- Home

- »

- Next Generation Technologies

- »

-

Drone Warfare Market Size, Share And Growth Report, 2030GVR Report cover

![Drone Warfare Market Size, Share & Trends Report]()

Drone Warfare Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Fixed-wing, Hybrid, Rotary-wing), By Range, By Operation Mode, By Capability, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-446-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Drone Warfare Market Summary

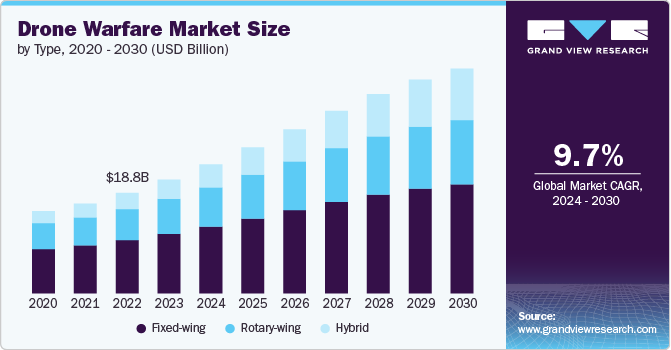

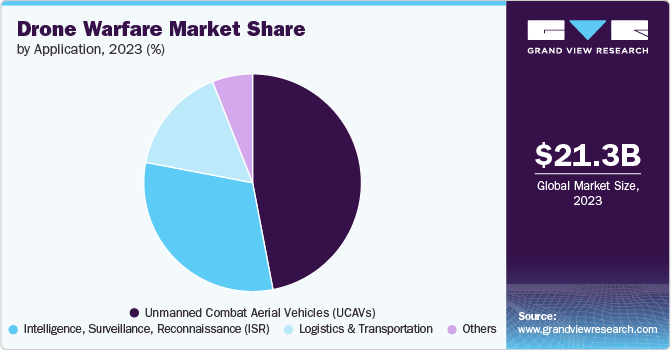

The global drone warfare market size was estimated at USD 21.30 billion in 2023 and is projected to reach USD 42.10 billion by 2030, growing at a CAGR of 9.7% from 2024 to 2030. The surge in global military spending is a primary market driver.

Key Market Trends & Insights

- North America accounted for the highest revenue share of 36% in 2023.

- U.S. is projected to grow at a CAGR of 6.7% from 2024 to 2030.

- By type, fixed-wing segment accounted for the largest market share, over 52% in 2023.

- By range, beyond visual line of sight (BVLOS) segment accounted for the largest market share in 2023.

- By capability, platform segment accounted for the largest share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 21.30 Billion

- 2030 Projected Market Size: USD 42.10 Billion

- CAGR (2024-2030): 9.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Countries invest heavily in advanced defense technologies, recognizing drones' strategic advantages in surveillance, reconnaissance, and targeted strikes. This trend is fueled by escalating geopolitical tensions and the need for nations to maintain military superiority, leading to a growing demand for sophisticated drone systems equipped with advanced sensors and autonomous capabilities.

Rapid advancements in drone technology are reshaping military operations. Innovations in artificial intelligence (AI), machine learning (ML), and sensor technology are enhancing the capabilities of unmanned aerial vehicles (UAVs). These developments allow for improved autonomous flight, target recognition, and mission planning, making drones more effective and efficient in various military applications. The integration of cutting-edge technologies is expected to drive further market growth as military forces seek to leverage these advancements for operational superiority, thereby creating lucrative opportunities for market expansion.

In addition, the increasing focus on counterterrorism operations is propelling the market growth. Drones offer significant advantages in conducting intelligence gathering and precision strikes in hostile environments, minimizing risks to personnel. Governments and defense agencies are investing in drone technologies to enhance their capabilities in counterterrorism efforts, leading to a heightened demand for advanced UAV systems.

Furthermore, network-centric warfare, which emphasizes integrating information technology, communication systems, and combat units, is driving the adoption of drones in military operations. Drones are increasingly used as key components in network-centric warfare strategies, providing real-time data, enhancing situational awareness, and enabling coordinated attacks. The ability to seamlessly integrate drones with other military assets, such as manned aircraft and ground forces, is a significant trend that is shaping the future of drone warfare. This shift led to developing more sophisticated and interoperable drone systems designed to operate within complex military networks.

Moreover, the push towards autonomy in military operations drives the development and deployment of autonomous and swarm drone technologies. Autonomous drones, equipped with advanced AI and machine learning algorithms, can carry out missions with minimal human intervention, making them highly effective in complex, high-risk environments. As AI technology advances, its incorporation into drone warfare is expected to drive market expansion in the coming years.

Type Insights

The fixed-wing segment accounted for the largest market share, over 52% in 2023, driven by its superior operational efficiency and extended flight times compared to rotary drones. Its ability to cover vast areas without frequent recharging or refueling makes it increasingly favored in surveillance, reconnaissance, and combat missions. The design of fixed-wing drones, which support higher speeds and altitudes, aligns with the evolving needs of modern military applications, further fueling their adoption.

The hybrid segment is expected to witness the fastest CAGR of 14.4% from 2024 to 2030, driven by the rising interest in hybrid drones, which merge the advantages of fixed-wing and rotary-wing designs. Their ability to take off and land vertically like helicopters while maintaining the endurance and speed of fixed-wing aircraft offers unparalleled versatility. This adaptability is increasingly valued in military applications where rapid deployment and flexible mission profiles are essential, driving significant growth in the hybrid segment in the years ahead.

Range Insights

The beyond visual line of sight (BVLOS) segment accounted for the largest market share in 2023, reflecting a growing trend toward leveraging drones for operations beyond the operator's visual range. This shift underscores the increasing importance of BVLOS capabilities in modern warfare, where situational awareness and tactical superiority are critical. The ability to conduct long-range surveillance and strike missions without exposing operators to direct threats is becoming a key strategic advantage, driving the widespread adoption of BVLOS technologies in military applications.

The extended visual line of sight (EVLOS) segment is expected to witness a significant CAGR from 2024 to 2030, driven by advancements in communication technologies. These innovations enhance control and monitoring capabilities over longer distances, making EVLOS increasingly attractive for missions that demand detailed situational awareness without requiring immediate visual confirmation. As the need for precise and reliable remote operations grows, EVLOS is emerging as a critical component in the evolving drone technology industry.

Operation Mode Insights

The semi-autonomous segment accounted for the largest market share in 2023. The growing trend towards drones that can operate autonomously while still allowing human oversight is driving segmental growth. This balance of control appeals to military organizations looking to enhance operational efficiency while maintaining command over critical missions.

The autonomous segment is expected to witness the fastest CAGR from 2024 to 2030, driven by the rapid advancements in artificial intelligence and machine learning. These technologies enable drones to perform complex tasks independently, thus increasing their utility in various military applications. Fully autonomous drones can execute missions with little or no human input, increasing operational efficiency and reducing risks associated with human error. As technology evolves, military organizations will likely invest more heavily in autonomous systems that adapt dynamically to changing battlefield conditions.

Capability Insights

The platform segment accounted for the largest share in 2023. This growth can be attributed to the strong demand for diverse drone platforms tailored to specific military needs. This segment's growth is fueled by ongoing investments in upgrading existing platforms and developing new ones that meet evolving military requirements.

The software segment is anticipated to record the fastest growth from 2024 to 2030, driven by the increasing reliance on advanced algorithms for mission planning, target recognition, and data analysis, enhancing drone missions' effectiveness.Advanced software enables real-time data analysis, mission planning, navigation control, and communication among multiple units on the battlefield. As military operations increasingly rely on integrated systems for coordination and efficiency, software development will play a crucial role in shaping future drone warfare strategies.

Application Insights

The unmanned combat aerial vehicles (UCAVs) segment accounted for the largest market share in 2023, reflecting a growing trend in modern warfare strategies. UCAVs are increasingly becoming the cornerstone of military operations, offering precision strike capabilities while minimizing risks to personnel. This shift towards UCAVs highlights their rising preference among military planners, prioritizing effective and safe solutions for complex combat scenarios, further solidifying their role in the future of warfare.

The logistics & transportation segment is expected to witness the fastest CAGR from 2024 to 2030, marking a significant trend in military operations. As the demand for efficient supply chain solutions intensifies, drones are increasingly being deployed to transport supplies and equipment to remote or contested areas. This expanding role highlights the growing versatility of drones, extending their use well beyond traditional combat roles and solidifying their importance in modern military logistics.

Regional Insights

North America drone warfare market accounted for the highest revenue share of 36% in 2023. The North American region accounted for the highest revenue share of 29% in 2023. In North American market is driven by significant defense spending and a strong focus on military modernization. The region also leads developing and deploying cutting-edge drone technologies, including autonomous systems and AI-driven capabilities. Growing geopolitical tensions and the need for counterterrorism and border security measures further fuel market growth.

U.S. Drone Warfare Market Trends

The drone warfare market in the U.S. is projected to grow at a CAGR of 6.7% from 2024 to 2030. The U.S. Department of Defense is investing heavily in advanced unmanned systems for intelligence, surveillance, reconnaissance, and combat missions, thereby boosting military modernization and further fueling the market growth.

Europe Drone Warfare Market Trends

The drone warfare market in Europe is anticipated to grow at a CAGR of 8.2% from 2024 to 2030. European countries are investing in both original drone development and collaboration with international defense contractors to enhance their drone capabilities. Regulatory frameworks and ethical considerations are also prominent in the European market, with a strong emphasis on ensuring compliance with international laws governing drone warfare. The trend towards developing multi-role drones that can perform a variety of missions, from surveillance to combat, is gaining momentum in this region.

Asia Pacific Drone Warfare Market Trends

The drone warfare market in the Asia Pacific region is expected to grow at the highest CAGR of 12.9% from 2024 to 2030. The market growth is driven by increasing defense budgets and the need to counterbalance regional security threats. Additionally, the trend towards indigenous development and production of drones is strong in the region, as nations seek to reduce dependence on foreign technology and boost their domestic defense industries.

Key Drone Warfare Company Insights

Some key players operating in the market include Northrop Grumman Systems Corporation and RTX Corporation, among others.

-

Northrop Grumman Systems Corporation is a global aerospace and defense technology company specializing in various sectors, including unmanned systems, cyber security, C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance), and missile defense. The company has been at the forefront of drone warfare technology by developing advanced unmanned aerial vehicles (UAVs) such as the Global Hawk and the MQ-4C Triton. These systems are designed for intelligence gathering and surveillance missions, showcasing the company’s commitment to innovation in military capabilities.

-

RTX Corporation is a multinational aerospace and defense conglomerate and operates through Collins Aerospace, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. The company is involved in drone warfare by developing advanced UAV technologies and systems that enhance situational awareness and operational effectiveness for military forces globally.

Teledeyne Technologies Incorporated, and The Boeing Company are some of the emerging market participants.

-

Teledyne Technologies Incorporated is an American company specializing in instrumentation, digital imaging products, aerospace components, and software solutions. The company operates through various segments, including Digital Imaging, Instrumentation, and Aerospace and defense Electronics. It provides critical components such as sensors and imaging technologies that are essential for UAV operations. Its innovations contribute significantly to enhancing reconnaissance capabilities for military applications.

-

The Boeing Company is an aerospace company that has developed various UAV systems for military applications, including surveillance, reconnaissance, and combat missions. The company’s commitment to innovation is evident in its development of sophisticated drones, such as the MQ-25 Stingray, which enhances naval operations by providing aerial refueling capabilities.

Key Drone Warfare Companies:

The following are the leading companies in the drone warfare market. These companies collectively hold the largest market share and dictate industry trends.

- The Boeing Company

- AeroVironment, Inc.

- Parrot Drones SAS

- RTX Corporation

- General Atomics

- Teledyne Technologies Incorporated

- Skydio, Inc.

- Flyability SA

- Dronamics Global Limited

- Lockheed Martin Corporation

- Airbus SE

- Northrop Grumman Systems Corporation

- BAE Systems Plc

- Thales Group

- Kratos Defense & Security Solutions, Inc.

- AgEagle Aerial Systems, Inc.

Recent Developments

-

In June 2024, Thales Group announced the signing of three agreements with the Ukrainian industry aimed at bolstering local defense capabilities, particularly in drone warfare. These agreements focus on enhancing front-line support and include the co-development and manufacturing of an Unmanned Aircraft System (UAS) designed to carry and release munitions.

-

In February 2024, Sweden selected the Parrot Anafi USA drone from French company Parrot for its Home Guard military reserve unit. The Anafi USA, now designated as UAV 06 Skatan, features a thermal camera and a long-range zoom camera designed to operate in GPS-denied environments.

-

In February 2024, Northrop Grumman Systems Corporation announced modifications to retired Global Hawk drones, transforming them into a new variant called Range Hawks to support hypersonic testing for the U.S. Defense Department. These drones will enhance telemetry data collection during hypersonic missile launches, replacing less efficient ship-mounted sensors.

Drone Warfare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.16 billion

Revenue forecast in 2030

USD 42.10 billion

Growth rate

CAGR of 9.7% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report Capability

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Range, type, operation mode, capability, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

The Boeing Company; AeroVironment, Inc.; Parrot Drones SAS; RTX Corporation; General Atomics; Teledyne Technologies Incorporated; Skydio, Inc.; Flyability SA; Dronamics Global Limited; Lockheed Martin Corporation; Airbus SE; Northrop Grumman Systems Corporation; BAE Systems Plc; Thales Group; Kratos Defense & Security Solutions, Inc.; AgEagle Aerial Systems, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Drone Warfare Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drone warfare market report based on type, range, operation mode, capability, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Wing

-

Hybrid

-

Rotary Wing

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Visual Line of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operation Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Autonomous

-

Semi-autonomous

-

-

Capability Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Software

-

Services

-

Ground Control Station

-

Drone Launch & Recovery System

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Unmanned Combat Aerial Vehicles (UCAVs)

-

Logistics & Transportation

-

Intelligence, Surveillance, Reconnaissance (ISR)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global drone warfare market size was estimated at USD 21.30 billion in 2023 and is expected to reach USD 24.16 billion in 2024.

b. The global drone warfare market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 42.10 billion by 2030.

b. North America accounted for a market revenue share of 36% in 2023, driven by significant defense spending and a strong focus on military modernization. The region also leads in the development and deployment of cutting-edge drone technologies, including autonomous systems and AI-driven capabilities.

b. Some key players operating in the drone warfare market include The Boeing Company, AeroVironment, Inc., Parrot Drones SAS, RTX Corporation, General Atomics, Teledyne Technologies Incorporated, Skydio, Inc., Flyability SA, Dronamics Global Limited, Lockheed Martin Corporation, Airbus SE, Northrop Grumman Systems Corporation, BAE Systems Plc, Thales Group, Kratos Defense & Security Solutions, Inc., AgEagle Aerial Systems, Inc.

b. The key factors driving the drone warfare market include the surge in global military spending, rapid advancements in drone technology and the increasing focus on counterterrorism operations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.