- Home

- »

- Digital Media

- »

-

E-learning Services Market Size, Share, Industry Report 2030GVR Report cover

![E-learning Services Market Size, Share & Trends Report]()

E-learning Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Custom E-learning, Responsive E-learning), By Courses, By Learning Method, By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-153-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-learning Services Market Summary

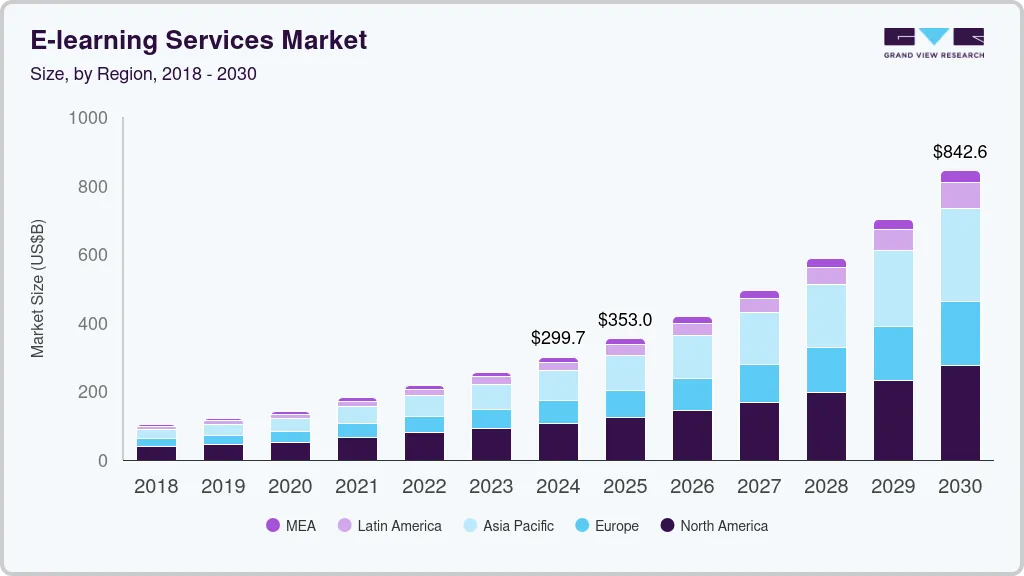

The global e-learning services market size was estimated at USD 299.67 billion in 2024 and is projected to reach USD 842.64 billion by 2030, growing at a CAGR of 19.0% from 2025 to 2030. This rapid growth is driven by increased adoption of digital learning platforms across educational institutions and corporate sectors, fueled by demand for remote learning and upskilling opportunities.

Key Market Trends & Insights

- North America E-learning services market dominated with a revenue share of over 35% in 2024.

- By type, the custom e-learning segment led the market in 2024, accounting for over 29% share of the global revenue.

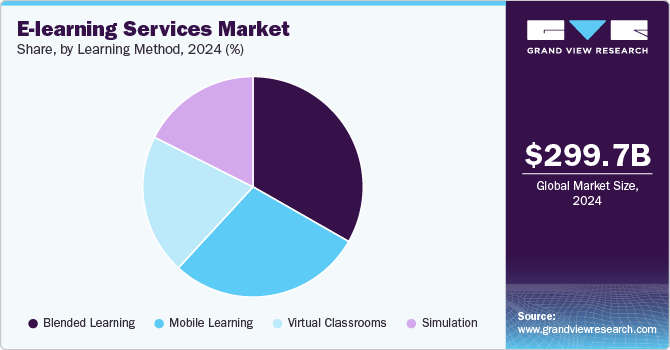

- By learning method, the blended learning segment accounted for the largest market revenue share in 2024.

- By technology, the cloud computing segment held the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 299.67 Billion

- 2030 Projected Market Size: USD 842.64 Billion

- CAGR (2025-2030): 19.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in technology, including artificial intelligence, virtual classrooms, and gamification, further enhance user engagement, driving market expansion. In addition, rising internet penetration, particularly in emerging economies, and government initiatives are promoting the growth of digital education.

The increasing focus on lifelong learning and professional development is a major factor propelling market growth. Corporations invest heavily in employee training through e-learning platforms to enhance productivity and meet evolving skill requirements, especially in technology-driven sectors. Furthermore, the rising popularity of microlearning and subscription-based models makes learning accessible and cost-effective for individuals and organizations. Higher education institutions also integrate e-learning modules to offer hybrid and distance-learning programs, further expanding market penetration.

The growing availability of mobile-based learning apps ensures learning on the go, which aligns with the modern learner's preferences. Moreover, the widespread adoption of AI and data analytics enables adaptive learning solutions that personalize content to individual needs. E-learning platforms are integrating tools such as augmented and virtual reality (AR/VR) to offer immersive learning experiences, enhancing comprehension and engagement. Increased investments in educational technology startups and partnerships between ed-tech companies and traditional educators further accelerate market growth. Furthermore, government regulatory support promoting digital literacy and training programs adds momentum to market expansion.

Courses Insights

The instructor-led virtual courses segment accounted for the largest market revenue share in 2024 due to its ability to combine real-time interaction with the flexibility of online learning. These courses replicate the traditional classroom experience, allowing learners to engage with instructors through live sessions, discussions, and Q&A, fostering better comprehension and engagement. Organizations and educational institutions prefer this format for training programs that require guided learning, personalized feedback, or interactive problem-solving. The demand for instructor-led courses also surged as hybrid and remote work environments became more prevalent, with companies emphasizing structured skill-building programs. For instance, in June 2023, IPC, a global association for electronics manufacturing, launched three online instructor-led courses to empower professionals in the electronics industry. These courses offer an in-depth exploration of the challenges and solutions related to lead-free production.

The self-paced courses segment is projected to experience significant growth over the forecast period due to the flexibility it offers learners to study at their own convenience and pace. This format caters to a wide range of users, including working professionals, students, and lifelong learners who can balance education with personal and professional commitments. Organizations increasingly adopt self-paced courses to provide on-demand training resources, reducing the need for fixed schedules and enabling continuous learning. The growing availability of online platforms offering affordable or even free courses across various subjects further accelerates adoption.

Type Insights

The custom e-learning segment led the market in 2024, accounting for over 29% share of the global revenue. This growth is attributed to the growing demand for tailored content that meets specific organizational training needs, enhancing relevance and learning outcomes. Companies across industries prefer custom solutions to align training programs with their unique business objectives, workflows, and compliance requirements. In addition, custom e-learning allows the integration of branding elements and specialized modules, providing a more engaging and consistent learning experience for employees.

The game-based learning segment is expected to witness significant market growth during the forecast period due to its ability to enhance learner engagement and retention. Incorporating game mechanics such as rewards, challenges, and leaderboards makes learning more interactive, fostering motivation and healthy competition among users. This approach is mainly popular in corporate training, where gamified modules are used to teach complex topics such as compliance, leadership, and technical skills enjoyably. Furthermore, advancements in AR/VR technologies are transforming game-based learning into immersive experiences, making it ideal for industries such as healthcare, defense, and engineering that require practical, hands-on training.

Learning Method Insights

The blended learning segment accounted for the largest market revenue share in 2024 due to its ability to combine the best aspects of both online and traditional face-to-face learning. This hybrid approach allows institutions and organizations to offer flexible, engaging courses by integrating self-paced digital content with live, instructor-led sessions. Blended learning enhances learner engagement and knowledge retention by providing multiple touchpoints, including assignments, virtual discussions, and in-person interactions. The model is mainly favored in higher education and corporate training, where personalized feedback and practical, hands-on activities are essential.

The simulation segment is expected to witness significant growth in the coming years due to its ability to provide hands-on, experiential learning in a risk-free virtual environment. Industries such as healthcare, aviation, and manufacturing increasingly rely on simulations for training complex skills, as they allow learners to practice real-world scenarios without the consequences of failure. Integrating technologies such as AR and VR further enhances simulation-based learning, making it more immersive and effective. Moreover, simulations are gaining traction in corporate settings for leadership development and soft skills training, as they offer interactive problem-solving exercises.

Technology Insights

The cloud computing segment held the largest market revenue share in 2024 due to its ability to offer scalable, flexible, and cost-efficient infrastructure for e-learning services. Cloud-based platforms enable seamless access to LMS and content from anywhere, supporting the growing demand for remote and hybrid learning. Organizations and educational institutions prefer cloud solutions as they facilitate real-time updates, easy storage, and secure management of large volumes of learning data. In addition, cloud computing reduces the need for heavy on-site infrastructure, lowering operational costs and enabling rapid deployment of e-learning programs.

The artificial intelligence (AI) segment is poised for significant market growth due to its ability to deliver personalized and adaptive learning experiences. AI-powered platforms can analyze learner behavior, assess progress, and recommend customized content based on individual needs, enhancing engagement and outcomes. Automated tools such as chatbots and virtual tutors provide real-time assistance, making learning more interactive and accessible. Furthermore, AI enables the development of predictive analytics, helping educators and organizations identify knowledge gaps and improve course delivery.

End-use Insights

The academic segment accounted for the largest market revenue share in 2024 due to educational institutions' widespread adoption of e-learning solutions, from K-12 schools to universities. The shift towards digital learning has driven schools and universities to invest in online platforms to ensure continuity in education. These platforms allow institutions to offer flexible learning options, including hybrid and fully online courses, accommodating diverse student needs. The growing demand for interactive and engaging learning experiences, such as virtual classrooms and digital assessments, also contributes to this segment's growth.

The corporate segment is expected to witness significant growth in the coming years due to the increasing focus on continuous employee training and upskilling in a fast-evolving business environment. Companies are adopting e-learning platforms to provide cost-effective and scalable training solutions, ensuring employees remain updated with the latest skills and industry trends. The rise of remote and hybrid work models has further accelerated the need for online corporate training, allowing organizations to deliver consistent learning experiences across geographically dispersed teams. Moreover, the growing use of technologies such as gamification, AI-based assessments, and virtual simulations enhances employee engagement and knowledge retention.

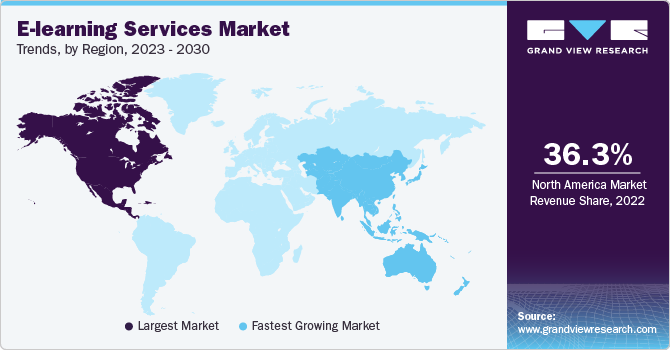

Regional Insights

North America E-learning services market dominated with a revenue share of over 35% in 2024 due to the region’s advanced digital infrastructure and high adoption of technology-driven education solutions. The widespread presence of major e-learning providers and LMS platforms has facilitated easy access to digital learning resources across corporate and academic sectors. Government initiatives promoting online education, along with rising investments in ed-tech startups, have further accelerated market growth. In addition, the growing demand for employee upskilling, driven by rapid technological advancements and the shift towards hybrid work models, has boosted corporate adoption of e-learning solutions.

U.S. E-learning Services Market Trends

The U.S. e-learning services market is expected to grow in 2024 due to the increasing need for flexible, remote learning solutions across both academic and corporate sectors. Educational institutions are expanding their digital offerings to meet the growing demand for hybrid and online programs, fueled by changing student preferences and technological advancements. In the corporate sector, companies invest in e-learning platforms to upskill employees, enhance productivity, and address evolving skill gaps in a competitive business landscape.

Europe E-learning Services Market Trends

The Europe e-learning services market is projected to experience significant growth over the forecast period, driven by an increasing emphasis on digital education and technological innovation across member states. European Union’s commitment to enhancing digital skills through initiatives like the Digital Education Action Plan, which aims to integrate digital technology into education and training systems, is driving market growth in the region.

Asia Pacific E-learning Services Market Trends

The e-learning services market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period, driven by rapid technological advancements and increasing internet penetration. A growing youth population and the increasing emphasis on skill development in emerging economies such as India and China drive the rising demand for online education.

Key E-learning Services Company Insights

Some key players in the market, such as edX LLC., Udacity, Inc., and Adobe, are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and developing new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

edX LLC offers university-level online courses. The initial stage of the edX LLC educational platform was created by the Harvard and MIT universities using the Python platform. The company works as a nonprofit organization and provides some courses free of cost. In June 2021, the company was acquired by 2U to create one of the world's complete free-to-degree online learning systems. The organization runs the edX open-source software platform for other higher-learning institutions. edX LLC operates across 162 countries and provides educational content in English, Thai, Ukrainian, French, Indonesian, Polish, and Hebrew languages. edX LLC has collaborations with more than 110 educational institutions, including Berkeley University, Boston University, Brown University, and Indian Institute of Technology Bombay, to offer educational content.

-

Udacity, Inc., is an educational organization that offers Massive Open Online Courses (MOOCs). The company operates in the U.S., UK, India, Egypt, Germany, and UAE. To enhance its offerings in technical education, Udacity Inc. has formed collaborations with industry partners, including Facebook, Google, NVIDIA Corporation, and AT&T. Udacity Inc. provides online courses in areas such as artificial intelligence, autonomous systems, data science, cloud computing, and machine learning.

Key E-learning Services Companies:

The following are the leading companies in the E-learning services market. These companies collectively hold the largest market share and dictate industry trends.

- McGraw Hill

- SAP SE

- IBM Corporation

- upGrad Education Private Limited

- NIIT (USA) Inc.

- Adobe

- LinkedIn Corporation

- Docebo

- Coursera Inc.

- BYJU’S

- edX LLC

- Udemy, Inc.

- Udacity, Inc

Recent Developments

In July 2024, LEORON, known for its e-learning, corporate training, and professional development services, received investment funding from Olive Rock Partners Limited, Inc., a private equity firm. This investment will fuel LEORON’s expansion and strengthen its presence and offerings across the Gulf Cooperation Council (GCC) countries, including Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

-

In July 2024, AMHSSC, a skill development online portal., in partnership with Bluesign Technologies AG, a Swiss company that offers a system of solutions to improve the sustainability of the textile industry, launched an eLearning course called "Foundation to Apparel Sustainability." The course is aimed at improving sustainable practices in India's apparel sector. The course covers sustainable fashion, circular economy, and advanced recycling methods to help students and professionals meet global standards and address environmental challenges.

-

In March 2024, Spotify AB expanded its content in the UK by adding video-based lessons from platforms such as Skillshare, Inc., Thinkific, BBC Maestro, and Play Virtuoso Group Ltd. These courses cover themes such as music-making, creativity, healthy living, and business. Both free and premium users can preview two lessons per course before purchasing, accessible via a new icon on the app’s home screen, browse tab, and search bar., and software platforms that facilitate seamless data integration and analysis.

E-Learning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 352.98 billion

Revenue forecast in 2030

USD 842.64 billion

Growth rate

CAGR of 19.0% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, courses, learning method, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

McGraw Hill; SAP SE; IBM Corporation; upGrad Education Private Limited; NIIT (USA) Inc.; Adobe; LinkedIn Corporation; Docebo; Coursera Inc.; BYJU’S; edX LLC; Udemy, Inc.; Udacity, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-learning Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global e-learning services market report based on type, courses, learning method, technology, end-use, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Custom E-Learning

-

Responsive E-Learning

-

Micro E-Learning

-

Translation & Localization

-

Game-Based Learning

-

Rapid E-Learning

-

-

Courses Outlook (Revenue, USD Billion, 2017 - 2030)

-

Self-Paced Courses

-

Instructor-Led Virtual Courses

-

-

Learning Method Outlook (Revenue, USD Billion, 2017 - 2030)

-

Blended Learning

-

Mobile Learning

-

Virtual Classrooms

-

Simulation

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud Computing

-

Big Data

-

Augmented Reality and Virtual Reality

-

Artificial Intelligence

-

-

End Use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Academic

-

Corporate

-

Government

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global energy management systems market size was estimated at USD 299.67 billion in 2024 and is expected to reach USD 352.98 billion in 2025.

b. The global e-learning services market is expected to grow at a compound annual growth rate of 19.0% from 2025 to 2030 to reach USD 842.64 billion by 2030

b. North America dominated the e-learning services market with a market share of 35% in 2024 due to the region’s advanced digital infrastructure and high adoption of technology-driven education solutions.

b. Some key players operating in the e-learning services market include McGraw Hill; SAP SE; IBM Corporation; upGrad Education Private Limited; NIIT (USA) Inc.; Adobe; LinkedIn Corporation; Docebo; Coursera Inc.; BYJU’S; edX LLC; Udemy, Inc.; Udacity, Inc

b. Key factors driving the market growth include the increasing need for upskilling of corporate employees and the growing demand for a flexible education system

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.