- Home

- »

- Automotive & Transportation

- »

-

E-Commerce Automotive Aftermarket Market Report, 2030GVR Report cover

![E-Commerce Automotive Aftermarket Size, Share & Trends Report]()

E-Commerce Automotive Aftermarket Size, Share & Trends Analysis Report By Replacement Parts, By End Use (Business To Business, Business To Customer), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-396-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

E-Commerce Automotive Aftermarket Summary

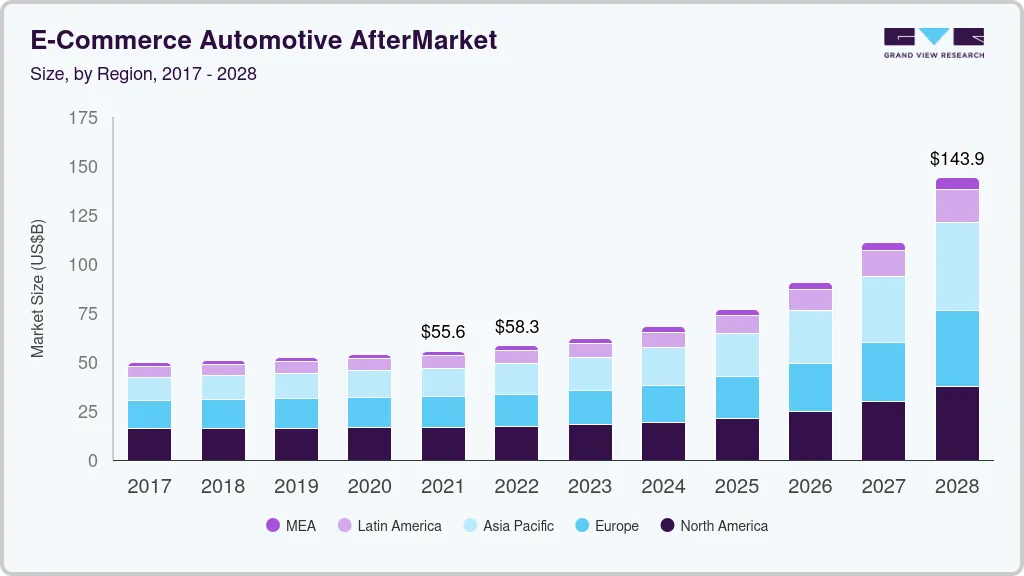

The global e-commerce automotive aftermarket size was valued at USD 62.12 billion in 2023 and is projected to reach USD 208.16 billion by 2030, growing at a CAGR of 20.5% from 2024 to 2030. The growing usage of online platforms to purchase car parts and accessories is a significant trend driven by consumers seeking convenience, variety, and competitive prices.

Key Market Trends & Insights

- North America e-commerce automotive aftermarket held the largest market revenue share of 28.9% in 2023.

- Asia Pacific is expected to grow at the fastest CAGR over the forecast period.

- Based on replacement parts, the transmission and steering segment held the largest market revenue share of 22.7% in 2023.

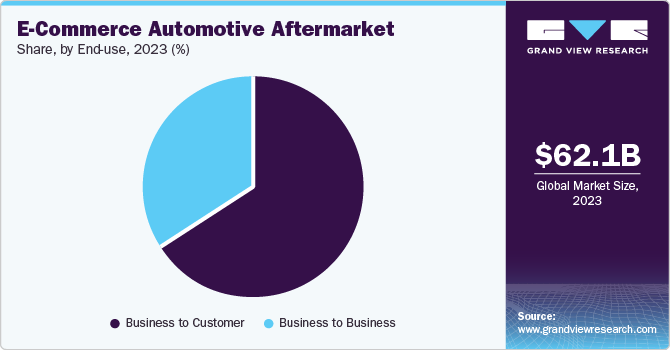

- Based on end use, the business-to-customer segment held the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 62.12 Billion

- 2030 Projected Market Size: USD 208.16 Billion

- CAGR (2024-2030): 20.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Enhancements in technology, such as improved logistics and real-time inventory management, improve the overall online shopping process. Moreover, the increasing number of smartphones and internet availability make reaching e-commerce websites easier.

The growing preference for online shopping across various sectors, including automotive parts and accessories drives market growth. Consumers find it more convenient to search, compare, and purchase automotive components online, thanks to the easy accessibility of information, user reviews, and competitive pricing offered by e-commerce platforms. This shift towards digital retail channels has been further amplified by the proliferation of mobile devices, which enable customers to make purchases anytime and anywhere, thus accelerating the demand for online automotive aftermarket services.

Additionally, advancements in logistics and supply chain networks have enhanced the capabilities of e-commerce platforms to deliver automotive parts quickly and efficiently. This has made online purchases more attractive to consumers who need timely delivery for maintenance and repair services. The rising availability of a wide range of automotive products, faster shipping options, and easier returns policies also support the demand surge. Including original equipment manufacturer (OEM) parts and aftermarket alternatives on online platforms provides consumers with more choices, encouraging further adoption of e-commerce in the automotive sector.

The growing penetration of the internet and the rising importance of digitization in emerging markets have also contributed to the increased demand for e-commerce automotive aftermarket services. In regions where access to traditional physical automotive parts stores may be limited, e-commerce is a crucial channel for sourcing necessary parts. This trend is expected to continue as internet access and digital literacy improve globally, making e-commerce platforms the preferred method for purchasing automotive aftermarket products.

Replacement Parts Insights

The transmission and steering segment held the largest market revenue share of 22.7% in 2023. As vehicles age, components such as steering and transmission systems experience wear and tear, leading to a higher need for replacement parts. E-commerce platforms offer a wide range of these parts, making it easier for consumers to find compatible components at competitive prices. Additionally, advancements in delivery logistics and user-friendly interfaces on e-commerce platforms have fueled this demand, allowing DIY enthusiasts and repair shops to access the necessary parts quickly.

The lighting segment is expected to grow at the fastest CAGR over the forecast period. The rising need for improved vehicle safety and visibility has led to an uptick in consumers seeking high-quality lighting solutions such as LED and HID bulbs. Additionally, the increasing number of vehicles on the road, combined with the frequent need to replace or upgrade automotive lighting due to wear and tear or technological advancements, has contributed to this growth. The trend is also influenced by the growing preference for energy-efficient lighting options, making replacement parts such as headlights, taillights, and interior lighting prevalent in the aftermarket segment.

End Use Insights

The business-to-customer segment held the largest market revenue share in 2023. The growing consumer preference for online shopping drives segment growth, which is driven by convenience, competitive pricing, and the vast range of products available through e-commerce platforms. Automotive aftermarket customers, such as car owners, are increasingly turning to online channels to purchase replacement parts, accessories, and maintenance products. Additionally, the rise of do-it-yourself (DIY) automotive repairs, bolstered by online tutorials and easy-to-access tools, has further fueled this demand. E-commerce platforms provide easy product comparisons, reviews, and discounts, making the B2C segment an attractive option for consumers seeking efficiency and savings in automotive care. This shift towards digital purchasing is also supported by improvements in supply chain logistics, allowing for faster deliveries and enhanced customer satisfaction.

The business-to-business segment is expected to grow significantly over the forecast period. Automotive businesses, such as repair shops, dealerships, and fleet operators, seek efficient and cost-effective ways to procure online parts and accessories. E-commerce platforms provide them with various products, competitive pricing, and streamlined ordering processes, reducing the need for traditional intermediaries. Additionally, the digital transformation of supply chains enables faster delivery times and better inventory management, which are crucial for businesses looking to minimize downtime and maximize productivity. This shift is also driven by the increasing adoption of e-commerce technologies that improve operational efficiencies for B2B transactions, helping companies meet the growing demand for quick, reliable, and cost-efficient automotive aftermarket solutions.

Regional Insights

North America e-commerce automotive aftermarket held the largest market revenue share of 28.9% in 2023. The aging vehicle fleet in the U.S. and Canada, where many cars are over 10 years old, increases the need for replacement parts and maintenance services. Consumers are increasingly turning to online platforms to find these parts due to the convenience of home delivery, competitive pricing, and the ability to compare different brands easily. Companies such as Amazon and RockAuto and traditional retailers expanding their digital presence are also enhancing their e-commerce infrastructure with fast shipping and easy return policies, further accelerating online purchases in this sector.

U.S. E-Commerce Automotive Aftermarket Trends

The U.S. held the largest regional market revenue share in 2023. The growing consumer preference for convenience and accessibility drives the market, as online platforms provide an extensive range of automotive parts and accessories that may not be available locally. Additionally, the increasing average age of vehicles in the U.S., which exceeds 12 years, contributes to higher demand for maintenance and repair parts, boosting the need for aftermarket products. The rise of do-it-yourself (DIY) culture, competitive pricing, and detailed product information available through e-commerce are encouraging more vehicle owners to purchase parts online.

Europe E-Commerce Automotive Aftermarket Trends

Europe e-commerce automotive aftermarket was witnessed as lucrative in this industry. Europe's stringent regulations around vehicle emissions and maintenance, such as the EU's CO2 emission standards, drive the need for aftermarket parts, especially for older vehicles that must meet regulatory requirements. The rise of do-it-yourself (DIY) car repairs in Europe, combined with the increasing presence of online retailers specializing in automotive parts, has made it easier for consumers to access the parts they need without relying on garages. This trend is further supported by advancements in e-commerce infrastructure, including faster delivery services and user-friendly platforms, which cater to the region's growing preference for digital purchasing.

Germany held a significant market revenue share in the European market. Germany's strong automotive culture, coupled with the high penetration of internet users, has encouraged more people to buy automotive parts and accessories online. The shift towards do-it-yourself (DIY) car repairs, especially for routine maintenance and minor repairs, further boosts demand. E-commerce platforms offer a broader selection of parts at competitive prices, making it easier for consumers and independent repair shops to access necessary products. The rise of electric vehicles (EVs) is also expanding the range of parts needed, creating more opportunities in the online aftermarket space.

Asia Pacific E-Commerce Automotive Aftermarket Trends

Asia Pacific is expected to grow at the fastest CAGR over the forecast period. Consumers in the region are increasingly turning to online platforms for the convenience of comparing prices, accessing a broader range of products, and benefiting from competitive pricing. Furthermore, improved digital infrastructure and the increasing penetration of smartphones and internet usage have made e-commerce more accessible to a wider audience. Additionally, the ongoing shift toward Do-It-Yourself (DIY) repairs, fueled by online tutorials and easy availability of parts, is also contributing to the growth of this market in Asia-Pacific.

China held a significant market revenue share in 2023. The demand for the e-commerce automotive aftermarket in China is increasing due to several factors specific to the country's automotive landscape. China's automotive market is the largest globally, with millions of vehicles sold annually, leading to many vehicles requiring regular maintenance, repairs, and parts replacement. Additionally, Chinese consumers are increasingly seeking quality and genuine parts, which are more easily accessible through online platforms that offer transparency and competitive pricing.

Key E-Commerce Automotive Aftermarket Company Insights

Some key companies in the e-commerce automotive aftermarket include Amazon.com, Inc.; TENEO.AI; Avaya LLC; Google; IBM Corporation; and others.

-

Advance Auto Parts is a leading provider in the automotive aftermarket industry, catering to both professional installers and do-it-yourself customers. Their e-commerce platform offers a comprehensive range of automotive parts and accessories, including replacement parts, car care products, chemicals, batteries, and engine maintenance items. This platform is designed to provide convenience and accessibility, allowing customers to easily purchase the parts they need online.

-

AutoZone Inc. is a key player in the automotive aftermarket sector, offering a variety of products and services via its vast online platform. AutoZone.com allows customers to buy automotive hard parts, maintenance items, accessories, and non-automotive products, while commercial customers can utilize AutoZonePro.com for their purchases. Furthermore, AutoZone provides the ALLDATA brand of automotive diagnostic, repair, collision, and shop management software on ALLDATA.com.

Key E-Commerce Automotive Aftermarket Companies:

The following are the leading companies in the e-commerce automotive aftermarket. These companies collectively hold the largest market share and dictate industry trends.

- Advance Auto Parts

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- AutoZone Inc.

- CARiD.com

- eBay Inc.

- Flipkart.com

- National Automotive Parts Association

- O’Reilly Auto Parts

- RockAuto, LLC

- U.S. Auto Parts Network, Inc.

View a comprehensive list of companies in the E-commerce Automotive Aftermarket.

E-Commerce Automotive Aftermarket Report Scope

Report Attribute

Details

Market size value in 2024

USD 67.98 billion

Revenue forecast in 2030

USD 208.16 billion

Growth Rate

CAGR of 20.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Replacement Parts, End Use, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Advance Auto Parts; Alibaba Group Holding Limited; Amazon.com, Inc.; AutoZone Inc.; CARiD.com; eBay Inc.; Flipkart.com; National Automotive Parts Association; O’Reilly Auto Parts; RockAuto, LLC; U.S. Auto Parts Network, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global E-Commerce Automotive Aftermarket Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the e-commerce automotive aftermarket report based on replacement parts, end use, and region.

-

Replacement Parts Outlook (Revenue, USD Billion, 2018 - 2030)

-

Engine Parts

-

Piston and Piston Rings

-

Engine Valves and Parts

-

Fuel Injection Systems

-

Power Train Components

-

-

Transmission and Steering

-

Clutch Assembly Systems

-

Gearbox

-

Axles

-

Wheels

-

Tires

-

-

Breaking System

-

Brake Calipers

-

Brake Pads

-

Rotor and Drums

-

Brake Disk

-

-

Lighting

-

Headlamps

-

Tail lamps

-

Oothers

-

-

Electrical Parts

-

Starter Motor

-

Spark Plugs

-

Battery

-

Others

-

-

Suspension Systems

-

Wipers

-

Others

-

-

Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Business to Business

-

Business to Customer

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.