Dry Eye Syndrome Treatment Market Size, Share & Trends Analysis Report By Type, By Drug, By Product, By Dosage Form, By Sales Channel, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-974-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Dry Eye Syndrome Treatment Market Trends

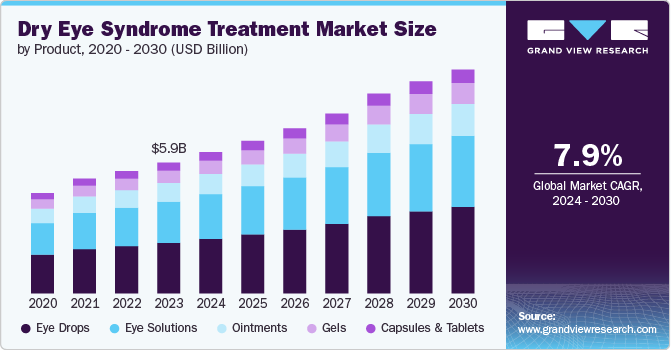

The global dry eye syndrome treatment market size was estimated at USD 6.29 billion in 2024 and is anticipated to expand at a CAGR of 6.56% by 2030. The dry eye syndrome treatment market is witnessing growth due to factors such as rising incidences of dry eye syndrome due to increased screen time, environmental factors, and aging populations globally. For instance, according to the study published in India Today on July 2024, nearly 90% of school going children are suspected to have mild to severe dry eye disease as the average screen time lies above 3 to 3.5 hours per day. In addition, advancements in treatment options, including new drug formulations and therapies, are expected to further propel market expansion.

Dry eye syndrome is becoming the most common ophthalmic problem reported across the globe, and the changing lifestyle can be considered as one of the major factors driving its prevalence. For instance, according to a BMC Ophthalmology June 2022 article, the exact prevalence of Digital Eye Strain (DES) varies widely and is estimated to be between 5% and 50% across the globe, with higher rates seen in certain populations such as women & older adults. Thus, rapidly increasing cases increases the demand for efficient treatments, further driving the market growth.

In addition, the rising demand for faster and noninvasive treatment approaches that provide long-term relief from dry eye symptoms is a key factor expected to drive the market. For instance, Intense Pulsed Light (IPL) is used for the treatment of the condition and each session lasts approximately 15 to 20 minutes, with 4 to 5 sessions being optimal to provide long-term relief from symptoms. Therefore, the rising preference for this treatment among patients unhappy and uncomfortable with frequent application of eye drops to alleviate dry eye symptoms is expected to fuel market growth.

Technological advancements play a pivotal role in the growth of the dry eye syndrome treatment market. The availability of alternative treatments, the high cost of laser treatment, numerous contraindications of IPL, and the lack of an efficient health insurance policy in several countries are the factors limiting the adoption of this therapy. For instance, the average treatment cost of IPL is approximately USD 700, which is practically unaffordable for patients in the low- to middle-level income group.

Type Insights

Evaporative dry eye syndrome segment dominated the market with the largest market share in 2024 and is also anticipated to grow with the fastest CAGR during the forecast period. EDE syndrome is recognized as one of the most prevalent forms of dry eye syndrome, characterized by an inability to produce quality tears. Patients commonly report symptoms such as grittiness, stinging sensations, blurred vision, difficulty tolerating contact lenses, and overall eye fatigue. The underlying cause of EDE is often attributed to the blockage of meibomian glands, this blockage leads to a reduction in the oil component of tears, resulting in accelerated tear evaporation. Treatment strategies for evaporative dry eye syndrome encompass a variety of approaches. Common interventions include lubricant-based drops and warm compresses, which help alleviate symptoms. Omega-3 fatty acid supplements are also recommended to support tear production.

Aqueous dry eye syndrome (ADES) segment is expected to witness significant growth in the coming years due to rising prevalence and technological advancements. ADES arises from the impaired function of the lacrimal glands, leading to insufficient tear production. This condition is characterized by a deficiency in aqueous tears, often exacerbated by chronic inflammation and enlarged tear ducts. Leading pharmaceutical companies, such as I-Med Pharma, Inc., Novaliq GmbH, and Allergan, are actively marketing the therapeutic solutions for this syndrome, capitalizing on the growing demand for effective management of ADES. As awareness of this condition increases, the market for dry eye treatments is expected to expand, presenting opportunities for innovation and enhanced patient care.

Drugs Insights

The Xiidra segment dominated the overall market in 2024, with a revenue share of 8.52%. This large share can be attributed to affordability, easy availability, and effectiveness in producing artificial tears. Strategic initiatives among pharmaceutical companies also impact the revenue generation from this segment. For instance, in September 2023 Bausch + Lomb announced the acquisition of Xiidra from Novartis to bolster their dry eye disease portfolio and expand the market penetration of the drug. Owing to such mergers and acquisitions, Xiidra segment is anticipated to grow significantly over the forecast period.

Tyrvaya segment is expected to grow at a lucrative CAGR making it the fastest growing drug under the segment. Research and development in the treatment of dry eye disease using this drug is attributed to the expected exponential growth of the segment. For instance, in July 2022, Oyster Point Pharma expanded access to TYRVAYA (varenicline solution) nasal spray, improving its availability to patients and reporting promising commercial performance in the U.S.

Product Insights

The artificial tears segment dominated the market with the largest market share of 43.1% in 2024. The segment is also projected to grow with a fastest CAGR over the study period. This high share can be attributed to significant research in the artificial tear sector and ease or comfort of use by the patients. For instance, according to the data published in May 2024, Eric Donnenfeld (ophthalmic surgeon) presented a study at the annual meeting of Association for Research in Vision and Ophthalmology (ARVO) wherein he presented the results of a novel artificial tear, “Blink Triple Care” for the treatment of eye disorders.

Topical Corticosteroids segment is expected to grow with a significant CAGR over the forecast period owing to regulatory approvals of new drugs under the segment. For instance, in October 2022, Novaliq received FDA approval for CyclASol, an innovative anti-inflammatory therapy specifically designed to treat DED. Such product launches and other activities contribute to the growth of the segment.

Dosage Form Insights

The eye drops/ solutions segment dominated the market with the largest share of 64.68% in 2024 due to its wide use in dry eye syndrome. In addition, the market for solutions is being bolstered by frequent product approvals and innovative launches. For instance, in January 2022, Sun Pharma introduced CEQUA 0.09%, a cyclosporine ophthalmic solution designed to treat DED. This novel therapy can potentially benefit over 6 million Canadians suffering from this condition. Such advancements in product availability not only enhance treatment options for patients but also contribute to the overall growth of the eye solutions market.

Capsules & Tablets (For Supplements) segment is projected to grow significantly over the forecast period due to the growing recognition and importance of holistic approaches to eye health-combining topical treatments with nutritional support. As patients become more aware of the benefits of maintaining proper tear function through diet and supplementation, the market for dry eye supplements is likely to expand, offering a broader range of options for effective symptom management.

Sales Channel Insights

Prescription segment dominated the market with the largest market share of in 2024 owing to the increasing prevalence, particularly among older adults. Prescription products typically contain active ingredients that provide moisturizing and lubricating effects, temporarily enhancing tear secretion. Due to their efficacy in treating ophthalmic disorders, prescription drugs are often preferred over over-the-counter (OTC) alternatives, making them a key driver in the market for dry eye treatments.

The Over-the-Counter (OTC) drugs segment is projected to be the fastest-growing category during the forecast period. This growth is largely driven by the increasing availability of generic options in the market, following the expiration of patents for major drugs. The relatively low cost of OTC medications makes them accessible to a larger patient population, especially in low- and middle-income countries

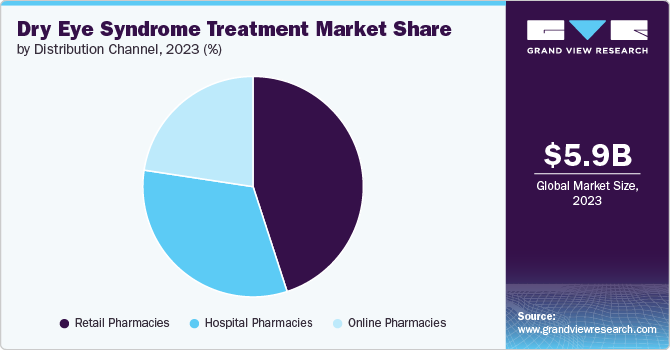

Distribution Channel Insights

Retail pharmacies segment dominated the market with the largest share of 55.6% in 2024, driven by high accessibility and affordability in retail stores. Patients usually purchase drugs from retail pharmacies due to favorable reimbursement policies on prescription prices. Retail pharmacists dispense & prepare medications and also provide patient education concerning medications and dosages. Penetrated trust and other advantages of retail pharmacies are some of the major market drivers of this segment.

The online pharmacies segment is the fastest-growing segment and is expected to grow at a CAGR of 7.2% over the forecast period. Online pharmacies offer a variety of branded and generic choices for treating dry eye conditions. In addition, they provide bundle pricing for items or certain discounts on purchases over a particular threshold. Patients appear to be responding favorably to this novel idea of online pharmacies, particularly for OTC drugs. Thus, factors such as easy availability of product, trend of self-medication and increased internet penetration among others are attributed to drive the segmental growth in the coming years.

Regional Insights

The North America dry eye syndrome treatment market dominated the global market and accounted for 42.7% of revenue share in 2024, which can be attributed to factors such as the rising prevalence of eye diseases and favorable government initiatives in the region. The local presence of regulatory entities in North American countries is expected to boost the development of dry eye treatment drugs in the near future. This is mainly because these entities play a pivotal role in creating awareness among people about the potential of treatment therapies in disease management.

U.S. Dry Eye Syndrome Treatment Market Trends

The U.S. dry eye syndrome treatment market held a significant share of North America market in 2024, driven frequent approvals and new product launches. Strategic initiatives undertaken by key players in the region are supporting the market growth in the U.S. For instance, in January 2023, Bausch & Lomb Corporation in collaboration with Novaliq GmbH announced the publication of NOV03 for the treatment of dry eye diseases and related symptoms. Additionally, due to the increasing coverage of ophthalmic drugs under healthcare plans, the out-of-pocket expenditure on drugs has significantly reduced in the last decade resulting in increased adoption of treatments and further propelling market growth.

Europe Dry Eye Syndrome Treatment Market Trends

The Europe dry eye syndrome treatment market is driven by an increase in research funding and the local presence of key market players. The number of biopharmaceutical companies is growing in Europe, owing to increasing investments. For instance, in 2021, EIT Health, an EU-funded program initiated to improve health, chose two innovation teams to get additional support over the next 2 years: PeriVision from Switzerland and INVENTION from Sweden. The teams have received up to USD 1.70 million (EUR 1.5 million) in investment to provide novel, effective, and safe technology to Europeans with debilitating eye and visual disorders in the region.

The UK dry eye syndrome treatment market is expected to grow significantly in the forecast period. The increasing prevalence of dry eye diseases in the UK is one of the major factors driving the market growth. According to data published by eyecare expert, Théa UK, it is estimated that 34% of the total population in the UK, representing one in every three people, is diagnosed with dry eye disease. Moreover, healthcare organizations and government authorities work together in the UK to organize campaigns to spread awareness about eye conditions leading to probable increase in adoption of DED treatments.

The Germany dry eye syndrome treatment market is experiencing significant growth in Europe. Some of the key players operating in the region are OmniVision GmbH and Novaliq GmbH. Pharmaceutical R&D sector is developing with a rapid pace in the country, contributing in the growth of the market. For instance, in March 2023, Optima Pharmazeutische launched TEARS AGAIN Complete, a new combination pack designed to address the various forms of the disease effectively.

Asia Pacific Dry Eye Syndrome Treatment Market Trends

The Asia Pacific dry eye syndrome treatment market is expected to grow with a significant CAGR over the forecast period. This region consists of multiple countries which can be classified under economically developing and developed nations. Increasing healthcare expenditure in the region is anticipated to fuel market growth. Also, rising geriatric population and growing awareness of dry eye syndrome are among the major factors driving the market in this region.

The China dry eye syndrome treatment market is growing at a lucrative rate. Presence of government funding and initiatives in the region further fuels regional growth. In addition, China Pharma Holdings plans to launch its patented Dry Eye Disease Therapeutic Device in China through its subsidiary, Hainan Helpson Medical and Biotechnology Co., Ltd., in the first quarter of 2025. The device has undergone commercialization, registration, application processes, production commissioning, and third-party testing.

Latin America Dry Eye Syndrome Treatment Market Trends

The Latin America dry eye syndrome treatment market exhibits high growth potential in the forecast period due to increasing awareness of eye health, rising incidences of DED, and advancements in treatment options. Factors contributing to the market expansion include the growing aging population, high prevalence of digital device usage, and environmental factors such as pollution and climate changes exacerbating dry eye symptoms.

The Brazil dry eye syndrome treatment market is projected to exhibit steady growth over the forecast period due to strategic product launches in the region. For instance, in May 2021, Nemera, a drug delivery device solutions provider, launched Novelia, a multidose eye dropper. The Brazilian regulatory authority for preservative-free formulations, ANVISA, has approved this product.

Middle East and Africa Dry Eye Syndrome Treatment Market Trends

The MEA dry eye syndrome treatment market growth driven by high prevalence of dry eye disease, rise in consumer awareness, and improvements in healthcare infrastructure. MEA is a largely untapped market for dry eye treatment drugs, with the presence of lucrative opportunities for players. Economic development witnessed in emerging markets, such as South Africa, and high unmet healthcare needs are some of the primary factors driving the growth of this market.

The Saudi Arabia dry eye syndrome treatment market is anticipated to grow in the coming years. Due to low humidity in the region and increased use of gadgets such as smartphones, computers, and visual display terminals is further driving the growth of the market. Moreover, extreme hot or cold weather, air-conditioned cars, air-conditioned offices, and airplane cabins are leading to an increase in the number of people experiencing damage to their tear film. These factors are contributing to the regional market growth.

Dry Eye Syndrome Treatment Market Share Insights

The market is highly competitive due to several strategic initiatives such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Dry Eye Syndrome Treatment Companies:

The following are the leading companies in the dry eye syndrome treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novartis AG

- AbbVie, Inc.

- Sun Pharmaceutical Industries Ltd.

- Santen Pharmaceutical Co Ltd.

- AFT Pharmaceuticals

- Johnson & Johnson Services, Inc.

- Otsuka Pharmaceutical Co., Ltd. (subsidiary of Otsuka Holdings Co., Ltd.)

- OASIS Medical

- Oyster Point Pharma, Inc. (acquired by Viatris Inc. in January 2023)

- Bausch Health Companies, Inc.

View a comprehensive list of companies in the Dry Eye Syndrome Treatment Market

Recent Developments

-

In October 2024, Novaliq and Laboratoires Théa announced that, Vevizye received approval from Europen commission to market the product for treating dry eye disease in adults. It is the first and only water-free ciclosporin 0.1% eye drop solution to receive approval in Europe.

-

In June 2024, Oculis reported Phase 2b positive results for licaminlimab, anti-TNFα eye drop, shows significant improvement in multiple DED signs. The drug, effective in patients with a specific TNFR1 genetic biomarker, demonstrated rapid and notable reduction in corneal inflammation. Licaminlimab was well tolerated with similar side effects to a vehicle.

-

In May 2024, Nordic Pharma, Inc. launched LACRIFILL Canalicular Gel, a novel dry eye treatment cleared by the FDA. This cross-linked hyaluronic acid gel temporarily blocks tear drainage by occluding the canalicular system, allowing natural tears to bathe the eyes. Administered via a simple in-office procedure, it lasts for six months and is reimbursed under CPT code 68761. Nordic Pharma is showcasing LACRIFILL at Kiawah Eye 2024, highlighting its potential to enhance ophthalmic practices. Nordic Pharma, part of SEVER Life Sciences, focuses on specialty pharmaceuticals and has a global presence.

Dry Eye Syndrome Treatment Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2025 |

USD 6.70 billion |

|

The revenue forecast in 2030 |

USD 9.20 billion |

|

Growth rate |

CAGR of 6.5% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, drugs, product, dosage form, sales channel, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Novartis AG; AbbVie, Inc.; Sun Pharmaceutical Industries Ltd.; Santen Pharmaceutical Co. Ltd.; AFT Pharmaceuticals; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd. (subsidiary of Otsuka Holdings Co., Ltd.); OASIS Medical; Oyster Point Pharma, Inc. (acquired by Viatris Inc. in January 2023); Bausch Health Companies, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Dry Eye Syndrome Treatment Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the dry eye syndrome treatment market on the basis of type, drugs, product, dosage form, sales channel, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Evaporative Dry Eye Syndrome

-

Aqueous Deficient Dry Eye Syndrome

-

-

Drugs Outlook (Revenue, USD Million, 2018 - 2030)

-

Xiidra

-

Restasis

-

Cequa

-

Tyrvaya

-

Eysuvis

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Artificial Tears

-

Cyclosporine

-

Topical Corticosteroids

-

Punctal Plugs

-

Oral Omega Supplements

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Eye Drops/ Solutions

-

Ointments and Gels

-

Capsules & Tablets (For Supplements)

-

Other Dosage Forms

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

OTC

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Hospital Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dry eye syndrome treatment market size was estimated at USD 6.29 billion in 2024 and is expected to reach USD 6.70 billion in 2025.

b. The global dry eye syndrome treatment market is expected to grow at a compound annual growth rate of 6.56% from 2025 to 2030 to reach USD 9.20 billion by 2030.

b. North America dominated the dry eye syndrome treatment market with a share of 42.7% in 2024. The presence of a wide target population, better access to healthcare, and a high rate of treatment adoption are anticipated to drive market growth in this region. A supportive regulatory framework eases the market entry for novel products.

b. Some key players operating in the dry eye syndrome treatment market are Novartis AG; AbbVie, Inc.; Sun Pharmaceutical Industries Ltd.; Santen Pharmaceutical Co., Ltd.; AFT Pharmaceuticals; Johnson & Johnson Services, Inc.; Otsuka Pharmaceutical Co., Ltd.; OASIS Medical.; Oyster Point Pharma, Inc., Bausch & Lomb

b. Key factors that are driving the market growth include the growing demand for effective treatments, the rising prevalence of dry eye disease, the presence of a lucrative pipeline, and increasing awareness amongst the population about the condition.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."