Drilling Fluids Market Size, Share & Trends Analysis Report By Product (OBF, SBF, WBF), By End-use (Onshore, Offshore), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-116-0

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Drilling Fluids Market Size & Trends

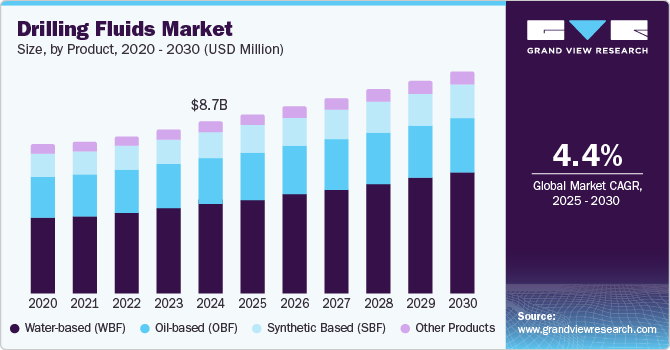

The global drilling fluids market size was valued at USD 8,707.8 million in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. Oil and gas market growth is primarily due to the increasing demand from the energy industry, which is projected to drive global market expansion during the forecast period. Additionally, various industrial sectors, including power plants and transportation, contribute to the rising demand for gas and crude oil. Concerns about managing solid waste, spill containment, and deteriorating boreholes are anticipated to create new opportunities for the drilling oil market throughout this period.

The industry is anticipated to significantly increase product demand due to its crucial role in oil and gas operations. The growing offshore sector, particularly in the Persian Gulf, is anticipated to drive growth in the market. The rising demand for advanced oil drilling chemicals will likely create considerable opportunities, especially due to their comprehensive use in horizontal drilling, such as well.

The U.S., Saudi Arabia, Russia, China, Canada, the UAE, Iran, Iraq, and Brazil were among the largest consumers of product market and drilling equipment, owing to the increasing E&P in the region. A large number of ongoing operations in major oilfields such as Ghawar, Bolivar Coastal Field, Burgan, Safaniya, Prudhoe Bay, and Cantarell Field are expected to play a key role in oil & gas industry growth across the globe.

Drivers, Opportunities & Restraints

The rise in oil and gas exploration activities worldwide is crucial for economic development. By tapping into new resources, countries can enhance energy security, attract foreign investment, and create job opportunities. Moreover, increased production can help stabilize energy prices and generate significant revenue for governments, which can be reinvested in infrastructure and social programs. This exploration supports immediate economic growth and contributes to long-term sustainability and energy independence.

The environmental impact of product market poses significant challenges that could hinder market growth. Concerns over contamination of water sources and the adverse effects on local ecosystems can lead to regulatory restrictions and increased compliance costs. Additionally, public opposition to environmentally harmful practices may push companies towards adopting more sustainable alternatives, further influencing market dynamics. As the industry shifts focus to greener technologies, the traditional market for product market may need to be revised.

Drilling operations in deepwater and ultra-deepwater areas are gaining significant attention due to their potential for accessing vast untapped oil and gas reserves. As conventional resources become scarcer, these deepwater fields present a lucrative market opportunity for energy companies. Advancements in technology have improved the feasibility and safety of such operations, enabling more efficient extraction processes. This shift promises to enhance energy security and offers substantial economic benefits through job creation and investment influx in coastal regions.

Product Insights

“WBF held the revenue share of over 53.1% in 2024.”

The WBF segment accounted for the largest revenue market share, 53.1%, in 2024 and is expected to continue to dominate the industry over the forecast period. This is due to their use in drilling over 75% of wells worldwide. The choice of fluid for the operation depends on the conditions of the well, which may include saturated brine, formate brine, or fresh water. Increasing concerns about the toxicity and biodegradability of other drilling fluids are expected to drive demand for these products in the coming years. Water-based oil is anticipated to gain importance due to its ease of use and ability to discharge during offshore activities. The growing need for an effective fluid system in high-temperature and high-pressure wells will likely increase the demand for water-based oils.

Oil-based products are the second-largest contributors to revenue in the global product market. Oil-based drilling fluid, used in drilling engineering, consists of a combination of oil and water in both continuous and dispersed phases. The significance of oil-based products is expected to increase due to their enhanced lubricity. As the demand for reduced corrosion of drilling tools and improved thermal stability rises, the use of these products is projected to grow significantly during the forecast period. However, despite this anticipated growth, the environmental impact of oil-based fluids has led to strict government regulations regarding their use.

End-use Insights

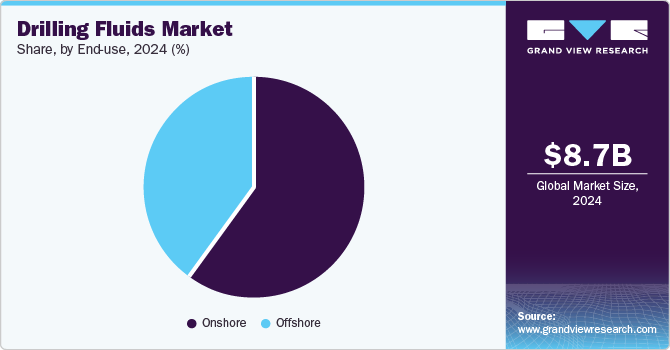

“Offshore segment is anticipated to register a revenue CAGR of 4.8% over the forecast period.”

The onshore segment dominated the market with a market share of 59.8% in 2024, during the forecast period. The rising energy demands primarily drive the increase in oil drilling activities. As research efforts focus on developing abandoned oil wells and reinvigorating projects in various onshore oilfields, the global oil and gas production volume is anticipated to rise significantly. Enhanced oil and gas exploration in countries such as Saudi Arabia, the United States, China, and Russia is expected to boost awareness and demand throughout the forecast period.

The global offshore rig count increase, combined with the significant development of existing offshore wells in deep and ultra-deep waters, especially in the South China Sea, North Sea, Persian Gulf, and Gulf of Mexico, is expected to drive demand during the forecast period. The rising number of ongoing projects and implementations in the Middle East and Africa will likely create substantial demand opportunities for offshore drilling fluids.

Regional Insights

“U.S. held over 76.2% revenue share of the overall North America Drilling Fluids market.”

The North America drilling fluids market held the largest revenue share of 25.2% in 2024, the rising exploration of shale gas in Canada and the U.S. is expected to significantly influence the market. Due to increased drilling activity in offshore areas of the U.S., Mexico, and Canada, the demand for drilling fluids in the region is projected to grow.

U.S. Drilling Fluids Market Trends

In theU.S. drilling fluids market, Significant oilfield development, including in Texas, North Dakota, and the Gulf of Mexico, along with significant Federal government support for unconventional hydrocarbon resource development, is expected to boost industry expansion.

Asia Pacific Drilling Fluids Market Trends

The Asia Pacific drilling fluids market is anticipated to experience significant growth as it explores deep water and tight oil reserves. Implementing advanced technologies aimed at reducing production costs and improving efficiency plays a crucial role in the growth of the regional market.

Europe Drilling Fluids Market

Europe drilling fluids market is expected to experience rapid growth. The significant demand for drilling fluids in horizontal wells is especially notable in Norway, Italy, the Netherlands, Denmark, the UK, and France. The increasing need for crude oil has prompted European exploration and production (E&P) companies to engage in extensive drilling activities in both onshore and offshore locations.

Latin America Drilling Fluids Market

The discovery of untapped oil and gas reserves primarily drives the market in Latin America. During the forecast period, drilling activities in the region are expected to increase, supported by significant deposits of hydrocarbon unconventional reserves such as tight oil, shale gas, and oil sands. Additionally, substantial investments from multinational oil and gas companies are anticipated to further contribute to this growth.

Middle East & Africa Drilling Fluids Market

The Middle East and African drilling fluids market is expected to grow significantly over the forecast period. Gas well and oil refineries production is increasing in Saudi Arabia and Oman, and the trend is steady for South Africa, Kuwait, and Qatar.

Key Drilling Fluids Company Insights

Some of the key players operating in the market include Clariant, Dow, and Solvay

-

Baker International and Hughes Tool Company. The company is headquarters in Neartown and offers oil field services in 90 countries. The company’s oilfield operation comprises two segments, namely drilling & evaluation and completion & production. Drilling & completion fluids are managed under the drilling & evaluation segment. Its drilling, evaluation, & fluids division manages the tricone & PDC drill bit, casing drilling, and ream-while-drilling technology.

-

Halliburton Inc.'s business portfolio comprises two divisions: drilling and evaluation and completion and production. The company caters for its product portfolio to the demand in the upstream oil and gas sectors. Major products and services offered by the company include exploration, technology development, formation evaluation, drilling, well construction, and completion.

Key Drilling Fluids Companies:

The following are the leading companies in the drilling fluids market. These companies collectively hold the largest market share and dictate industry trends.

- AkzoNobel N.V.

- China Oilfield Services Ltd.

- Baker Hughes, Inc.

- CES Energy Solutions Corp.

- Halliburton, Inc.

- Newpark Resources, Inc.

- Petrochem Performance Chemical Ltd. LLC

- Schlumberger Ltd.

- Scomi Group Bhd

- Weatherford International

- Chevron Phillips Chemical Company

- BASF SE

- DuPont

- Dow

Recent Developments

-

In April 2023, ADNOC Drilling secured a contract to provide drilling services for ADNOC's largest producing offshore field, the Upper Zakum field. This agreement includes the deployment of advanced drilling units and aims to increase production capacity. The collaboration reflects ADNOC's strategy to enhance operational efficiency and boost production from its offshore assets while maintaining a focus on sustainable practices. The project underscores the importance of advanced technologies and experienced service providers in optimizing oil and gas extraction in the region.

-

In March 2022, Repsol implemented an enhanced riserless mud recovery system at the Yme field, aimed at improving drilling efficiency and environmental safety. This innovative technology allows for the recovery and recycling of drilling fluids without the need for a riser, which reduces potential environmental impacts associated with conventional drilling methods. The system also facilitates a more streamlined drilling process, minimizing operational downtime.

Drilling Fluids Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 9,073.5 million |

|

Revenue forecast in 2030 |

USD 11,274.8 million |

|

Growth rate |

CAGR of 4.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, End-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Norway; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa. |

|

Key companies profiled |

AkzoNobel N.V.; China Oilfield Services Ltd.; Baker Hughes, Inc.; CES Energy Solutions Corp.; Halliburton, Inc.; Newpark Resources, Inc.; Petrochem Performance Chemical Ltd. LLC; Schlumberger Ltd.; Scomi Group Bhd; Weatherford International; Chevron Phillips; Chemical Company; BASF SE; DuPont; Dow |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Drilling Fluids Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global drilling fluids market report on the basis of product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-based (OBF)

-

Synthetic Based (SBF)

-

Water-based (WBF)

-

Other Products

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global drilling fluids market size was valued at USD 7.99 billion in 2022 and is expected to reach USD 8.32 billion in 2023.

b. The global drilling fluids market is projected to register a CAGR of 4.4% from 2023 to 2030 and is expected to reach USD 11.27 billion by 2030. Growing demand for crude oil and natural gas in various energy-intensive industries such as power generation, manufacturing, and transportation has urged exploration and production companies to increase their investments in onshore and offshore drilling activities.

b. Water-based fluids emerged as the largest product segment with a share of more than 52% in 2022. These fluids are estimated to witness increased penetration and growth rate on account of cost-effectiveness and lower environmental impact of the discharged cuttings and mud.

b. Key market players in the global market include Baker Hughes, Newpark Resources, Halliburton, National Oilwell Varco Weatherford International, and Schlumberger.

b. Increasing number of oil drilling activities in order to fulfill growing energy needs is anticipated to drive the product demand over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."