E-commerce Platform Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Application (Apparel & Fashion, Food & Beverage), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-430-6

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

E-commerce Platform Market Size & Trends

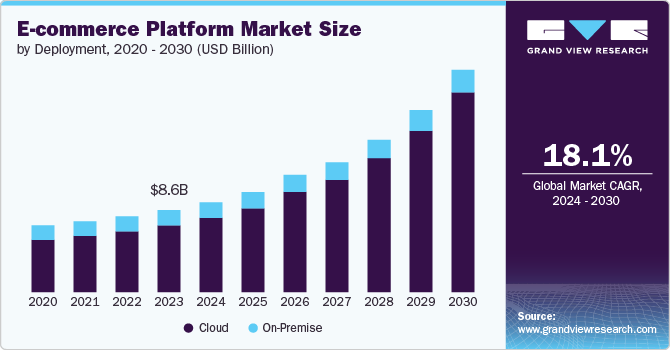

The global e-commerce platform market size was estimated at USD 8.58 billion in 2023 and is expected to grow at a CAGR of 18.1% from 2024 to 2030. The global shift towards online shopping has significantly accelerated the demand for professional e-commerce website development services. As consumer behavior increasingly favors the convenience and accessibility of online shopping, businesses across various sectors are either establishing new online stores or enhancing their existing digital presence. This surge is driven by the need to reach a broader audience, capitalize on the growing trend of mobile and remote shopping, and stay competitive in an increasingly digital marketplace.

Companies are investing in custom website development to create unique, user-friendly online experiences that cater to their specific target markets, incorporate advanced features, and integrate seamlessly with other digital tools and platforms. This trend has led to a heightened demand for specialized development services that can deliver tailored, scalable, and secure e-commerce solutions, ultimately helping businesses capitalize on the expansive opportunities offered by the digital economy. The growing shift towards online retail and increasing demand for sophisticated, customized e-commerce solutions drive this market. These companies offer essential services such as building and integrating e-commerce platforms, designing user-friendly interfaces, optimizing website performance, and ensuring secure transactions.

The rapid growth of mobile commerce has significantly influenced the e-commerce landscape, as an increasing number of consumers use mobile devices for online shopping. This shift has resulted in businesses investing in mobile-optimized websites to ensure a seamless and user-friendly experience across various screen sizes and devices. Mobile optimization involves implementing responsive design techniques that adjust the website's layout, content, and functionality to fit different mobile devices, enhancing usability and performance. As a result, there is a growing demand for responsive design services that cater specifically to mobile users, enabling businesses to capture and retain a larger share of the mobile shopping market, improve customer satisfaction, and drive higher conversion rates.

Government initiatives globally are significantly boosting digital transformation and e-commerce growth. Many countries are introducing policies that offer funding, incentives, and support for businesses to develop and enhance their online platforms. These initiatives aim to promote technological innovation, improve digital infrastructure, and encourage e-commerce adoption. By providing financial assistance and resources, governments help businesses build advanced e-commerce solutions, adopt new technologies, and expand their online presence. Such support accelerates the growth of the e-commerce market and helps businesses compete effectively in the digital economy.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 81% in 2023. Cloud solutions provide crucial scalability and flexibility for e-commerce businesses, allowing them to adjust resources based on traffic and demand. This adaptability is vital for managing seasonal spikes or rapid growth, as businesses can easily scale their infrastructure up or down without large upfront investments in hardware. The cloud's pay-as-you-go model ensures that companies only pay for the resources they use, optimizing costs and preventing overprovisioning. By leveraging cloud scalability, e-commerce businesses can efficiently handle fluctuating customer activity and ensure optimal performance during peak times, ultimately enhancing their ability to meet customer needs and sustain growth without the constraints of traditional, fixed infrastructure.

The on-premises segment is expected to grow at a CAGR of 6.8% during the forecast period. On-premises solutions offer businesses complete control over their e-commerce infrastructure, enabling extensive customization and configuration to meet specific needs. This high level of control allows enterprises to tailor their systems to accommodate unique requirements, integrate with complex internal systems, and implement specialized functionalities not readily available in cloud-based solutions. The ability to adjust every aspect of the platform ensures that businesses can align their e-commerce operations precisely with their strategic goals and operational processes. This customization is particularly advantageous for organizations with intricate requirements or those needing to integrate with legacy systems, making on-premises solutions a preferred choice for enterprises seeking a highly tailored and controlled environment.

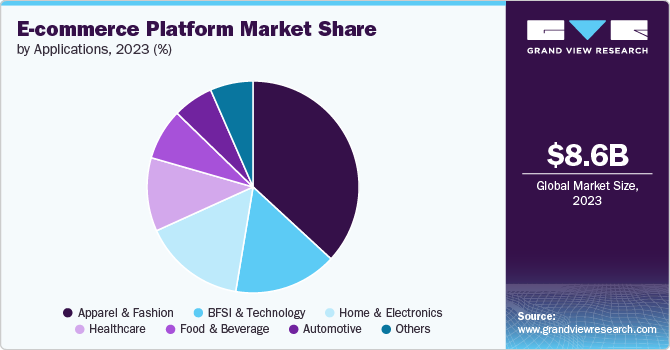

Application Insights

Apparel & fashion held a market share of over 36% in 2023 and is expected to dominate the market by 2030. Omnichannel retailing is becoming essential for apparel brands as they seek to integrate their online and offline channels to provide a seamless shopping experience for customers. This strategy allows consumers to move effortlessly between digital and physical touchpoints-whether browsing online, purchasing in-store, or using click-and-collect services. The ability to deliver a consistent and unified brand experience across all channels drives the demand for e-commerce platforms that support omnichannel operations.

These platforms enable inventory synchronization, unified customer data, and seamless order fulfillment across channels, ensuring that customers enjoy a cohesive shopping journey. As consumer expectations for convenience and flexibility grow, the adoption of omnichannel solutions becomes increasingly important for apparel brands aiming to stay competitive.

The food & beverage segment is expected to grow at a CAGR of 21.1% over the forecast period. Food brands are increasingly shifting towards using e-commerce platforms to expand into markets, enabling them to reach customers without needing physical stores. Similarly, the increasing preference for online grocery shopping, driven by convenience and time efficiency, is reshaping the food and beverage industry.

Consumers are turning to online platforms for their grocery needs, preferring the ease of shopping from home and avoiding in-store visits. This shift is boosting demand for e-commerce platforms that can effectively handle the complexities of selling and delivering perishable goods. These platforms must support features like real-time inventory tracking, efficient order fulfillment, and temperature-controlled logistics to ensure the freshness of products upon delivery. Additionally, they need to accommodate various delivery options, from same-day delivery to click-and-collect services, catering to the growing consumer expectation for speed and reliability in online grocery shopping.

Regional Insights

The North America e-commerce platform market held the largest revenue share of 36% in the year 2023. North America's high internet penetration and widespread digital adoption significantly fuel the growth of e-commerce platforms in the region. With a large percentage of the population having reliable internet access and embracing digital technology, online shopping has surged across various sectors. Consumers are increasingly comfortable with making purchases online, from everyday essentials to luxury goods, creating a robust demand for e-commerce platforms that offer seamless and secure shopping experiences. This digital readiness has resulted in businesses scaling up their online operations, and adopting advanced e-commerce solutions to meet the needs of tech-savvy customers.

U.S. E-commerce Platform Market Trends

The e-commerce platform market in the U.S. is growing significantly at a CAGR of 15.3% from 2024 to 2030. The U.S. boasts a highly developed e-commerce ecosystem, driven by industry giants like Amazon, Shopify, and BigCommerce. These platforms have set high standards for online shopping, encouraging businesses of all sizes to invest in building and optimizing their e-commerce websites. This robust market creates a thriving environment for service providers who specialize in website development, design, and optimization. Companies offering tailored e-commerce solutions, such as site customization, mobile optimization, and integration with payment gateways, are in high demand as businesses aim to compete in this fast-paced market. The presence of established e-commerce leaders also accelerates innovation and sets benchmarks, driving further growth for companies that support e-commerce website development across various sectors.

Asia Pacific E-commerce Platform Market Trends

The e-commerce platform market in Asia Pacific is growing significantly at a CAGR of 19.6% from 2024 to 2030. The Asia Pacific region's booming startup ecosystem is fostering a surge in new e-commerce ventures eager to establish an online presence. As these startups enter the market, there is a growing demand for website development and optimization services to help them create functional, engaging, and competitive online platforms. These startups often seek tailored solutions to address specific market needs, including localization, mobile optimization, and user experience enhancements. Consequently, companies that specialize in building and refining e-commerce websites are well-positioned to capitalize on this growth, offering crucial support to new businesses aiming to succeed in a rapidly evolving digital landscape. The influx of e-commerce startups in the region fuels a robust market for website development services.

Europe E-commerce Platform Market Trends

The e-commerce platform market in Europe is growing significantly at a CAGR of 18.7% from 2024 to 2030. European consumers increasingly expect personalized shopping experiences, such as tailored product recommendations and dynamic content that reflects their preferences and browsing behavior. This demand for personalization drives the need for e-commerce platforms that can deliver customized experiences and enhance customer satisfaction. E-commerce development companies are responding by integrating advanced features like AI-driven recommendation engines, personalized marketing, and adaptive user interfaces into their platforms. These personalization tools help businesses engage customers more effectively, increase conversion rates, and build brand loyalty. As the competition intensifies, companies that offer sophisticated personalization capabilities are in high demand, enabling businesses to meet the evolving expectations of European shoppers and stand out in a crowded market.

Key E-commerce Platform Company Insights

Key companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key E-commerce Platform Companies:

The following are the leading companies in the e-commerce platform market. These companies collectively hold the largest market share and dictate industry trends.

- BigCommerce Partners

- Shopify

- Magento

- Wix eCommerce

- Omniful

- WooCommerce

- Oracle

- Shopify

- SAP Commerc

- Sana Commerce

- Shopware.

Recent Developments

-

In June 2024, Shopify announced plans to expand access to its AI-powered features to attract more businesses. The initiative was aimed at enhancing merchants' capabilities with tools, such as personalized product recommendations and automated marketing insights, helping them improve customer engagement and sales. By leveraging AI, the company was looking forward to providing a more efficient and competitive platform for e-commerce businesses.

-

In December 2023, Omniful, a Saudi Arabian startup focused on supply chain and e-commerce enablement, raised USD 5.85 million in seed funding. The company aims to enhance in-store and warehouse operations for retailers, enabling seamless omnichannel retail experiences. The funding, led by Outliers Venture Capital, will support Omniful's growth and technology development, helping retailers optimize order fulfillment and integrate online and offline inventory management.

-

In May 2023, BigCommerce announced a partnership with Oracle NetSuite to help merchants streamline their e-commerce and back-office operations. The collaboration was aimed at enabling BigCommerce merchants to leverage NetSuite's comprehensive suite of business management applications, integrating their online store with financial, inventory, and order management systems. The partnership was also aimed at enhancing efficiency, improving customer experiences, and supporting business growth for merchants using BigCommerce and NetSuite.

E-commerce Platform Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.40 billion |

|

Revenue forecast in 2030 |

USD 23.27 billion |

|

Growth rate |

CAGR of 18.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

BigCommerce Partners; Shopify; Magento; Wix eCommerce; Omniful; WooCommerce; Oracle; Shopify; SAP Commerce; Sana Commerce; Shopware. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global E-commerce Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global e-commerce platform market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Apparel & Fashion

-

Food & Beverage

-

Automotive

-

Home & Electronics

-

Healthcare

-

BFSI & Technology

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global E-commerce platform market was valued at USD 8.58 billion in 2023 and is expected to reach USD 9.40 billion in 2024.

b. The global E-commerce platform market is expected to grow at a compound annual growth rate of 18.1% from 2024 to 2030 to reach USD 23.27 billion by 2030.

b. The cloud segment held the largest revenue share of more than 81% in 2023 in the global E-commerce platform market. Cloud solutions provide crucial scalability and flexibility for e-commerce businesses, allowing them to adjust resources based on traffic and demand. This adaptability is vital for managing seasonal spikes or rapid growth, as businesses can easily scale their infrastructure up or down without large upfront investments in hardware

b. Key players operating in the e-commerce platform market include BigCommerce Partners, Shopify, Magento, Wix eCommerce, Omniful, WooCommerce, Oracle, Shopify, SAP Commerce, Sana Commerce, and Shopware.

b. The global shift towards online shopping has significantly accelerated the demand for professional e-commerce website development services. As consumer behavior increasingly favors the convenience and accessibility of online shopping, businesses across various sectors are either establishing new online stores or enhancing their existing digital presence. This surge is driven by the need to reach a broader audience, capitalize on the growing trend of mobile and remote shopping and stay competitive in an increasingly digital marketplace

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."