Dual And Multi Energy Computed Tomography Market Size, Share & Trends Analysis Report By Product (Prospective, Retrospective), By Application (Oncology, Neurology, Cardiology, Vascular Musculoskeletal), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-009-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

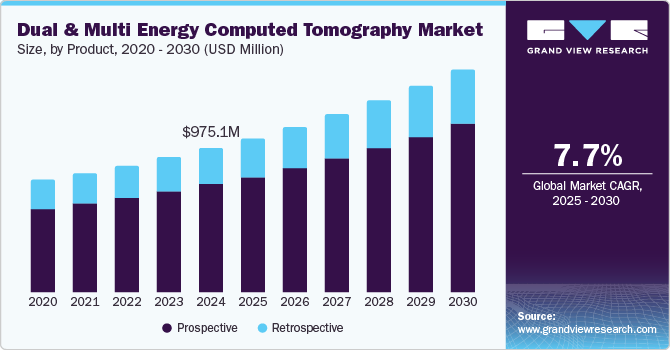

The global dual and multi energy computed tomography market size was estimated at USD 975.1 million in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. In the U.S., approximately 56 million individuals were aged 65 and older in 2023, with projections estimating this number would increase to about 58 million by 2024. This demographic shift necessitated more advanced diagnostic imaging solutions to address age-related health issues. Similarly, in Germany, the elderly population accounted for roughly 22% of the total population in 2023, expected to reach about 23% in 2024. As older adults often present with complex medical conditions, the need for enhanced imaging technologies became increasingly critical in clinical practice.

Technological advancements in CT imaging techniques have further propelled the adoption of dual and multi-energy modalities. Continuous innovations improved diagnostic capabilities, enabling healthcare providers to deliver superior patient outcomes. This trend was evidenced by the increased integration of advanced imaging technologies within clinical settings. For example, the integration of dual-energy techniques enhances the characterization of tumors and optimizes the differentiation between various tissue types. Consequently, healthcare providers were compelled to invest in advanced imaging solutions to meet rising expectations for quality care, particularly among older patients.

According to the American Heart Association, in North America, approximately 48% of adults aged over 65 were affected by cardiovascular diseases in both 2023 and 2024. In the UK, about one-third of the elderly population reported chronic conditions during the same period. This surge in chronic diseases increased the requirement for effective imaging solutions, further elevating the significance of dual and multi-energy CT technologies in diagnosing and managing complex medical issues.

Furthermore, according to the Indian Union Budget 2024-2025, the government allocated approximately USD 11 billion to healthcare for FY 2024-25, marking a 12.9% increase from the previous fiscal year’s budget. Increased funding specifically for advanced diagnostic techniques and minimally invasive procedures highlights a growing commitment to enhancing medical imaging capabilities, reflecting a broader trend toward improving healthcare delivery systems on a global scale.

Product Insights

Prospective techniques dominated the market and accounted for a share of 74.4% in 2024. Technological advancements in dual and multi-energy CT systems have markedly improved diagnostic capabilities and imaging quality. Driven by the rising prevalence of chronic diseases and increasing patient expectations, these innovations support early diagnosis and treatment planning, further accelerated by enhanced healthcare infrastructure and ongoing investment in research and development.

The demand for retrospective techniques is expected to grow lucratively over the forecast period. Retrospective techniques facilitate the analysis of multi-energy scan data, enabling precise tissue differentiation essential for identifying pathologies, especially in oncology and cardiovascular imaging. Ongoing hardware and software advancements enhance the reliability of these analyses, while increased research, development, and regulatory approvals drive adoption among healthcare professionals seeking evidence-based imaging solutions.

Application Insights

Oncology led the market with a revenue share of 26.9% in 2024, owing to its advanced diagnostic capabilities, enabling detailed tissue characterization and early tumor detection. This technology enhances treatment planning and monitoring, addressing the growing cancer prevalence and the need for precise medical imaging solutions, ultimately improving patient outcomes.

Vascular applications are expected to register significant growth over the forecast period, fueled by the technology’s superior image quality through enhanced tissue differentiation, improved contrast for detecting vascular structures, reduced artifacts from high-energy virtual monoenergetic images, and the ability to generate virtual non-contrast images, minimizing radiation exposure. Moreover, technological advancements, the rising prevalence of chronic diseases, and increasing patient expectations further propel market growth, highlighting the significance of advanced imaging solutions.

End-use Insights

Hospitals held the largest revenue share of 42.8% in 2024, as hospitals are witnessing increasing patient caseloads due to chronic diseases, significant technological advancements enhancing diagnostic accuracy, and non-invasive diagnostic capabilities that reduce surgical risks. Moreover, growing patient expectations for high-quality care, economic investments in advanced imaging technologies, and diverse clinical applications further elevate the demand for these systems.

Diagnostic imaging centers are projected to grow at the fastest CAGR of 8.0% over the forecast period. Key factors driving demand for dual and multi-energy CT systems in diagnostic imaging centers include technological advancements offering superior imaging capabilities, an increase in patient referrals due to chronic diseases, and a focus on early disease detection. Moreover, these systems provide cost-effectiveness through improved diagnostic precision, meet rising patient expectations for quality care, and support research and development initiatives.

Regional Insights

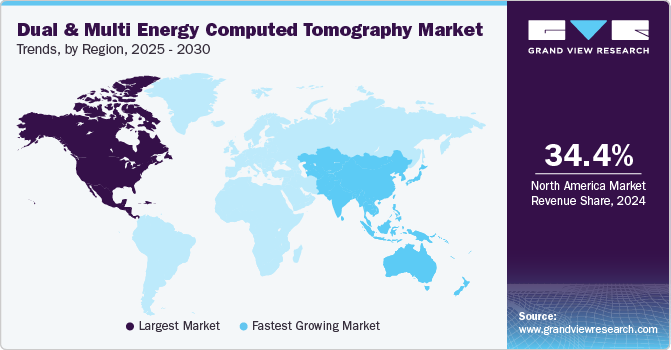

North America dual and multi energy computed tomography market dominated the global market with a revenue share of 34.4% in 2024. Market growth in the region is driven by several factors, including an advanced healthcare infrastructure, high healthcare expenditure, and a rising prevalence of chronic diseases. Significant government support for medical technologies and research further amplifies this growth. The region’s commitment to innovative diagnostic solutions and increasing demand for accurate imaging techniques is propelling the adoption of dual and multi-energy CT systems.

U.S. Dual And Multi Energy Computed Tomography Market Trends

The dual and multi energy computed tomography market in the U.S. dominated the North America market with a revenue share of 77.2% in 2024, driven by substantial investments in healthcare technology, a high prevalence of chronic diseases such as cancer, and an aging population. The presence of key industry players promotes innovation and competition within the sector. Moreover, increased government funding for healthcare initiatives enhances access to advanced imaging technologies.

Europe Dual And Multi Energy Computed Tomography Market Trends

Europe dual and multi energy computed tomography market held substantial market share in 2024, fueled by rising healthcare expenditures, ongoing technological advancements, and an increasing prevalence of chronic diseases. The growing aging population plays a significant role in increasing demand for advanced imaging solutions. Moreover, supportive regulatory frameworks for innovative medical technologies encourage the widespread adoption of dual-energy CT systems across diverse healthcare settings.

The dual and multi energy computed tomography market in UK is expected to grow lucratively in the forecast period. Japan’s aging population, with over 1 in 10 citizens aged 80 or older, drives a heightened demand for diagnostic imaging services. As the country consistently ranks as the world’s oldest population, this demographic shift fuels market growth. Enhanced investments in healthcare technology and growing awareness of early disease detection further accelerate adoption of advanced imaging solutions.

Asia Pacific Dual And Multi Energy Computed Tomography Market Trends

Asia Pacific dual and multi energy computed tomography market is expected to register the fastest CAGR of 8.6% in the forecast period. The region is experiencing a surge in chronic disease incidences, rapid urbanization, and increasing demand for advanced medical imaging technologies. The expansion of healthcare infrastructure and rising disposable incomes facilitate market growth as more patients seek quality diagnostic services. These trends underscore the growing importance of dual and multi-energy CT systems in improving healthcare outcomes across the region.

The dual and multi energy computed tomography market in Japan is projected to grow at the fastest CAGR of 8.9% over the forecast period, supported by an aging population. This demographic trend intensifies the demand for advanced diagnostic imaging solutions. Japan’s strong commitment to healthcare innovation and investment in cutting-edge medical technologies also aid market growth in the country.

Key Dual And Multi Energy Computed Tomography Company Insights

Some key companies operating in the market include Koninklijke Philips N.V.; GE HealthCare; Siemens Healthcare Limited; CANON MEDICAL SYSTEMS CORPORATION; among others. These companies are investing in product launches and conducting clinical trials to determine the clinical efficacy of these systems.

-

GE HealthCare specializes in advanced dual and multi-energy computed tomography systems that enhance diagnostic capabilities. Their Revolution Ascend platform employs Gemstone Spectral Imaging and rapid kV switching to optimize image quality and support early disease detection.

-

Shimadzu Corporation provides dual-energy CT systems designed to enhance diagnostic accuracy and patient safety. Their advanced imaging technologies improve material differentiation within the body, facilitating tumor and cardiovascular disease detection while reducing radiation exposure during procedures.

Key Dual And Multi Energy Computed Tomography Companies:

The following are the leading companies in the dual and multi energy computed tomography market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- GE HealthCare

- Siemens Healthcare Limited

- CANON MEDICAL SYSTEMS CORPORATION

- FUJIFILM Corporation

- Shimadzu Corporation

- Koning Health

- Neusoft Medical Systems Co., Ltd.

- Carestream Health

- PLANMECA OY

- Hitachi High-Tech Corporation

- Stryker

Recent Developments

-

In January 2025, Philips launched its AI-enabled CT 5300 in India, featuring advanced diagnostic capabilities and streamlined workflows, at the Asian Oceanian Congress of Radiology.

-

In December 2024, Siemens Healthineers expanded its photon-counting CT portfolio in the USA, introducing new scanners with high image quality at low radiation doses.

-

In December 2024, GE HealthCare showcased over 40 innovations, including AI-enabled technologies, at RSNA in Chicago, aiming to enhance precision care and improve operational efficiencies in the USA.

-

In December 2024, Neusoft Medical Systems showcased its AI-powered medical imaging solutions at the RSNA Annual Meeting in Chicago, aiming to enhance diagnostic precision and improve global access to quality care.

-

In May 2024, Siemens Healthineers hosted a clinical symposium in Quang Ninh, Vietnam, focusing on Dual Energy CT’s impact on cardiovascular imaging, marking their first collaboration in the region.

Dual And Multi Energy Computed Tomography Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.0 billion |

|

Revenue forecast in 2030 |

USD 1.5 billion |

|

Growth rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Koninklijke Philips N.V.; GE HealthCare; Siemens Healthcare Limited; CANON MEDICAL SYSTEMS CORPORATION; FUJIFILM Corporation; Shimadzu Corporation; Koning Health; Neusoft Medical Systems Co., Ltd.; Carestream Health; PLANMECA OY; Hitachi High-Tech Corporation; Stryker |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dual And Multi Energy Computed Tomography Market Report Segmentation

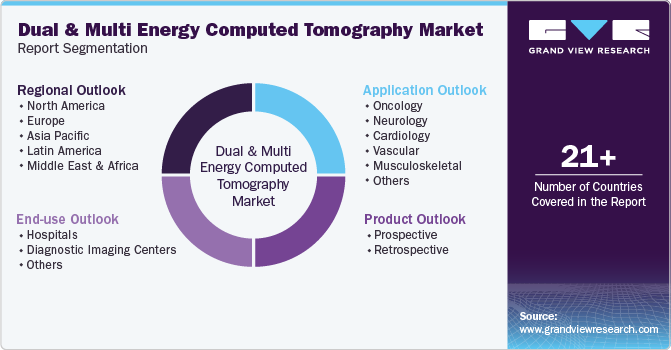

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dual and multi energy computed tomography market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prospective

-

Retrospective

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Vascular

-

Musculoskeletal

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."