Docks Market Size, Share & Trends Analysis Report By Material (Wood, Plastic & Composites), By Frame Material, By Product Type, By Application, By End Use, By Dock Accessories, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-987-7

- Number of Report Pages: 198

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Docks Market Size & Trends

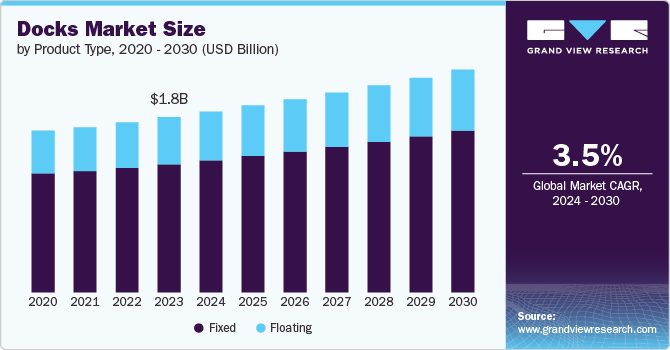

The global docks market size was estimated at USD 1.79 billion in 2023 and is expected to witness a CAGR of 3.5% from 2024 to 2030. The market is driven by the rising structure demand as the governing bodies of various economies are conducting re-development of waterfronts to maximize their value for both business and community.

The majorly used set of materials for floating dock construction includes wood, metal, plastic, composites, and concrete. Wood is the conventional material used for dock manufacturing. However, it is susceptible to warp, rot, splinters, and insect damage. This dock material also requires constant ongoing maintenance and upkeep which is time-consuming and costly. Thus, plastic or composite materials have emerged as a better alternative to wood, as they are more robust, lightweight, and adaptable. In addition, these materials do not rust, dent, or warp and also withstand extreme weather conditions.

Furthermore, as coastal regions become more popular vacation destinations, the infrastructure needed to support this influx of visitors has expanded. This expansion includes the development of marinas, private docks, and other boating facilities which are essential for recreational activities such as boating, fishing, and water sports. These activities require adequate docking facilities and boat lifts to ensure safe and convenient access to the water. As more tourists flock to coastal destinations, there is a corresponding increase in demand for these facilities to accommodate the growing number of boats and watercraft.

Currently, the challenge in the market is the environmental conditions, the docks operating state, and technical equipment that are primarily handled manually and thus separately. One of the Norway-based engineering firms has developed smart application software to reduce the risk of accidents using an IoT platform. The newly developed technology uses hi-tech sensors to monitor the operating states of floating docks in real-time from virtually anywhere. This newly created application software shows the water levels across different tanks and other operating parameters for the docks.

The U.S. dominated the North American market accounting for the largest revenue share in 2023. This growth is attributed to the rise in the use of shipping for the movement of products and goods across regions. This increase in the movement of marine vessels has increased maintenance and repair work for ships and boats. This has helped in the increased use of floating docks, which has helped in the market growth.

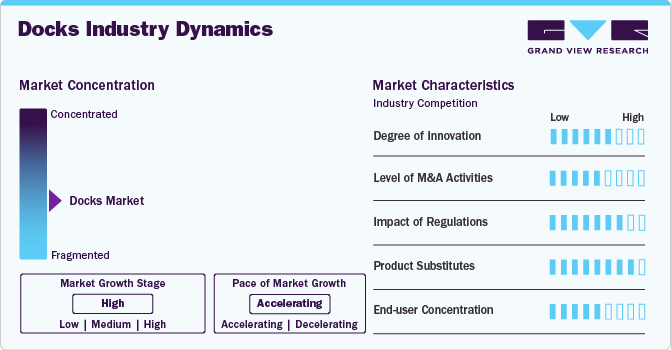

Market Concentration & Characteristics

The global docks market is characterized by strong competition owing to the presence of a large number of dock manufacturers due to the increased number of marine projects and the surged shipyard construction worldwide. These manufacturers compete based on the quality and maintenance level of their docks to differentiate their products in the market.

The presence of big players in the market, which includes Meeco Sullivan, Bellingham Marine, EZ Dock, Jet Dock Systems, Marinetek, and Candock makes the market highly competitive. These companies have been in the market for a prolonged period and have an established client base that makes them the market leaders. For instance, Candock has distributor channels in Canada, the U.S., Latin America, Europe, the Middle East, Africa, Asia, and Oceania. In addition, these companies indulge in strategies such as acquisition, expansion, partnership, and diversification of sales & distribution networks to have a strong foothold in the market.

The market is often affected by sudden events such as hurricanes and floods, which may cause damage to dock infrastructure. This requires the companies to stay alert and ready for these eventualities for repair and reconstruction purposes. Negotiation strategies may focus on addressing potential risks in the supply chain, such as market fluctuations, geopolitical uncertainties, or disruptions in the raw material supply. Agreements may include provisions for risk-sharing, alternative sourcing options, or contingency plans to mitigate potential disruptions.

Manufacturers often enter into formal supply agreements with raw material suppliers. These agreements outline the terms and conditions of the supply, including pricing, quality specifications, delivery schedules, and other relevant terms. Supply agreements provide clarity and stability to the procurement process, ensuring a reliable raw material supply.

Frame Material Insights

The metal frame segment led the market and accounted for more than 52.4% of revenue share in 2023. The metal segment is anticipated to see a boom in the market, over the forecast period, owing to the increasing demand for aluminum frame docks in the market. Docks with aluminum frames are highly preferred by lakefront homes or business owners as they offer strength as well as improve the aesthetic profile of the property where the docks are installed.

The concrete frame segment is projected to register a CAGR of 2.9% from 2024 to 2030. The concrete dock frames offer exceptional structural strength and durability thus exhibiting the capability to withstand a significant marine load. Thus, these structures are used in a variety of harbor and marine applications, especially in the Asia Pacific market. The plastic and composites frame segment is one of the fastest-growing product segments on account of its high demand in the market. Plastic or composite frame docks are emerging as suitable alternatives for wood-based docking frames, as the materials offer better resistance to rot. High-density polyethylene floatation framework offers excellent strength, superior buoyancy, and stability.

Material Insights

The wood material segment is expected to witness a CAGR of 2.8% from 2024 to 2030. The demand for wood has been increasing in the market as it is the most conventional material used in building docks and is expected to maintain its dominance over the forecast period owing to the superior natural aesthetics offered by the same.

Metal material accounted for 8.0% of revenue share in 2023. Metals especially aluminum can be used for the dock manufacturing. However, it is majorly used as a frame material and not used for other parts such as decking. Metals are least preferred for other parts of the docks as they get corroded over time.

The plastic and composites material segment is expected to witness a CAGR of 4.6% over the forecast period. It is expected to grow at the highest rate as high-quality plastic docks do not dent, warp, or rust and offer superior resistance to extreme weather conditions when integrated with ideal anchoring hardware. These materials are also highly versatile. If a section of the docks gets damaged it can be replaced easily without dismantling the entire dock system.

The concrete material segment is expected to witness a CAGR of 3.4% over the forecast period. Concrete tiles or precast concrete is one of the major materials used in the decking of floating docks. Concrete floating docks offer exceptional strength and durability, thus offering resistance against significant impact which is increasing the market demand for concrete material.

Product Type Insights

Fixed docks dominated the market with a revenue share of 73.1% in 2023. These docks are large, solid structures that provide a stable & sturdy platform for boats, thus serving as a focal point for waterfront properties. These docks require lower maintenance compared to floating docks, thereby offering long-term reliability once installed. However, a potential restraint of fixed docks is their limited adaptability in areas with fluctuating water levels or tidal movements, which may make them unsuitable for certain environments. Additionally, depending on the materials used, fixed docks may require more maintenance over time to withstand various environmental factors and ensure longevity.

The demand for floating dock systems is driven by the growth of water-based recreational activities, such as boating and sailing, contributing significantly to the need for essential infrastructure for mooring and accessing watercraft. Furthermore, floating docks are recommended in areas frequently hit by hurricanes due to their ability to ride the waves along with the boat, making them a popular choice among storm-resilient dock solutions.

Application Insights

Saltwater dominated the market with a revenue share of 76.8% in 2023 and is further expected to grow at the fastest rate from 2024 to 2030. Coastal and marine tourism is a significant driver of demand for docks and boat lifts. Destinations such as the Mediterranean, the Caribbean, and Southeast Asia attract millions of tourists who engage in boating, sailing, and other water activities. The infrastructure required to support these activities, including docks and boat lifts, must be robust and resilient to withstand the harsher conditions of saltwater environments. As high tourist traffic necessitates reliable and safe docking facilities, the demand for docks & boat lifts is expected to grow rapidly in seawater settings.

Boat owners seek to enhance their boating experiences through convenience and ease of access. Docks and boat lifts provide secure and easy ways to access boats, making it simpler for owners to embark on and return from water activities. Boat lifts, in particular, offer the added benefit of keeping boats out of the water when not in use, preventing hull damage, reducing maintenance costs, and prolonging the vessel's lifespan. This convenience drives demand for these products in freshwater areas.

Dock Accessories Insights

Lightings dominated the dock accessories market in 2023. It is crucial for docks, providing visibility and safety during nighttime operations or low-light conditions. Lights are typically mounted on the dock structure, illuminating the walking surface and edges. LED lights are commonly used due to their energy efficiency and durability. Other major types of lights used in docks include underwater lights, decorative lights, and safety lights.

Trash cans are essential for maintaining a clean and environmentally responsible waterfront area. Heavy-duty materials, animal-resistant lids, and integrated recycling compartments are some of the major innovations in trash cans, which have contributed to effective waste containment and disposal. Trash cans are designed to withstand harsh outdoor conditions and promote responsible waste management, thereby contributing to the overall cleanliness and sustainability of the waterfront area.

End Use Insights

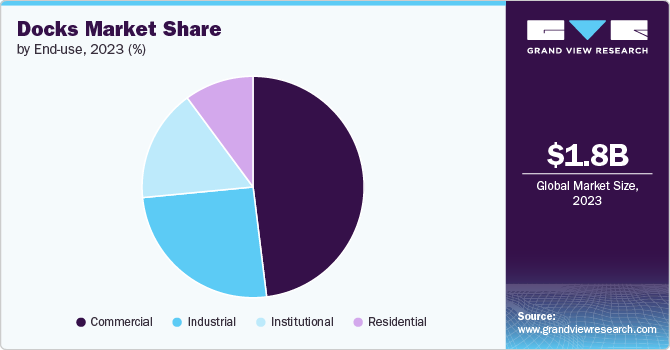

The commercial application segment led the market and accounted for 48.0% of the revenue share in 2023. There are endless possibilities for commercial applications for floating docks. However, they are commonly used in settings such as waterfront resorts and marinas. Commercial application places for floating docks include custom-built fuel docks and ship stores. Commercial application is the dominant segment of the floating docks market.

The industrial application segment accounted for 25.4% of the revenue share in 2023. Floating docks are a practical and reliable solution for industrial work sites that demand water tasks. These dock structures can also be used as other floating equipment, work platforms, and material barges. These floating docks offer the safety of workers, and equipment against wear and slipping-related damages.

Institutional application is projected to register a CAGR of 4.3% in terms of values from 2024 to 2030. Floating docks are one of the most preferred structures for various public properties such as parks and recreational centers. These structures are also used by town councils and municipalities for floating bridges and public marinas.

Regional Insights

North America docks market dominated and accounted for 44.2% of the global revenue in 2023 and is expected to continue the trend from 2024 to 2030. This growth of the market in the region can be attributed high penetration of docks in residential and commercial applications in North America. Moreover, rising efforts to increase the recreational centers in the region post-COVID-19 are also expected to contribute to the growth of the docks market in North America in the coming years.

The U.S. Docks Market dominated the North American Docks market in 2023. This growth is attributed to the rise in the use of shipping for the movement of products and goods across regions. This increase in the movement of marine vessels has increased maintenance and repair work for ships and boats. This has helped in the increased use of floating docks, which has helped in the growth of the docks market.

The docks market in Canada is expected to grow at a significant rate from 2024 to 2030.Recreational boating activities in Canada are expected to rise in the forecast period due to the increase in expendable income of the population and the rising focus on the lifestyle of the consumers. According to Transport Canada, the number of new boater licenses has increased by 75% in 2021 from 2020. The NMMA-Canada has stated that recreational boating has a market value of about USD 5 billion in 2020. These factors are expected to help in the growth of docks market in Canada.

Europe Docks Market Trends

Europe comprises many developed economies, such as Germany, the UK, Italy, and France. The European Union’s maritime industry consists of shipbuilding and recreational craft sectors. The European Commission sets forth rules and regulations regarding the production and usage of maritime materials and products based on the end-usage. The focus on both these sectors is augmented to help the growth of the docks market in Europe during the forecast period.

Docks market in Germany was valued at a significant revenue in 2023. The German maritime industry is expected to witness a turnover of USD 52.5 billion in 2022, according to the Federal Ministry of Economic Affairs and Climate Action. The advanced innovation in terms of technology has helped the German marine industry to capture a major share of the global market. Moreover, the German government has worked out the Maritime Agenda 2025 which is focused on improving the marine industry in the country. The agenda includes innovation in terms of sustainable energy sources, ship propulsion systems, and funding programs for SMEs. Digitization in activities such as navigation is also a key aspect of the agenda. The growth of the marine industry is expected to have a positive effect on the growth of the docks market in Germany.

Asia Pacific Docks Market Trends

The Asia-Pacific is expected to grow at the fastest CAGR of 4.4% in the docks market. The region consists of many developing as well as developed and strong economies, such as India, China, Japan, and South Korea. Further, rising demand for outdoor recreational activities and waterfronts in the region is expected to drive the market growth.

China Docks Market is the largest in the Asia Pacific and is further expected to grow at a significant rate. China is one of the largest shipbuilders in the world. China also has a monopoly on shipping container production due to the low cost of production and increased governmental support. These factors are expected to increase the use of floating docks in the region as shipping activities and movements increase to rise in production.

Middle East & Africa Docks Market Trends

The Middle East and Africa market for docks is anticipated to grow at the fastest CAGR of 4.9%. Countries in the African region have extensively invested in the development of their ports in recent times.

The geographical location of the UAE has led to the maritime industry contributing extensively to the country’s economy. Apart from industrial and commercial maritime activities, tourism and leisure maritime segments have majorly contributed to the growth of the country’s shipping industry and subsequent docks industry.

Central & South America Docks Market Trends

The Central and South American maritime industry is majorly made up of small to medium sized players with considerably smaller fleets which cover a small geographic area. The contraction in GDP and decrease in import and export levels are expected to negatively impact the maritime industry. This is also expected to have a negative impact on the floating docks market.

Brazil Docks Market is the largest developed market in Central and South America. Over the last few decades, initiatives by the Brazilian government in terms of economic reforms have helped in stabilizing the country and increasing opportunities in the industrial and manufacturing sectors. This has had a positive impact on the shipping and maritime industry, further driving demand for docks.

Key Docks Company Insights

Some key players operating in the market include Marinetek and Candok.

-

Marinetek company specializes in the fabrication and installation of marina and floating solutions. The company’s offerings include marina solutions, pontoons, and pontoon technology, floating solutions, and equipment such as docking equipment, boat mooring equipment, anchoring material, and safety equipment. In addition, they also offer modernization and remodeling services along with after sales maintenance, spare parts, and support. Marinetek operates in 45 countries including Canada, the Philippines, Italy, Malaysia, the U.S., and Russia along with 12 manufacturing plants across the world.

-

Candock is involved in the manufacturing of docks and modular floating systems. The company’s product line includes modular floating docks, jetroll, jetslides boat/PWC lift, rowing docks, service channels, edge line, and floating dock accessories & tools. Candock has its manufacturing plant in Canada and its products are manufactured according to the ISO 9001:2008 quality standards as well as 14001:2004 environmental standards. Furthermore, the company has arranged a distribution channel that covers many countries including Canada, the United States, Latin America, Europe, the Middle East, Africa, Asia, and Oceania. In addition, the company also provides online purchase options from their official website.

AccuDock and EZ Dock are some emerging market participants.

-

AccuDock specializes in the manufacturing of floating docks for commercial as well as residential sectors. The company also caters to Kayak and paddle sports, rowing, work floats, gangways and ramps, ADA-compliant docks, custom design, dock builders, and jet ski docks. It also provides customizable options solutions to its clients for different sectors, including residential docks, commercial docks, rowing docks, and camps & park docks. The company has a team of mechanics, fabricators, engineers, welders, and sales professionals to provide quality products and better consumer satisfaction.

-

EZ Dock is involved in the manufacturing of floating modular docks, boats & PWC lifts, accessories, and ports. The company delivers a wide range of advantages through its products including low maintenance, barefoot-friendly, easy to configure, durable, and versatile. Its product portfolio includes floating docks, ports, launched/lifts, add-ons, and walkaways. Its products cater to the demand of various markets including residential, commercial, government, and industrial.

Key Docks Companies:

The following are the leading companies in the docks market. These companies collectively hold the largest market share and dictate industry trends.

- Snap Dock

- RHINO, INC.

- Tommy Docks

- Hydrohoist

- Connect-A-Dock

- Carolina Docks

- PMS Dock Marine Company

- Cellofoam North America Inc.

- Sunstream

- RONAUTICA QUALITY MARINAS, S.L.

- VERSADOCK

- Bellingham Marine

- Marinetek

- AccuDock

- MariCorp U.S.

- PMS Dockmarine

- Martini Alfredo

- Transpac Marinas Inc.

- Ingemar

- Meeco Sullivan

- Jet Dock Systems, Inc.

- Walcon Marine

- Candock

- EZ Dock

- Damen

Recent Developments

-

In July 2024, Walcon Marine Ltd completed a project for Guernsey Ports, involved in the removal and replacement of piers D & E in the QEII Marina. The project focused on renovating and restoring an area spanning 500 meters of finger pontoons and walkaways capable of handling 130 large leisure boats. The USD 1.8 million project, as a part of the bigger 14.2 million program, focused on improving the marina’s infrastructure.

-

In June 2024, Marinetek Finland completed the installation for the marina extension project based in Inkoo, Finland. The newly extended marina will now contain over 800 protected marina berths, thus becoming one of the biggest marina projects to be completed in one phase. The company used its Premier, Breakwater, and Super Yacht concrete pontoons to complete the 200- meter-long project.

-

In May 2024, Meeco Sullivan announced the completion of the Lighthouse Point Marina project. The project, which started in the third quarter of 2022, involved overhauling the aging concrete dock, which made 50% of the marina unsafe. The project was completed successfully with three gangways and five gates placed for aesthetic and functional purposes.

Docks Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.84 billion |

|

Revenue forecast in 2030 |

USD 2.27 billion |

|

Growth rate |

CAGR of 3.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, frame material, dock accessories, product type, end use, application, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Australia; Japan; Indonesia; Brazil; UAE |

|

Key companies profiled |

Snap Dock, RHINO, INC., Tommy Docks, Hydrohoist, Connect-A-Dock, Carolina Docks, PMS Dock Marine Company, Cellofoam North America Inc., Sunstream, RONAUTICA QUALITY MARINAS, S.L., VERSADOCK, Bellingham Marine, Marinetek, AccuDock, MariCorp U.S., PMS Dockmarine, Martini Alfredo, Transpac Marinas Inc., Ingemar, Meeco Sullivan, Jet Dock Systems, Inc., Walcon Marine, Candock, EZ Dock, Damen |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Docks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global docks market report based on material, frame material, product type, application, end use, dock accessories, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood

-

Metal

-

Plastics & Composites

-

Concrete

-

-

Frame Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood

-

Metal

-

Plastics & Composites

-

Concrete

-

-

Product Type Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Floating

-

Fixed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Freshwater

-

Saltwater

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Institutional

-

-

Dock Accessories Outlook (Revenue, USD Million, 2018 - 2030)

-

Ladders

-

Bumpers

-

Cleats

-

Carts

-

Benches/Seats

-

Fish Cleaning Station

-

Kayak Rack

-

Trash Cans

-

Lighting

-

Handrails

-

Other Accessories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global docks market size was estimated at USD 1.79 billion in 2023 and is expected to reach USD 1.84 billion in 2024.

b. The global docks market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 2.27 billion by 2030.

b. Metal frame docks segment led the market and accounted for more than 52.4% share of the global revenue in 2023. The metal segment is anticipated to see a boom, over the forecast period, owing to the increasing demand for aluminum frame docks.

b. Some of the key players operating in the docks market include Bellingham Marine, Marinetek, Accudock, Maricorp U.S., Pms Dockmarine, Martini Alfredo, Transpac Marinas Inc., Ingemar, Meeco Sullivan, Jet Dock Systems, Inc., Walcon Marine, Candock, Ez Dock, Damen, Great Northern Docks.

b. The key factors driving the docks market includes rising structure demand as the governing bodies of various economies are conducting redevelopment of waterfronts to maximize their value for both business and community.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."