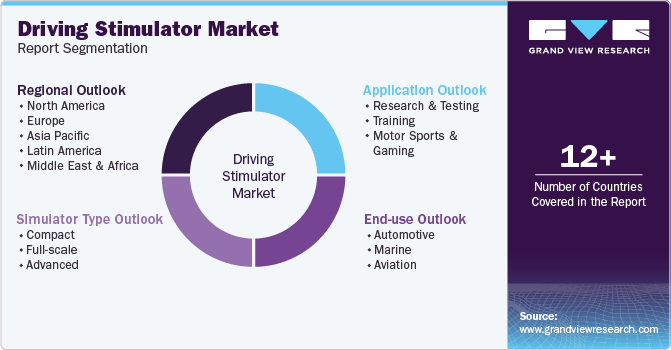

Driving Simulator Market Size, Share & Trends Analysis Report By Simulator Type (Compact, Full-scale, Advanced), By End Use (Automotive, Marine, Aviation), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-199-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Driving Simulator Market Size & Trends

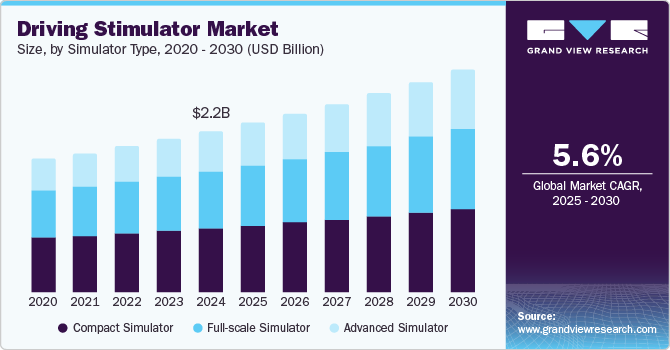

The global driving simulator market size was valued at USD 2.16 billion in 2024 and is expected to expand at a CAGR of 5.6% from 2025 to 2030. The market growth is attributed to the increasing focus on improving road safety is prompting governments and organizations to adopt advanced training solutions, such as driving simulators, to enhance driver skills and reduce accidents. Additionally, the rising demand for skilled drivers in various sectors, including transportation, logistics, and defense, is bolstering the adoption of driving simulators for comprehensive training programs.

Demand for various features such as adaptive cruise control, automatic parking, collision avoidance systems, blind-spot monitors, and lane departure warning systems has increased with the advent of Advanced Driving Assistance Systems (ADAS). Automotive companies all over the globe are making developments in the aforementioned technologies to remove the possible glitches, which may perhaps cause injury to the driver. Therefore, manufacturers put ADAS systems to test on simulators, which, in turn, provides them with a realistic view of the entire vehicle's performance. Therefore, driving simulators are aiding automobile manufactures with pre-testing capabilities for system improvements.

Automotive manufacturers mainly use advanced driving simulators for the purpose of research and testing as they provide exceptional testing capabilities in realistic surroundings. The technologies used in these testing machines are undergoing several advancements, including clear image formation, better quality control loaders, and extensive motion capabilities. Factors such as the high initial cost of machines and lack of infrastructure in developing countries are expected to impede the growth of the market. However, increasing efforts by the governments of developing countries to attract automotive companies to build R&D centers in these nations will gradually reduce the impact of such hindrances on market growth.

Simulators are increasingly used in the marine and aviation industries. In the aviation industry, flight simulators are used for training pilots and crew members by delivering real-time flight experience. Flight simulators have been gaining importance, especially for military and commercial aircraft training purposes. These testing machines aid in developing new and improvised skills in pilots for operating and handling flights in critical situations, which, in turn, helps in reducing the risk associated with the passengers. Reduced risk and a reduction in the training cost are expected to boost market growth over the forecast period.

Simulator Type Insights

Full-scale simulators dominated the market with the largest revenue share of 39.7% in 2024. The segment growth is attributed to full-scale simulators' comprehensive training experience, closely replicating real-life driving conditions. These simulators are particularly valued for their ability to provide immersive and highly detailed training scenarios, which are essential for professional driver training, research, and vehicle development. Consequently, the demand for full-scale simulators has surged across various industries, reinforcing their market-leading position.

Advanced driving simulators are expected to grow at the fastest CAGR of 6.8% over the forecast period owing to the increasing demand for high-fidelity training solutions that incorporate cutting-edge technology to simulate complex driving scenarios. Advanced driving simulators offer enhanced realism and interactive features, making them indispensable tools for driver training, research, and vehicle testing. The integration of advanced sensors, augmented reality (AR), and virtual reality (VR) technologies further enhances the training experience, providing users with a more immersive and effective learning environment. As industries continue to prioritize safety and efficiency, the adoption of advanced driving simulators is expected to accelerate, driving their market expansion at an unprecedented pace.

Application Insights

Research & testing dominated the market with the largest revenue share in 2024. The increasing reliance on driving simulators for conducting advanced vehicle testing and research. Automakers and research institutions leverage these simulators to evaluate new vehicle designs, safety features, and autonomous driving technologies in a controlled and risk-free environment. The ability to simulate diverse driving conditions and scenarios makes research and testing simulators invaluable tools for enhancing vehicle performance and safety standards.

Training is expected to grow at the fastest CAGR over the forecast period. The increasing recognition of the importance of effective driver training programs in enhancing road safety and reducing accidents. Driving simulators are becoming indispensable tools for providing comprehensive training to both new and experienced drivers, allowing them to practice various driving scenarios and improve their skills in a controlled and risk-free environment. Additionally, advancements in simulator technology, such as the incorporation of augmented reality (AR) and virtual reality (VR), are making training programs more engaging and effective. As industries and governments continue to prioritize driver education and safety, the demand for advanced training solutions is expected to drive the expansion of the training segment significantly.

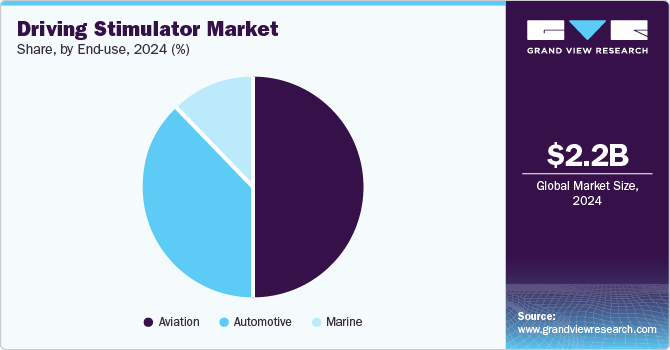

End Use Insights

Automotive dominated the market with the largest revenue share in 2024. This dominance is largely due to the automotive industry's continuous efforts to innovate and enhance vehicle safety and performance. Driving simulators play a crucial role in testing new vehicle designs, advanced driver-assistance systems (ADAS), and autonomous driving technologies in a controlled and safe environment. The ability to simulate various driving conditions and scenarios helps automakers refine their products and ensure compliance with stringent safety standards. Additionally, the growing focus on developing electric and connected vehicles has further fueled the demand for advanced simulation tools, solidifying the automotive segment's leading position in the market.

Aviation is expected to grow at the fastest CAGR over the forecast period, owing to the increasing demand for pilot training programs as the aviation industry expands. With a growing number of airlines and the introduction of more advanced aircraft, there is a pressing need for high-quality simulation training to ensure pilot proficiency and safety. Driving simulators in aviation provide realistic and immersive environments for training pilots, testing new aircraft designs, and improving overall operational efficiency. As technology continues to advance, the aviation sector's reliance on sophisticated simulators is expected to drive significant market expansion, making it a key growth area in the coming years.

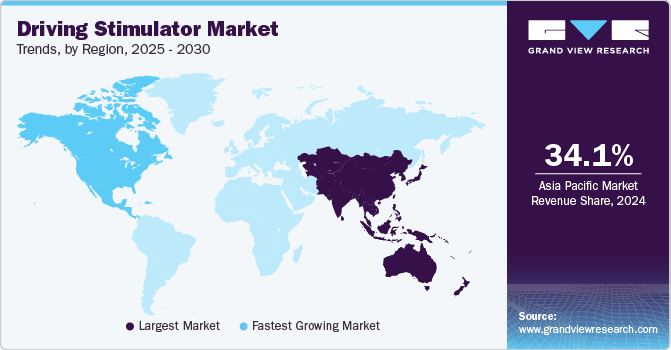

Regional Insights

Asia Pacific driving simulator industry dominated the global market with the largest revenue share, 34.1%, in 2024. The region's rapid urbanization and the expansion of road infrastructure have led to a higher demand for skilled drivers and advanced driver training solutions. Secondly, the automotive industry's continuous growth in countries like China, India, and Japan has spurred investments in cutting-edge driving simulation technologies. Additionally, government regulations promoting road safety and the increasing need for efficient and cost-effective driver training programs have further accelerated the adoption of driving simulators. Moreover, the integration of virtual reality (VR) and augmented reality (AR) in driving simulators has enhanced the realism and effectiveness of training, attracting more users.

Europe Driving Simulator Market Trends

The European driving simulator industry held a considerable share in 2024. The region's strong emphasis on road safety and stringent regulations that mandate advanced driver training have contributed to the industry's expansion. Additionally, the presence of leading automotive manufacturers and continuous advancements in driving simulation technology have contributed to the industry's expansion. Europe’s focus on reducing road accidents and improving driver skills has led to increased adoption of driving simulators across various sectors, including automotive, aviation, and defense.

In August 2024, AVSimulation announced a partnership with epicnpoc to present a pioneering Mixed Reality demonstration at the DSC Europe 2024 VR conference. This collaboration integrates AVSimulation’s advanced SCANeR software with epicnpoc’s innovative BOWL I-Cockpit, aiming to enhance immersion and realism in automotive simulation.

North America Driving Simulator Market Trends

North America driving simulator industry is expected to grow at the fastest CAGR of 6.6% over the forecast period. The increasing focus on road safety and driver training in the region is driving the demand for advanced driving simulators. Additionally, prominent automotive manufacturers and technology companies in North America are fueling investments in state-of-the-art simulation technologies. The region's strong emphasis on research and development, coupled with government initiatives to enhance driver education and training programs, is further propelling the industry's expansion.

U.S. Driving Simulator Market Trends

The U.S. driving simulator industry is expected to grow significantly over the forecast period owing to the presence of major automotive manufacturers and technology companies in the U.S. has spurred innovation in driving simulation technology. Companies invest heavily in research and development to create more realistic and immersive simulators that replicate various driving conditions and scenarios. This technological advancement is not only enhancing driver training but also contributing to the development of autonomous vehicles by providing a safe and controlled environment for testing and validation.

Moreover, government initiatives and regulations aimed at improving driver education and training are playing a crucial role in the market's growth. Programs that emphasize the importance of comprehensive driver training are leading to increased adoption of driving simulators in schools, training centers, and even corporate fleets.

Key Driving Simulator Market Company Insights

Some key companies in the driving simulator market include Adacel Technologies Limited, Anthony Best Dynamics Limited, Bosch Rexroth AG, CAE Inc., and others.

Key Driving Simulator Companies:

The following are the leading companies in the driving simulator market. These companies collectively hold the largest market share and dictate industry trends.

- Adacel Technologies Limited

- Anthony Best Dynamics Limited

- Bosch Rexroth AG

- CAE Inc.

- Cruden BV

- ECA Group

- L3Harris Technologies, Inc.

- Tecknotrove

- Thales

- VI-grade GmbH

Recent Development

-

In October 2023, AB Dynamics and Ansible Motion announced the merger of their Driver-in-the-Loop (DIL) vehicle simulation businesses, forming a single, experienced driving simulator provider. This integration enhances resources and expertise, with experienced personnel from AB Dynamics joining Ansible Motion.

Driving Simulator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.27 billion |

|

Revenue forecast in 2030 |

USD 2.98 billion |

|

Growth rate |

CAGR of 5.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

January 2025 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Simulator Type, Application, End Use, Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Argentina, Brazil, South Africa, Saudi Arabia, UAE |

|

Key companies profiled |

Adacel Technologies Limited; Anthony Best Dynamics Limited; Bosch Rexroth AG; CAE Inc.; Cruden BV; ECA Group; L3Harris Technologies, Inc.; Tecknotrove; Thales VI-grade GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Driving Simulator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global driving simulator market report based on simulator type, application, end use, and region:

-

Simulator Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Compact

-

Full-scale

-

Advanced

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Testing

-

Training

-

Motor Sports & Gaming

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Marine

-

Aviation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."