Drug Discovery Outsourcing Market Size, Share & Trends Analysis Report By Drug Type (Small, Large Molecules), By Workflow, By Therapeutics Area, By Service Type, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-392-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Drug Discovery Outsourcing Market Trends

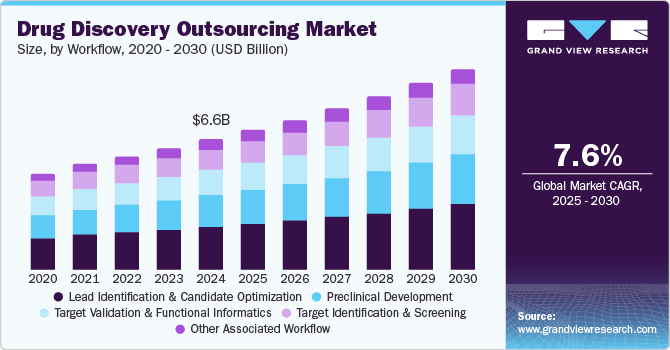

The global drug discovery outsourcing market size was estimated at USD 6.62 billion in 2024 and is expected to grow at a CAGR of 7.58% from 2025 to 2030. The changing scenarios for the contract research landscape offering fully integrated research and development services to multinational biotechnology, pharmaceutical & medical device companies, and academic & government institutions that seek the flexibility to access high-quality, early-stage drug development expertise from drug discovery to drug development is fueling market growth. Furthermore, most emerging biopharma companies rely on outsourcing services due to the growing number of clinical trials and increasing drug discovery, which is expected to drive the demand for outsourcing services. In addition, the number of market players serves as an extension of the drug development team, providing expertise & guidance on the design and conduct of drug trials.

For instance, Life Science Strategy Group survey of 120 clinical development decision-makers in the U.S., China, & Europe industry professionals are undertaking strategic changes to maintain their share in the unpredictable market scenario. In addition, the pharmaceutical industry has witnessed radical changes in the past two decades regarding patent expiration, a shift toward biologics, & unprecedented downsizing of internal discovery of big pharmaceuticals. All of this has accelerated the adoption of outsourcing activities. Breaking down the different steps of drug discovery, such as hit confirmation, lead generation, lead optimization, & high-speed screening, allows players to specialize in their core services.

In addition, outsourcing has become a significant part of the pharmaceutical industry as most companies seek to minimize inefficiencies around the existing -successful approach to drug discovery. As such, most pharmaceutical companies seek to utilize technologies they are unable to rationalize in-house. In addition, drug discovery is emerging at a rapid pace with a rising global R&D pipeline and growing service expansions. For instance, around 75.0% to 80.0% of research and development spending in the biopharmaceutical industry can be outsourced, further propelling new growth opportunities for CROs, which is expected to boost market growth. Pharmaceutical companies are partnering with manufacturing facilities in developing countries, backed by skilled workforces, low costs, and quality data. Cost-cutting, innovation, gaining access to knowledge and technology, and increasing speed and agility are significant factors encouraging pharma companies to expand the level of outsourcing.

Furthermore, the market competition is driven by high quality and strict compliance to regulations worldwide, international scientific excellence, especially in the most demanded research areas, speed and unbeatable timelines to delivery, and complex, competitive prices. In addition, companies are increasingly collaborating and leveraging expertise, which is expected to drive the drug discovery outsourcing industry. Organizations are undertaking and extending strategic partnerships with many academic institutions, venture capitalists for funding, and other public or private companies to exploit patented technology, molecules, and more. Rising partnerships among public and private entities accelerate drug discovery processes, increasing the global demand for outsourcing.

In addition, growing competition among market key players, leading to the emergence of various new startups across the hotspot countries, such as the U.S., India, China, South Korea, Singapore, & other Southeast Asian countries. For instance, in July 2023, Teijin Limited & Axcelead, Inc. announced a drug discovery research joint venture company in 2024. It will investigate & identify candidate compounds for upcoming drugs and further support the drug discovery research. This is expected to grow its drug discovery services globally by leveraging companies' strengths in knowledge, technology, & assets.

However, on a brighter note, generous incentives are expected for pharmaceutical companies to invest in developing Infectious Diseases (ID) drugs and vaccines. Public health challenges in oncology, heart disease, and many other rare conditions still exist. For these, clinical research must go on. Here, CROs are expected to use their creativity to the fullest. With an urgent need for an effective vaccine/drug, companies are increasingly opting for outsourcing to enhance their clinical trials, which is expected to boost the market growth for several years.

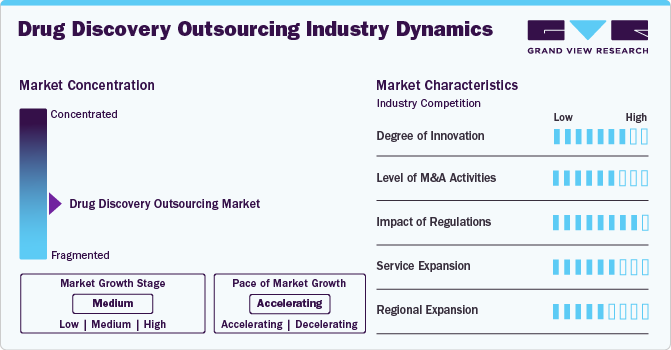

Market Concentration & Characteristics

The drug discovery outsourcing industry growth stage is medium, and growth is accelerating. The market is characterized by the level of M&A activities, degree of innovation, regulatory impact, product expansions, and regional expansions.

Recent advances in compound screening instruments are expected to influence R&D. In addition, robotic systems and AI integration are revolutionizing high-throughput screening, further driving market growth. Proteomics is also being used as a valuable tool to reveal the biochemical changes and mechanisms of diseases. According to researchers, it has the potential to determine new drug targets, especially for cancer treatment.

The market is dynamic due to stringent global regulatory standards and the need to comply with agencies such as the FDA, EMA, & other regional authorities. Regulatory requirements mandate rigorous quality control, documentation, and traceability, compelling CDMOs to maintain high standards of GMP. The evolving environmental sustainability, safety, & efficacy regulations further impact the market, necessitating continuous updates and adherence to new guidelines, which can influence market competition and growth.

Small- and Medium-Sized Enterprises (SMEs) lack the resources and capital to conduct long-term drug R&D, coupled with the fact that discovering and developing novel mechanisms of action is a complex and expensive task. This factor has led to rising strategic partnerships and mergers among companies to expand their global reach and service offerings. This competitive dynamic can further enhance the overall market and positively influence the market dynamics.

The increasing outsourcing requirement for the production of specialized drugs with cost efficiency is expected to boost the market. In addition, the implementation of initiatives such as the new Drug Discovery Initiative (DDI), under which clinicians, researchers, and industry collaborate to develop promising drugs and delivery methods for improving human health, fuels the market.

CDMOs are expanding their global footprint to cater to increased client needs and access new markets. This includes establishing facilities in emerging markets to capitalize on growing demand and lower operating costs, further fueling the market growth.

Workflow Insights

On the basis of workflow segment, the market is segmented into target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and other associated workflow.Lead identification & candidate optimization segment gained a largest market share of 32.19% in 2024. This workflow of drug development involves the Quantitative Structure-Activity Relationship (QSAR) and structure-based optimization of generated lead compound. Besides, these techniques involve many in silico, in vitro & in vivo approaches that have been thoroughly tested & proven reliable.

Furthermore, the rising need for skilled resources combined with knowledge of computer software, along with the high cost associated with the integration of the latest computation technology is enabling a higher outsourcing for lead identification services. Besides, the knowledge of metabolism and analytical chemistry play an important role in generating the need for these services. In addition, the introduction of advanced in silico techniques to improve the lead identification process i.e. Computer-Aided Drug Discovery & structure-based drug designs) support the growth. For example, the most frequently used lead optimization methods include MS & NMR methods. The iterative process of lead identification is a significant stage in early drug discovery. It has historically proven to have improved efficiencies and economies of scale for drug developers.

In addition, success of lead optimization in drug discovery & safety requires knowledgeable & collaborative scientists at a CRO that invests in technology. The presence of considerable tools for predicting drug safety using techniques drives the segment's growth. Huge investment by key pharmaceutical companies in drug discovery is anticipated to boost revenue of the segment.

On the other hand, the other associated services segment is expected to witness growth at a CAGR of 7.96% over the forecast period. The other related services segment includes analytical/bioanalytical methods, cell line development, upstream & downstream processes, formulation & quality assessment, and regulatory assistance, is expected to grow rapidly in the coming years. This is due to increased adoption of outsourcing services and investments in drug discovery research and development activities. Such factors are anticipated to drive the segment growth.

Therapeutics Area Insights

On the basis of therapeutics area segment, the market is segmented into Respiratory System, Pain and Anesthesia, Oncology, Ophthalmology, Hematology, Cardiovascular, Endocrine, Gastrointestinal, Immunomodulation, Anti-Infective, Central Nervous System, Dermatology, and Genitourinary System.

The respiratory systems segment dominated the global drug discovery outsourcing market and accounted for a revenue share of 14.16% in 2024. High incidence of respiratory disorders, such as bronchitis, Chronic Obstructive Pulmonary Diseases, tuberculosis, and asthma, coupled with increasing cases of drug resistance, has influenced the growth of segments. For instance, COPD affects 11.7 million adults accounting for majority of emergency department visits and 10 billion in healthcare costs annually. Furthermore, the introduction of novel drug delivery technologies, such as nasal sprays, has been identified to be the key contributor to the segment revenue. Lung diseases are responsible for hospital admissions and over millions of inpatient bed-days in the U.S. per year. In addition, for COPD around 90% of deaths under 70 years occur in low- to middle-income countries. The disease is the eighth leading cause of poor health across the globe. In these regions, the tobacco smoking accounts for 30-40% of COPD cases, and air pollution is a major risk factor.

In addition, oncology segments are anticipated to grow as the fastest-growing segment during the forecast period. Increased focus on the identification of novel targets to support cancer treatment contributes to the lucrative growth of the oncology segment. In addition, research focused on the tumor microenvironment, including cancer-associated fibroblasts, immune cells, and extracellular matrix, which is expected to drive the segment growth. Furthermore, emerging new immunotherapies, including bispecific antibodies, CAR-T therapies, and tumor vaccines, are gaining increasing its demand to improve response rates and broaden the scope of immunotherapy to different cancer types. Moreover, private players provide biophysical, biochemical, and cellular assay systems for oncology targets, which include tumor microenvironment, tumor metabolism, cancer immunology, and other assays. For instance, U.S. FDA mentioned that as of 2023, the global oncology pipeline mentioned 16 oral medications & 6 injectable drugs, with 6 drugs dedicated to breast cancer and 3 aimed for non-small cell lung cancer.

Drug Type Insight

On the basis of drug type segment, the market is segmented into Small Molecules, and Large Molecules (Biopharmaceuticals). The small molecules/pharmaceuticals segment accounted for the largest share in 2024 during the forecast period. Small molecule synthesis is a viable pathway in drug discovery and development for novel and generic products. Small molecules differ from other types of drug compounds such as proteins and biologics. Small molecules developed for oncology therapies penetrate the cell wall and target the cell. Small molecules are thus used in cytotoxic chemotherapy to exploit the generic vulnerabilities of a tumor. Most of the new drugs in the market are based on this capability of small molecules.

Most of the new drugs in the market are based on this capability of small molecules. Sales of the specialty medicines are increasing owing to small molecule applications. For instance, in 2024, the U.S. FDA Center for Drug Evaluation and Research approved 50 new molecular entities, consisting of 32 chemical entities & 18 biologic entities. Of the NCEs, small molecules gained major attention and share, making up 91% (31 drugs), with the remaining drugs comprising peptides and nucleic acids. Small molecules continue to play a vital role in the innovation of treatments across therapeutic areas such as cardiovascular, oncology, autoimmune, and respiratory diseases.

Increased significance and effective components add up to the potential of small molecules in the pharmaceutical portfolio. Furthermore, the benefits of small molecules over larger ones has led rise in investments in the field, especially in cancer research. These molecules can be administered orally for the chronic diseases treatment as these are cheaper, easy to manufacture, and can be combined with intracellular targets. The continuous ongoing studies to investigate and develop novel therapeutics for indications are likely to drive the market segment.

In addition, large molecules are anticipated to grow as the fastest-growing segment during the forecast period. Large molecule (biopharmaceuticals) are protein-based class of drugs that consist of more than 1,300 amino acids essentially optimized by versions of endogenous human proteins. These molecules hold great promise for disease diagnosis and prevention as demonstrated by early phase clinical trials. Moreover, significant investment for drug development entities are anticipated to drive the segment in the coming years.

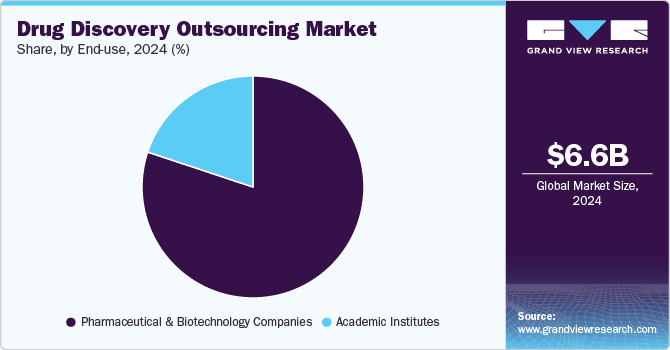

End Use Insight

On the basis of end use segment, the market is segmented into Pharmaceutical & Biotechnology companies, Academic Institutes, and Others. The pharmaceutical & biotechnology companies segment dominated the market with the largest revenue share in 2024. The high growth of the segment is majorly due to the growing rate of pipeline therapeutics, high R&D investment to develop innovative therapeutics, and increasing outsourcing to reduce costs & focus on core competencies. The growing R&D pipeline is expected to have a positive impact on the market. Furthermore, the burden of chronic and infectious diseases is rising steadily worldwide. The growing burden of these diseases is expected to increase the interest of pharmaceutical and biopharmaceutical companies in developing new drugs. This is further expected to promote market growth.

On the other hand, the academic institutes segment is projected to grow at a significant CAGR during the forecast period. The segment is driven by significant amount of funding provided for drug discovery research to research institutions, which is one of the key reasons driving this segment. Furthermore, collaboration agreements with market players and research institutes have further promoted segment growth. For instance, Evotec mentioned a multiyear partnership with the Medical Center Hamburg-Eppendorf for the development of cell therapy treatment for heart failure. Adoption of such strategies by market players in the future is likely to have a positive impact on market growth.

Service Type Insight

On the basis of service type segment, the market is segmented into Chemistry Services, and Biology Services. The chemistry segment dominated the market with the largest revenue share in 2024, owing to increasing number of outsourcing projects for small molecules across the industry. Furthermore, the availability of drug discovery service providers offering high-quality services for drug chemical synthesis is increasing the demand for chemistry service outsourcing, particularly among small and midsized pharmaceutical companies lacking drug discovery research capabilities.

On the other hand, the biology services segment is projected to grow at a CAGR of 6.56% during the forecast period. The growing demand for technical experts to conduct drug discovery services while maintaining regulatory requirements is one of the key factors promoting segment growth. In addition, the presence of a number of biology drug discovery service providers, such as Aurigene Pharmaceutical Services Ltd., Syngene International Limited, and Eurofins is further supporting segment growth.

Regional Insights

North America is projected to register a significant CAGR during the forecast period. This can be attributed to technological advancements, well-established research infrastructure & market players, higher investments in drug discovery R&D, and the local presence of major players involved in intensive investigations of new drug candidates against various diseases. Moreover, the increase in disease-related morbidity and mortality has led to the discovery of more drug candidates, thereby driving the growth in this region. In addition, the region’s growing research and development investment, rise in the incidence of various diseases, and increasing need for efficiency, quality, and innovation are driving the growth of the drug discovery outsourcing industry in North America. In addition, public-private partnerships formed to develop novel drug molecules are expected to impact market growth in this region dramatically. Moreover, growing extensive drug development activities, several pharmaceutical & biotech companies, and a surge in regional clinical trials are some factors boosting the market.

U.S. Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in the U.S. held the largest share in 2024. The growing need for innovative drug options, escalating disease prevalence, and the surge in public-private partnerships focused on developing new molecules have significantly fueled the collaborations between drug developers and service providers. In addition, these collaborations have contributed to the increased market size. For instance, in September 2023, Charles River Laboratories International, Inc. and Related Sciences mentioned the collaboration to utilize an AI-powered drug solution, Logica, for drug discovery on previously unexplored targets. The partnership will exemplify the growing trend in the U.S. market towards AI technologies enhancing efficiency and innovation. Such factors are expected to drive the country’s growth.

Europe Drug Discovery Outsourcing Market Trends

The drug discovery outsourcing market in Europe is expected to grow significantly due to the rising demand for biopharmaceutical products and the increasing need for new drugs to treat complex diseases. In addition, the European market has a highly skilled workforce, well-developed infrastructure, and favorable regulatory policies, making it a preferred destination for pharmaceutical companies to outsource their drug discovery activities. Furthermore, with the increasing adoption of personalized medicine and the need for precision medicine, Europe's drug discovery outsourcing market is expected to witness steady growth in the coming years.

The drug discovery outsourcing market in Germany held the largest share in 2024. German drug discovery outsourcing plays a critical role for pharmaceutical manufacturers owing to growing new drug candidates’ development in collaboration with many research institutions & organizations. This factor is expected to bridge a gap between the discovery of new treatment approaches, their preclinical development, and clinical testing, as well as encourage the participation of larger pharmaceutical firms. Moreover, collaborations among enterprises to develop novel drugs are anticipated to drive market growth over the estimated time. For instance, in November 2024, BioPharmaSpec mentioned opening three new European facilities in Germany, Freiburg, Bergamo, Italy, and Vilnius, Lithuania, which will focus on discovery and R&D services. Such factors are anticipated to drive the market.

The drug discovery outsourcing market in the UK is anticipated to grow over the forecast period. This growth is primarily due to the growing discovery of high-quality drug molecules, and the presence of top-notch companies such as AstraZeneca, Bayer Pharma, Merck KGaA, Lundbeck, UCB Pharma, Janssen Pharmaceuticals, and Sanofi is anticipated to drive the requirement for the drug discovery outsourcing market.

Asia Pacific Drug Discovery Outsourcing Market Trends

Asia Pacific market held the largest market share of 45.99% in 2024. This growth can be attributed to various factors, such as rising healthcare expenditure and growing demand for pharmaceutical products. In addition, the region is emerging as a hub for outsourcing drug discovery activities owing to the lower costs, favorable regulatory environment, and quality data. In addition, a growing number of ongoing studies in the region for drug discovery, private-public collaborations, and government initiatives are some of the key factors likely to propel the growth of the Asia Pacific drug discovery outsourcing industry.

The drug discovery outsourcing market in China held the largest share in 2024. The country is one of the major hubs for drug discovery as it supports minimizing the cost of drug discovery and a skilled workforce; hence, outsourcing services has become one of the most favored strategies adopted globally. In addition, recent trends have shown that the increasing percentage of clinical trials being performed will likely drive the market. Besides, many outsourcing providers offer excellent drug/therapy development and manufacturing services.

Japan, being the second-largest drug discovery outsourcing market at a global level, is expected to provide a robust opportunity for drug discovery outsourcing services, thus driving the market. The country has the fastest aging population in the world and is developing a demographic trend that results in a higher incidence of cancer. This makes Japan a lucrative market for drug discovery outsourcing.

The drug discovery outsourcing market in India is anticipated to witness growth at a significant CAGR over the forecast period owing to the growing number of low costs of drug discovery services, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. Furthermore, various initiatives undertaken by the government and investments in R&D programs are further boosting market growth in the country. For instance, the operational costs in India are comparatively lower than in other countries, which certainly presents economic benefits for multinational companies. Increased government funding for R&D to accelerate new product development has made India one of the most favored locations for research activities. These factors are anticipated to drive the market in India.

Key Drug Discovery Outsourcing Company Insights

Market players are undertaking various strategic initiatives, such as the launch of new product partnerships, collaborations, and mergers & acquisitions, to strengthen their service portfolio and provide a competitive advantage. For instance, in October 2023, Pharma Solutions mentioned the screening facility launch that will drive its in-vitro biology capabilities at its India’s drug discovery services site. It will add primary and secondary screening of compounds at the facility.

Key Drug Discovery Outsourcing Companies:

The following are the leading companies in the drug discovery outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- EVOTEC

- Pharmaceutical Product Development, LLC

- Charles River Laboratories

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

View a comprehensive list of companies in the Drug Discovery Outsourcing Market.

Recent Developments

-

In October 2024, Samsung Biologics mentioned a launch of high-concentration formulation platform to support developing and manufacturing high-dose biopharmaceuticals. S-HiConTM can identify unintended pH changes, reduce viscosity, enhance efficacy, enhance formulation stability, and maximize drug delivery.

-

In April 2024, Scantox mentioned the acquisition of QPS Neuropharmacology. With the acquisition the company’s value chain coverage is expanded significantly with market-leading CNS research capabilities.

-

In December 2023, MilliporeSigma mentioned launching AIDDISON drug discovery software. This software-as-a-service platform bridges the gap between real-world manufacturability & virtual molecule design through Synthia retrosynthesis software API integration.

Drug Discovery Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.10 billion |

|

Revenue forecast in 2030 |

USD 10.23 billion |

|

Growth rate |

CAGR of 7.58% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Workflow, therapeutics area, drug type, service type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherland; Belgium; Switzerland; Russia; Sweden; Japan; China; India; Thailand; South Korea; Australia; Malaysia; Indonesia; Singapore; Philippines; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Israel; Egypt |

|

Key companies profiled |

Pharmaceutical Product Development, LLC; Charles River Laboratories; WuXi AppTec; Merck & Co., Inc.; Thermo Fisher Scientific Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; DiscoverX Corp.; QIAGEN; Eurofins SE; Syngene International Limited; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.; Domainex Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drug discovery outsourcing market report based on workflow, therapeutics area, drug type, service type, end use, and region.

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Other Associated Workflow

-

-

Therapeutics Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory system

-

Pain and Anesthesia

-

Oncology

-

Ophthalmology

-

Hematology

-

Cardiovascular

-

Endocrine

-

Gastrointestinal

-

Immunomodulation

-

Anti-infective

-

Central Nervous System

-

Dermatology

-

Genitourinary System

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecules

-

Large Molecules (Biopharmaceuticals)

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemistry Services

-

Biology Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology companies

-

Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherland

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

-

South Korea

-

Australia

-

Malaysia

-

Indonesia

-

Singapore

-

Philippines

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global drug discovery outsourcing market size was estimated at USD 6.62 billion in 2024 and is expected to reach USD 7.10 billion in 2025.

b. The global drug discovery outsourcing market is expected to grow at a compound annual growth rate of 7.58% from 2025 to 2030 to reach USD 10.23 billion by 2030.

b. Asia Pacific dominated the drug discovery outsourcing market with a share of 45.99% in 2024. This is attributable to the higher adoption of technological advancements, the presence of well-established research infrastructure, the presence of key players, and higher investments in drug discovery R&D.

b. Some key players operating in the drug discovery outsourcing market include Pharmaceutical Product Development, LLC, Charles River Laboratories, WuXi AppTec, Merck & Co., Inc., Thermo Fisher Scientific Inc., Dalton Pharma Services, Oncodesign, Jubilant Biosys, DiscoverX Corp., QIAGEN, Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., Domainex Ltd.

b. Key factors that are driving the drug discovery outsourcing market growth include increasing trends of partnerships in drug discovery research; rising incidence rate of metabolic, genetic, and other chronic diseases; technology advancements in drug discovery.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."