- Home

- »

- Advanced Interior Materials

- »

-

Dolomite Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Dolomite Market Size, Share & Trends Report]()

Dolomite Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Calcined, Sintered, Agglomerated), By End-use (Iron & Steel, Construction, Glass & Ceramics, Water Treatment, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-020-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dolomite Market Summary

The global dolomite market size was estimated at USD 1.97 billion in 2024 and is projected to reach USD 3.05 billion by 2030, growing at a CAGR of 7.8% from 2025 to 2030. Rising penetration of steel products in industries such as construction, automotive, and energy is anticipated to augment its production and positively influence dolomite demand over the forecast period.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, U.S. is expected to register the significant CAGR from 2025 to 2030.

- Based on product, the calcined product held a market share of over 39.0% in 2024.

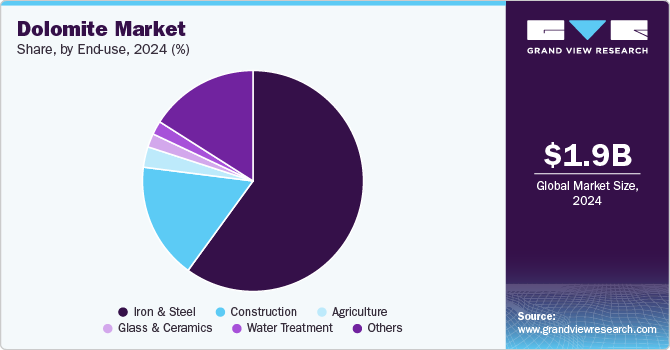

- Based on end-use, the iron & Steel segment held a market share of over 60.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.97 Billion

- 2030 Projected Market Size: USD 3.05 Billion

- CAGR (2025-2030): 7.8%

- North America: Largest market in 2024

The product is used as a raw material in steel production. For instance, calcined dolomite is used to protect furnace linings in steel manufacturing, wherein it serves as a flux. In addition, sintered products are a significant raw material for producing refractories that are utilized in steel production.

Drivers, Opportunities & Restraints

The industry is primarily driven by its applications in construction, steel, and agriculture, as dolomite serves as a cost-effective material for improving soil quality and as a flux in steel manufacturing. Increasing demand from the construction and infrastructure sectors, particularly in emerging markets, boosts dolomite consumption. Recent investments in sustainable infrastructure have spurred demand, as seen in Lhoist Group’s 2024 expansion of high-quality dolomite production in Europe to meet growing construction material needs.

Environmental concerns and regulatory restrictions on mining activities pose significant restraints in the industry. Stricter environmental standards limit mining expansions, affecting supply. Additionally, land degradation from dolomite extraction is a rising issue, prompting many governments to impose regulations that can restrict industry growth. For instance, India’s 2023 environmental policy revision impacts limestone and dolomite extraction, adding operational costs for compliance.

Technological advancements in mining and processing create new opportunities for the industry by improving extraction efficiency and reducing environmental impact. Increasing interest in eco-friendly building materials and innovations in green steel present opportunities for dolomite applications, as more companies look to sustainable alternatives. A notable example is Omya’s recent introduction of sustainable dolomite products to meet eco-friendly construction demands, positioning itself as a leading supplier in low-impact materials.

Price Trend Analysis

Since 2023, dolomite prices have generally shown a steady increase due to rising demand in construction, steel, and environmental applications. Driven by infrastructure projects, particularly in Asia Pacific and the Middle East, demand for high-quality dolomite remains robust, keeping prices firm.

Additionally, energy and mining costs have contributed to higher production expenses, which are passed along to consumers, further elevating prices. However, as new regulations on mining expand, especially in environmentally sensitive areas, prices may see more volatility, with potential increases in regions impacted by stricter extraction controls.

Product Insights

Calcined product held a market share of over 39.0% in 2024. This material is commonly used as a refractory material in the manufacturing of basic refractories. In this form, the calcined can withstand high temperatures and is resistant to corrosion and erosion, making it useful in applications that require durability and thermal stability.

Increasing investment to set up new plants or expanding the existing manufacturing capacity of steel manufacturing is expected to propel the consumption of dolomite. For instance, in June 2024, SteelAsia, inaugurated Compostela Works, the largest steel mill in the Philippines. It has a production capacity of 1 million tons per annum. The plant will produce high strength rebars and welded rebar mesh.

End-use Insights

Iron & Steel segment held a market share of over 60.0% in 2024. The product is utilized as a refractory material in steelmaking processes such as converter lining, opening hearth furnaces, and electric furnace walls. Apart from its fluxing and sintering characteristics, dolomite is a natural source of magnesium oxide (MgO). Magnesium oxide is a crucial ingredient in the manufacturing of refractory bricks that are utilized for lining high-temperature furnaces.

The construction segment is expected to register the fastest growth rate across the forecast period. Dolomite is used as a construction aggregate because of its high density and surface hardness. Countries across the world are investing in their infrastructure, such as roads, highways, and airports, which is expected to propel product demand over the forecast period.

The water treatment segment is anticipated to register a growth rate of 8.5%, in terms of revenue, across the forecast period. Calcined dolomite is one of the most cost-efficient alkaline products that is used for making drinking water. It is highly suitable as a medium for filtering drinking water and is also used to increase the pH value of purified water after reverse osmosis. The rising awareness about health and the environment among people is likely to benefit the growth of the segment.

Regional Insights

North America dolomite market held over 36.0% revenue share of the global market. North America dolomite market is expected to sustain its dominance owing to its extensive demand for dolomite in the construction industry. For instance, over the last ten years, the construction sector has witnessed tremendous growth in Canada, with over 50 skyscrapers in major cities. In addition, over 6,000 infrastructure projects for expressways and highways support the growth of the construction sector in the country.

U.S. Dolomite Market Trends

The U.S. dolomite market is characterized by robust demand across construction, steel manufacturing, and agricultural sectors. Environmental concerns are also increasing the demand for dolomite in wastewater treatment and soil stabilization. With U.S. producers focusing on sustainable mining practices, industry players are optimizing production processes to reduce environmental impact, aligning with stringent regulatory frameworks aimed at promoting sustainability within the mineral extraction industry.

Asia Pacific Dolomite Market Trends

The Asia Pacific dolomite market is anticipated to register the fastest growth over the forecast period. The region is witnessing expansion in steel facilities. For instance, in January 2023, SteelAsia Manufacturing Corporation and China BaoWu Steel Group Corporation Limited announced their partnership to build a USD 1.98 billion steel production facility in the Philippines owing to the rising infrastructure expenditure in the country. The facility is expected to produce 3 million tons annually.

Europe Dolomite Market Trends

The dolomite market in Europe is driven by strong demand in construction, glass, ceramics, and refractory materials, with growing emphasis on carbon-reducing building practices. Manufacturers are investing in sustainable extraction techniques aligned with EU regulations. Infrastructure projects in countries like Germany and France further boost demand, positioning the region for steady growth.

Central & South America Dolomite Market Trends

The dolomite market in Central and South America is growing with rising construction and mining investments, especially in Brazil, where it supports cement production. Urbanization and agriculture demand in Argentina and Chile also drive the market, with dolomite used as a soil conditioner. Local extraction methods are improving despite regulatory challenges, and steady economic conditions are likely to support ongoing demand across construction and industrial sectors.

Middle East & Africa Dolomite Market Trends

The dolomite market in the Middle East & Africa is expected to grow significantly over the forecast period. This growth can be attributed to the increasing investments by government and private players in various industries such as tourism, construction, manufacturing, and food & beverages. Countries in the region are developing at a fast pace owing to the ongoing rapid industrialization and urbanization.

Key Dolomite Company Insights

Some of the key players operating in the market include Petra Dolomites Limited and Rio Tinto

-

Calcinor is a leading Spanish producer of lime and dolomite products, specializing in the production of high-quality materials for industrial applications, including steel, glass, and construction.

-

CARMEUSE is a global supplier of high-calcium and dolomitic lime, with operations across North America, Europe, and Asia. The company serves diverse industries, including steel, water treatment, and construction, offering products that enhance environmental sustainability and optimize production efficiency.

Key Dolomite Companies:

The following are the leading companies in the dolomite market. These companies collectively hold the largest market share and dictate industry trends.

- Calcinor

- CARMEUSE

- Essel Mining & Industries Limited (EMIL)

- Imersys S.A.

- JFE Mineral & Alloy Company, Ltd.

- Lhoist

- Omya AG

- RHI Magnesita

- Sibelco

- VARDAR DOLOMITE

Recent Developments

-

In April 2024, RHI Magnesita announced the acquisition of U.S.-based Resco Group for USD 430 million. This acquisition strengthens RHI Magnesita's position in the North American market and expands its product offerings, including dolomite-based refractories. The deal is expected to enhance the company's ability to serve key industries like steel and cement, providing a broader portfolio of high-performance materials critical for industrial applications.

-

In September 2023, the Competition Commission of India (CCI) approved Ignite Luxembourg Holdings S.A.R.L.'s acquisition of a significant shareholding in RHI Magnesita N.V. This deal strengthens Ignite Luxembourg’s position in the refractory market, which includes dolomite-based products used in industries such as steel and cement.

Dolomite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.10 billion

Revenue forecast in 2030

USD 3.05 billion

Growth Rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Russia; Turkey; China; India; Japan; South Korea; Brazil; Argentina; Colombia; Venezuela

Key companies profiled

Calcinor; CARMEUSE; Essel Mining & Industries Limited (EMIL); Imerys S.A.; JFE Mineral & Alloy Company, Ltd.; Lhoist; Omya AG; RHI Magnesita; Sibelco; VARDAR DOLOMITE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dolomite Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dolomite market report on the basis of product, end-use and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Calcined

-

Sintered

-

Agglomerated

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Iron & Steel

-

Construction

-

Glass & Ceramics

-

Water Treatment

-

Agriculture

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

Colombia

-

Venezuela

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global dolomite market size was estimated at USD 1.97 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The global dolomite market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 3.05 billion by 2030.

b. Based on end-use segment, iron & steel held the largest revenue share of more than 60.0% in 2024 on account of widespread applications of steel in various end-uses.

b. Some of the key players operating in the dolomite market include CARMEUSE, Imerys, Lhoist, RHI Magnesita, Calcinor, Sibelco, among others.

b. The key factors driving the dolomite market include increasing production of steel and infrastructural developments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.