Drone Package Delivery Market Size, Share & Trends Analysis Report By Type (Fixed Wing, Rotary Wing), By Range (Short Range, Long Range), By Package Size (More Than 5Kg), By End Use (Food Delivery, Healthcare & Medical Aid), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-454-8

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Drone Package Delivery Market Trends

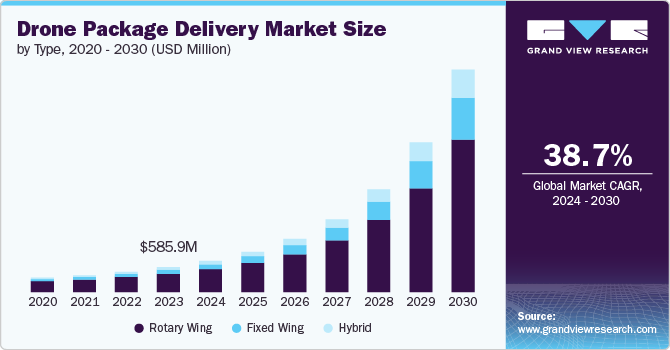

The global drone package delivery market size was valued at USD 585.9 million in 2023 and is expected to grow at a CAGR of 38.7% from 2024 to 2030. The rapid growth of e-commerce platforms globally has led to an increased demand for faster and more efficient delivery solutions. Drones offer the ability to deliver packages directly to customers in a short period, reducing the reliance on traditional shipping methods. This is particularly significant in urban areas, where traffic congestion can slow deliveries. E-commerce companies are investing heavily in drone technologies to gain a competitive edge, which accelerates market growth.

Moreover, the continuous innovations in drone technology, such as enhanced battery life, autonomous navigation, and improved payload capacities, are making drone deliveries more practical and scalable. The integration of AI and IoT in drones allows for better route planning and obstacle avoidance, making them more reliable. These advancements also reduce operational costs, contributing to the market's growth by making drone deliveries feasible on a larger scale.

The COVID-19 pandemic accelerated the demand for contactless delivery options, as consumers sought ways to minimize human contact. Drones provide an ideal solution by delivering packages directly to a customer's doorstep without the need for physical interaction. This shift in consumer behavior, combined with ongoing health concerns, has created long-term demand for drone deliveries in various sectors, including retail and healthcare, thereby augmenting the market growth.

Additionally, governments and regulatory bodies globally are beginning to establish frameworks and policies that support drone deliveries. This includes creating airspace regulations, issuing pilot certifications, and setting safety standards, all of which are crucial for large-scale deployment. With regulatory hurdles being addressed, companies are more confident in investing in drone delivery infrastructure, boosting market growth.

Furthermore, drones offer a more environmentally friendly alternative to traditional delivery vehicles as businesses seek to reduce their carbon footprints. Drones powered by electric batteries produce lower emissions compared to fuel-powered trucks, particularly for last-mile deliveries. The shift towards sustainable operations is a significant driver for the adoption of drone deliveries, especially for companies with environmental, social, and governance (ESG) goals.

Type Insights

The rotary wing segment dominated the market in 2023 with a market share of nearly 74%, owing to its ability to perform vertical takeoffs and landings, making it ideal for urban environments with limited space. Technological advancements have improved their performance, enhancing battery life and payload capacity. The surge in e-commerce and demand for faster deliveries is driving investments in rotary drones. Regulatory clarity is also boosting confidence and adoption of these technologies. Additionally, decreasing costs make rotary drones more accessible to a wider range of businesses, thereby driving the segment growth.

The hybrid segment is expected to record the highest CAGR of around 42% from 2024 to 2030, owing to its combination of vertical takeoff and efficient forward flight, allowing for both long-range travel and maneuverability. Technological advancements have improved hybrid drones’ efficiency, range, and payload capacity. Increased demand for faster and more versatile delivery solutions drives their adoption. Supportive regulations and decreasing costs also contribute to their growing use. These factors collectively boost the appeal and practicality of hybrid drones for diverse delivery needs.

Range Insights

The short range segment held the highest revenue share in 2023, owing to its efficiency in delivering small parcels within urban and localized areas. These drones are cost-effective, requiring less advanced technology and lower operational expenses compared to long-range models. Their compact size and agility make them ideal for navigating congested environments and providing rapid deliveries. The growth of e-commerce and the need for quick, last-mile deliveries are driving their adoption. Advances in battery life and automation are further enhancing their performance and reliability, supporting the segment growth.

The long range segment is estimated to register a considerable growth rate from 2024 to 2030 due to its ability to cover extensive distances and reach remote or underserved areas. These drones are equipped with advanced navigation systems and high-capacity batteries, enabling efficient delivery over long journeys. The increasing demand for improved logistics and delivery services in rural and distant locations is driving their adoption. Technological advancements, such as enhanced aerodynamics and energy-efficient designs, further boost their performance.

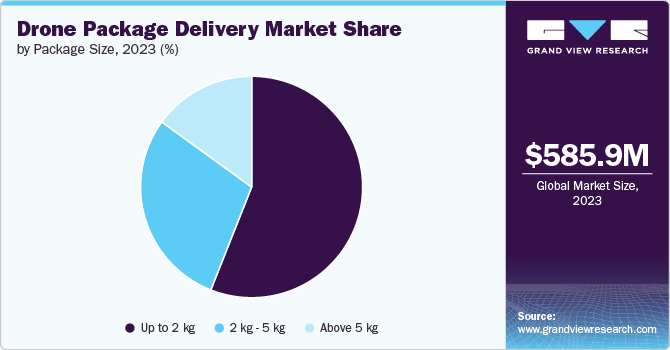

Package Size Insights

The up to 2 kg segment held the highest revenue share in 2023, owing to its suitability for lightweight and frequent deliveries, such as documents and small goods. These drones are more affordable and easier to operate compared to those designed for larger payloads. The rise in e-commerce and the demand for quick, efficient delivery of small items are driving their increased use. Advances in drone technology have improved their reliability and range, making them ideal for last-mile deliveries. The cost-effectiveness and operational simplicity of these drones further contribute to the segment growth.

The 2 kg - 5 kg segment is estimated to register a considerable growth rate from 2024 to 2030 due to the increasing need for transporting such as medical supplies and industrial equipment. Advances in drone technology have enhanced payload capacity, allowing these drones to safely carry larger loads over longer distances. The rise in sectors requiring substantial deliveries and logistics efficiency is driving this segment’s growth. Regulatory developments and innovations in battery life and propulsion systems are also contributing to their expanded use. Additionally, improved infrastructure and cost reductions make these heavy-lift drones more viable for commercial applications.

End Use Insights

The food delivery segment held the highest revenue share in 2023 owing to the demand for faster and more efficient delivery of meals. Drones can significantly reduce delivery times and ensure hot, fresh food reaches customers quickly. Innovations in drone technology, such as improved thermal protection and precise navigation, enhance their suitability for food transport. The growth of online food ordering and consumer expectations for rapid service are driving this trend. Regulatory advancements and reduced operational costs further support the adoption of drones for food delivery.

The healthcare & medical aid segment is estimated to register the highest growth rate from 2024 to 2030, due to the critical need for rapid and reliable transport of medical supplies and emergency items. Drones can quickly deliver medications, blood samples, and vaccines to remote or underserved areas, improving access to essential healthcare. Technological advancements enhance their reliability, payload capacity, and safety for sensitive cargo. The rising focus on efficient medical logistics and the need for timely interventions drive their adoption. Supportive regulations and increasing investment in healthcare drone technology further bolster this segment's growth.

Regional Insights

The market in North America accounted for the highest revenue share of over 44% in 2023. The market is experiencing rapid growth driven largely by advancements in drone technology, leading to increased payload capacities and extended flight ranges. Regulatory support, particularly in the U.S., with the Federal Aviation Administration (FAA) updating policies to facilitate commercial drone operations and a strong e-commerce sector, are key growth drivers.

U.S. Drone Package Delivery Market Trends

The market in the U.S. is anticipated to grow at a CAGR of around 34% from 2024 to 2030. Enhanced consumer expectations for quicker delivery times are pushing companies towards adopting drone technology to provide expedited services, setting a new standard in delivery efficiency. Moreover, technological advancements in drone design and operation have led to a significant decrease in costs, making drone deliveries an increasingly economical option.

Asia Pacific Drone Package Delivery Market Trends

The market in AsiaPacific is anticipated to grow at the fastest CAGR of nearly 44% from 2024 to 2030. The Asia Pacific region is witnessing a surge in the drone package delivery market, motivated by extensive e-commerce growth in countries such as China and India. The region’s readiness to adopt new technologies, along with substantial investments in drone delivery by regional e-commerce giants, has been pivotal. Additionally, diverse geographic landscapes, particularly in rural and hard-to-reach areas, have made drone deliveries a viable and efficient logistics solution, supporting the market's swift expansion.

Europe Drone Package Delivery Market Trends

The drone package delivery market in Europe accounted for a notable revenue share of over 35% in 2023. In Europe, the market is propelled by strong regulatory frameworks that facilitate safe drone operations across member states, coupled with a high demand for last-mile delivery solutions in densely populated areas. Innovations in airspace management and drone traffic control, particularly with the European Union's efforts to create a unified air traffic management system for drones, are critical drivers. Furthermore, environmental concerns and the push for greener alternatives in logistics have also contributed substantially to market growth.

Key Drone Package Delivery Company Insights

Some of the key players operating in the market are Amazon.com, Inc., Drone Delivery Canada Corp., and United Parcel Service, Inc., among others.

-

Amazon.com, Inc., is a multinational technology company that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is considered one of the Big Five companies in the U.S. information technology industry. Initially starting as an online marketplace for books, Amazon.com, Inc. has expanded to a vast array of products and services, including its own electronic devices and a comprehensive cloud computing platform.

-

Drone Delivery Canada Corp. is a technology company focused on designing, developing, and implementing a commercially viable drone delivery system within the Canadian geography. Their platform is aimed at providing a depersonalized delivery service for a variety of market sectors, including remote communities, healthcare, logistics, and specialized cargo.

Matternet Inc., Wingcopter GmbH, and Flytrex Inc., among others are some of the emerging market participants in the drone package delivery market.

-

Matternet Inc. is a technology firm specializing in the development of autonomous drone logistics systems, primarily for the transportation of lightweight goods over short distances. The company focuses on creating efficient solutions for urban and semi-urban areas, aiming to improve delivery times and reduce logistical bottlenecks.

-

Wingcopter GmbH is a German-based developer and manufacturer of innovative, vertical take-off and landing (VTOL) drones designed for a variety of uses across logistics, agriculture, and healthcare sectors. Their technology emphasizes the efficient and rapid delivery of goods, particularly in hard-to-reach areas, leveraging unmanned aerial vehicles (UAVs) to overcome traditional logistical barriers.

Key Drone Package Delivery Companies:

The following are the leading companies in the drone package delivery market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com, Inc.

- United Parcel Service, Inc.

- Wing Aviation LLC

- Zipline International Inc.

- Flytrex Inc.

- Drone Delivery Canada Corp.

- FedEx Corporation

- Workhorse Group

- Wingcopter GmbH

- Matternet Inc.

Recent Developments

-

In February 2024, Zipline International Inc. has expanded its collaboration with the Government of Rwanda, by launching a new delivery initiative aimed at fostering economic growth and protecting wildlife. Working together with the Rwanda Development Board (RDB), Zipline will start distributing items crafted by local artisans directly to visitors staying at various lodges and resorts.

-

In October 2023, Amazon.com, Inc. announced that the company is anticipating to introduce its latest prime air drones, which will be used for the delivery of parcels for customers at three locations in the U.S. along with a few cities in Italy and the UK The company also aims to expand its drone delivery fleet in the coming years.

-

In September 2023, United Parcel Service, Inc. announced that they have been granted approval by U.S. regulatory authorities for their delivery drones to undertake extended flight operations beyond the visual line of sight of ground crews.

Drone Package Delivery Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 735.8 million |

|

Revenue forecast in 2030 |

USD 5,238.8 million |

|

Growth Rate |

CAGR of 38.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, range, package size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Amazon.com, Inc.; United Parcel Service, Inc.; Wing Aviation LLC; Zipline International Inc.; Flytrex Inc.; Drone Delivery Canada Corp.; FedEx Corporation; Workhorse Group; Wingcopter GmbH; Matternet Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drone Package Delivery Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global drone package delivery market report based on type, range, package size, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Wing

-

Rotary Wing

-

Hybrid

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Short Range

-

Long Range

-

-

Package Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 2Kg

-

2Kg - 5Kg

-

Above 5Kg

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Delivery

-

Healthcare & Medical Aid

-

Postal Delivery

-

Retail Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drone package delivery market size was estimated at USD 585.9 million in 2023 and is expected to reach USD 735.8 million in 2024.

b. The global drone package delivery market is expected to grow at a compound annual growth rate of 38.7% from 2024 to 2030 to reach USD 5,238.8 million by 2030.

b. North America dominated the drone package delivery market with a share of around 45% in 2023, driven largely by advancements in drone technology, leading to increased payload capacities and extended flight ranges.

b. Some key players operating in the drone package delivery market include Amazon.com, Inc., United Parcel Service, Inc., Wing Aviation LLC, Zipline International Inc., Flytrex Inc., Drone Delivery Canada Corp., FedEx Corporation, Workhorse Group, Wingcopter GmbH, Matternet Inc.

b. Key factors that are driving the drone package delivery market growth include the rapid growth of e-commerce platforms, continuous innovations in drone technology, and the shift towards sustainable operations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."