Domain Name System Tools Market Size, Share & Trends Analysis Report By Type (Managed DNS Services, Standalone DNS Tools), By Deployment (On-premises, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-383-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Domain Name System Tools Market Trends

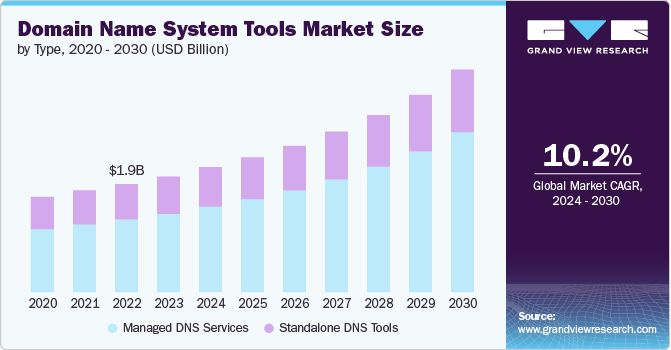

The global domain name system tools market size was estimated at USD 2.11 billion in 2023 and is expected to grow at a CAGR of 10.2% from 2024 to 2030. The growth of the DNS tools market can be attributed to the increasing focus on the online presence of businesses. As organizations prioritize digital transformation and expand e-commerce initiatives, the demand for secure and efficient domain name management has surged. Domain name system (DNS) tools play a crucial role in enhancing online visibility, ensuring reliable connectivity, and safeguarding against cyber threats. These tools facilitate optimal website performance, minimize downtime, and improve user experience, all of which are essential for maintaining a competitive edge in the digital marketplace.

The growth is mainly attributed to rapid digital transformation efforts across various industries. As businesses increasingly migrate their operations and services online, the need for reliable and efficient DNS solutions grows. DNS tools play a crucial role in ensuring seamless connectivity and optimal performance for websites and applications, thereby supporting organizations in enhancing their digital presence and customer engagement strategies. This trend is driving the demand for advanced DNS tools that can effectively manage complex IT environments, accommodate scalability, and deliver robust security measures to safeguard against cyber threats.

Advancements in technologies such as cloud computing, artificial intelligence, and machine learning have significantly contributed to the development of advanced DNS tools. These intelligent DNS tools offer enhanced performance, security, and automation features, enabling organizations to effectively manage their DNS infrastructure and optimize application delivery. With capabilities such as predictive analytics, automated threat detection, and real-time traffic management, modern DNS tools can proactively identify and mitigate potential issues, ensuring uninterrupted service and robust protection against cyber threats.

With the rise in cyber threats, including distributed denial-of-service (DDoS) attacks and data breaches, the need for robust DNS security has become more critical. DNS tools equipped with advanced security features help protect against such threats by providing secure DNS resolution, mitigating attacks, and ensuring data integrity. The growing awareness and prioritization of cybersecurity measures are driving the demand for secure DNS solutions. In March 2024, a report, DDoS: Here to Stay, published by Akamai Technologies, Inc. and Financial Services Information Sharing and Analysis Center (FS-ISAC), a U.S.-bed non-profit organization dedicated to enhancing cybersecurity and resilience within the global financial system revealed that in 2023, over one-third (35%) of all DDoS attacks targeted the financial services industry, which surpassed the gaming sector as the most frequently attacked vertical.

This increase is largely due to the growing strength of botnets and the rise of hacktivism. In the Europe, Middle East, and Africa region, the financial services sector bore the brunt of 66% of all DDoS attacks, while North America experienced 28%. In the APAC region, financial services were the third most attacked sector, accounting for 11% of DDoS attacks.

Stringent regulatory frameworks and data protection laws, such as GDPR, mandate organizations to ensure the security and privacy of their online operations. DNS tools play a vital role in complying with these regulations by offering features such as encryption, secure DNS resolution, and access controls. The need to adhere to regulatory requirements and protect sensitive data drives the adoption of advanced DNS tools.

Type Insights

The managed DNS services segment dominated the market in 2023 and accounted for a 67.9% share of the global revenue. The increasing reliance on the internet for business operations and communication has made the need for robust, reliable, and high-performance DNS services more critical. Businesses are seeking managed DNS services to ensure their websites and online services are always available, leading to reduced downtime and improved user experience. As a result, the demand for these services is on the rise, especially among enterprises that cannot afford disruptions to their online presence.

The standalone DNS tools segment is projected to witness significant growth from 2024 to 2030. The rising awareness of cybersecurity threats related to DNS infrastructure is a growth driver of the segment. DNS is often a target for various types of cyberattacks, including DDoS attacks, DNS spoofing, and cache poisoning. Standalone DNS tools offer enhanced security features, such as real-time threat detection and mitigation, to protect against these vulnerabilities. As cyber threats continue to evolve, businesses are increasingly prioritizing DNS security, leading to greater adoption of standalone DNS tools that provide comprehensive security measures.

Deployment Insights

The cloud deployment segment dominated the market in 2023 and accounted for a 57.9% share of the global revenue due to the increasing adoption of cloud computing across various industries. As businesses migrate their operations and services to the cloud, there is a growing need for DNS tools that are specifically designed to operate within cloud environments. Cloud-based DNS tools offer scalability, flexibility, and ease of deployment, making them ideal for dynamic and rapidly changing business needs. This shift towards cloud infrastructure is driving the demand for DNS tools that can seamlessly integrate with cloud platforms and manage DNS services effectively.

The on-premises segment is projected to witness significant growth from 2024 to 2030 due to the heightened focus on data security and privacy. Organizations in regulated industries such as finance, healthcare, and government, prefer on-premises solutions to maintain strict control over their data. On-premises DNS tools ensure that sensitive information remains within the organization's internal network, reducing the risk of data breaches and complying with stringent regulatory requirements. This need for enhanced security and compliance is a significant factor driving the adoption of on-premises DNS tools.

Enterprise Size Insights

The large enterprises segment dominated the market in 2023 and accounted for a 57.9% share of the global revenue. The digital transformation initiatives undertaken by large enterprises are propelling the demand for DNS tools. As these organizations expand their online presence, adopt cloud services, and integrate Internet of Things (IoT) devices, the complexity and scale of their DNS infrastructure grow correspondingly. Standalone DNS tools provide the necessary capabilities to manage this complexity, ensuring seamless connectivity, high availability, and optimal performance of digital services. The drive towards digital transformation and the need to support dynamic, cloud-based environments are key factors fueling the adoption of DNS tools in large enterprises.

The SMEs segment is projected to witness significant growth from 2024 to 2030 owing to the increasing reliance of SMEs on digital platforms and online presence. As more SMEs embrace digital transformation, the need for reliable and efficient DNS management tools becomes essential to ensure their websites and online services remain accessible and performant. This digital shift necessitates robust DNS tools that can help SMEs manage their domain names effectively, leading to a rise in demand within this segment.

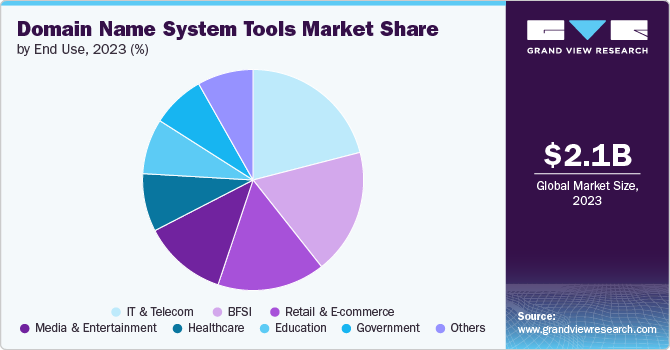

End Use Insights

The IT & telecom segment dominated the market in 2023 and accounted for a 21.0% share of the global revenue. The rapid growth of cloud computing and the increasing adoption of hybrid cloud environments are driving the demand for DNS solutions. IT and telecom companies are migrating services to the cloud, necessitating advanced DNS management tools to handle dynamic IP addressing and service continuity. Standalone and integrated DNS solutions are critical for managing the complexities of cloud deployments, thus driving growth in this segment as organizations seek reliable tools to support their cloud strategies.

The government segment is projected to witness significant growth from 2024 to 2030. The rise in public sector initiatives aimed at enhancing citizen engagement and service delivery also contributes to the growth of the DNS tools market. Governments are increasingly focusing on improving their online presence and ensuring reliable access to services for citizens. Efficient DNS management is critical in ensuring high availability and performance of government websites and applications. As agencies seek to enhance their digital services, the demand for reliable and effective DNS tools becomes paramount, further supporting market growth. For instance, the UK Government's National Cyber Security Centre (NCSC) announced a new partnership with Cloudflare Inc., a U.S.-based DNS provider for its Protective Domain Name System (PDNS) service starting in September 2024.

Regional Insights

North America held the major share of 36.0% of the domain name system tools market in 2023 owing to the rapid digital transformation occurring across industries. Businesses are increasingly migrating to cloud services and adopting IoT solutions, which necessitate a more sophisticated approach to DNS management. As organizations expand their digital footprints, the need for reliable and efficient DNS solutions becomes critical to ensure optimal performance and availability. This demand for advanced DNS tools is driving investments in the market.

U.S. Domain Name System Tools Market Trends

The domain name system tools market in the U.S. is expected to grow significantly from 2024 to 2030 due to the rapid growth of the Internet of Things (IoT) and connected devices. The proliferation of connected devices generates significant DNS traffic and complexity, necessitating specialized tools to manage these environments effectively. As businesses integrate IoT into their operations, the demand for scalable and efficient DNS solutions rises, driving further market expansion. Companies are investing in DNS tools that can handle the unique challenges posed by IoT environments, contributing to overall market growth.

Europe Domain Name System Tools Market Trends

The domain name system tools market in Europe is growing significantly at a CAGR of 9.8% from 2024 to 2030. The evolving regulatory landscape in Europe, including directives such as the Digital Services Act (DSA), necessitates stringent compliance measures. Organizations are compelled to invest in DNS tools that ensure adherence to these regulations, driving growth in the market as businesses seek reliable solutions to manage compliance.

Asia Pacific Domain Name System Tools Market Trends

The domain name system tools market in Asia Pacific is growing significantly at the highest CAGR of 12.0% from 2024 to 2030. Rapid increase in internet penetration across Asia Pacific is a significant growth driver for the Domain Name System (DNS) tools market. With more individuals and businesses coming online, there is a growing need for robust DNS solutions to ensure reliable connectivity and online presence. This surge in internet usage has encouraged organizations to invest in DNS management tools to improve website performance and security.

Key Domain Name System Tools Company Insights

Key players operating in the domain name system tools market include Akamai Technologies, Cloudflare, Inc., F5, Inc., GoDaddy Operating Company, LLC, Microsoft, MxToolBox, Inc, TransUnion LLC. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In April 2024, Akamai Technologies introduced Shield NS53, a new product designed to protect on-premises DNS infrastructure from resource exhaustion attacks, which can incapacitate servers by overwhelming them with requests. Shield NS53 enhances company’s existing solutions, including the cloud-based Akamai Edge DNS and the Akamai Prolexic platform, known for its DDoS protection for Layer 3 and Layer 4 attacks.

-

In December 2023, Cloudflare, Inc. partnered with Stairwell, Inc., a U.S.-based cybersecurity firm, to integrate their services. This collaboration aimed to combine Cloudflare's fast DNS resolver with Stairwell's automated malware analysis, enhancing the Stairwell DNS service powered by Cloudflare. Users to benefit from improved insights and research on new cybersecurity threats.

Key Domain Name System Tools Companies:

The following are the leading companies in the domain name system tools market. These companies collectively hold the largest market share and dictate industry trends.

- Akamai Technologies

- Cloudflare, Inc.

- easyDNS Technologies Inc.

- F5, Inc.

- GoDaddy Operating Company, LLC

- Microsoft

- MxToolBox, Inc

- MyDomain

- Network Solutions, LLC

- TransUnion LLC

Domain Name System Tools Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.27 billion |

|

Revenue forecast in 2030 |

USD 4.06 billion |

|

Growth rate |

CAGR of 10.2% from 2024 to 2030 |

|

Actual data |

2018 - 2022 |

|

Base year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, deployment, enterprise size, end use, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Akamai Technologies; Cloudflare, Inc.; easyDNS Technologies Inc.; F5, Inc.; GoDaddy Operating Company, LLC; Microsoft; MxToolBox, Inc; MyDomain; Network Solutions, LLC.; TransUnion LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Domain Name System Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the domain name system tools market report based on type, deployment, enterprise size, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Managed DNS Services

-

Standalone DNS Tools

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Telecom and IT

-

Media and Entertainment

-

Retail and E-commerce

-

Healthcare

-

Government

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global domain name system (DNS) tools market size was estimated at USD 2.11 billion in 2023 and is expected to reach USD 2.27 billion in 2024.

b. The global domain name system tools market is expected to grow at a compound annual growth rate of 10.2% from 2024 to 2030 to reach USD 4.06 billion by 2030.

b. The managed DNS services segment dominated the market in 2023 and accounted for a 67.9% share of the global revenue. The increasing reliance on the internet for business operations and communication has made the need for robust, reliable, and high-performance DNS services more critical.

b. Some key players operating in the domain name system tools market include Akamai Technologies, Cloudflare, Inc., easyDNS Technologies Inc., F5, Inc., GoDaddy Operating Company, LLC, Microsoft, MxToolBox, Inc, MyDomain, Network Solutions, LLC., and TransUnion LLC.

b. The growth of the DNS tools market can be attributed to the increasing focus on businesses' online presence. As organizations prioritize digital transformation and expand e-commerce initiatives, the demand for secure and efficient domain name management has surged. DNS tools play a crucial role in enhancing online visibility, ensuring reliable connectivity, and safeguarding against cyber threats.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."