- Home

- »

- Renewable Energy

- »

-

E-Fuel Market Size, Share & Growth, Industry Report, 2050GVR Report cover

![E-fuel Market Size, Share & Trends Report]()

E-fuel Market (2026 - 2050) Size, Share & Trends Analysis Report By Product (E-Diesel, E-Gasoline), By State (Liquid, Gas), By Production Method, By Technology, By End Use, By Carbon Source, By Carbon Capture Type, By Region, and Segment Forecasts

- Report ID: GVR-4-68040-115-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2035

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

E-fuel Market Summary

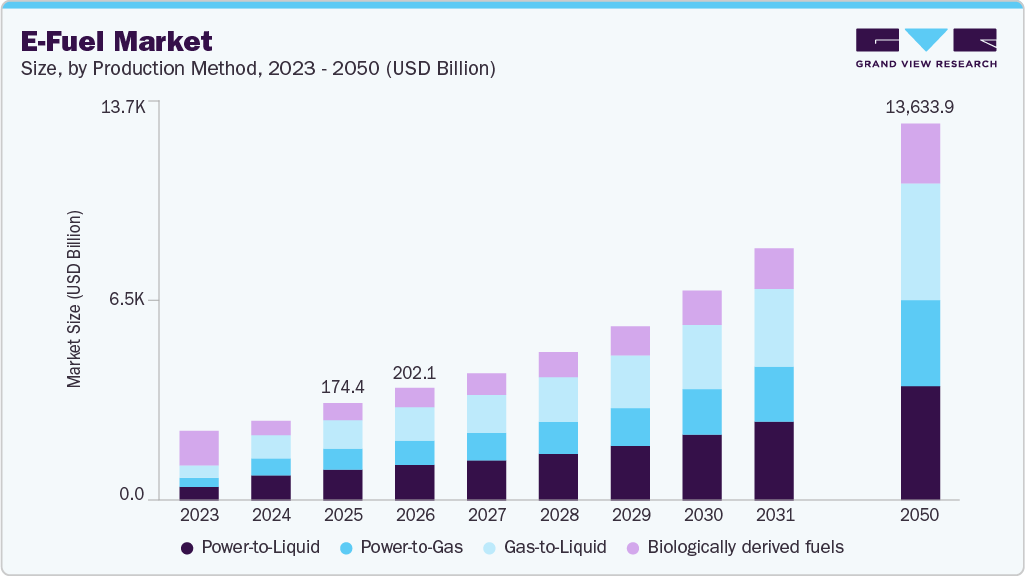

The global e-fuel market size was estimated at approximately USD 174.38 billion in 2025 and is projected to reach USD 13,633.95 billion by 2050, at a CAGR of 19.2% from 2026 to 2050. The market is expected to experience steady growth over the next several years, driven by tightening decarbonization regulations, increasing adoption of sustainable aviation and marine fuels, rapid expansion of renewable energy and green hydrogen capacity, and rising investments from governments and industry players to address emissions in hard-to-abate transport and industrial sectors.

Key Market Trends & Insights

- Europe's e-fuel market held the largest share of over 46.0% of the global market in 2025.

- The U.S. represents the largest and most active market within North America, driven by federal and state-level decarbonization initiatives, tax incentives, and corporate sustainability commitments.

- Based on product, the ethanol segment accounted for the largest market share of over 26.0% in 2025, supported by its established blending use and widespread compatibility with existing fuel infrastructure.

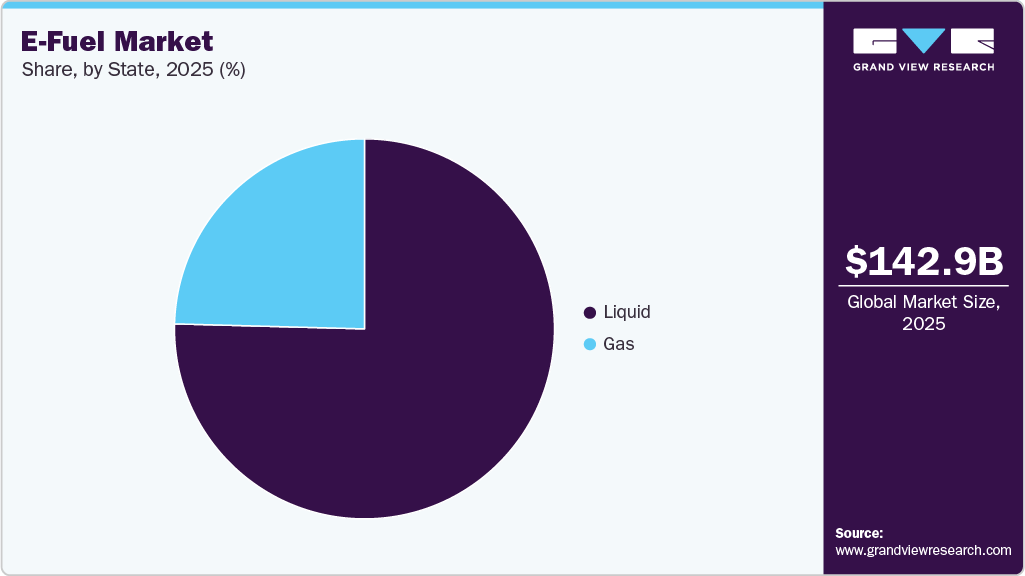

- Based on state, gaseous e-fuels are projected to witness the highest CAGR during the forecast period, driven by increasing hydrogen and e-methane adoption.

- Based on production methods, the power-to-gas segment is anticipated to grow at the fastest rate over the forecast period, supported by expanding green hydrogen projects.

Market Size & Forecast

- 2025 Market Size: USD 174.38 Billion

- 2050 Projected Market Size: USD 13,633.95 Billion

- CAGR (2026-2050): 19.2%

- Europe: Largest market in 2025

The market plays a critical role in global decarbonization efforts, particularly for hard-to-abate sectors such as aviation, maritime shipping, and heavy-duty transport. By utilizing renewable electricity, green hydrogen, and captured carbon dioxide, e-fuel offers the potential for near-carbon-neutral lifecycle emissions when produced at scale using clean energy sources. Their drop-in compatibility with existing engines and fuel infrastructure further enhances their sustainability value, as it enables emissions reduction without requiring large-scale asset replacement. As governments strengthen carbon-reduction mandates and introduce sustainable fuel blending targets, e-fuels are increasingly viewed as a complementary solution to electrification and biofuels in achieving long-term net-zero goals.

Technological advancements are central to the commercialization and cost reduction of e-fuel. Key innovations are emerging across the value chain, including higher-efficiency electrolyzes for green hydrogen production, enhanced carbon capture technologies, and more scalable synthesis pathways, such as Power-to-Liquid and Fischer-Tropsch processes. Continuous improvements in catalyst performance, system integration, and renewable energy utilization are enhancing overall process efficiency and output yields. As these technologies mature and benefit from economies of scale, production costs are expected to decline, supporting broader adoption of e-fuel across transportation and industrial energy applications over the medium to long term.

Drivers, Opportunities & Restraints

The market is being driven by tightening decarbonization regulations and mandatory sustainable fuel targets across the aviation, shipping, and heavy transport sectors. Regulatory frameworks in major economies are prompting fuel suppliers to increase their share of synthetic and low-carbon fuels, thereby accelerating demand for e-fuel as a compliance solution. In parallel, growing capital allocation from public institutions and private investors toward large-scale e-fuel plants indicates rising confidence in commercial viability. Industry participation, particularly from airlines and energy companies, further reinforces demand as corporates seek long-term pathways to meet net-zero commitments.

The market presents strong opportunities linked to the rapid expansion of renewable power, green hydrogen production, and carbon capture capacity. As production costs decline and project pipelines move from pilot to commercial scale, e-fuel are expected to gain traction through long-term offtake agreements, especially in the aviation and maritime sectors. This creates scope for regional manufacturing hubs, export-oriented supply chains, and technology licensing models.

High production costs remain the primary constraint for the market, as electrolysis, carbon capture, and synthetic fuel synthesis are energy-intensive and capital-heavy processes. In regions with limited subsidies or lower fossil fuel prices, cost competitiveness remains a significant challenge. Additional barriers include limited large-scale infrastructure, uncertainties around certification and sustainability criteria, and competition from alternative decarbonization solutions such as advanced biofuels, direct electrification, and hydrogen-based systems, which may slow near-term market penetration.

Product Insights

Ethanol accounted for the largest share of 26.0% in 2025, supported by its established role in fuel blending, relatively mature production pathways, and broad acceptance across automotive and industrial applications. Its compatibility with existing fuel infrastructure, lower technical complexity compared to other synthetic fuels, and widespread policy support for low-carbon alcohol fuels contributed to higher commercial adoption. Additionally, ethanol benefits from comparatively lower production costs and easier scalability, reinforcing its dominant position in the near term.

E-gasoline is expected to register the highest CAGR over the forecast period due to rising demand for drop-in synthetic fuels that can directly replace conventional gasoline without engine modifications. Growth is further supported by regulatory pressure to decarbonize legacy vehicle fleets, particularly in regions where full electrification is expected to take longer to achieve. Advancements in synthesis efficiency and declining green hydrogen costs are expected to enhance the economic viability of e-gasoline, driving faster adoption.

State Insights

Liquid held the largest market share in 2025, primarily due to its ease of storage, transport, and direct use within existing fuel distribution and refuelling infrastructure. Liquids such as ethanol, e-diesel, and e-kerosene are widely preferred across automotive, aviation, and industrial sectors, enabling near-term deployment without major system modifications. This operational flexibility has made liquid the preferred form for early commercialization.

Gaseous fuels are projected to grow at the fastest rate during the forecast period, driven by expanding interest in hydrogen and e-methane for industrial, power generation, and mobility applications. Increased investments in gas-based infrastructure, pipeline integration, and power-to-gas projects are accelerating the adoption of these technologies. As hydrogen economies develop and storage technologies improve, gaseous e-fuel are expected to gain stronger momentum.

Production Method Insights

Power-to-Liquid dominated the market in 2025, as it enables the production of high-value liquid fuels suitable for aviation, marine, and road transport. The method benefits from advanced technological maturity, strong policy backing, and compatibility with renewable electricity and captured CO₂. Its ability to produce drop-in fuels at a commercial scale positioned PtL as the leading production pathway.

Power-to-Gas is anticipated to witness the highest CAGR owing to the growing deployment of green hydrogen and synthetic methane projects. The method is increasingly favoured for energy storage, grid balancing, and industrial decarbonization applications. As renewable electricity generation expands and hydrogen demand rises, PtG technologies are expected to scale rapidly, driving accelerated growth.

Technology Insights

Hydrogen technology based on electrolysis held the largest share in 2025, reflecting its central role in the value chain. Electrolysis is the primary source of green hydrogen, a crucial feedstock to produce synthetic fuels. Widespread investments in electrolyzer manufacturing, supportive government policies, and declining costs of renewable power have reinforced its dominance.

RWGS technology is expected to grow at the fastest rate during the forecast period due to its importance in efficiently converting captured CO₂ into carbon monoxide for downstream fuel synthesis. Ongoing advancements in catalyst performance and process integration are improving conversion efficiency and reducing costs. As carbon utilization becomes increasingly critical, the adoption of RWGS is projected to accelerate.

End Use Insights

The automotive segment accounted for the largest share of the market in 2025, driven by the large existing vehicle fleet and the immediate applicability of synthetic fuels in internal combustion engines. E-fuels provide a practical decarbonization pathway for regions where EV penetration remains limited. Fuel blending mandates and OEM support further strengthened demand for the automotive industry.

Aviation is expected to register the highest CAGR during the forecast period due to the sector’s limited electrification options and increasing reliance on sustainable aviation fuel. Regulatory mandates, airline net-zero commitments, and long-term offtake agreements are accelerating the adoption of e-kerosene. As SAF blending requirements tighten globally, aviation demand is set to expand rapidly.

Carbon Source Insights

Point source carbon capture held the highest share in 2025, as it offers a reliable, concentrated CO₂ supply from industrial facilities such as refineries, cement plants, and power stations. Lower capture costs and established infrastructure made point sources the preferred option for early e-fuel projects. This approach enabled faster project execution and commercial feasibility.

Point source carbon capture is also expected to record the highest CAGR, supported by the rapid expansion of industrial carbon capture projects and integration with e-fuel facilities. Continued deployment of capture technologies across heavy industries ensures a scalable and cost-effective CO₂ supply. As utilization pathways expand, point source capture remains central to e-fuel growth.

Carbon Capture Type Insights

Pre-combustion carbon capture accounted for the largest share in 2025 due to its higher efficiency and lower energy penalties compared to post-combustion methods. It is widely adopted in hydrogen and syngas production processes, making it well-suited for integrated e-fuel systems. Its technical maturity supported early adoption at scale.

Pre-combustion capture is expected to maintain the highest CAGR over the forecast period as investments in hydrogen, ammonia, and synthetic fuel production accelerate. Its compatibility with large-scale industrial operations and improved cost economics supports continued expansion. As e-fuel projects scale globally, pre-combustion capture is likely to remain the preferred approach.

Regional Insights

The North American e-fuel market is supported by strong investment activity, expanding renewable energy capacity, and increasing focus on sustainable aviation fuel and low-carbon transport fuels. Policy incentives, private capital participation, and collaboration between energy companies, airlines, and technology providers are driving pilot and early commercial-scale projects. The region benefits from established fuel infrastructure and access to low-cost renewable resources, positioning it as a key hub for the development and deployment of e-fuel.

U.S. E-fuel Market Trends

The U.S. represents the largest and most active market within North America, driven by federal and state-level decarbonization initiatives, tax incentives, and corporate sustainability commitments. The growing demand for sustainable aviation fuel, combined with investments in green hydrogen, carbon capture, and synthetic fuel production facilities, is accelerating the commercialization of these technologies. Strategic partnerships between fuel producers and airlines further support long-term offtake and market growth.

Asia Pacific E-fuel Market Trends

The Asia Pacific market is experiencing rapid growth, driven by increasing energy demand, government-led decarbonization initiatives, and investments in hydrogen and renewable energy. Countries such as Japan, South Korea, China, and Australia are exploring e-fuel for aviation, shipping, and industrial applications to complement their efforts in electrification. Abundant renewable resources and growing interest in energy security create long-term opportunities for large-scale production and export-oriented projects.

Europe E-fuel Market Trends

Europe's e-fuel market held the largest share of over 46.0% of the global market in 2025. Europe is a leading market, driven by stringent climate policies, binding fuel mandates, and robust public funding mechanisms. Regulatory frameworks supporting e-SAF, renewable fuels of non-biological origin, and carbon pricing are accelerating adoption across aviation, maritime, and industrial sectors. The region also hosts several pilot and commercial-scale e-fuel projects, supported by advanced hydrogen infrastructure and coordinated cross-border policy support.

Latin America E-fuel Market Trends

Latin America presents significant opportunities for the market, driven by its abundant solar and wind resources, as well as growing interest in the development of green hydrogen. Countries in the region are positioning themselves as potential exporters of e-fuel, particularly for aviation and marine applications, supported by the favorable economics of renewable energy. While commercialization remains in its early stages, policy development and international partnerships are expected to support a gradual expansion of the market.

Middle East & Africa E-fuel Market Trends

The Middle East & Africa region is gaining attention in the market due to access to low-cost renewable energy, existing fuel infrastructure, and strategic positioning as a global energy supplier. Investments in green hydrogen and synthetic fuel projects are on the rise as countries diversify their energy portfolios and target export markets. However, market growth remains uneven, with adoption largely dependent on policy support, infrastructure readiness, and long-term international offtake agreements.

Key E-fuel Company Insights

Some of the key players operating in the global E-fuels market include HIF Global, Sunfire GmbH, and Liquid Wind AB, among others.

-

HIF Global is a prominent participant in the global e-fuel market, focusing on the large-scale production of synthetic fuels for transportation applications, including sustainable aviation fuel and e-diesel. The company leverages renewable electricity, green hydrogen, and captured CO₂ to produce drop-in fuels compatible with existing engines and infrastructure. With flagship projects across the Americas and Australia, HIF Global is positioning itself as a leading supplier for hard-to-abate sectors, supported by strategic partnerships with energy majors, automotive OEMs, and aviation stakeholders to enable commercial-scale deployment.

-

Sunfire GmbH is a key technology-driven player in the e-fuel market, specializing in advanced electrolysis systems and Power-to-Liquid solutions for synthetic fuel production. The company’s proprietary high-temperature electrolyzer and fuel synthesis technologies enable efficient conversion of renewable electricity, water, and CO₂ into e-fuel such as e-kerosene and e-diesel. Sunfire works closely with industrial partners and governments to scale pilot and commercial plants, positioning its technology as a critical enabler for decarbonizing aviation, maritime transport, and industrial energy use.

-

Liquid Wind AB is an emerging leader in the e-methanol segment of the global e-fuel market, focusing on scalable production facilities powered by renewable hydrogen and captured carbon dioxide. The company’s modular e-fuel plant concept integrates renewable electricity, electrolysis, and fuel synthesis to supply low-carbon methanol for marine fuel and industrial applications. Liquid Wind is advancing multiple commercial projects in Europe, supported by public funding and long-term offtake agreements, reinforcing its role in accelerating the transition to sustainable fuels for shipping and heavy industry.

Key E-fuel Companies:

The following are the leading companies in the E-fuels market. These companies collectively hold the largest market share and dictate industry trends.

- Arcadia eFuels

- Electrochaea GmbH

- ExxonMobil Corporation

- HIF Global

- LanzaJet, Inc.

- Liquid Wind AB

- Norsk e-Fuel AS

- Sunfire GmbH

- Synhelion SA

- Zero Petroleum

Recent Developments

-

In June 2025, INERATEC announced the financial close and construction start of its large-scale Power-to-Liquid e-fuel production facility in Frankfurt, Germany, supported by public and private funding. The plant is designed to supply synthetic fuels for aviation and industrial applications, marking a key step toward commercial-scale deployment of e-fuel in Europe and strengthening supply readiness for mandated eSAF blending targets.

-

In May 2025, Liquid Wind commissioned one of Europe’s first commercial e-methanol facilities in Sweden, enabling the production of renewable methanol for maritime fuel and industrial use. The project integrates renewable electricity, green hydrogen, and captured CO₂, demonstrating the technical and economic feasibility of scaling e-fuel beyond the pilot stage and supporting decarbonization efforts in the shipping industry.

-

In September 2024, HIF Global advanced the development of its U.S.-based e-fuel project by securing strategic partnerships and initiating long-term offtake discussions with aviation and energy stakeholders, targeting the large-scale production of e-diesel and sustainable aviation fuel. This development reinforces growing commercial confidence in synthetic fuels as a viable solution for reducing emissions in hard-to-abate transport sectors.

E-Fuel Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 202.12 billion

Revenue forecast in 2050

USD 13,633.95 billion

Growth rate

CAGR of 19.2% from 2026 to 2050

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2050

Quantitative Units

Revenue in USD billion/million, Volume in Million Tons, and CAGR from 2026 to 2050

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, state, production method, technology, end use, carbon source, carbon capture type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Netherlands; UK; Germany; France; Italy; Spain; Russia; China; Indonesia; Thailand; India; Japan; South Korea; Australia; Brazil; Colombia; Paraguay; Argentina; Saudi Arabia; UAE; South Africa; Egypt

Key companies profiled

Arcadia eFuels; Electrochaea GmbH; ExxonMobil Corporation; HIF Global; LanzaJet, Inc.; Liquid Wind AB; Norsk e-Fuel AS; Sunfire GmbH; Synhelion SA; Zero Petroleum

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-Fuel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2050. For this study, Grand View Research has segmented the e-fuel market report based on product, state, production method, technology, end use, carbon source, carbon capture type, and region:

-

Product Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

E-diesel

-

E-Gasoline

-

Ethanol

-

Hydrogen

-

E-kerosene

-

E-methane

-

E-methanol

-

Others

-

-

State Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Liquid

-

Gas

-

-

Production Method Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Power-to-Liquid

-

Power-to-Gas

-

Gas-to-Liquid

-

Biologically Derived Fuels

-

-

Technology Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Hydrogen Technology (Electrolysis)

-

Fischer-Tropsch

-

Reverse-Water-Gas-Shift (RWGS)

-

-

End Use Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Automotive

-

Marine

-

Industrial

-

Railway

-

Aviation

-

Others

-

-

Carbon Source Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Point Source

-

Smokestack

-

Gas Well

-

-

Direct Air Capture

-

-

Carbon Capture Type Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

Post-combustion

-

Pre-combustion

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Tons; 2021 - 2050)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Netherlands

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Indonesia

-

Thailand

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Colombia

-

Paraguay

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global e-fuel market size was estimated at USD 174.38 billion in 2025 and is expected to reach USD 202.12 billion in 2026.

b. The global e-fuels market is expected to grow at a compound annual growth rate of 19.2% from 2026 to 2050 to reach USD 13,633.95 billion by 2050.

b. Based on product, the ethanol segment accounted for the largest market share of over 26.0% in 2025, supported by its established blending use and widespread compatibility with existing fuel infrastructure.

b. Some of the key players operating in the global e-fuel market include Arcadia eFuels, Electrochaea GmbH, ExxonMobil Corporation, HIF Global, LanzaJet, Inc., Liquid Wind AB, Norsk e-Fuel AS, Sunfire GmbH, Synhelion SA, and Zero Petroleum, among others.

b. The e-fuel market is primarily driven by the need to decarbonize hard-to-abate sectors, such as aviation, marine, and heavy-duty transport, supported by increasingly stringent climate regulations and fuel blending mandates.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.