- Home

- »

- Advanced Interior Materials

- »

-

Duplex Stainless Steel Pipe Market Size Report, 2030GVR Report cover

![Duplex Stainless Steel Pipe Market Size, Share & Trends Report]()

Duplex Stainless Steel Pipe Market (2025 - 2030) Size, Share & Trends Analysis Report By End Use (Oil & Gas, Chemical & Petrochemical, Desalination & Water Treatment) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Duplex Stainless Steel Pipe Market Summary

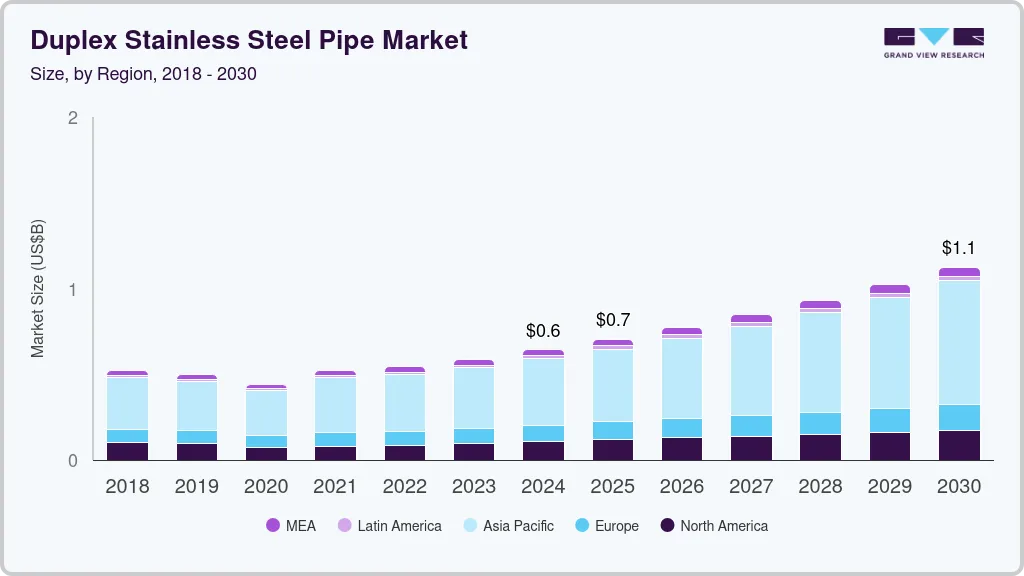

The global duplex stainless steel pipe market size was estimated at USD 642.3 million in 2024 and is projected to reach USD 1,124.8 million by 2030, growing at a CAGR of 9.8% from 2025 to 2030. Rising industrial construction activities specifically in the oil & gas industry are expected to benefit the market demand for duplex stainless steel pipes.

Key Market Trends & Insights

- North America duplex stainless steel pipe market dominated the market in 2023.

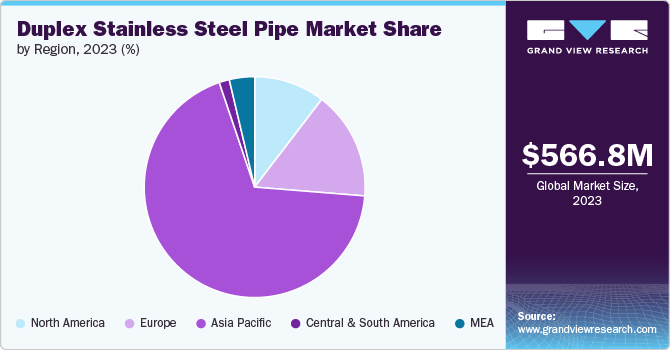

- The duplex stainless steel pipe market in the Asia Pacific region dominated the global market and accounted for over 66.0% revenue share in 2023.

- Middle East & Africa duplex stainless steel pipe market holds a significant share in overall market.

- Based on end use, oil & gas held the largest revenue share of over 42% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 642.3 Million

- 2030 Projected Market Size: USD 1,124.8 Million

- CAGR (2025-2030): 9.8%

- Asia Pacific: Largest market in 2024

For instance, in May 2024, Abu Dhabi National Oil Company (ADNOC), a subsidiary of ADNOC Gas, announced that it is aiming to more than double its LNG production capacity by 2028 with the commencement of operations of its Ruwais LNG Plant that is currently under construction. Increasing oil exploration activities in the offshore oil industry are expected to benefit the demand for duplex stainless steel pipes. These activities often have harsh conditions such as high pressure and high temperature. Additionally, it has been observed that there is an increase in the life expectancy of subterranean walls and the rise of corrosive agents in these walls. In such conditions, duplex stainless steel materials exhibit excellent performance.

Drivers, Opportunities & Restraints

The rising need to fulfill the demand for freshwater is likely to propel investments in desalination and wastewater treatment, ensuring stable demand for duplex stainless steel pipes. In June 2024, Morocco announced the commencement of construction work for a desalination plant with an annual production capacity of 300 million cubic meters. The Casablanca seawater desalination plant, spanning 50 hectares, is expected to serve around 7.5 million people and supply water to the cities of Casablanca, Jdid, Bir, Berrechid, and Settat. The plant will be completed in two phases by 2028.

The investment in energy sectors such as nuclear is expected to provide new opportunities for market participants as duplex pipes find application in power generation turbines. In January 2024, the Government of Egypt announced the construction of the final reactor of the first nuclear plant in the country. This plant will have four reactors, with a capacity of 1.2 GW each. Rosatom and Nuclear Power Plants Authority (NPPA) started construction of the first two reactors in 2022 and laid the foundation for the third reactor in May 2023. The total plant is valued at USD 30.0 million and is expected to be functional in 2030.

Geopolitical events, trade disputes, natural disasters, and rising freight charges, etc. are some of the restraining factors for the market. The recent Russia-Ukraine conflict impacted the market as many countries put sanctions on Russia, thus creating supply disruptions. Russia is the key producer of nickel, an important material required for stainless steel production. Thus, conflict also impacted the supply of nickel enabling volatility in nickel prices.

Price Trends of Stainless Steel Pipe

In GCC countries like Qatar prices of stainless steel pipes witnessed an increase in May 2024 than April 2024. The short- to medium-term demand for these pipes remained robust in Qatar, with the Government of Qatar announcing that it intends to boost its LNG production capacity by 13% by adding an extra 16 million tons annually by 2030. It has reportedly decided to focus on LNG deliveries to developing countries, such as China, India, Thailand, and Bangladesh. Alongside ongoing LNG production projects announced earlier this year, the demand for stainless steel pipes is anticipated to increase and maintain steady pricing levels in the country in the coming months.

End Use Insights

“Oil & Gas held the largest revenue share of over 42% in 2023.”

The oil & gas end use industry is anticipated to continue its dominance from 2024 to 2030. The investments in the industry are expected to amplify the demand for stainless steel products including pipes. For instance, the Anchois Conventional Gas Field in Morocco, owned by Office National des Hydrocarbures et des Mines, for an investment value of USD 400 million is due for the final investment decision (FID) later this year. Production is anticipated to commence in 2025 and is projected to reach peak levels in 2026.

Machinery & equipment, aerospace, and automotive industries are anticipated to attract a significant demand for duplex stainless steel pipe over the forecast period. This has resulted in significant investment in aluminum production facilities. For instance, in March 2024, Vista Metals announced an investment of USD 60 million to produce specialty aluminum products for aerospace industries. This facility will support downstream processing and is expected to serve aerospace forging, extrusion, and rolling markets.

The growing interest in the generation of energy using solar technolog is projected to provide a boost to the market. Aluminum is a key material required in solar photovoltaic components such as mounting structures and frames. The rising interest from governments for clean energy and subsidies is likely to boost market growth. For instance, as of 2023, among overall renewable energy generation installed capacity in India, solar is the leading technology with a capacity of around 81.81 GW.

Regional Insights

North America duplex stainless steel pipe market dominated the market in 2023. Rising focus on oil production and investments in the construction and energy industry is anticipated to act as a key factor for the market. As per the Government of Canada, there are around 470 projects in the pipeline with a value of USD 520 million over the next 10 years. Out of this, 183 projects are for green energy with value of USD 116 million.

U.S. Duplex Stainless Steel Pipe Market Trends

Oil exploration to act as a key driver for the U.S. duplex stainless steel pipe market. As reported by the International Energy Agency, the U.S. produced more crude oil than any other country over the last six years. The country’s crude oil production reached 12.9 million barrels per day in 2023 from 12.3 million barrels per day in 2019.

Asia Pacific Duplex Stainless Steel Pipe Market Trends

“China held over 65% revenue share of the overall Asia Pacific duplex stainless steel pipe market.”

The duplex stainless steel pipe market in the Asia Pacific region dominated the global market and accounted for over 66.0% revenue share in 2023. The demand from the construction sector in countries such as India and the ASEAN region is increasing owing to increasing urbanization across the country. According to Invest India, the construction industry in the country is anticipated to reach USD 1.4 trillion by 2025. Government policies such as the smart city mission are generating demand for modernized construction activities and urban planning in India as it is estimated that 600 million people will be living in urban centers in the country by 2030.

Middle East & Africa Duplex Stainless Steel Pipe Market Trends

Middle East & Africa duplex stainless steel pipe market holds a significant share in overall market. Stainless steel pipes witnessed buoyant demand from the oil & gas industry in the Middle East & Africa in the recent past. India-based Welspun Corp Ltd signed multiple agreements worth SAR 1.65 million (~USD 440 million) with Saudi Aramco to supply steel pipes. Further, to develop the solar power industry, Saudi Aramco announced an investment of USD 920 million for a 30% share in Sudair. This is the first phase of a 40 GW solar farm.

Key Duplex Stainless Steel Pipe Company Insights

Some key players operating in the market include Outokumpu, JFE Steel Corporation., POSCO, and Acerinox SA

-

Outokumpu is one of the leading players in the stainless steel industry value chain. The company produces stainless steel grades such as ferritic, duplex, austenitic, and martensitic. The company caters to industries including appliances, automotive & transportation, building & infrastructure, and energy & heavy industry.

-

Acerinox SA is a Spain-based manufacturer of stainless steel and high-performance alloy products. The company has a shop melting capacity of 3.5 million tons and has around 13 production facilities.

Key Duplex Stainless Steel Pipe Companies:

The following are the leading companies in the duplex stainless steel pipe market. These companies collectively hold the largest market share and dictate industry trends.

- Acerinox SA

- Aperam SA

- JFE Steel Corporation

- JSW Group

- Metline Industries

- Nippon Steel Corporation

- Outokumpu

- POSCO

- Tata Steel

- ThyssenKrupp AG

Recent Developments

-

In June 2024, Jindal Stainless completed the acquisition of Evergreat International Investment Pte Ltd, Singapore (EIPL). With this acquisition, EIPL became whole subsidiary of the company.

-

In May 2024, Mubadala Investment Company acquired a 40% stake in Tubacex’s Tubular Solutions, a facility of Spanish stainless steel pipes producer Tubacex, for an investment value of USD 150 million. The deal is subject to regulatory approval and aims to speed up the construction of a corrosion-resistant oil and gas steel pipe coating (OCTG) plant in Abu Dhabi.

-

In October 2023, Tube Investments of India announced an investment of USD 25 million for the Greenfield factory in Pune. The project is expected to be completed in 2025. With this investment, the company plans to improve its product portfolio in the steel pipes segment.

Duplex Stainless Steel Pipe Report Scope

Report Attribute

Details

Market size value in 2025

USD 704.5 million

Revenue forecast in 2030

USD 1,124.8 million

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East& Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Russia; China; India; Japan; South Korea; Brazil; GCC; South Africa

Key companies profiled

Acerinox SA; Aperam SA; JFE Steel Corporation; JSW Group; Metline Industries; Nippon Steel Corporation; Outokumpu; POSCO; Tata Steel; Thyssenkrupp AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Duplex Stainless Steel Pipe Market Report Segmentation

This report forecasts revenue and volume growth at global, country, and regional levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global duplex stainless steel pipe market report based on the end use, and region.

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Chemical & Petrochemical

-

Desalination & water treatment

-

Paper & pulp

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global duplex stainless steel pipe market size was estimated at USD 566.8 million in 2023 and is expected to reach USD 591.4 million in 2024.

b. The global duplex stainless steel pipe market is expected to grow at a compound annual growth rate of 4.6% from 2024 to 2030 to reach USD 775.3 million by 2030.

b. By end use, oil & gas dominated the market with a revenue share of over 42.0% in 2023.

b. Some of the key vendors of the global duplex stainless steel pipe market are Acerinox SA, Aperam SA, JFE Steel Corporation, JSW Group, Metline Industries, Nippon Steel Corporation, Outokumpu, POSCO, Tata Steel and thyssenkrupp AG

b. The key factor driving the growth of the global duplex stainless steel pipe market is the rising oil & gas exploration activities and focus on desalination for stable supply of water

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.