Drone Software Market Size, Share & Trends Analysis Report By Solution (System, Application), By Architecture, By Deployment, By Application, By Industry Vertical, By Drone Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-113-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global drone software market size was valued at USD 5.45 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 18.6% from 2023 to 2030. The increasing deployment of drones in both commercial and military applications is expected to drive substantial growth in the global market for drone software. Additionally, increasing retail sales and widespread adoption of e-commerce platforms worldwide are expected to create new opportunities for the drone software industry’s expansion during the forecast period.

Moreover, the global market for drone software is experiencing robust growth, primarily driven by the rising utilization of drones in numerous sectors, which include mapping, photography, agricultural surveillance, tracking, search and rescue operations, engineering applications, shipping, and delivery, among others. The increasing adoption of drones across these diverse industries is expected to drive the market for drone software over the forecast period. For instance, in April 2023, SZ DJI Technology Co., Ltd. introduced the New Inspire 3 commercial drone, a precise, full-frame 8K, streamlined cinema drone to cater to the growing needs of movie productions. Such factors are expected to augment market growth further.

Additionally, key market players are constantly partnering and collaborating to develop new solutions and enhance user experiences with the help of hardware and software upgrades. For instance, in September 2022, AEE Technology partnered with Drone Harmony to integrate first responder UAS by AEE into Drone Harmony's Search and Rescue (S&R) Autonomous Flight System Software. As a result of this collaboration, Drone Harmony's support now extends to cover the entire range of AEE's commercial aircraft and other renowned UAV/Drone manufacturers globally, specifically for Search and Rescue missions. Such developments by key players are expected to drive the market for drone software during the forecast period.

The COVID-19 pandemic had a considerable impact on the market for drone software. Initially, there was a surge in demand for contactless delivery and surveillance solutions, leading to increased interest in drone software supporting autonomous flight and logistics capabilities. However, the industry also faced challenges due to supply chain disruptions, affecting the manufacturing and distribution of drone hardware and potentially influencing the adoption of associated software solutions.

Additionally, with lockdowns and restrictions in place, non-essential drone activities, such as aerial photography for tourism and entertainment temporarily declined, affecting the demand for certain drone software applications. However, the pandemic also accelerated the adoption of drone technology in industries such as agriculture, construction, and infrastructure inspection, as companies required remote and socially distant solutions, which is a trend expected to drive market growth.

The growing demand for drone analytics in various commercial applications is anticipated to drive the global market for drone software with substantial growth during the forecast period. Additionally, increasing capital investments, growing government projects for developing advanced drone software, and continuous technical innovations in the drone industry are expected to expand the market further. For instance, in March 2023, Quantum-Systems GmbH, in partnership with various German organizations, launched KIWA, a German government project that aims to set new milestones in forest firefighting with AI support. This project will help the government detect forest fires early using drones, data analytics, artificial intelligence, and decision support systems.

Solution Insights

The application segment accounted for the largest market share of 60.55% in 2022. This is attributed to the properties offered such as comprehensive and integrated software platforms that cater to various drone-related functionalities, including mission planning, flight management, and data analytics, among others. Furthermore, application-based solutions streamline workflows by integrating different aspects of drone operations into a single platform. This improves operational efficiency, allowing users to manage and analyze data more effectively, reducing manual efforts and saving time, which is expected to drive segment growth over the forecast period.

The system segment is expected to register significant growth over the forecast period, owing to the increasing demand for industry-specific solutions, the need for enhanced efficiency and compliance, and the continuous evolution of drone technology. In addition, system-based solutions support industry-specific sensors and payloads, enabling the collection of data and information relevant to the targeted applications, which is driving segment growth over the forecast period.

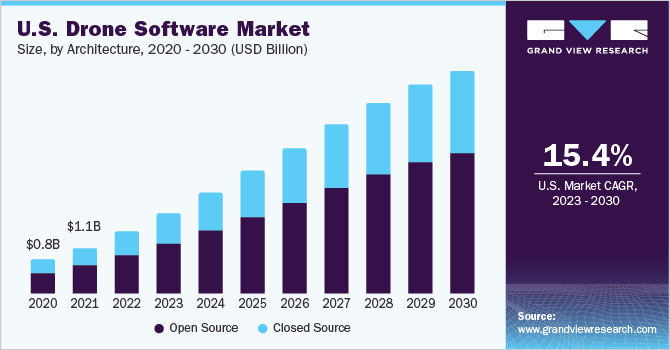

Architecture Insights

The open source segment accounted for the largest market share of around 62.0% in 2022. This share is attributed to its public availability and its ability to modify as per the requirements of the end-user. Open-source drone software is typically free to use, reducing the financial barrier for businesses and individuals looking to adopt drone technology. This cost-effectiveness is particularly attractive to smaller companies, researchers, and hobbyists who may have limited budgets, which is driving segment growth.

The closed source segment is expected to register considerable growth over the forecast period. Specific companies develop closed-source drone software, allowing them to protect their proprietary features and intellectual property. This exclusivity provides a competitive advantage and encourages companies to invest in research and development, leading to the creation of innovative and differentiated software solutions, which are expected to fuel segment growth over the forecast period.

Application Insights

The filming & photography segment accounted for the largest revenue share of 29.2% in 2022 and is expected to continue the same trend over the forecast period. An increase in the number of events being held, such as weddings, sports and race events, and educational ceremonies, among others, creates a strong demand to capture high-quality photos and videos, which augments segment growth. Furthermore, drones provide advantages to filming and photography with their small size, portability, maneuvering capabilities, and significantly low operational cost, which is expected to drive segment growth over the forecast period.

The precision agriculture segment is expected to grow significantly over the forecast period. The integration of advanced sensors and imaging technologies in drones, enabling the collection of diverse data about crops, soil conditions, and environmental factors, is expected to boost segment growth. Additionally, by leveraging these insights, agricultural professionals can make well-informed decisions and strategically optimize their farming practices for improved productivity and sustainability, which is expected to drive the precision agriculture segment’s growth during the forecast period.

Industry Vertical Insights

The media & entertainment segment accounted for the largest revenue share of 25.4% in the drone software market in 2022. The increasing adoption of drones equipped with high-quality cameras and advanced stabilization systems for aerial cinematography is driving segment growth. Furthermore, continuous improvements in drone technology, such as longer flight times and more advanced autonomous features, are factors expected to augment segment growth over the forecast period.

The logistics & transportation segment is expected to witness a significant growth of 23.3% over the forecast period. This is attributed to several advantages offered by the drone technology, such as reduced shipping and operational costs, and faster delivery, among others. Moreover, key players in the drone market are partnering with other companies of different industries to showcase their product’s ability to serve industries efficiently. For instance, in December 2022, Zipline International Inc., an American company that manufactures, designs, and operates delivery drones, extended its partnership with the government of Rwanda. This partnership includes the last-mile delivery of medicine, medical supplies, and nutrition, among others, across the region. Such examples are expected to drive segment growth over the forecast period.

Drone Type Insights

The rotary blade segment accounted for the largest revenue share of 74.2% in 2022 and is expected to continue the same trend over the forecast period. The demand for rotary blade drones is anticipated to surge for inspection activities, owing to their ability to hover and execute agile maneuvering while maintaining a visual on a particular target for prolonged periods. These drones are often seen as a suitable alternative for various business applications such as surveillance, filmmaking, photography, and monitoring, which are factors expected to drive the rotary blade segment growth during the forecast period.

The hybrid segment is expected to expand at the fastest CAGR of 22.0% over the forecast period. Hybrid commercial drones come with features of both fixed-wing and rotary-blade drones, making them more advantageous in terms of efficiency and practicality. Hybrid commercial drones enhance their efficiency and power by integrating the capabilities of batteries and fuel. Moreover, these drones can fly for long periods with heavier payloads, even in severe weather conditions, which is expected to drive the hybrid segment’s growth over the forecast period.

End-use Insights

The commercial segment accounted for the largest revenue share of 52.9% in 2022. The drone software industry is evolving, owing to the increasing enterprise application of drones across various industry verticals. Several drone manufacturers are continually testing, inventing, and upgrading software and services for diverse markets. Moreover, advancements in drone technology have reduced the cost of payloads and software systems; as a result, inspection, aerial photography, surveying, aerial mapping, and precision agriculture are witnessing significant adoption, which is expected to drive segment growth over the forecast period.

The consumer segment is expected to expand at a significant CAGR over the forecast period. Customers are increasingly exploring the benefits of drones in enriching leisure activities and interests, resulting in a significant increase in global consumer drone sales. Furthermore, technological innovations in consumer drones are driving the segment growth and this trend is expected to continue over the forecast period. For instance, in February 2022, Skyfish, a U.S. drone manufacturer, announced a technical collaboration with Sony Electronics to deliver drones with high-quality data gathering and photogrammetry capabilities. Such developments by market players are expected to drive the consumer segment growth during the forecast period.

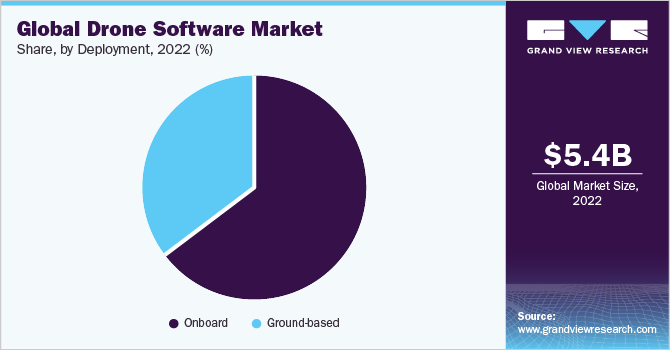

Deployment Insights

In terms of deployment, the onboard segment accounted for the highest revenue share of 65.1% in 2022. On-board deployment enables software applications to run directly on the drone's embedded systems, allowing for real-time data processing and analysis. This capability is essential for applications that require immediate responses and decision-making, such as autonomous flight control and obstacle avoidance. These properties have resulted in the strong share of the onboard segment during the forecast period.

The ground-based segment is expected to advance at the highest CAGR of 19.2% during the forecast period. With ground-based deployment, software updates and upgrades can be easily applied to the computing systems, ensuring that the latest advancements and improvements are readily available for drone operations. This flexibility allows operators to adapt to changing requirements and advancements in technology, which is expected to drive the ground-based deployment segment growth during the forecast period.

Regional Insights

The North America regional market captured the largest revenue share of 35.95% in 2022 and is expected to remain a significant contributor over the forecast period. The regional growth is attributed to the presence of key market players, along with strong drone-based infrastructure. Moreover, the growing trend of using drones as a hobby in the region is expected to drive the market growth for drone software. For instance, as of January 2023, according to the Federal Aviation Administration, there were more than 500,000 registered drones for recreation and hobbyist purposes. Such significant growth in the drone industry is anticipated to propel the growth of the regional market for drone software.

The Asia Pacific region is expected to expand at the fastest CAGR of 21.6% over the forecast period. This growth is attributed mainly to China’s vibrant drone industry, the established consumer electronics market across Japan, and the increasing demand for drones across developing countries such as India and Southeast Asian economies. The rapid technological advancements and increasing adoption of drone technology across various industries have fueled the demand for drone software solutions. The region's diverse sectors, such as agriculture, construction, infrastructure, and logistics, are recognizing the potential benefits of drones and the value they bring to their operations, which is expected to fuel the demand for the drone software industry in the region.

Key Companies & Market Share Insights

The market is highly competitive, owing to the presence of several major players specializing in drone software. The key players operating in the drone software industry are focusing on strategic alliances, mergers & acquisitions, expansions, and product development to remain competitive.

For instance, in February 2023, Skye Air Mobility, an India-based drone delivery company, launched a traffic management system for drones. The software, Skye UTM, offers drone operators in India an innovative solution, enabling them to plan routes efficiently, create flight plans, and assess potential risks before conducting drone-based operations in the country. As the first-of-its-kind platform in India, Skye UTM offers drone operators advanced capabilities, enhancing safety and streamlining operations. Such initiatives are anticipated to augment market growth over the forecast period. Some of the prominent players in the global drone software market:

-

AirMap Inc. (DroneUp, LLC)

-

DELAIR SAS

-

SZ DJI Technology Co., Ltd.

-

DroneDeploy, Inc.

-

Esri

-

Pix4D SA

-

PrecisionHawk, Inc.

-

AgEagle Aerial Systems Inc.

-

Skycatch, Inc.

-

Skydio, Inc.

-

Skyward IO, Inc.

-

Yuneec International Co., Ltd.

Drone Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 7.20 billion |

|

Revenue forecast in 2030 |

USD 23.73 billion |

|

Growth rate |

CAGR of 18.6% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, architecture, deployment, application, industry vertical, drone type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE |

|

Key companies profiled |

AirMap Inc. (DroneUp, LLC); DELAIR SAS; SZ DJI Technology Co., Ltd.; DroneDeploy, Inc.; Esri; Pix4D SA; PrecisionHawk, Inc.; AgEagle Aerial Systems Inc.; Skycatch, Inc.; Skydio, Inc.; Skyward IO, Inc.; Yuneec International Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drone Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global drone softwaremarket report on the basis of solution, architecture, deployment, application, industry vertical, drone type, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

System

-

Application

-

Flight Planning, Operations & Management

-

Data Capture

-

Data Processing & Analytics

-

Others

-

-

-

Architecture Outlook (Revenue, USD Billion, 2018 - 2030)

-

Open Source

-

Closed Source

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Onboard

-

Ground-based

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Search & Rescue

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Construction and Mining

-

Defense and Government

-

Energy and Utilities

-

Media and Entertainment

-

Logistics and Transportation

-

Others

-

-

Drone Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed Wing

-

Rotary Blade

-

Hybrid

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Consumer

-

Military

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global drone software market size was estimated at USD 5.45 billion in 2022 and is expected to reach USD 7.20 billion in 2023.

b. The global drone software market is expected to grow at a compound annual growth rate of 18.6% from 2023 to 2030 to reach USD 23.73 billion by 2030.

b. The North America region accounted for the largest share of more than 35.0% in the drone software market in 2022 and is expected to continue its dominance over the forecast period.

b. Some key players operating in the drone software market include AirMap Inc. (DroneUp, LLC), Delair SAS, SZ DJI Technology Co., Ltd., DroneDeploy, Inc., ESRI, Pix4D SA, PrecisionHawk, Inc., AgEagle Aerial Systems Inc., Skycatch, Inc., Skydio, Inc., SkyWard IO, Inc., Yuneec International Co., Ltd.

b. Key factors that are driving the drone software market growth include the integration of AI and ML algorithms, increasing deployment of drones in both commercial and military applications, and the growing retail sales and widespread adoption of e-commerce platforms worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."