Drone Sensor Market Size, Share & Trends Analysis Report By Sensor Type (Inertial Sensor, Image Sensor, Position Sensor), By Platform Type, By Application, By Technology, By End User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-446-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Drone Sensor Market Size & Trends

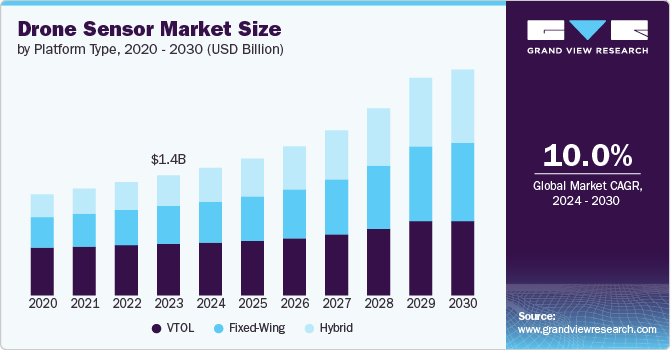

The global drone sensor market size was estimated at USD 1.42 billion in 2023 and is expected to grow at a CAGR of 10.0% from 2024 to 2030. The rising demand for high-resolution drones with advanced capabilities is significantly impacting the market. As industries seek enhanced data collection capabilities, sensors that offer improved accuracy, reliability, and real-time data processing are becoming essential. This trend is particularly evident in sectors like agriculture, where precision farming techniques require detailed aerial data for optimizing crop yields and resource utilization.

Consequently, manufacturers are investing in the development of sophisticated sensors that can meet these growing needs, incorporating features such as multispectral imaging and hyperspectral sensing. The integration of advanced technologies, such as artificial intelligence and machine learning, is further enhancing the capabilities of drone sensors, enabling them to analyze data more efficiently and make informed decisions.

The increasing demand for precision agriculture is driving the adoption of drone sensors equipped with specialized imaging technologies. Farmers are leveraging drones to monitor crop health, assess soil conditions, detect pests and diseases, and optimize resource usage, all of which require advanced sensing capabilities. This trend not only enhances agricultural productivity but also promotes sustainable farming practices by reducing waste and minimizing environmental impact. As a result, the market for drone sensors tailored for agricultural applications is expected to expand rapidly, with a focus on developing sensors that can capture multispectral and thermal data to provide a comprehensive view of crop conditions. The integration of AI and machine learning algorithms is enabling drones to identify patterns, predict crop yields, and make data-driven decisions to optimize farming practices.

The growing adoption of drones in security and surveillance applications is another key trend shaping the market. Organizations are increasingly utilizing drones equipped with high-definition cameras, thermal imaging sensors, and radar systems for monitoring and reconnaissance purposes. This shift is driven by the need for enhanced security measures in both urban and rural settings, as well as the growing demand for efficient and cost-effective surveillance solutions. Consequently, the demand for sophisticated sensors that can operate in various conditions, including low light and adverse weather, is on the rise. The integration of AI and machine learning algorithms is enabling drones to detect and track suspicious activities, identify potential threats, and alert authorities in real-time. This trend is expected to continue as the demand for advanced security solutions increases across various sectors, including law enforcement, border patrol, and critical infrastructure protection.

One of the key trends in the drone sensor market is the rapid expansion of drones in the commercial sector. Businesses are increasingly adopting drone technology for tasks such as aerial photography, infrastructure inspection, and environmental monitoring. This growth is driven by the need for cost-effective and efficient solutions in various industries. As commercial applications continue to evolve, the demand for advanced sensors that can support these functions is expected to rise significantly.

Sensor Type Insights

The image sensor segment dominated the market in 2023 with a share of around 32%. The integration of AI and ML with image sensors is transforming drones into intelligent machines capable of making real-time decisions. These technologies allow drones to analyze images as they are captured, identify objects, track movements, and even predict behavior. This capability is crucial for applications in surveillance, where drones need to autonomously follow targets or monitor large areas. AI-powered image sensors are also being used in search and rescue missions, where quick identification of people or hazards can save lives. The combination of AI and advanced image sensors is setting the stage for a new era of autonomous drone operations across various sectors.

The inertial sensor segment is estimated to have a significant CAGR from 2024 to 2030. Continuous advancements in sensor technology are enhancing the performance and capabilities of inertial sensors. Improved algorithms and data fusion techniques are enabling more accurate and reliable navigation solutions, further propelling market growth. The development of miniaturized and low-power inertial sensors is also contributing to the integration of these technologies into smaller and more versatile drones. As manufacturers continue to push the boundaries of sensor performance, the inertial sensor segment is expected to benefit from increased adoption and integration into drone platforms. These advancements are crucial for expanding the operational capabilities of drones and addressing the evolving needs of various industries.

Platform Type Insights

The Vertical Take-Off and Landing (VTOL) segment held the largest revenue share in 2023, VTOL drones demand sophisticated navigation and control systems due to their dual flight modes. Sensors like IMUs, GPS, and barometers are becoming more advanced to ensure precise transitions between vertical and horizontal flight. This precision is crucial for maintaining stability, especially in challenging environments. The trend towards enhanced navigation systems is enabling VTOL drones to safely perform complex missions in various industries.

The hybrid segment is estimated to register the fastest CAGR from 2024 to 2030. Hybrid drones are increasingly being equipped with a diverse range of sensors, including Lidar, multispectral, and thermal imaging, to enhance their multi-mission capabilities. These advanced sensor suites enable hybrid drones to gather detailed data for applications like precision agriculture, environmental monitoring, and infrastructure inspection. The trend towards sensor integration is making hybrid drones more capable and efficient, allowing them to perform complex tasks with greater accuracy. This capability is particularly valuable in industries that require high-quality data collection over large and diverse areas.

Application Insights

The navigation segment held the largest revenue share in 2023. The integration of multiple sensors, including inertial measurement units (IMUs), magnetometers, and barometers, is becoming standard practice to create more robust navigation systems. Sensor fusion combines data from these different sensors to provide more accurate and reliable navigation, especially in GPS-denied environments. This trend is particularly important for drones operating indoors, underground, or in areas with weak satellite signals. By leveraging sensor fusion, drones can maintain stable and precise navigation even in complex or obstructed environments, expanding their operational capabilities.

The data acquisition segment is estimated to register the fastest CAGR from 2024 to 2030. The demand for high-resolution sensors is rising as industries seek more detailed and accurate data from drones. These sensors, including high-definition cameras, Lidar, and multispectral sensors, are critical for applications such as precision agriculture, environmental monitoring, and infrastructure inspection. The trend towards higher resolution data acquisition is driven by the need for more precise and actionable insights. As a result, drone manufacturers are increasingly integrating advanced sensors to meet these demands, allowing for more detailed analysis and decision-making.

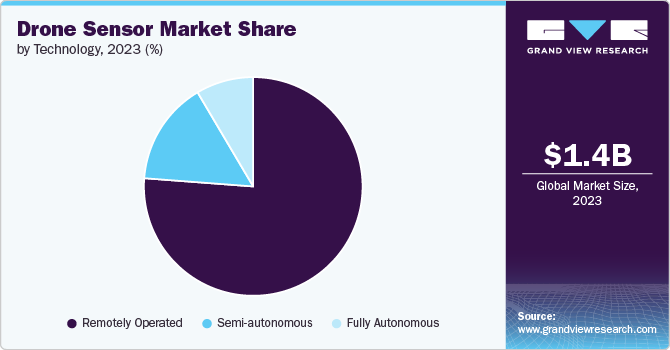

Technology Insights

The remotely operated segment held the highest revenue share in 2023. The remotely operated segment is experiencing increased demand for surveillance and security applications, particularly in urban areas and critical infrastructure. Organizations are utilizing drones for real-time monitoring and threat detection, which enhances situational awareness and response capabilities. This trend is driven by the need for improved security measures in both public and private sectors. As concerns over safety and security grow, the adoption of remotely operated drones for surveillance purposes is expected to rise.

The fully autonomous segment is estimated to register the fastest CAGR from 2024 to 2030. Fully autonomous drones are increasingly relying on advanced AI algorithms for real-time navigation and decision-making. These systems process data from various sensors, such as cameras, Lidar, and radar, to navigate complex environments and make autonomous decisions during flight. The trend towards AI integration is enhancing the capabilities of fully autonomous drones, allowing them to perform tasks such as obstacle avoidance, route optimization, and dynamic mission planning without human input. This is particularly important in industries like logistics, where efficiency and reliability are critical.

End User Insights

The military segment held the highest revenue share in 2023. There is a notable trend towards the adoption of autonomous and semi-autonomous drones in military operations. These systems can execute missions with minimal human intervention, reducing risks to personnel and increasing mission success rates. The development of sophisticated algorithms for navigation, target recognition, and obstacle avoidance is driving this trend. As militaries seek to enhance operational efficiency and reduce costs, the demand for autonomous drone systems is expected to rise significantly.

The consumer segment is estimated to register the fastest CAGR from 2024 to 2030. One of the primary growth drivers for the consumer segment is the increasing demand for aerial photography and videography. Drones equipped with high-resolution image sensors and stabilization technology are becoming popular tools for capturing stunning visuals from unique perspectives. This trend is particularly evident among social media influencers, content creators, and hobbyists who seek to enhance their photography and videography skills. As more individuals recognize the creative potential of drones, the demand for consumer-grade drones with advanced imaging capabilities is expected to rise.

Regional Insights

The drone sensor market in North America accounted for a revenue share of nearly 40% in 2023. In North America, the market is significantly propelled by the rising use of drones in military and defense applications, as well as in precision agriculture, where advanced sensor technologies are essential for optimizing productivity and operational efficiency.

U.S. Drone Sensor Market Trends

The drone sensor market in the U.S. is anticipated to grow at a CAGR of around 8% from 2024 to 2030. The U.S. market is experiencing steady growth, driven by the increasing adoption of drones in commercial and industrial applications. Advancements in sensor technology, such as high-resolution cameras and Lidar, are enhancing the capabilities of drones, making them more effective for tasks like infrastructure inspection, agriculture, and emergency response.

Europe Drone Sensor Market Trends

The drone sensor market in Europe accounted for a notable revenue share in 2023. The market growth is supported by advancements in regulatory frameworks that aim to ensure safe and compliant drone operations. This includes developing standards for sensor accuracy and data security to meet stringent European regulations. As regulations evolve, they are facilitating the broader adoption of drones across various sectors.

Asia Pacific Drone Sensor Market Trends

The drone sensor market in Asia Pacific is anticipated to grow at the fastest CAGR of over 11% from 2024 to 2030. The Asia Pacific region is seeing a surge in investments in smart city initiatives, with drones playing a crucial role in urban planning and infrastructure management. Advanced sensors are being utilized for tasks such as traffic monitoring, infrastructure inspection, and environmental data collection, supporting the development of more efficient and sustainable urban environments.

Key Drone Sensor Company Insights

The Drone Sensor market is characterized by intense competition, with key players such as KVH Industries, Inc., RTX, Sony Semiconductor Solutions Group, TE Connectivity, Teledyne FLIR LLC, and Trimble Inc. leading the industry as of 2023. These companies are actively pursuing growth by engaging in strategic initiatives, including partnerships, mergers, acquisitions, and the innovation of new products and technologies. This dynamic landscape highlights the ongoing efforts of major firms to enhance their market presence and capitalize on emerging opportunities within the drone sensor sector. For instance, In January 2023, Missiya unveiled the M-22Q1 Zakal, a cutting-edge drone capable of flying up to 40 kilometers in diverse weather conditions and staying airborne for 45 to 60 minutes while carrying payloads up to 6 kilograms. The drone is equipped with multiple 360-degree onboard sensors to detect and avoid obstacles during flight. This advanced drone technology showcases the rapid progress in the drone industry, with improved range, payload capacity, and safety features compared to previous models.

Key Drone Sensor Companies:

The following are the leading companies in the drone sensor market. These companies collectively hold the largest market share and dictate industry trends.

- ams-OSRAM AG.

- Bosch Sensortec GmbH

- InvenSense.

- KVH Industries, Inc.

- LeddarTech Holdings Inc.

- RTX

- Sentera

- Sony Semiconductor Solutions Group

- Sparton

- TE Connectivity.

- Teledyne FLIR LLC

- Trimble Inc.

Recent Developments

-

In April 2024, InvenSense, a TDK subsidiary, announced the availability of its SmartSonic ICU-10201 ultrasonic time-of-flight sensor with integrated on-chip processing. This sensor enhances the development of energy-efficient IoT and robotics solutions by providing precise obstacle avoidance and proximity sensing, applicable to robotics, drones, and vacuum cleaners. Its versatility also extends to level sensing applications in products like liquid dispensers and coffee machines.

-

In January 2024, Bosch Sensortec GmbH launched the BMA580 and BMA530, touted as the world’s smallest accelerometers. These miniature accelerometers enable the creation of advanced features in ultra-compact devices, broadening innovation opportunities in the IoT and robotics fields. This introduction underscores Bosch's dedication to delivering state-of-the-art sensor solutions that advance both size and performance.

-

In February 2023, Teledyne FLIR Defense was awarded a USD 13 million contract by the U.S. Department of Defense to upgrade its R80D SkyRaider unmanned aerial system. As part of this agreement, Teledyne FLIR will develop prototype sensor payloads for chemical and radiological detection and will integrate existing detectors from the U.S. Army’s inventory. This project is designed to enhance the operational effectiveness of the SkyRaider, underscoring the growing dependence on advanced sensor technologies within the military sector. Such advancements are anticipated to drive increased drone utilization and positively impact market opportunities for drone sensors in defense applications.

-

In June 2023, RTX Corporation was awarded a USD 118 million contract by the U.S. Army to upgrade the standard sensor payload for the MQ-1C Gray Eagle unmanned aircraft systems. This contract reflects the military's commitment to enhancing its drone capabilities through advanced sensor technologies, which are critical for surveillance and reconnaissance missions. The upgrades are anticipated to improve the operational effectiveness of the Gray Eagle systems, further driving the demand for sophisticated drone sensors. These significant contracts illustrate the growing importance of drone technology in military operations and its positive impact on the overall market for drone sensor.

Drone Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.51 billion |

|

Revenue forecast in 2030 |

USD 2.67 billion |

|

Growth rate |

CAGR of 10.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Sensor type, platform type, application, technology, end user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

ams-OSRAM AG; Bosch Sensortec GmbH; InvenSense; KVH Industries, Inc.; LeddarTech Holdings Inc.; RTX; Sentera; Sony Semiconductor Solutions Group; Sparton; TE Connectivity; Teledyne FLIR LLC; Trimble Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drone Sensor Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global drone sensor market report based on sensor type, platform type, application, technology, end user, and region:

-

Sensor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inertial Sensor

-

Image Sensor

-

Position Sensor

-

Current Sensor

-

Others ( Light Sensor, Pressure Sensor, Speed and Distance Sensor)

-

-

Platform Type Outlook (Revenue, USD Million, 2018 - 2030)

-

VTOL

-

Fixed-Wing

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigation

-

Data Acquisition

-

Motion Detection

-

Air Pressure Measurement

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Remotely Operated

-

Semi-autonomous

-

Fully Autonomous

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Prosumer

-

Toy/Hobbyist

-

Photogrammetry

-

-

Commercial

-

"Inspection/Maintenance"

-

Mapping & Surveying

-

Photography/ Filming

-

Surveillance & Monitoring

-

"Localization/Detection"

-

Spraying/ Seeding

-

Others

-

-

Military

-

Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR)

-

Communication

-

Combat Operations

-

Military Cargo Transport

-

Precision Strikes

-

Others

-

-

Government & Law Enforcement

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drone sensor market size was estimated at USD 1.42 billion in 2023 and is expected to reach USD 1.51 billion in 2024

b. The global drone sensor market is expected to grow at a compound annual growth rate of 10.0% from 2024 to 2030, reaching USD 2.67 billion by 2030.

b. North America dominated the drone sensor market, with a share of 40.1% in 2023. The market is expanding rapidly, driven by factors like increased drone adoption, technological advancements, and supportive regulations. Key trends include the growing demand for high-resolution cameras and imaging sensors and the increasing adoption of LiDAR and thermal imaging sensors.

b. Some key players operating in the drone sensor market include ams-OSRAM AG, Bosch Sensortec GmbH, InvenSense, KVH Industries, Inc., LeddarTech Holdings Inc., RTX, Sentera, Sony Semiconductor Solutions Group, Sparton, TE Connectivity, Teledyne FLIR LLC, Trimble Inc.

b. Key factors driving market growth include smaller, lighter, more efficient components, diverse applications across various industries, and supportive regulations for commercial use.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."