- Home

- »

- Automotive & Transportation

- »

-

Dredging Equipment Market Size And Share Report, 2030GVR Report cover

![Dredging Equipment Market Size, Share & Trends Report]()

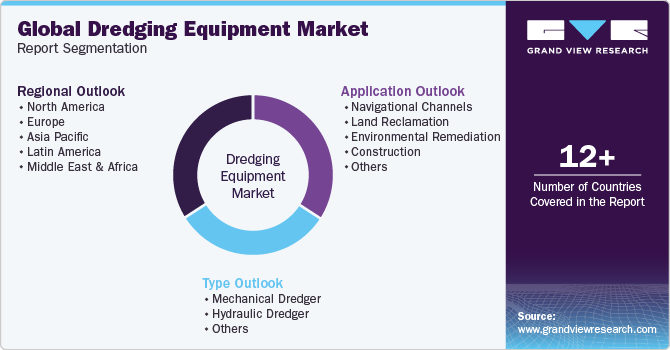

Dredging Equipment Market Size, Share & Trends Analysis Report By Type (Mechanical Dredger, Hydraulic Dredger) By Application (Navigational Channels, Land Reclamation, Construction), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Dredging Equipment Market Size & Trends

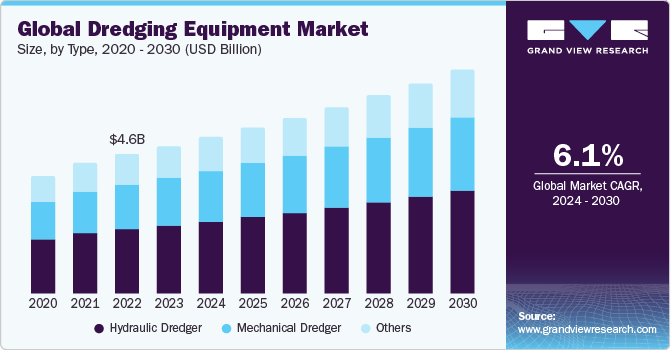

The global dredging equipment market size was estimated at USD 4.86 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. Dredging represents a cutting-edge maritime task involving skilled personnel, including scientists, engineers, and trained crews, and supported by a variety of large, medium, and small dredging firms and suppliers of dredging equipment and technology.

The growing number of dredging projects being undertaken worldwide is a major driving factor behind the market growth. In addition, development of technologically advanced dredging equipment, including advanced dredging pumps, more efficient dredgers, and innovative material transport systems is further driving the market growth.

Growing government funding and increasing infrastructure projects, including the expansion and construction of harbors and ports, expected to drive the demand for dredging equipment from 2024 to 2030. For instance, in November 2023, the Maritime Administration (MARAD) of the U.S. Department of Transportation (DoT) announced the funding of over USD 653 million to support forty-one port improvement projects across the U.S. through the Port Infrastructure Development Program (PIDP). The funding is expected to enhance efficiency at Great Lakes ports, coastal seaports, and inland river ports. Such initiatives are expected to bode well for the market’s growth.

The market is further driven by the need for deeper channels and expanded infrastructure to accommodate larger vessels. As ports handle increasing volumes of maritime traffic, the demand for dredging activities grows to maintain and enhance waterways and ports. The growth of urbanization, global trade, and maritime transportation activities has led to an increased demand for the expansion and maintenance of ports and related infrastructure. As a result, the demand for dredging equipment and services is increasing to meet the evolving needs of modern ports.

The extraction and exploration of offshore energy resources, such as oil & gas, require dredging operations for pipeline installation, seabed preparation, and offshore platform maintenance. For instance, dredging is necessary to create channels for vessels to access the site and maintain the infrastructure once operational. Moreover, the continuous extraction of offshore energy resources leads to sedimentation and sediment accumulation around drilling platforms and pipelines. This necessitates maintaining optimal water depths in ongoing dredging operations for navigation and preventing infrastructure damage. As the demand for offshore oil & gas exploration and extraction increases, the need for efficient and advanced dredging equipment also rises.

Factors such as the fluctuations in the raw material prices and high installation costs to operate dredging equipment are expected to impede the market growth to a certain extent. In addition, despite various benefits of dredging equipment, there are some drawbacks that could hamper the market growth. For instance, mechanical dredgers, in contrast to hydraulic dredgers, often have limited mobility and may not be as well-suited for operating in demanding environments. Also, they tend to be less cost-effective compared to their hydraulic counterparts.

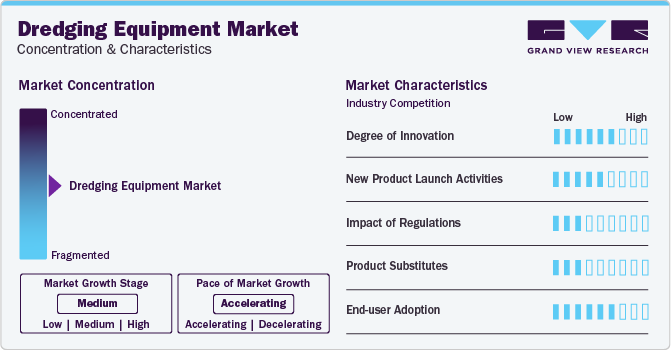

Market Concentration & Characteristics

The industry's growth stage is medium, and the pace is moderate. The dredging equipment industry can be characterized by a high degree of innovation. These innovations include advancements in dredging technology aimed at enhancing efficiency and sustainability and meeting the evolving needs of the maritime industry.

The dredging equipment industry is characterized by new product launch activities by key companies. Companies are adopting this strategy to enhance their dredging equipment offerings in the global industry.

The regulatory trends play a substantial role in influencing the dredging equipment industry. The dredging industry is facing increasing pressure from regulatory bodies to address environmental concerns, such as reducing carbon emissions and preserving sensitive marine habitats. This shift in regulatory focus is driving the dredging sector to adapt its practices and technologies to meet these evolving environmental requirements while still maintaining the operational standards necessary to serve the needs of waterway users.

Dredging is a specialized process that involves excavating and removing sediments from waterways to maintain navigability and support infrastructure development. There are no direct substitutes available for the dredging equipment in terms of performing these critical functions.

The dredging equipment industry has a high concentration of end users. An increasing demand for dredging equipment for applications such as coastal protection and land reclamation, environmental remediation and restoration, and port and harbor development, among others, is propelling the market's growth.

Type Insights

Based on type, the hydraulic dredger segment led the market with the largest revenue share of 46.65% in 2023. In the ever-evolving landscape of environmental management and civil engineering, the hydraulic dredging process has emerged as a fundamental technique for maintaining navigation channels, reshaping waterways, and reclaiming valuable sediments. Hydraulic dredging is a preferred choice in several dredging situations. It provides mobility, cost-effectiveness, versatility, reliability, and adaptability to challenging conditions. Thus, increasing demand for hydraulic dredging equipment in various applications, from deepening ports and harbors to flood control and environmental restoration efforts, is driving the growth of the segment.

The mechanical dredger segment is projected to witness at a significant CAGR during the forecast period. Mechanical dredging involves the physical removal of sediment from a waterbody using equipment like backhoes, clamshells, excavators, draglines, or cranes. Mechanical dredgers provide benefits such as removal of large debris and sediment regardless of size, easy removal of vegetation including woody debris, roots, and logs, and efficient removal from the shoreline. Thus, owing to the above-mentioned benefits, the demand for mechanical dredgers is expected to increase from 2024 to 2030.

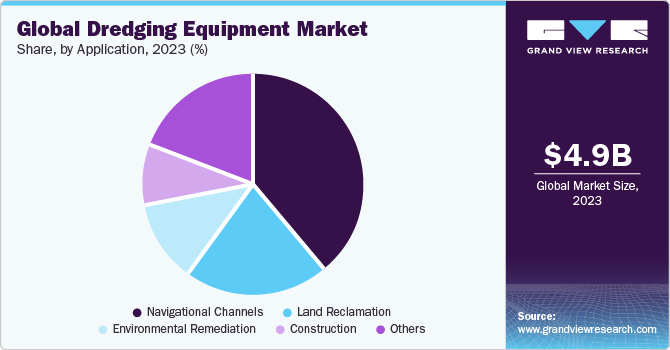

Application Insights

Based on application, the navigational channels segment led the market with the largest revenue share of 38.79% in 2023. The growing use of dredging equipment in harbors, ports, and shipping channels to create and maintain waterways is driving the market growth. Dredging operations deepen navigation channels, ensuring safe passage for vessels transporting various goods, such as textiles, food, and technology, which are essential for international trade and economic growth. Thus, the growing demand for dredging equipment to ensure safe navigation for vessels, improve or maintain the navigability and depth of water channels, and support different maritime activities is boosting the growth of the segment.

The construction segment is projected to witness at a significant CAGR during the forecast period. Construction dredging equipment is used at the beginning of a project to relocate and remove sediments, enabling the creation of new land for the development of artificial islands, industrial and residential areas, airports, causeways, and highways. This process also supports the construction of dikes, dams, and wildlife habitats by providing the necessary land preparation through the removal and relocation of sediments. In addition, increasing development of new ports and waterways in developing as well as developed regions is boosting the segment’s growth.

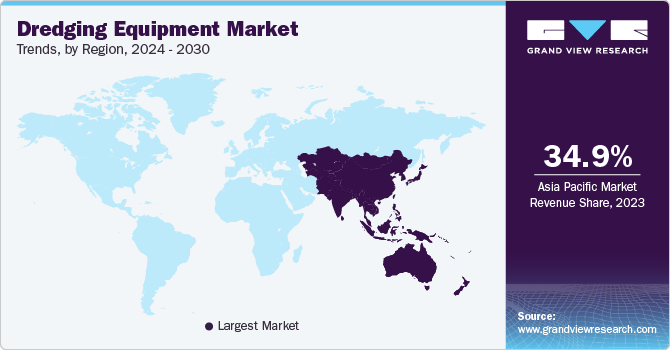

Regional Insights

The dredging equipment market in North America is expected to witness at a significant CAGR during the forecast period. The presence of various established market players, such as DSC Dredge, LLC, American Marine Corporation, and GeoForm International Inc. across the region is propelling the market growth in North America.

U.S. Dredging Equipment Market Trends

The dredging equipment market in the U.S. is expected to grow at a significant CAGR of 6.3% from 2024 to 2030. The growth is attributed to the rising investments in the infrastructure sector. The federal government's investments in infrastructure projects, including harbors and port improvements, are bolstering the need for dredging machines across the country.

The Canada dredging equipment market is expected to grow at a significant CAGR from 2024 to 2030. The vast presence of dredging service providers across the country is driving the market growth. For instance, Canadian Dewatering LP provide a broad range of dredging equipment to handle unique situations. The company’s inventory includes portable swinging ladder, cutterhead and drag flow dredges.

Asia Pacific Dredging Equipment Market Trends

Asia Pacific dominated the dredging equipment market with the revenue share of 34.98% in 2023. With the government's focus on infrastructure development, environmental protection, and economic growth, the dredging equipment market in the region is expected to witness significant growth, presenting opportunities for domestic and international manufacturers.

The dredging equipment market in China is expected to grow at a significant CAGR of 6.4% from 2024 to 2030. The increasing number of port dredging-related projects is expected to drive the demand for dredging equipment across China, thereby propelling the market growth.

The India dredging equipment market is anticipated to grow at a fastest CAGR from 2024 to 2030. India’s infrastructure development plans, including the Sagarmala initiative, have propelled the demand for dredging equipment. The Sagarmala initiative, led by the Ministry of Ports, Shipping, and Waterways (MoPSW), serves as the primary Central Sector Scheme designed to advance port-led development across the country.

The dredging equipment market in Japan is expected to grow at a significant CAGR from 2024 to 2030. The growth in global trade has led to an increase in port development activities across the country, which in turn is driving the demand for dredging equipment.

Europe Dredging Equipment Market Trends

The dredging equipment market in Europe is expected to grow at a significant CAGR of 6.1% from 2024 to 2030. The growth can be attributed to the growing emphasis on urban development and redevelopment. In addition, Europe is investing in upgrading its transportation infrastructure, including ports, to improve connectivity, enhance mobility, and support economic growth.

The UK dredging equipment market is expected to grow at a significant CAGR from 2024 to 2030. The growing demand and adoption of dredging equipment in the UK for growing construction and dredging activities is a major factor propelling the market growth.

The dredging equipment market in Germany is expected to grow at a significant CAGR from 2024 to 2030. The market’s growth can be attributed to factors such as inland waterway modernization and port and harbor improvements.

Middle East & Africa Dredging Equipment Market Trends

The dredging equipment market in Middle East & Africa is anticipated to grow at a significant CAGR of 4.8% from 2024 to 2030. Ports play a key role in enabling trade in the Middle East and Africa. Countries like the UAE and Kingdom of Saudi Arabia are investing in modernizing and expanding their ports to improve logistics and support increasing maritime activities. Thus, increasing port improvement activities are expected to drive the demand for dredging equipment in the region.

The Kingdom of Saudi Arabia (KSA) dredging equipment market is expected to grow at a significant CAGR from 2024 to 2030. The rapid growth in the maritime expansion projects and surge in the infrastructure development initiatives are driving the market growth in the country.

Key Dredging Equipment Company Insights

Some of the key companies operating in the market include Liebherr-International AG, Royal IHC, DSC Dredge, LLC, and Holland Dredge Design

-

Royal IHC is a leading provider of advanced maritime technology, offering a comprehensive portfolio of efficient and innovative equipment, offshore vessels, and related services. The company caters to the specialized needs of maritime service providers operating in the mining, dredging, and offshore industries

-

Liebherr-International AG, along with its subsidiaries, supplies and manufactures construction machinery. It offers commercial freezing and refrigeration products, domestic appliances, crawler cranes, mobile cranes, deep foundation machines, maritime cranes, and port equipment

DSC Dredge, LLC, Dredge Yard, Ellicott Dredges, LLC, US Aqua Services, and VMI, Inc., are some of the emerging companies in the global market.

-

DSC Dredge, LLC is a dredging equipment manufacturer. The company designs and builds custom dredges that lower operating costs and boost efficiency. It also offers dredging support equipment and dredge parts

-

Dredge Yard specializes in the engineering, design, manufacture, and supply of small- and medium-sized dredgers. With offices in the United Arab Emirates and the Netherlands, the company serves customers around the world

Key Dredging Equipment Companies:

The following are the leading companies in the dredging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- American Marine Corporation

- Dredge Yard

- DSC Dredge, LLC

- Ellicott Dredges, LLC

- GeoForm International Inc.

- Holland Dredge Design

- Liebherr-International AG

- Royal IHC

- Shandong Haohai Dredging Equipment Co., Ltd.

- US Aqua Services

- VMI, Inc.

Recent Developments

-

In April 2024, Shandong Haohai Dredging Equipment Co. Ltd (HID) launched a heavy-duty, large-capacity cutter suction dredger CSD750 at clients' working sites. The precision-engineered dredger can dredge to depths of up to -22 meters, showcasing a cutter power of 700KW. The dredger is equipped with dual marine dredging pumps, ensuring a dredging capacity of 7000m3/h

-

In December 2022, Royal IHC, a leading supplier of maritime technology, announced the successful supply of two cutter suction dredgers, namely IHC Beaver 70 and IHC Beaver 45, to Xuan Thien Group, a prominent construction and infrastructure development company. These dredgers were deployed to establish a reclamation area for the creation of the Xuan Thien Nam Dinh green steel complex

Dredging Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.15 billion

Revenue forecast in 2030

USD 7.36 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Indonesia; Malaysia; Philippines; Singapore; Vietnam; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Liebherr-International AG; DSC Dredge, LLC; Royal IHC; American Marine Corporation; Dredge Yard; GeoForm International Inc.; Holland Dredge Design; Ellicott Dredges, LLC; US Aqua Services; Shandong Haohai Dredging Equipment Co., Ltd.; VMI, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dredging Equipment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dredging equipment market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical Dredger

-

Hydraulic Dredger

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Navigational Channels

-

Land Reclamation

-

Environmental Remediation

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

Malaysia

-

Philippines

-

Singapore

-

Vietnam

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global dredging equipment market size was estimated at USD 4.86 billion in 2023 and is expected to reach USD 5.15 billion in 2024.

b. The global dredging equipment market is expected to grow at a compound annual growth rate of 6.1% from 2024 to 2030 to reach USD 7.36 billion by 2030.

b. The hydraulic dredger segment dominated the market in 2023 and accounted for a 46.65% share of the global revenue. The increasing demand for hydraulic dredging equipment in various applications, from deepening ports and harbors to flood control and environmental restoration efforts is driving the growth of the segment.

b. Some of the key players operating in the dredging equipment market include Liebherr-International AG, DSC Dredge, LLC, Royal IHC, American Marine Corporation, Dredge Yard, GeoForm International Inc., Holland Dredge Design, Ellicott Dredges, LLC, US Aqua Services, Shandong Haohai Dredging Equipment Co., Ltd., and VMI, Inc.

b. The growing number of dredging projects being undertaken worldwide is a major driving factor behind the growth of the dredging equipment market. In addition, the development of technologically advanced dredging equipment, including advanced dredging pumps, more efficient dredgers, and innovative material transport systems is further driving the growth of the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."