- Home

- »

- Medical Devices

- »

-

Dura Substitutes Market Size & Share, Industry Report 2030GVR Report cover

![Dura Substitutes Market Size, Share & Trends Report]()

Dura Substitutes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Biological Dura Substitutes, Synthetic Dura Substitutes), By Region (North America, Europe, APAC, Latin America, Middle East And Africa ), And Segment Forecasts

- Report ID: GVR-4-68040-490-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dura Substitutes Market Size & Trends

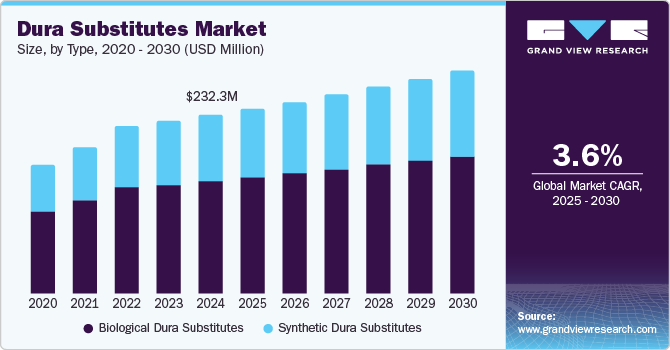

The global dura substitutes market size was estimated at USD 232.27 million in 2024 and is projected to grow at a CAGR of 3.63% from 2025 to 2030. The market growth is driven by advancements in neurosurgical techniques and the increasing prevalence of conditions requiring cranial or spinal surgeries, such as traumatic brain injuries, meningiomas, and chiari malformations. Moreover, an increasing focus on minimally invasive neurosurgical techniques has increased the demand for dura substitutes optimized for small incisions and endoscopic procedures.

Dura substitutes, used to repair or replace the dura mater, are essential in cases of traumatic injuries, tumor resections, or congenital abnormalities. According to a report published by UpToDate, Inc. in May 2023, Traumatic Brain Injury (TBI) represents a critical global health challenge, contributing significantly to both disability and mortality. It is estimated that annually, between 27 and 69 million individuals worldwide experience a TBI. Such a high prevalence of TBIs is expected to increase the demand for advanced solutions offering better patient outcomes, which is expected to fuel the market growth over the forecast period.

The aging population faces a higher risk of neurological disorders, which often require surgical interventions that utilize dura substitutes. According to UN population projections, the global population aged 65 and over is rapidly aging. Between 1974 and 2024, this demographic doubled, rising from 5.5% to 10.3% of the global population. By 2074, this figure is projected to double again, reaching 20.7%. In addition, the aging global population, coupled with a rising prevalence of neurological disorders, has increased the overall surgical volumes, thereby contributing to the rising need for effective dura substitutes. For instance, according to data from the CDC in May 2024, there were approximately 5,676 TBIs in the U.S. Furthermore, the same source reported over 69,000 TBI-related deaths in the U.S. in 2021, equating to 190 TBI deaths per day. In addition, according to data published by the Cleveland Clinic in May 2024, more than 75% of all TBIs are mild. Therefore, the increasing incidence of traumatic brain injuries is expected to drive market growth in the forecast period.

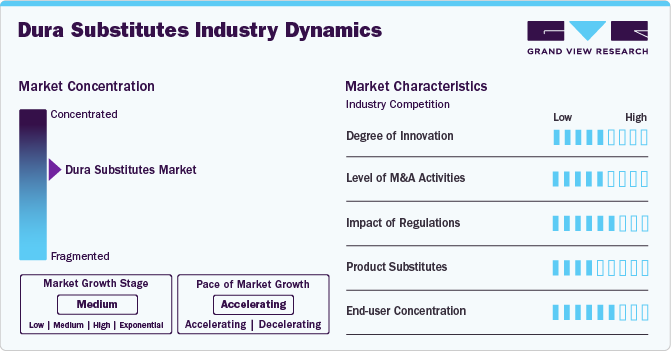

Market Concentration & Characteristics

The market growth stage is medium, with an accelerating pace. The market is characterized by the rising prevalence of neurological disorders, the aging population, the rising preference towards minimally invasive surgical procedures, and the rising acceptance of dura substitutes as an effective solution for improving patient outcomes.

The market is experiencing a moderate degree of innovation. Limited research into novel biomaterials offers challenges to innovation, as several companies rely on established synthetic options. However, the increasing prevalence of various neurological conditions and the rise in surgeries are expected to drive innovation in dura substitutes over the forecast period.

Regulatory bodies play a significant role in shaping the dura substitutes industry. Compliance with regulatory standards, such as those set by the FDA and EMA, is crucial for product approval and market entry. These regulations require stringent preclinical and clinical testing of dura substitutes. The complexity of regulatory processes can offer challenges for manufacturers, potentially impacting timely access to advanced dura substitutes for healthcare providers and patients. However, these regulations ensure that the dura substitutes are safe and effective for end users.

The level of M&A activities in the dura substitutes industry is moderate. Market players use this strategy for several reasons, including increasing market presence, enhancing product offerings, regional expansion, and others. Major players are acquiring smaller firms to enhance their product portfolios and expand market reach. Strategic mergers and acquisitions also enable companies to leverage advanced technologies and research capabilities.

The threat of product substitutes in the dura substitute industry is moderate but significant, as alternative materials such as autografts or allografts can serve similar purposes. While these traditional options may be preferred for certain applications due to their established efficacy, advancements in synthetic substitutes are significantly reducing this acceptance gap for the dura substitutes.

The dura substitutes industry is characterized by a moderate level of end user concentration. The end user concentration in the market primarily involves hospitals and surgical centers specializing in neurosurgery. As the number of neurosurgical procedures rises, driven by an aging population and increased incidence of neurological disorders, manufacturers need to meet the evolving needs of these facilities.

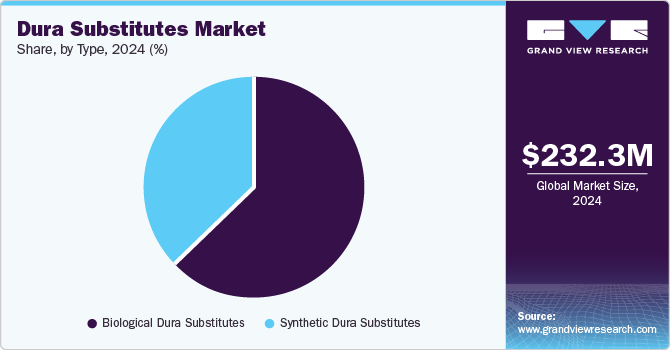

Type Insights

The biological dura substitutes segment dominated the market in 2024 owing to their superior biocompatibility, reduced risk of immunogenic reactions, and ability to integrate effectively with native tissue. These substitutes are primarily derived from human or animal tissues, such as bovine or porcine sources, which undergo rigorous processing to remove cellular components and reduce antigenicity. This process ensures that biological dura substitutes copy the natural properties of the human dura master, providing enhanced structural and functional support for neural tissue repair. Furthermore, their biodegradable nature eliminates the need for secondary removal surgeries, a significant advantage in neurosurgical procedures.

The synthetic dura substitutes segment is expected to witness the fastest growth in the market due to several key advantages that these materials offer over other alternatives. Synthetic dura substitutes, made from advanced polymers such as polytetrafluoroethylene (PTFE), polyester, and silicone, provide a high degree of customization and reliability. These materials can be designed to meet specific mechanical and physical requirements, ensuring consistent performance in neurosurgical applications. Moreover, their properties, including flexibility and strength, make them suitable to withstand the biomechanical stresses in various surgeries, such as cranial and spinal surgeries, thereby increasing their demand.

Regional Insights

The North America dura substitutes market dominated globally with a share of 32.89% in 2024. This can be attributed to the combination of increasing neurological procedures, advancements in biomaterials, and rising awareness among healthcare providers regarding effective post-surgical healing. North America has witnessed a steady rise in the prevalence of neurological conditions such as brain tumors, traumatic brain injuries, and spinal disorders. For instance, according to the American Cancer Society, in 2023, around 25,400 cases of malignant tumors of the brain or spinal cord were estimated to be diagnosed in the U.S. Furthermore, brain and spinal cord tumors were estimated to cause around 18,760 mortalities in the U.S. in 2023. This rising prevalence of neurological conditions has increased the demand for various neurosurgical procedures.

U.S. Dura Substitutes Market Trends

The dura substitutes market in the U.S. held a significant share in the North American region in 2024, owing to the advancements in neurosurgical techniques and the rising prevalence of neurological disorders requiring surgical intervention. Moreover, the increasing adoption of minimally invasive neurosurgical procedures, which often require the use of precise and adaptable dura substitutes, has further contributed to this rising demand. In addition, the presence of several key market players and access to advanced dura substitute products has further allowed healthcare providers to adopt these solutions, thereby driving their demand in the country.

The Canada dura substitutes market is experiencing steady growth driven by advancements in neurosurgical procedures, increasing prevalence of cranial injuries, and a robust healthcare infrastructure supporting innovation. In recent years, Canada has experienced a rise in traumatic brain injuries and neurological disorders, such as tumors requiring cranial surgery, which has created a sustained demand for effective dura substitutes. For instance, according to the Government of Canada, around 127,460 TBI-related hospitalizations were reported in Canada between 2018 and 2023.

Europe Dura Substitutes Market Trends

The Europe dura substitutes market is experiencing significant growth, driven by factors such as an aging population and the increasing adoption of synthetic biomaterials. Over the past decade, Europe has seen a surge in brain and spinal surgeries due to an aging population and higher diagnostic rates of conditions such as traumatic brain injuries and spinal tumors. This has increased the demand for effective dura substitutes, as repairing dura mater defects is crucial for preventing cerebrospinal fluid leakage and post-operative complications.

The dura substitutes market in the UK is expected to grow significantly over the forecast period. The growing number of patients requiring dural repair, particularly due to head and spinal injuries, is a key factor pushing this market. Moreover, the UK’s commitment to advancing healthcare technology, coupled with an aging population and the rise of neurological diseases, has created significant demand for durable, cost-effective dura substitutes.

The Germany dura substitutes market is witnessing a significant growth driven by the country’s developed healthcare infrastructure and growing focus on medical research. In addition, German hospitals have increasingly adopted minimally invasive techniques, which rely on advanced materials for dura repair, thereby contributing to the market growth in the country.

Asia Pacific Dura Substitutes Market Trends

Asia Pacific dura substitutes market is anticipated to grow at the fastest CAGR over the forecast period. Several factors, including rising incidences of neurological disorders, developing healthcare infrastructure, and increased awareness of brain surgeries, are attributed to the anticipated growth. In recent years, countries such as Japan, China, and India have seen a growing demand for dura substitutes, driven by an aging population and an increase in traumatic brain injuries. The region's healthcare infrastructure has also improved, with more specialized hospitals and surgical centers offering advanced treatments that involve dura mater repair, a process critical for patients undergoing cranial surgeries.

The dura substitute market in China is expected to witness significant growth over the forecast period. China has witnessed significant development in the country’s healthcare infrastructure, which has also allowed for the adoption of advanced healthcare solutions offering better patient outcomes in the country. Moreover, the country’s aging population, coupled with rising awareness towards minimally invasive procedures, has further contributed to the market growth in the country.

Latin America Dura Substitutes Market Trends

The Latin America Dura Substitutes Market is experiencing significant growth, driven by advances in neurosurgery and an increasing demand for effective treatments for conditions involving the dura mater, such as traumatic brain injuries, spinal cord surgeries, and brain tumor resections. Latin American countries have increasingly invested in advanced medical technologies and training, leading to more efficient use of these substitutes in complex surgical procedures. Additionally, as healthcare systems in the region evolve, regulatory bodies are expected to streamline approval processes for dura substitutes, making them more accessible for the end user in the market.

Middle East And Africa Dura Substitutes Market Trends

The dura substitutes market in MEA is experiencing growth driven by the increasing focus on healthcare infrastructure development, rising healthcare expenditure, and an increasing focus on improving patient outcomes following brain and spinal surgeries. Over the past decade, the demand for effective dura substitutes has risen as the region's healthcare infrastructure improves, with more hospitals and clinics specializing in neurosurgery. Moreover, countries such as the UAE and Saudi Arabia have witnessed a rise in medical tourism, with patients seeking advanced surgical treatments, further increasing demand for dura substitutes.

The dura substitutes market in Saudi Arabia is expected to witness significant growth over the forecast period. Saudi Arabia has made significant investments in the country’s healthcare infrastructure, including the field of neurosurgery, where dura substitutes are essential for treating dural defects resulting from trauma, surgery, or congenital conditions. The Saudi government’s Vision 2030 initiative has accelerated this development, with a focus on improving the quality of healthcare services and reducing reliance on international medical providers.

Neurological Health Awareness Initiatives

In November 2024, the National Center for Neurological Disorders launched a series of books aimed at increasing awareness of neurological disorders in China. The publication addresses common and major disorders, increasing the need for better understanding and support for affected individuals and their families.

In June 2024, the Società Italiana di Neurologia launched the Italian Brain Health Strategy 2024-2031, which aims to enhance awareness and combat mental and neurological diseases. It aligns with the WHO's Global Action Plan and emphasizes collaboration among patients, healthcare professionals, and policymakers to improve brain health across all demographics in Italy.

In May 2022, the WHO announced the adoption of the Intersectoral Global Action Plan on Epilepsy and Other Neurological Disorders (2022-2031) plan to enhance treatment access and improve the quality of life and access to treatment for individuals with neurological disorders. It outlines strategic objectives addressing governance, diagnosis, prevention, research, and public health responses to epilepsy and related conditions.

Key Dura Substitutes Company Insights

Key market players are adopting various strategies such as product launches, approvals, and others to increase their market presence and get a competitive advantage over other market players. These advancements in the dura substitutes industry are anticipated to boost market growth over the forecast period.

Key Dura Substitutes Companies:

The following are the leading companies in the Dura Substitutes Market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- B. Braun SE

- Stryker

- DePuy Synthes (Johnson & Johnson)

- W. L. Gore & Associates, Inc.

- Acera Surgical Inc.

- Severn Healthcare Technologies Limited.

- INTEGRA LIFESCIENCES

- GUNZE LIMITED

Recent Developments

-

In August 2023, NURAMI MEDICAL announced that its ArtiFascia Dura Substitute received FDA 510(k) clearance. This innovative graft, made from electrospun nanofibers, is designed for dural repair in neurosurgery. It offers several benefits, including promoting tissue regeneration, preventing cerebrospinal fluid (CSF) leakage, and providing ease of handling. The ArtiFascia Dura Substitute represents a significant advancement in soft tissue repair technology, enhancing surgical outcomes for patients undergoing neurosurgical procedures.

Dura Substitutes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 240.70 million

Revenue forecast in 2030

USD 287.68 million

Growth Rate

CAGR of 3.63% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segments covered

Type

Key companies profiled

Medtronic; B. Braun SE; Stryker; DePuy Synthes (Johnson & Johnson); W. L. Gore & Associates, Inc.; Acera Surgical Inc.; Severn Healthcare Technologies Limited.; INTEGRA LIFESCIENCES; GUNZE LIMITED.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dura Substitutes Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dura substitutes market report based on type and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biological Dura Substitutes

-

Synthetic Dura Substitutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dura substitutes market size was estimated at USD 232.27 million in 2024 and is expected to reach USD 240.70 million in 2025.

b. The global dura substitutes market is expected to grow at a compound annual growth rate of 3.63% from 2025 to 2030 to reach USD 287.68 million by 2030.

b. North America dominated the dura substitutes market with a share of 32.89% in 2024. This can be attributed to increasing neurological procedures, advancements in biomaterials, and rising awareness among healthcare providers regarding effective post-surgical healing.

b. Some key players operating in the dura substitutes market include Medtronic; B. Braun SE; Stryker; DePuy Synthes (Johnson & Johnson); W. L. Gore & Associates, Inc.; Acera Surgical Inc.; Severn Healthcare Technologies Limited.; INTEGRA LIFESCIENCES; GUNZE LIMITED.

b. Key factors that are driving the market growth include the increasing prevalence of neurological and spinal disorders, including traumatic brain injuries, tumors, and degenerative conditions, which often necessitate neurosurgical interventions. Advances in biomaterial science have also fueled growth, with the development of biocompatible and synthetic dura substitutes that enhance surgical outcomes and minimize complications such as infections.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.