Drone Analytics Market Size, Share & Trends Analysis Report By End-use (Power & Utility, Construction & Infrastructure), By Application, By Deployment (On-premises, On-demand), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-485-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Drone Analytics Market Size & Trends

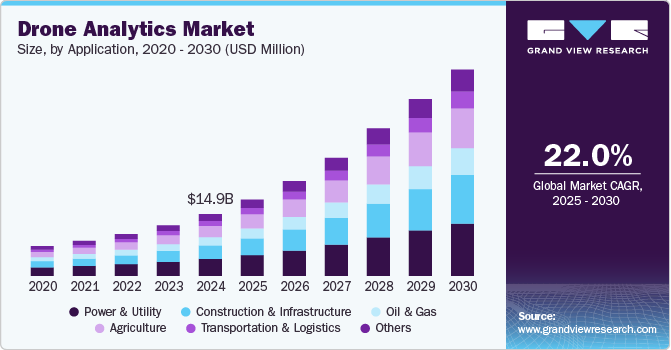

The global drone analytics market size was estimated at USD 14.99 billion in 2024 and is expected to grow at a CAGR of 22.0% from 2025 to 2030. The growing demand for sophisticated industry-specific analytical solutions that assist companies in gaining actionable insights from the data acquired by drones is primarily driving growth. Drones have proven advantageous in optimizing the data more efficiently in numerous industries, including agriculture, construction and infrastructure, and oil and gas, driving the demand for drone analytics solutions. Companies are investing heavily in drone analytics solutions, foreseeing the enormous opportunity the market holds. Drone monitoring is majorly carried out across oil and gas, construction, and defense industries. End-users use drone analytics to process and analyze the data procured from drone monitoring. Additionally, drone analytics software is used to assess 2D/3D images and videos captured via drones.

The use of drone analytics in agriculture is revolutionizing farming practices. Drones equipped with multispectral sensors and high-resolution cameras provide valuable insights into crop health, soil conditions, and irrigation needs. Farmers can use this data to monitor crops in real-time, enabling early detection of pests, diseases, and water stress. This helps optimize the use of resources, reduce wastage, and enhance crop yields. As precision farming continues to gain traction, the demand for drone analytics in agriculture is expected to grow exponentially, improving both productivity and sustainability.

Drone analytics is reshaping the infrastructure and construction industries by improving project efficiency and accuracy. Drones are used to capture high-definition imagery and generate 3D models of construction sites, which aid in surveying, planning, and real-time progress monitoring. This reduces the time and cost associated with traditional surveying methods while improving safety by minimizing the need for workers in dangerous areas. The integration of drone data into Building Information Modeling (BIM) enhances project coordination, offering better visualization and data-driven decision-making. As the construction industry increasingly adopts digital technologies, the demand for drone analytics in this sector is set to grow significantly.

Drone analytics is becoming an essential tool for environmental monitoring and conservation efforts. Environmental agencies and research organizations are using drones to track deforestation, monitor wildlife, and assess the impacts of climate change. Drones provide a cost-effective and non-intrusive way to collect detailed aerial data across large areas, which is challenging with traditional methods. This data helps inform policy decisions, improve conservation strategies, and ensure regulatory compliance. With increasing global focus on sustainability and environmental protection, the use of drone analytics for environmental monitoring is expected to continue rising.

The energy and mining sectors are leveraging drone analytics to enhance operational efficiency and safety. Drones equipped with advanced sensors such as LiDAR and thermal cameras are used for inspecting critical infrastructure like power lines, wind turbines, and mining sites. This minimizes human exposure to hazardous environments while enabling detailed asset inspections and real-time data collection. Additionally, drones are being used in resource exploration, surveying vast areas for geological assessments more efficiently than ground-based methods. As the focus on reducing downtime and improving safety grows in these industries, the adoption of drone analytics is accelerating, leading to cost savings and improved performance.

End use Insights

The power & utility segment led the market in 2024, accounting for over 27% of the global revenue. The Drone Analytics market in the power and utility segment is experiencing significant growth as companies increasingly recognize the value of drone technology for asset inspection, maintenance, and operational efficiency. Drones equipped with thermal imaging, LiDAR, and high-resolution cameras are being used to monitor power lines, solar panels, and wind turbines, providing detailed insights into potential issues such as overheating, structural defects, and vegetation encroachment. This real-time data helps utility companies identify faults before they lead to costly failures or service disruptions, enhancing the reliability of energy delivery. Additionally, drones reduce the need for manual inspections, particularly in hazardous or hard-to-reach areas, improving both safety and cost efficiency. As the demand for renewable energy and smart grid infrastructure continues to rise, the adoption of drone analytics in the power and utility sector is expected to grow, driven by the need for more efficient, scalable, and safer operational practices.

The construction & infrastructure segment is predicted to foresee significant growth in the coming years. The Drone Analytics market in the construction and infrastructure segment is gaining momentum as companies adopt drones to streamline project management, improve accuracy, and reduce costs. Drones are increasingly being used for site surveying, 3D mapping and 3D modeling, enabling project managers to monitor progress in real-time and make informed decisions quickly. This reduces the reliance on manual inspections and traditional surveying methods, which are often time-consuming and labor-intensive. Additionally, drone analytics provide a more comprehensive view of construction sites, allowing for better planning, risk assessment, and safety monitoring, particularly in hazardous or complex environments. As the construction industry embraces digital transformation, the integration of drone analytics is expected to grow, driving improvements in project efficiency, safety, and overall productivity.

Deployment Insights

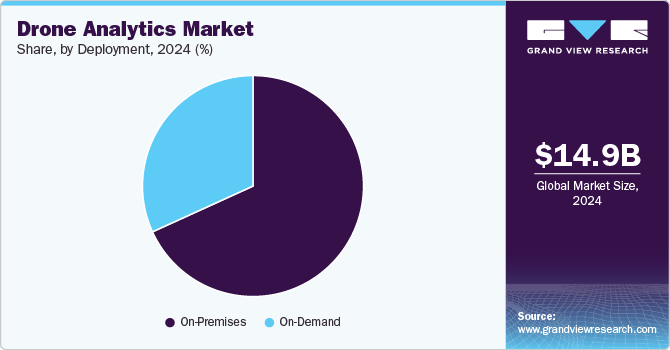

The on-Premises segment accounted for the largest market revenue share in 2024.Many organizations prefer On-Premises solutions for drone analytics to maintain control over their data and ensure compliance with strict data protection regulations. By storing sensitive information on local servers, businesses can mitigate risks associated with data breaches and unauthorized access. This trend is particularly prevalent in sectors such as defense, government, and healthcare, where data confidentiality is paramount. Organizations are investing in robust security protocols and infrastructure to safeguard their analytics data. As a result, the demand for On-Premises drone analytics solutions is expected to remain strong among enterprises prioritizing data security.

The on-demand segment is anticipated to exhibit a significant CAGR over the forecast period. The on-demand segment of the drone analytics market is gaining popularity due to its inherent flexibility and cost-effectiveness. Organizations can access drone services and analytics as needed, avoiding the substantial upfront costs associated with purchasing and maintaining drones and software. This pay-per-use model allows businesses to align their expenses with actual usage, making it an attractive option for smaller companies and those with fluctuating project demands. As companies seek to optimize budgets and resource allocation, the demand for on-demand drone analytics services is expected to grow.

Application Insights

The thermal detection segment accounted for the largest market revenue share in 2024. The Drone Analytics market in the thermal detection segment is witnessing robust growth due to the increasing demand for advanced inspection and monitoring solutions across various industries. Drones equipped with thermal imaging technology offer significant advantages in identifying heat anomalies, detecting faults, and assessing equipment performance in real time. This capability is particularly valuable in sectors such as energy, utilities, and building inspections, where overheating components can lead to operational failures or safety hazards. Moreover, the integration of thermal detection with data analytics enhances predictive maintenance strategies, allowing organizations to address potential issues proactively and minimize downtime. As awareness of the benefits of thermal detection continues to rise, the adoption of drone analytics in this segment is expected to accelerate driving efficiency and safety in operations.

The 3D modelling segment is predicted to foresee significant growth in the coming years. The Drone Analytics market in the 3D modeling segment is experiencing substantial growth as organizations increasingly adopt this technology for enhanced visualization and planning. Drones equipped with advanced photogrammetry and LiDAR sensors can capture high-resolution aerial imagery, which can be processed to create detailed 3D models of construction sites, landscapes, and infrastructure. These models provide valuable insights for project planning, design, and execution, allowing stakeholders to visualize changes over time and make informed decisions. Furthermore, 3D modeling enhances collaboration among project teams by providing a shared visual reference that facilitates communication and understanding. As industries such as construction, real estate, and urban planning continue to recognize the benefits of accurate 3D modeling, the demand for drone analytics in this segment is expected to grow significantly, driving improvements in project efficiency and accuracy.

Regional Insights

North America drone analytics market dominated with a revenue share of over 36% in 2024. North America is witnessing rapid advancements in drone technology, driving the growth of the drone analytics market. Innovations such as AI integration, machine learning, and advanced sensor technology are enhancing data collection and analytics capabilities. As industries increasingly adopt these technologies, the demand for sophisticated drone analytics solutions is expected to rise significantly.

U.S. Drone Analytics Market Trends

The drone analytics market in the U.S. is expected to grow at a CAGR from 2025 to 2030. The integration of drone analytics into smart city initiatives is gaining traction in the U.S. Drones are being deployed for urban planning, infrastructure maintenance, and traffic management, contributing to more efficient city operations. As smart city projects expand, the role of drone analytics is expected to become increasingly vital.

Europe Drone Analytics Market Trends

The Europe drone analytics market is expected to witness significant growth over the forecast period. The European market is increasingly leveraging drone analytics to support sustainability initiatives, particularly in agriculture and environmental monitoring. Drones are being used for precision farming, helping to minimize chemical use and optimize resource management. As sustainability becomes a priority, the demand for eco-friendly drone analytics solutions is anticipated to grow.

Asia Pacific Drone Analytics Market Trends

The drone analytics market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The Asia-Pacific region is experiencing significant urbanization and infrastructure development, driving the need for efficient monitoring and management solutions. Drone analytics is increasingly being utilized for construction site monitoring, urban planning, and disaster management. As urban areas expand, the demand for drone analytics in infrastructure projects is expected to rise.

Key Drone Analytics Company Insights

Some key players in the market such as AeroVironment, Inc., Airware, Delta Drone, DroneDeploy, Kespry Inc., and PrecisionHawk. These companies are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products and technologies. This proactive approach allows them to enhance their market presence and innovate in response to evolving security needs.

-

Kespry Inc. is a leading player in drone analytics, specializing in autonomous drone solutions for industries such as construction, mining, and insurance. The company has established a strong market presence by focusing on automated data collection and analysis, enabling businesses to streamline their operations and enhance decision-making. Kespry’s platform integrates drones with advanced analytics tools, providing users with accurate measurements, inventory assessments, and risk analysis. The company emphasizes user-friendly interfaces and seamless workflows, allowing clients to quickly interpret drone data for operational efficiency. Kespry’s solutions cater to a diverse range of sectors, enhancing site surveying, stockpile measurement, and inspection processes.

-

PrecisionHawk is a prominent player in the drone analytics market, offering advanced solutions tailored for agriculture, energy, and construction industries. The company combines drone technology with sophisticated analytics to deliver actionable insights that improve operational efficiency and reduce costs. PrecisionHawk’s platform supports a wide array of applications, including crop health monitoring, land surveying, and infrastructure inspection, enabling businesses to make data-driven decisions. The company also invests in research and development to incorporate machine learning and AI capabilities into its analytics, further enhancing data accuracy and predictive modeling. PrecisionHawk’s commitment to innovation and integration makes it a key player in advancing the capabilities of drone analytics across various sectors.

Key Drone Analytics Companies:

The following are the leading companies in the drone analytics market. These companies collectively hold the largest market share and dictate industry trends.

- AeroVironment, Inc.

- Agribotix

- Airware

- Delta Drone

- DroneDeploy

- ESRI

- Huvrdata

- Kespry Inc.

- Optelos.

- PrecisionHawk

Recent Developments

-

In October 2023, DroneDeploy introduced a comprehensive new platform that allows users to seamlessly collaborate and manage data captured from aerial and ground sources. This unified solution integrates exterior and interior data, streamlining workflows and enhancing the accuracy of reality capture applications. By merging with StructionSite, DroneDeploy aims to simplify data collection processes, making high-accuracy insights accessible without requiring specialized survey knowledge. The platform is designed to automate data capture through robotic systems, positioning DroneDeploy as a leader in the evolving landscape of reality capture technology.

-

In October 2023, Verge Aero launched the Verge Aero X7 drone alongside significant upgrades to its all-in-one drone show product suite. These advancements are intended to lower barriers to entry into the aerial entertainment industry, making it more accessible to a wider audience. The new features enhance the operational capabilities of drone shows, allowing for more dynamic performances and streamlined production processes. Verge Aero's commitment to innovation positions it as a key player in transforming aerial entertainment experiences.

Drone Analytics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 18.49 billion |

|

Revenue forecast in 2030 |

USD 49.97 billion |

|

Growth rate |

CAGR of 22.0% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End use, application, deployment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled

|

AeroVironment, Inc.; Agribotix; Airware; Delta Drone; DroneDeploy; ESRI; Huvrdata; Kespry Inc.; Optelos; PrecisionHawk. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drone Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global drone analytics market based on end use, application, deployment, and region.

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Power & Utility

-

Construction & Infrastructure

-

Oil & Gas

-

Agriculture

-

Transportation & Logistics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Thermal detection

-

Aerial monitoring

-

Ground exploration

-

3D modelling

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

On-Demand

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global drone analytics market size was valued at USD 14.99 billion in 2024 and is expected to reach USD 18.49 billion in 2025.

b. The global drone analytics market is expected to grow at a compound annual growth rate of 22.0% from 2025 to 2030 to reach USD 49.97 billion by 2030.

b. North America dominated the drone analytics market with a share of 36% in 2024. Key factors driving the growth of the regional market include increased investment in drone analytics from the commercial sector.

b. Some of the key players operating in the drone analytics market include AeroVironment Inc.; AgEagle Aerial Systems Inc.; Airware; DroneDeploy Inc.; DroneSense Inc.; Kespry Inc.; Optelos LLC; Pix4D SA; PrecisionHawk Inc.; Sentera.

b. The growing demand for sophisticated industry-specific analytical solutions that assist companies in gaining actionable insights from the data acquired by drones is primarily driving the drone analytics market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."