Dust Control Systems Market Size, Share & Trends Analysis Report By Product Type (Dry, Wet), By Application (Construction, Mining, Oil & Gas, Chemical, Pharmaceutical), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-924-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Dust Control Systems Market Size & Trends

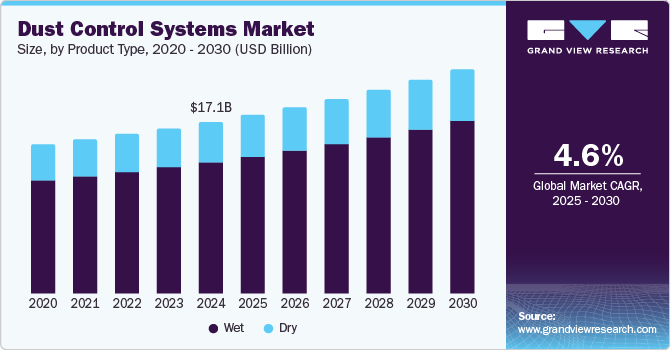

The global dust control systems market size was estimated at USD 17.09 billion in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2030. This growth can be attributed to the increasing industrial activities, especially in construction and mining, which generate significant dust emissions, necessitating effective control solutions. In addition, heightened awareness of health risks associated with airborne dust particles has led industries to prioritize worker safety and compliance with stringent environmental regulations. Furthermore, technological advancements, including automated systems and eco-friendly dust suppression methods, are enhancing operational efficiency and sustainability.

Dust control systems are essential for managing and minimizing the release of dust particles produced during various industrial activities. The increasing demand for these systems globally is fueled by several converging factors. A primary driver is the expansion of industrial activities, particularly in the mining sector, which necessitates effective dust control solutions to ensure worker safety, meet regulatory requirements, and minimize environmental impact.

Heightened awareness of the health hazards associated with exposure to airborne dust particles is also contributing to market growth. Dust generated during industrial processes can contain harmful substances, leading industries to prioritize safer and healthier work environments. In addition, the focus on sustainable practices is creating a demand for eco-friendly and energy-efficient dust control technologies. Companies are seeking sustainable solutions such as water-saving systems to minimize their environmental impact and gain a competitive advantage. Furthermore, technological advancements are further revolutionizing dust management solutions. Integrating IoT devices enables real-time dust levels and air quality monitoring, allowing for proactive responses and optimized efficiency. AI-powered algorithms can improve predictive maintenance and maximize equipment performance, reducing operational costs.

Moreover, the rise in mining activities worldwide significantly drives the demand for dust suppression chemicals, increasing awareness of worker safety and health concerns within the mining industry further boosting the market. The environmental impact of mining dust on air quality, soil composition, and water systems necessitates effective dust control measures. In response, manufacturers are developing advanced and smart dust control solutions for the mining industry, incorporating automation and remote monitoring capabilities for efficient operations and proactive maintenance.

Product Type Insights

The wet dust control systems dominated the market and accounted for the largest revenue share of 76.4% in 2024, primarily driven by their cost-effectiveness and efficient cleaning capabilities. They utilize water sprays or chemical solutions to capture dust particles effectively, making them suitable for many industries. Stricter environmental regulations and growing concerns about health and safety also boost their adoption. In addition, wet electrostatic precipitators are anticipated to expand due to their effectiveness in smoke removal from substantial airflows.

The dry dust control systems are expected to grow at a CAGR of 4.2% over the forecast period, owing to the rising need for dust-free environments in sectors such as manufacturing and construction. These systems excel at capturing dust directly at its source using enclosures and hoods. In addition, technological progress and innovations in filtration systems further contribute to their growth. Furthermore, a strong emphasis on worker safety and compliance with stringent environmental regulations is accelerating the use of dry dust control methods.

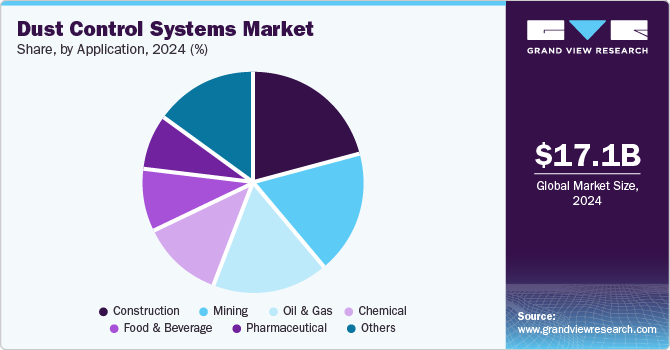

Application Insights

The construction segment dominated the global dust control systems industry, with the highest revenue share of 20.9% in 2024. This growth can be attributed to rapid urbanization and increased infrastructure projects. As construction activities escalate, they generate considerable dust, necessitating effective management solutions to protect air quality and worker health. In addition, stricter regulations aimed at minimizing dust emissions further enhance the need for these systems. Furthermore, rising awareness of the health risks associated with dust exposure has prompted construction companies to adopt advanced dust control measures, ensuring compliance with safety standards and promoting a healthier work environment.

The oil and gas segment is expected to grow at a CAGR of 4.9% from 2025 to 2030, owing to the industry's rigorous operational demands and environmental regulations. Activities such as drilling, welding, and transportation produce significant amounts of dust and toxic fumes, posing serious health risks to workers. In addition, as global demand for oil continues to rise, exploration and production activities increase, further necessitating effective dust management solutions. Moreover, stricter compliance requirements regarding air quality and worker safety are driving investments in advanced dust control technologies within this sector, ensuring safer working conditions and reducing environmental impact.

Regional Insights

The Asia Pacific dust control systems market dominated the global market and accounted for the largest revenue share of 39.2% in 2024, primarily driven by rapid industrialization and urbanization. In addition, increasing construction activities, particularly in countries such as India and China, generate substantial dust emissions, necessitating effective management solutions. Furthermore, heightened awareness of health risks associated with dust exposure has led to stricter regulations aimed at controlling air quality.

The dust control systems market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, due to its booming construction and mining sectors. As the country continues to urbanize and expand its infrastructure, the generation of dust has become a pressing concern for public health and environmental safety. Furthermore, stricter government regulations regarding air quality and worker safety are pushing industries to adopt effective dust management solutions. Moreover, technological advancements in dust control systems are enhancing efficiency and effectiveness, further propelling market growth in this rapidly developing economy.

Middle East & Africa Dust Control Systems Market Trends

The Middle East and Africa dust control systems market is expected to grow at a CAGR of 5.1% over the forecast period, owing to the increasing industrial activities, particularly in construction and mining. In addition, the region's harsh environmental conditions exacerbate dust generation, making effective control solutions essential for maintaining air quality and protecting worker health. Furthermore, government initiatives aimed at improving environmental standards are driving investments in dust management technologies. Moreover, the rising focus on sustainable practices within industries also contributes to the growing demand for efficient dust control systems across these regions.

North America Dust Control Systems Market Trends

The dust control systems market in North America is expected to witness substantial growth over the forecast period, primarily driven by stringent environmental regulations and a strong focus on worker safety. Industries such as construction, mining, and oil & gas are under increasing pressure to minimize dust emissions to comply with regulatory standards. Furthermore, technological innovations in dust control systems are also enhancing operational efficiency and effectiveness. Moreover, growing public awareness of health risks associated with airborne dust is prompting companies to invest in advanced solutions that ensure cleaner air and safer working environments.

U.S. Dust Control Systems Market Trends

The U.S. dust control systems market led the North American market and accounted for the largest revenue share in 2024, driven by robust industrial activities across various sectors including construction and manufacturing. Furthermore, increased awareness of health implications related to dust exposure among workers drives investment in advanced dust control technologies. Moreover, the emphasis on sustainable practices and environmental responsibility further enhances the growth potential of the dust control systems market within the U.S.

Europe Dust Control Systems Market Trends

The dust control systems market in the Europe is expected to be driven by the stringent environmental regulations that mandate effective air quality management across industries. In addition, the region's commitment to sustainability encourages investments in advanced dust control technologies that minimize emissions. Furthermore, increasing industrial activities in sectors such as construction and manufacturing contribute to rising demand for efficient dust management solutions. Moreover, public awareness of health risks associated with airborne pollutants also plays a crucial role in driving the adoption of innovative dust control systems across European countries.

Key Dust Control Systems Company Insights

Key players in the global dust control systems industry include Donaldson Company, EnviroSystems LLC, Camfil APC, and others. These companies employ various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve product efficiency. In addition, strategic partnerships and collaborations are also common, allowing companies to leverage complementary strengths. Furthermore, expanding production capabilities and entering new markets help firms meet growing demand while optimizing distribution networks.

-

Camfil APC specializes in manufacturing industrial dust collectors designed to enhance indoor air quality across various settings, including manufacturing plants, pharmaceutical suites, metal shops, and mines. Their product line encompasses a range of dust, mist, and fume collectors, as well as replacement filters compatible with most dust collector brands. Their offerings include dry dust collectors, oil mist collectors, wet scrubbers, and the Gold Series® cartridge dust and fume collectors.

-

C&W Manufacturing and Sales Co. specializes in high-quality industrial dust collectors and dust collection systems tailored for various industries, particularly in concrete and construction. The company offers a diverse range of products, including central dust collectors, silo dust collectors, and mobile dust collection systems.

Key Dust Control Systems Companies:

The following are the leading companies in the dust control systems market. These companies collectively hold the largest market share and dictate industry trends.

- Donaldson Company

- Colliery Dust Control (Pty) Ltd

- EnviroSystems LLC

- Camfil APC

- National Environmental Service Company

- United Air Specialists Inc.

- Sealpump Engineering Limited

- Dust Control Systems Ltd

- C&W Manufacturing and Sales Co.

- Dust Solutions Inc.

- Piian Systems

Recent Developments

-

In April 2024, Donaldson Company, Inc. launched the DFPRE 2, a compact and dependable filtration system designed for various manufacturing applications. This pre-assembled unit addresses the demand for powerful dust control systems in a smaller footprint. The DFPRE 2 features combustible dust mitigation options, an optional spark-reducing inlet, and multiple fan motor choices to handle diverse dust types and airflow needs.

-

In March 2024, Camfil APC introduced a user-friendly pulse-jet cleaning control solution known as Gold Series Timer (GST), for industrial dust control systems. The GST features expandable pulse output modules, compliant with several dust collector sizes and solenoid valve types. An incorporated differential pressure sensor allows pulse-on-demand cleaning and high-pressure alarms. The system comprises a UV-resistant LCD, front panel controls, and optional GoldLink cellular connection for cloud-based remote monitoring of key dust collector parameters.

Dust Control Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.78 billion |

|

Revenue forecast in 2030 |

USD 22.32 billion |

|

Growth Rate |

CAGR of 4.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

February 2025 |

|

Quantitative units |

Revenue in USD Million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product type, application, and region |

|

Regional scope |

North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

|

Country scope |

U.S., Canada, Mexico, Germany, France, UK, Italy, China, Japan, India, Australia, Brazil, Argentina, Saudi Arabia, and UAE. |

|

Key companies profiled |

Donaldson Company; Colliery Dust Control (Pty) Ltd; EnviroSystems LLC; Camfil APC; National Environmental Service Company; United Air Specialists Inc.; Sealpump Engineering Limited; Dust Control Systems Ltd; C&W Manufacturing and Sales Co.; Dust Solutions Inc.; Piian Systems. |

|

Customization scope |

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dust Control Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global dust control systems market report based on product type, application, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet

-

Wet Scrubbers

-

Wet Electrostatic Precipitators (WEPS)

-

-

Dry

-

Bag Dust Collectors

-

Cyclone Dust Collectors

-

Electrostatic Dust Collectors

-

Vacuum Dust Collectors

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Mining

-

Oil & Gas

-

Chemical

-

Food & beverage

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."