Dried Berries Market Size, Share & Trends Analysis Report By Product (Blueberries, Strawberries, Grapes), By Application (Frozen Desserts, Cereals & Snack Bars), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-872-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Dried Berries Market Size & Trends

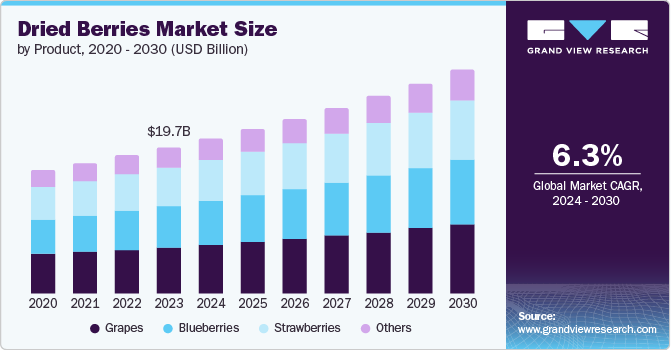

The global dried berries market size was valued at USD 19.67 billion in 2023 and is projected to grow at a CAGR of 6.3% from 2024 to 2030. Factors such as the increasing awareness about healthy and nutritious products, flavoring in bakery products, and increasing acceptance of these products as perfect health food are responsible for the growth of the dominance. In addition, the rising disposable income of the people and inclination towards organic substitutes has been responsible for further propelling the market growth.

The increasing cases of cardiovascular disorders have increased the trend for consuming organic substances such as berries, which are rich in antioxidants, which help reduce bad cholesterol and minimize the risk of heart disorders. The antioxidants further help solve problems such as atherosclerosis, helping expand the market. According to the U.S. Centers for Disease Control and Prevention, in the U.S., from 2019 to 2020, heart disease cost about USD 252.2 billion, including healthcare services, medications, and lost productivity due to mortality. In 2022, it caused 702,880 deaths, with one person dying every 33 seconds from cardiovascular disease.

The increasing consumer trends include opting for better and more nourished foods as consumers have become more aware of their health and are seeking alternatives to packaged snacks and sugary sweets, due to which dried fruits became their natural choice because of their benefits. According to the International Nut & Dried Fruit Council, after a decline in 2021/22 due to poor weather in the U.S., global production of sweetened dried cranberries bounced back in 2022/23, reaching approximately 194,836 metric tons. North America contributed 95% of the total, with the U.S. producing 74% and Canada 21%, while Chile provided the remaining 5%. In 2021, cranberry shipments (H.S. Code 2008 93) totaled 160,401 metric tons, nearly tripling since 2012.

The adaptability of dried fruits makes them capable of being used for different purposes, such as snacking, baking, and consuming meals, as well as for customers trying to maintain a balanced and nutritious diet. The developments in the packaging of these products have also been the key drivers for the segment's growth. The creative packaging designs and materials have been more appealing to the customers, which has developed the attraction to buy the products.

Product Insights

The grapes segment accounted for the largest market revenue share of 32.0% in 2023. Factors such as the increasing prevalence of online shopping, which is the primary reason for the segment's growth because it provides the various vendors with easy access to the market, the increase in the urban population, which is aware of the nutritional benefits, and easy portability have influenced the segment's dominance and growth. According to the Horticulture Innovation Australia Limited, Australia's dried grape industry spans 3,183 hectares (ha) in Victoria, New South Wales, and South Australia, with 2,817 ha fully productive. Newer weather-tolerant varieties such as Sunmuscat and Sunglo now cover 44% of the area, surpassing Sultanas at 34%. Newer varieties, such as Sugra39, account for 2%, and Selma Pete, an early bearer, covers 5%. Producers use a mix of early, mid-, and late-bearing varieties for harvest risk management.

The blueberries segment is expected to grow at the fastest CAGR of 6.7% over the forecast period. The factors such as the abundance of vitamins, minerals, and antioxidants which have the potential to improve the health of the customer and fend off diseases, the increasing demand in frozen, processed, and dried forms have been seen because of various ways of consumption which are responsible for the growth of the segment. In addition, the introduction of disease-resistant and high-yield blueberries, improvement in farming techniques, and an increase in industrialization have further helped the market's growth. For instance, released in 2022 by the University of Florida, the 'Albus' cultivar (U.S. Patent PPAF) was a vigorous and high-yielding variety suited for central Florida's evergreen production system. It had an extended harvest period, starting early and continuing through the season, and produced firm fruit with a heavy wax bloom, receiving high marks in consumer taste tests.

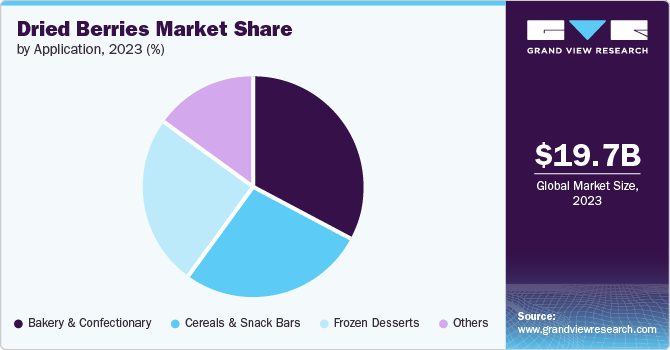

Application Insights

The bakery and confectionary segment accounted for the largest market revenue share of 32.6% in 2023. The growing preference for natural and organic ingredients in bakery and confectionery products drives demand for dried berries, which are seen as wholesome and minimally processed. Their versatility further enhances their appeal, as they can be incorporated into various products, from muffins and bread to granola bars and chocolates. This adaptability makes dried berries popular for health-conscious consumers and innovative food products. For instance, in May 2024, Calbee America Inc., the provider of plant-based snacks, expanded its flagship brand with kid-friendly options, including Harvest Snaps Kids Crispy Fruit Snacks. These snacks, made from 100% whole fruit and available in Bananas, Strawberries, Grapes, and Apples, are vacuum-dried or freeze-dried to maintain their nutrients and natural sweetness. They are non-GMO and gluten-free.

The cereals and snacks segment are expected to grow at the fastest CAGR of 7.0% over the forecast period. Factors such as the increasing popularity of healthy snacking for health and fitness and the popularity of dried fruit packages and dried fruit-enabled cereals breakfasts helped the market's growth. In addition, the increasing trend of organically sourced food products further drives the market growth.

Distribution Channel Insights

The hypermarkets/supermarkets segment held a significant market share in 2023 owing to the increasing consumer demand for healthy and convenient snacks. These retail outlets meet this demand by offering a diverse range of dried berry products that address various dietary preferences. The extensive product variety and accessibility enhance their appeal to health-conscious shoppers. For instance, in July 2024, Walgreen Co. launched a new private label brand featuring over 150 healthy food and beverage products. These include jerky, beverages, white cheddar cheese, dried cranberries, roasted pistachios, tart cherry juice, apple juice boxes, oatmeal, nuts, trail mixes, dried fruit, coffee, frozen items, and more. The brand aims to offer a diverse selection of nutritious options for consumers.

Specialty stores are expected to grow significantly over the forecast period; this growth is attributed to the increasing consumer demand, increase in disposable income, changing consumer behavior, increasing urbanization, and infrastructure improvement, which have helped the market's growth. In addition, credit availability and digital retailing, transforming the in-store experience by incorporating technology and the seamless shopping experience they provide, are expected to fuel the market in upcoming years.

Regional Insights

North America dried berries held the largest market share of 41.8% in 2023. The increasing trends in consumer behavior, shifting trends towards a vegan lifestyle, and increasing health consciousness among people have been the primary reasons for the market growth in the region. In addition, the high ice cream consumption per capita has raised the product demand, and the increasing cases of heart disorders influenced patients to consume berries for better health, positively impacting the market. For instance, in 2023, U.S. ice cream manufacturers produced 1.30 billion gallons, contributing USD 11.4 billion to the economy. The industry provides 27,100 jobs and USD 1.9 billion in direct wages.

U.S. Dried Berries Market Trends

The U.S. dried berries market was identified as a lucrative country in 2023. This dominance can be attributed to increased veganism, increased consumption of dry fruit products such as cakes, juice, muffins, etc., and increased awareness about dried berries' health benefits and nutritional value. In addition, dried berries are used for making ice cream, and the availability of various industries has influenced the growth of the market.

Europe Dried Berries Market Trends

Europe dried berries market is anticipated to grow significantly over the forecast period. Factors such as the increasing need for healthy and natural food, the various uses of dried berries, and the increase in the knowledge of the advantages of dried fruit such as high in fiber, nutrition, and antioxidants appeal more to the customers helped in the growth of the market. For instance, in May 2024, Ghana planned to boost its export revenues by focusing on dried fruit exports, supported by a USD 1.08 million investment package from CBI, the Netherlands Center for Import Promotion. This four-year project aimed to strengthen the dried fruits value chain and enhance the export capacity of small and medium-sized enterprises. The initiative was designed to develop and expand Ghana's dried fruit industry.

The UK dried berries market is expected to grow significantly over the forecast period owing to the increasing population and availability of products across the country. The bakery industry's presence in the country has positively impacted the market growth.

Dried berries market in Germany held a significant market share in 2023 owing to rising disposable income, which enables consumers to invest in premium, health-oriented food products, including dried berries. This increased spending power supports the growth of the dried berries market. For instance, in Germany, the average household's per capita net-adjusted disposable income stands at USD 38,971, surpassing the OECD's average of USD 30,490. Employment rates for individuals aged 15 to 64 hovers around 77%, above the OECD average of 66%. This elevated income and employment level contribute to enhanced purchasing power among German consumers.

Asia Pacific Dried Berries Markets Trends

Asia Pacific dried berries market is expected to grow at the fastest CAGR of 7.7% over the forecast period. Factors such as shifting consumer preference for healthy and nutritionally enriched food products, increase in obesity and geriatric population who need the most antioxidants and minerals, increasing acceptance of packaged food products, and widespread use of dried berries in various industries such as bakery, dairy, and confectionary have further helped in market expansion.

China dried berries market is expected to grow significantly over the forecast period owing to the rising health awareness as consumers seek out the nutritional benefits and antioxidants found in dried berries. Increasing disposable incomes allow people to invest in premium, health-focused products, including dried berries. In addition, rapid urbanization results in busier lifestyles, creating a higher demand for convenient, nutritious snacks.

Key Dried Berries Company Insights

Some of the key companies are Del Monte Foods, Inc, Dole, Lion Raisins Inc., Bergin Fruit and Nut Company, Bella Viva Orchards, Sun Valley Raisins, Ocean Spray, Olam Group, Sunsweet International, and UAB Arimex. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Del Monte Foods, Inc. is an American food production and distribution company that offers a wide range of food products, including canned fruits, vegetables, broths, and sauces. The company also manufactures frozen dried fruits.

-

Dole is an Irish American company that manufactures fresh fruits such as pineapple, canned and jarred, beverages, dried fruits such as raisins and dates, and snack products.

Key Dried Berries Companies:

The following are the leading companies in the dried berries market. These companies collectively hold the largest market share and dictate industry trends.

- Del Monte Foods, Inc

- Dole

- Lion Raisins Inc.

- Bergin Fruit and Nut Company

- Bella Viva Orchards

- Sun Valley Raisins

- Ocean Spray

- Olam Group

- Sunsweet International

- UAB Arimex

Recent Developments

-

In June 2023, Ocean Spray launched a new line of dried fruit snack medleys, Snack Medley, available in Walmart stores throughout the U.S. These medleys come in single-serving packs, mixing whole dried cranberries with various fruits. They are offered in three flavors: Cran-Pineapple, Cran-Mango, and Cran-Blueberry.

-

In April 2022, Sun-Maid Growers of California expanded its snack offerings with Grape Jerky, a textured dehydrated snack. This unique product was aimed at adventurous consumers such as spelunkers, hikers, and off-roaders. Made from whole grapes, the jerky was 100% sun-dried and came in convenient servings for easy snacking on the go.

Dried Berries Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.85 billion |

|

Revenue forecast in 2030 |

USD 30.15 billion |

|

Growth rate |

CAGR of 6.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Del Monte Foods, Inc; Dole; Lion Raisins Inc.; Bergin Fruit and Nut Company; Bella Viva Orchards; Sun Valley Raisins; Ocean Spray; Olam Group; Sunsweet International; UAB Arimex |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Dried Berries Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the dried berries market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Blueberries

-

Strawberries

-

Grapes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Frozen Desserts

-

Cereals & Snack Bars

-

Bakery & Confectionary

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Specialty Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Mexico

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA).

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."