2.26 billion in 2024 and is projected to reach USD 4.93 billion by 2030, growing at a CAGR of 14.0% from 2025 to 2030. A growing number of consumers are choosing vaping as a safer alternative to traditional smoking, seeking to reduce their exposure to harmful chemicals.

Key Market Trends & Insights

- The North America e-liquid market dominated the global revenue with a revenue share of 39.5% in 2024.

- The U.S. e-liquid market is witnessing a shift towards increased consumer preference for flavored products.

- Based on flavor, the tobacco segment dominated the market with a revenue share of 31.7% in 2024, owing to the continued demand for tobacco-flavored e-liquids among smokers.

- In terms of type, the bottled segment dominated the market with the highest revenue share in 2024 due to its convenience and versatility.

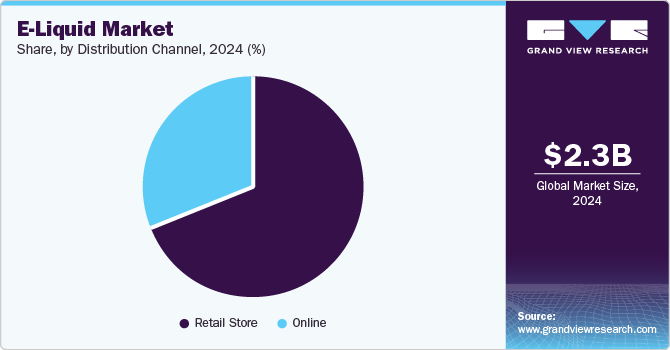

- In terms of distribution channel, the retail store segment dominated the e-liquid industry with the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.26 billion

- 2030 Projected Market Size: USD 4.93 billion

- CAGR (2025-2030): 14.0%

- North America: Largest market in 2024

Moreover, a wide variety of flavors appeals to both smokers and non-smokers. Furthermore, improved accessibility through online sales and innovative marketing strategies has expanded the reach of e-liquids to a broader audience.

As public awareness of the health risks associated with tobacco use rises, many smokers are seeking less harmful options. Vaping is often perceived as a way to reduce exposure to harmful chemicals found in combustible cigarettes. For instance, Johns Hopkins Medicine notes that vaping is less harmful than smoking traditional cigarettes. The organization highlights that regular tobacco cigarettes contain a significantly higher number of toxic substances, reinforcing the idea that e-cigarettes may provide a less harmful alternative for those looking to reduce their exposure to dangerous chemicals. This shift in consumer behavior is particularly evident among younger demographics, who are more inclined to experiment with vaping as a lifestyle choice. Additionally, public health campaigns and regulations aimed at reducing smoking rates have further encouraged smokers to consider e-cigarettes and e-liquids as viable alternatives.

Moreover, manufacturers continuously innovate by introducing unique flavor profiles that cater to diverse consumer preferences. From traditional tobacco and menthol flavors to fruity, dessert, and beverage-inspired options, the large number of options enhances the appeal of e-liquids. This variety not only attracts existing smokers looking for alternatives but also draws in non-smokers, especially younger consumers who may be more interested in flavored products.

Lastly, the rise of online sales channels has made e-liquids more accessible to consumers. The convenience of purchasing products online and targeted marketing strategies have facilitated greater reach and engagement with potential customers. As more consumers become aware of the benefits of vaping and the variety of products available, the demand for e-liquids is expected to increase, driving overall market growth in the coming years.

Flavor Insights

The tobacco segment dominated the market with a revenue share of 31.7% in 2024, owing to the continued demand for tobacco-flavored e-liquids among smokers. Many consumers prefer these flavors as they provide a familiar experience that mimics traditional smoking while allowing for a perceived reduction in harmful chemical exposure. Furthermore, the growing trend of using e-liquids as a smoking cessation tool has solidified the tobacco segment's position, appealing to those looking to transition away from combustible cigarettes while still enjoying the taste of tobacco.

The menthol segment is projected to grow at the highest CAGR during the forecast period, owing to its popularity among consumers seeking a refreshing vaping experience. Menthol flavors are particularly appealing to younger demographics and former menthol cigarette smokers who are looking for alternatives that maintain their preferred flavor profile. The increasing awareness of health risks associated with traditional smoking has also led many consumers to switch to menthol e-liquids, which are perceived as less harsh and more enjoyable. Moreover, in June 2024, the U.S. Food and Drug Administration (FDA) authorized the marketing of four menthol-flavored e-cigarette products from NJOY LLC after a scientific review. These products include NJOY ACE Pod Menthol and NJOY DAILY Menthol, marking the first non-tobacco flavored e-cigarettes to receive such approval.

Type Insights

The bottled segment dominated the market with the highest revenue share in 2024 due to its convenience and versatility. Bottled e-liquids allow users to easily refill their vape devices, offering a cost-effective solution for regular vapers. Additionally, they can be stored securely for extended periods and are often used in DIY e-juice creation, appealing to consumers who enjoy customizing their vaping experience. For instance, according to Freevap, making customized e-liquid can lead to significant savings compared to purchasing pre-made options, with users able to produce larger quantities at a lower cost. This combination of practicality and user engagement has boosted the bottled segment's dominance in the market.

The pre-filled segment is projected to grow at a significant CAGR during the forecast period, driven by its convenience and ease of use. Pre-filled cartridges eliminate the hassle of refilling, making them a popular choice for consumers seeking a straightforward vaping experience. Their disposable nature also appeals to those looking for a low-maintenance option, particularly among younger users who favor quick and easy solutions.

Distribution Channel Insights

The retail store segment dominated the e-liquid industry with the highest revenue share in 2024. This dominance can be attributed to the unique advantages that physical stores offer, such as the ability for customers to sample various flavors before making a purchase. In addition, tobacconists and specialty stores play pivotal roles by providing unique shopping experiences that cater to diverse consumer preferences. Tobacconists focus on a curated selection of tobacco-related products, including e-liquids, and provide expert advice from knowledgeable staff, fostering trust and encouraging repeat visits. Meanwhile, specialty stores emphasize variety and quality, showcasing an extensive array of flavors and brands that appeal to both novice and experienced vapers.

The online segment is projected to grow at the highest CAGR during the forecast period due to increased accessibility, consumer awareness of vaping as a safer alternative to smoking, and a diverse range of product offerings. Consumers are drawn to the convenience of shopping online for various flavors and formulations, often at competitive prices. Additionally, favorable regulatory conditions enhance consumer confidence in purchasing e-liquids online.

Regional Insights

The North America e-liquid market dominated the global revenue with a revenue share of 39.5% in 2024. There is a well-established vaping culture and a strong distribution network that supports both online and retail sales. The region has seen significant investment from major players who are focused on innovation and product differentiation, catering to a diverse consumer base. In addition, regulatory frameworks in the U.S. and Canada have generally been supportive of e-cigarette products, facilitating market growth and encouraging consumers to switch from traditional tobacco products to e-liquids.

U.S. E-Liquid Market Trends

The U.S. e-liquid market is witnessing a shift towards increased consumer preference for flavored products, which are particularly popular among younger users. This trend is supported by a strong culture of vaping, where many smokers are transitioning to e-liquids as a perceived safer alternative. Regulatory frameworks in the U.S. have generally been favorable, allowing for innovation and product differentiation among major players. Additionally, the growth of online retail platforms has made it easier for consumers to access a wide variety of e-liquid options, enhancing convenience and choice.

Europe E-Liquid Market Trends

The Europe e-liquid industry is experiencing a significant growth, driven by rising consumer interest in vaping as a healthier alternative to traditional smoking. Countries like the United Kingdom and France are leading the way, with regulations that support the use of e-cigarettes while ensuring safety standards. For instance, according to organizations like Action on Smoking & Health (ASH) e-cigarettes share characteristics with both traditional cigarettes and nicotine replacement therapy (NRT) products, as they deliver nicotine through inhalation while mimicking the smoking experience. Furthermore, the expansion of distribution channels, including online sales and specialized vape shops, is also making it easier for consumers to find and purchase e-liquids.

Asia Pacific E-Liquid Market Trends

The Asia Pacific e-liquid market is expected to grow at the highest CAGR during the forecast period. Countries such as China and India are seeing an increase in vaping popularity, driven by growing awareness of the risks associated with cigarettes. Rising disposable incomes are enabling consumers to invest in vaping products, while the proliferation of e-commerce platforms provides easy access to a wide range of e-liquids and devices. As regulatory environments become more supportive of vaping, this region is poised for substantial growth in the coming years.

China's e-liquid market is experiencing significant growth, largely fueled by its vast population of over 300 million smokers seeking alternatives to traditional tobacco products. The increasing awareness of the health risks associated with smoking has led to a rise in e-cigarette usage among consumers. Although online sales have been prohibited in the country, there is a substantial presence of branded stores and vaping outlets from leading companies such as Yooz, Relx, and MOTI. These physical retail locations allow consumers to try various products, enhancing their overall purchasing experience.

Key E-Liquid Company Insights

The e-liquid industry is characterized by key players such as Black Note and Turning Point Brands, each contributing to growth through innovative flavors and high-quality products. Increasing consumer awareness of vaping as a less harmful alternative to smoking is driving demand in the sector. Additionally, the rise of online sales channels is enhancing accessibility for consumers. Companies focus on product innovation and strategic partnerships to strengthen their market presence in this competitive landscape.

-

Black Note, Inc. is a premium e-liquid manufacturer recognized for its dedication to producing authentic tobacco flavors using natural extracts. The company prioritizes a clean vaping experience by eliminating artificial additives, appealing to new and experienced vapers. Black Note emphasizes transparency in its production processes and aims to meet the needs of discerning consumers seeking high-quality alternatives to traditional smoking.

-

Turning Point Brands, Inc. is a prominent manufacturer and distributor of branded consumer products, particularly in the alternative smoking accessories market. The company is well known for its flagship brands, including Zig-Zag rolling papers and Stoker’s smokeless tobacco products. Turning Point Brands is committed to adapting to evolving consumer preferences through innovation and strategic acquisitions while expanding its product offerings within the NewGen segment, encompassing vaping and other alternative products.

Key E-liquid Companies:

The following are the leading companies in the e-liquid market. These companies collectively hold the largest market share and dictate industry trends.

- Black Note, Inc.

- Breazy

- BSMW Ltd.

- Crystal Canyon Vapes LLC

- eLiquid Factory

- Mig Vapor LLC

- Molecule Labs, Inc.

- Nicopure Labs LLC

- Philip Morris International Inc.

- Turning Point Brands, Inc.

- VMR Products LLC

Recent Development

-

In August 2024, Japan Tobacco (JT Group) announced its agreement to acquire Vector Group, the fourth-largest tobacco company in the United States, for approximately USD 2.4 billion. This strategic acquisition aims to bolster JT's investment in e-cigarettes and heated tobacco products while enhancing its competitive position in the U.S. market.

-

In June 2023, Innokin, a Chinese vape manufacturer, emphasized its commitment to innovation and sustainability in the vaping industry. The company introduced the Aquios Bar, the first vaporizer to utilize water-based e-liquids, which enhances the vaping experience by reducing harmful emissions and dehydration.

E-Liquid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.56 billion

Revenue forecast in 2030

USD 4.93 billion

Growth rate

CAGR of 14.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Germany, UK, China, Japan, Australia, Brazil

Key companies profiled

Black Note, Inc.; Breazy; BSMW Ltd.; Crystal Canyon Vapes LLC; eLiquid Factory; Mig Vapor LLC; Molecule Labs, Inc.; Nicopure Labs LLC; Philip Morris International Inc.; Turning Point Brands, Inc.; VMR Products LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-Liquid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global e-liquid market report based on flavor, type, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Menthol

-

Tobacco

-

Dessert

-

Fruits & Nuts

-

Chocolate

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-Filled

-

Bottled

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Retail Store

-

Convenience Store

-

Drug Stores

-

News Stands

-

Tobacconist

-

Specialty Stores

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.