- Home

- »

- Consumer F&B

- »

-

Dried Cranberries Market Size, Share & Growth Report, 2030GVR Report cover

![Dried Cranberries Market Size, Share & Trends Report]()

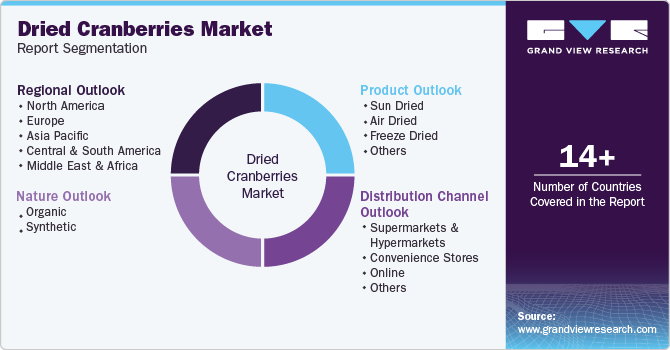

Dried Cranberries Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sun Dried, Air Dried, Freeze Dried), By Nature (Organic, Conventional), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-460-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dried Cranberries Market Size & Trends

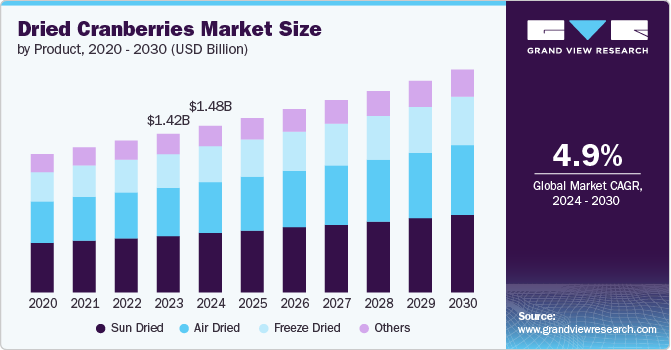

The global dried cranberries market size was estimated at USD 1.42 billion in 2023 and is expected to grow at a CAGR of 4.9% from 2024 to 2030. The rising demand and consumption of dried cranberries can be attributed to several interconnected factors and trends. Primarily, the growing emphasis on health and wellness has led consumers to seek out nutrient-rich snacks. Dried cranberries are celebrated for their high antioxidant content, vitamins, and dietary fiber, making them an appealing choice for those looking to incorporate more healthful foods into their diets. This trend is further supported by the convenience of dried cranberries; they offer a ready-to-eat, portable snack that fits seamlessly into busy lifestyles.

The versatility of dried cranberries also plays a crucial role in their increasing popularity. Beyond being a nutritious snack, they are frequently used in a variety of culinary applications, including salads, baked goods, and trail mixes. This adaptability enhances their appeal to both consumers and food manufacturers, who are continuously exploring new ways to incorporate dried cranberries into diverse products. In addition, the rise of dietary preferences such as plant-based and clean eating diets has further bolstered their demand, as dried cranberries align well with these nutritional trends.

Several market trends are driving the expansion of dried cranberry consumption. Product innovations, such as the introduction of organic and non-GMO options, as well as new flavor combinations and added nutrients, have broadened the range of offerings and attracted a wider audience. Improved packaging solutions, such as re-sealable bags and single-serving packs, have also contributed to greater consumer convenience and satisfaction. Effective marketing strategies that highlight the health benefits of dried cranberries, such as their support for urinary tract health and high antioxidant levels, have enhanced consumer awareness and interest.

Market innovations have also played a significant role in driving demand. Flavored variants of dried cranberries, such as those coated with dark chocolate or combined with other fruits and nuts, offer new and exciting options for consumers. In addition, the inclusion of functional ingredients, such as probiotics or added vitamins, caters to those seeking foods with additional health benefits. The adoption of sustainable farming and processing practices by some brands has further appealed to eco-conscious consumers.

Product Insights

Sun-dried cranberries accounted for a revenue share of 35.6% in 2023. Sun-drying is a traditional method that involves minimal processing, which aligns with the growing consumer preference for natural and whole foods. Many consumers perceive sun-dried cranberries as a healthier option because they are less likely to contain added sugars, preservatives, or artificial ingredients. Sun-dried cranberries tend to have a more concentrated flavor and a chewy texture, which appeals to consumers looking for a rich, natural taste experience. The sun-drying process enhances the natural sweetness and tartness of cranberries, making them a popular choice for snacking and culinary applications, such as baking and cooking, where robust flavor is desirable.

Air-dried is expected to grow at a CAGR of 5.4% from 2024 to 2030. Air-dried cranberries have a texture that is less chewy than sun-dried varieties but still soft enough to be easily incorporated into a wide range of dishes. Their consistent quality and rehydration properties make them suitable for use in various culinary applications, such as baking, salads, cereals, and trail mixes. This versatility appeals to both home cooks and food manufacturers looking to add a burst of flavor and color to their products. With a growing number of consumers seeking healthier snack options, air-dried cranberries cater to the demand for products that are low in calories and free from artificial additives. Air-dried fruits are often perceived as a healthier alternative to sugar-laden snacks or candies, making them a popular choice among individuals looking for guilt-free indulgences.

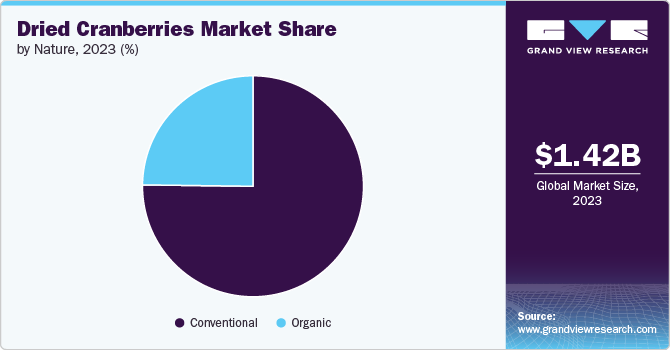

Nature Insights

Conventional dried cranberries accounted for a revenue share of 75.2% in 2023. Conventional dried cranberries are typically more affordable than organic or specialty varieties, making them accessible to a broader range of consumers. The lower price point appeals to budget-conscious buyers and those looking for economical options without sacrificing flavor or convenience. This affordability makes conventional dried cranberries a popular choice for everyday use in snacks, baking, and cooking. Many consumers prefer conventional dried cranberries because they are familiar with the taste, texture, and quality of these products. Conventional drying methods often produce a consistent product that meets consumer expectations for flavor and usability. This reliability makes conventional dried cranberries a trusted choice for consumers who use them regularly in recipes or as snacks.

Organic dried cranberries are expected to grow at a CAGR of 5.2% from 2024 to 2030. Consumers are becoming increasingly aware of the potential health benefits of consuming organic foods, which are grown without the use of synthetic pesticides, fertilizers, and GMOs. Organic dried cranberries are perceived as a healthier option because they are free from harmful chemicals and additives. This aligns with the preferences of health-conscious consumers who are looking to avoid potentially harmful substances and prioritize natural, wholesome ingredients in their diets. In addition, the trend towards clean eating and natural foods has led to a surge in demand for organic products. Consumers are seeking out foods that are perceived as more natural and less processed, and organic dried cranberries fit well within this category.

Distribution Channel Insights

Sales of dried cranberries through supermarkets & hypermarkets accounted for a revenue share of 38.6% in 2023. Supermarkets and hypermarkets offer a convenient one-stop shopping experience where consumers can find a wide variety of products, including dried cranberries. The strategic placement of dried fruits in prominent sections, such as snack aisles or health food sections, makes them easily accessible to shoppers. This convenience drives impulse purchases and encourages consumers to buy dried cranberries during regular grocery shopping trips.

Sales of dried cranberries through online channels are expected to grow at a CAGR of 5.6% from 2024 to 2030. Online retailers often offer a broader range of dried cranberry products than physical stores, including various brands, packaging sizes, and specialty options such as organic, sugar-free, or flavored varieties. This wide selection allows consumers to find specific products that suit their dietary needs and preferences. In addition, online platforms may offer customization options, such as subscription services or bulk purchasing, catering to different consumption habits and increasing demand.

Regional Insights

The dried cranberries market in North America is expected to grow at a CAGR of 4.6% from 2024 to 2030. There is a strong and growing focus on health and wellness among North American consumers. Dried cranberries are rich in antioxidants, vitamins, and fiber, making them a popular choice for those seeking healthier snack options. In addition, the perceived benefits of cranberries in supporting urinary tract health and boosting overall immunity have further driven demand among health-conscious consumers looking to include more functional foods in their diets.

U.S. Dried Cranberries Market Trends

The dried cranberries market in the U.S. is facing intense competition and innovation. The popularity of on-the-go snacking and convenience foods has surged in the U.S., with consumers seeking nutritious, portable, and easy-to-consume options. Dried cranberries fit perfectly into this trend as they are a convenient snack that can be eaten alone or added to other snack products such as trail mixes, granola bars, and cereals. Their long shelf life and ease of storage also make them a practical choice for busy consumers who need quick, healthy snack options.

Europe Dried Cranberries Market Trends

The dried cranberries market in Europe accounted for a revenue share of 35.5% in 2023 of the global market. European consumers are increasingly open to experimenting with new ingredients and incorporating them into diverse culinary applications. Dried cranberries offer a versatile ingredient that can be used in a wide range of dishes, from salads, cereals, and baked goods to savory dishes and cheese platters. The growing trend of incorporating dried fruits into everyday meals and snacks has contributed to the increased demand for dried cranberries as a unique ingredient that adds flavor, texture, and nutritional value.

Asia Pacific Dried Cranberries Market Trends

The dried cranberries market in the Asia Pacific is expected to grow at a CAGR of 5.7% during the forecast period. The Asia Pacific region is known for its diverse culinary traditions, which increasingly embrace global flavors and ingredients. Dried cranberries offer a versatile ingredient that can be incorporated into both traditional and modern dishes. From being added to salads, baked goods, and desserts to being used as a garnish in savory dishes, dried cranberries provide a unique sweet-tart flavor profile that complements various cuisines. The rise of fusion cuisine and the desire to experiment with new ingredients have encouraged the use of dried cranberries in everyday cooking.

Key Dried Cranberries Company Insights

The dried cranberries market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Dried Cranberries Companies:

The following are the leading companies in the dried cranberries market. These companies collectively hold the largest market share and dictate industry trends.

- Ocean Spray Cranberries, Inc.

- Graceland Fruit, Inc.

- Decas Cranberry Products, Inc.

- Fruit d'Or

- Cape Blanco Cranberries, Inc.

- Atoka Cranberries

- Mariani Packing Company, Inc

- The Wonderful Company

- Habelman Bros. Co.

- Cliffstar LLC

Recent Developments

-

In June 2023, Ocean Spray introduced Ocean Spray Snack Medley, a new line of perfectly paired dried fruit mixes designed for families on the go. These medleys combine Ocean Spray's signature Craisins Dried Cranberries with other premium dried fruits, offering a convenient and tasty snack option. The Snack Medley line features three varieties: The Cranberry Almond Medley, which pairs Craisins with roasted almonds and golden raisins; the Cranberry Pistachio Medley, combining Craisins with roasted pistachios and golden raisins; and the Cranberry Berry Medley, which blends Craisins with dried blueberries and dried strawberries.

Dried Cranberries Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.48 billion

Revenue forecast in 2030

USD 1.98 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Ocean Spray Cranberries, Inc.; Graceland Fruit, Inc.; Decas Cranberry Products, Inc.; Fruit d'Or; Cape Blanco Cranberries, Inc.; Atoka Cranberries; Mariani Packing Company, Inc; The Wonderful Company; Habelman Bros. Co.; and Cliffstar LLC

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dried Cranberries Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global dried cranberries market report based on product, nature, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sun Dried

-

Air Dried

-

Freeze Dried

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dried cranberries market size was estimated at USD 1.42 billion in 2023 and is expected to reach USD 1.48 billion in 2024.

b. The global dried cranberries market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030 to reach USD 1.98 billion by 2030.

b. Sun-dried cranberries dominated the dried cranberries market with a share of 35.60% in 2023. Sun-drying is a traditional method that involves minimal processing, which aligns with the growing consumer preference for natural and whole foods. Many consumers perceive sun-dried cranberries as a healthier option because they are less likely to contain added sugars, preservatives, or artificial ingredients.

b. Some key players operating in the dried cranberries market include Ocean Spray Cranberries, Inc., Graceland Fruit, Inc., Decas Cranberry Products, Inc., Fruit d'Or, Cape Blanco Cranberries, Inc., Atoka Cranberries, Mariani Packing Company, Inc., The Wonderful Company, Habelman Bros. Co., and Cliffstar LLC.

b. Key factors that are driving the market growth include rising processed food consumption, rising innovation in food products, and increasing health consciousness among consumers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.