Docker Monitoring Market Size, Share & Trends Analysis Report By Component (Solution, Service), By Deployment (Cloud, On-premise), By Enterprise Size, By End-use (BFSI, Healthcare, Retail & E-commerce), Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-534-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Docker Monitoring Market Size & Trends

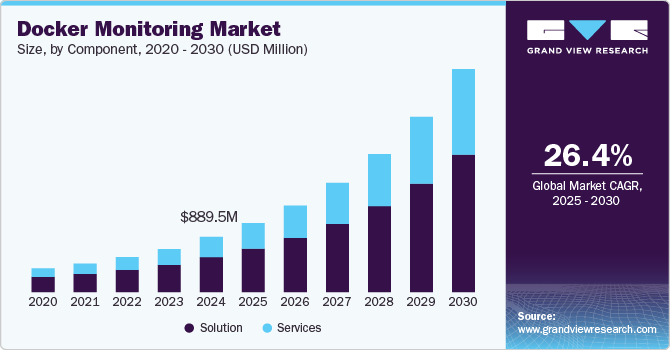

The global docker monitoring market size was estimated at USD 889.5 million in 2024 and is projected to grow at a CAGR of 26.4% from 2025 to 2030. The market is driven by the increasing adoption of containerization technologies across industries as organizations modernize their IT infrastructure. As businesses embrace microservices architectures to enhance agility, scalability, and efficiency, the need for effective monitoring solutions has grown significantly. As a leading container platform, docker is widely used to develop, deploy, and manage applications, making it critical for organizations to monitor container performance, resource utilization, and security. This growing reliance on containers contributes to the expanding demand for docker monitoring tools that provide real-time insights into containerized environments.

Another key driver is the rising complexity of IT environments, where containers are deployed across multi-cloud and hybrid-cloud infrastructures. Traditional monitoring tools often fall short in providing visibility into dynamic, ephemeral containers in such environments. As a result, organizations are increasingly adopting purpose-built docker monitoring solutions capable of tracking container health, resource consumption, and interdependencies in real-time. These tools help ensure optimal performance, detect anomalies, and enable proactive troubleshooting, thus supporting business continuity and service reliability.

Furthermore, compliance and security requirements also play a significant role in shaping the docker monitoring industry. With containers being frequently spun up and down, maintaining consistent security postures and ensuring compliance across dynamic containerized environments has become challenging. Docker monitoring solutions with integrated security and compliance capabilities are in high demand, particularly among industries with strict regulatory requirements, such as finance, healthcare, and government. As organizations seek to balance innovation with risk management, the need for comprehensive docker monitoring solutions will continue to grow.

In addition to the growing adoption of containerized applications, the shift toward DevOps practices is a significant driver for the docker monitoring industry. As organizations accelerate their development lifecycles and adopt continuous integration and deployment (CI/CD) pipelines, they require real-time visibility into container performance at every stage of the software development process. Docker monitoring tools enable development and operations teams to collaborate effectively, identify performance bottlenecks, and optimize container performance before applications are released into production. This emphasis on speed, efficiency, and reliability within DevOps environments fosters increased demand for robust Docker monitoring solutions.

Component Insights

Based on component, the solution segment led the market with the largest revenue share of 63.20% in 2024. The solution segment dominates the docker monitoring industry primarily due to the increasing need for comprehensive, automated tools that provide real-time visibility, performance analysis, and security monitoring for containerized environments. Organizations across industries are rapidly adopting containerization to enhance scalability and flexibility, creating a demand for purpose-built monitoring solutions that can effectively track and manage docker containers' health, performance, and resource consumption. These solutions offer advanced capabilities such as container discovery, anomaly detection, log management, and visualization, enabling IT teams to identify issues and optimize container performance proactively. Moreover, many organizations prefer integrated docker monitoring platforms that seamlessly connect with their existing cloud and hybrid infrastructure monitoring systems, further driving the adoption of ready-to-deploy solutions.

The services segment is expected to grow at a significant CAGR during the forecast period, due to the rising complexity of deploying, managing, and optimizing docker monitoring tools in dynamic, large-scale container environments. As organizations adopt docker at scale, many lack the in-house expertise to implement monitoring solutions effectively, driving demand for professional services such as consulting, deployment, customization, and integration. These services help businesses tailor docker monitoring tools to their specific infrastructure, application architectures, and compliance requirements. In addition, with the increasing shift toward managed services and container monitoring-as-a-service, organizations increasingly rely on third-party providers to handle continuous monitoring, performance tuning, and troubleshooting on their behalf. This growing preference for outsourced and managed docker monitoring services, particularly among small and mid-sized enterprises (SMEs), contributes to the services segment's rapid expansion within the docker monitoring industry.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 63.42% in 2024.The cloud deployment segment dominates in the docker monitoring industry due to the widespread adoption of cloud-native technologies and the increasing shift toward cloud-based infrastructure. As organizations embrace digital transformation and migrate applications to public, private, and hybrid clouds, they rely heavily on container technologies like docker to ensure portability, scalability, and flexibility across cloud environments. Cloud-based docker monitoring solutions are favored for their ease of deployment, scalability, and ability to offer real-time, centralized visibility into distributed containerized environments. These solutions also benefit from seamless integration with cloud-native tools and services provided by leading cloud providers, enabling organizations to monitor infrastructure and containerized applications through a single, unified platform.

The on-premise segment is expected to grow at a significant CAGR during the forecast period, driven by industries and organizations with stringent data security, privacy, and compliance requirements. Highly regulated sectors like finance, healthcare, government, and defense often prefer on-premise docker monitoring solutions to retain greater control over sensitive data and ensure compliance with local regulations governing data sovereignty and cybersecurity. In addition, large enterprises with extensive legacy infrastructure and established on-premise data centers are increasingly deploying docker containers within these environments to modernize their applications while maintaining control over infrastructure. This, in turn, creates demand for on-premise docker monitoring tools capable of offering deep visibility into containerized workloads operating within private data centers. Furthermore, organizations adopting hybrid cloud strategies - where both on-premise and cloud environments coexist - are investing in flexible monitoring solutions that can provide consistent visibility across both deployment models, further contributing to the growth of the on-premise segment.

Enterprise Size Insights

Based on enterprise size, the large enterprise segment accounted for the largest revenue share in 2024. The large enterprise segment holds the dominant share in the docker monitoring industry due to the extensive adoption of containerization technologies among these organizations to support complex, large-scale digital transformation initiatives. Large enterprises often manage distributed application environments across multi-cloud and hybrid infrastructures, requiring advanced docker monitoring solutions to ensure real-time performance tracking, resource optimization, security monitoring, and compliance enforcement across hundreds or thousands of containers. These organizations also have the financial and technical capacity to invest in comprehensive, enterprise-grade monitoring platforms that integrate seamlessly with their broader IT management and observability ecosystems.

The small & medium enterprise (SME) segment is expected to grow at the fastest CAGR during the forecast period, driven by the increasing adoption of container technologies among smaller businesses seeking agility, cost efficiency, and faster application delivery. Many SMEs are turning to cloud-native platforms and DevOps methodologies to accelerate innovation and compete with larger players, leading to a growing reliance on docker for application development, testing, and deployment. As these businesses scale their containerized applications, they recognize the need for cost-effective, easy-to-deploy monitoring solutions that provide visibility into container performance, resource utilization, and security risks. Furthermore, affordable, pay-as-you-go docker monitoring solutions, including SaaS-based offerings, make advanced monitoring capabilities accessible to SMEs with limited IT budgets.

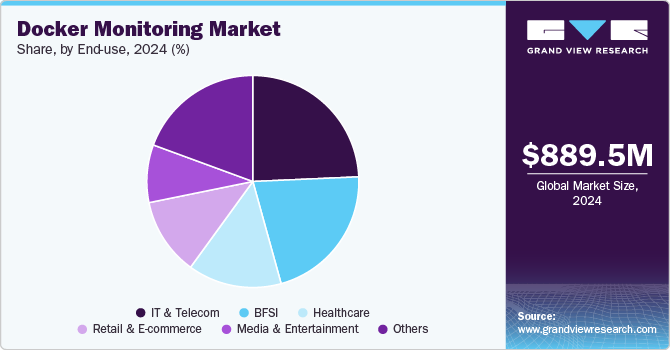

End-use Insights

Based on end use, the IT & telecom segment accounted for the largest market revenue share in 2024. The IT and telecom sector holds the dominant position in the docker monitoring industry due to its early and extensive adoption of containerization technologies to support cloud-native application development, infrastructure modernization, and digital service delivery. Organizations within this sector rely heavily on microservices architectures, DevOps practices, and continuous integration and delivery (CI/CD) pipelines to rapidly develop, deploy, and scale new digital services and applications. This fast-paced environment requires comprehensive Docker monitoring solutions that provide real-time visibility, performance optimization, and proactive troubleshooting across distributed containerized environments. Moreover, telecom companies, in particular, are leveraging containers to support 5G infrastructure, network function virtualization (NFV), and edge computing deployments, which necessitate advanced monitoring to ensure network performance, service reliability, and efficient resource utilization.

The government segment is expected to grow at a significant CAGR during the forecast period. The healthcare sector is witnessing significant growth in the Docker monitoring industry, driven by increased digitalization, growing adoption of cloud technologies, and the need to modernize healthcare IT infrastructure. Healthcare providers, insurers, and healthtech companies increasingly leverage containerized applications to support electronic health records (EHR) systems, telemedicine platforms, medical imaging systems, and patient portals, all of which require scalable, secure, and highly available infrastructure. Docker monitoring solutions play a crucial role in ensuring these containerized applications' performance, security, and compliance, especially as healthcare organizations must adhere to strict regulatory standards such as HIPAA (Health Insurance Portability and Accountability Act). In addition, the increased use of big data analytics and AI-driven diagnostics in healthcare further accelerates the adoption of containerized data processing pipelines, driving demand for robust monitoring solutions to ensure data accuracy, process efficiency, and system reliability.

Regional Insights

North America dominated the docker monitoring market with the largest revenue share of 37.82% in 2024. In North America, widespread adoption of cloud-native technologies and extensive use of microservices and DevOps practices drive demand for advanced docker monitoring solutions. Organizations across industries are investing in integrated observability platforms that provide end-to-end visibility into containerized environments, focusing on security, compliance, and cost optimization.

U.S. Docker Monitoring Market Trends

The docker monitoring market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The U.S. leads the global market due to its early adoption of containers in large-scale enterprises across IT, telecom, finance, and healthcare sectors. The growing emphasis on cybersecurity and compliance management within containerized environments further accelerates the adoption of sophisticated monitoring tools.

Europe Docker Monitoring Market Trends

The docker monitoring market in the Europe is expected to grow at a CAGR of over 25% from 2025 to 2030. In Europe, increasing investments in digital transformation and cloud migration initiatives drive demand for docker monitoring solutions. The region also strongly focuses on data privacy and regulatory compliance, encouraging the adoption of secure, policy-driven monitoring platforms.

The UK docker monitoring market is expected to grow at a rapid CAGR during the forecast period. In the UK, financial services, healthcare, and retail sectors are leading the adoption of containerized applications, creating demand for real-time monitoring and performance optimization solutions. The rise of hybrid cloud strategies further promotes the deployment of flexible docker monitoring tools.

The docker monitoring market in Germany held a substantial market share in 2024. Germany is witnessing increased container adoption driven by manufacturing, automotive, and industrial sectors embracing Industry 4.0 initiatives. Demand for on-premise and hybrid docker monitoring solutions is rising, especially in highly regulated industries focused on data security and operational resilience.

Asia Pacific Docker Monitoring Market Trends

The docker monitoring market in Asia Pacific is anticipated to grow at a significant CAGR of 27% from 2025 to 2030. The Asia Pacific region is experiencing rapid growth in the docker monitoring industry due to increasing cloud adoption, digital-first strategies, and rising investments in IT infrastructure modernization. Both large enterprises and SMEs are deploying container monitoring tools to enhance operational efficiency and application performance.

The China docker monitoring market held a substantial share in 2024. In China, technology firms, e-commerce companies, and financial services providers are leading the adoption of containerized architectures, driving demand for scalable docker monitoring solutions. Government support for cloud innovation and the growth of domestic cloud providers further boost the market.

The docker monitoring market in Japan held a substantial share in 2024. Japan focuses on IT modernization across manufacturing, telecom, and financial services sectors, creating opportunities for docker monitoring vendors. The growing shift toward hybrid cloud deployments drives demand for monitoring solutions that manage on-premise and cloud-based containers.

The India docker monitoring market is expanding rapidly. In India, startups, SMEs, and digital service providers increasingly adopt containerized applications to improve application scalability and cost efficiency, creating demand for affordable, cloud-based Docker monitoring solutions. The expansion of cloud data centers in India is further fostering this trend.

Key Docker Monitoring Company Insights

Key players operating in the docker monitoring industry include AppDynamics, BMC Software, Broadcom, Datadog, Dynatrace, Elastic, IBM, New Relic, SolarWinds, and Splunk. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Docker Monitoring Companies:

The following are the leading companies in the docker monitoring market. These companies collectively hold the largest market share and dictate industry trends.

- AppDynamics

- BMC Software

- Broadcom

- Datadog

- Dynatrace

- Elastic

- IBM

- New Relic

- SolarWinds

- Splunk

Recent Developments

-

In March 2025, Docker Inc. announced the release of Docker Engine 28, introducing enhanced container networking security features enabled by default. This update focuses on hardening the container networking stack by restricting unintended inter-container communication and improving isolation between containers running on the same host. Specifically, Docker Engine 28 limits containers' ability to communicate with each other unless explicitly allowed, reducing the risk of lateral movement attacks within container environments. These security improvements align with zero-trust networking principles, ensuring containerized applications operate in more secure and isolated environments by default. With these enhancements, Docker continues to strengthen the security posture of its platform, enabling developers and organizations to build and deploy containerized applications with greater confidence in their networking security.

-

In March 2024, Dynatrace announced its container security capabilities enhancements, expanding coverage to popular cloud-based container registries, including Amazon Elastic Container Registry (ECR), Google Artifact Registry, and Azure Container Registry. These enhancements allow Dynatrace to automatically scan container images for vulnerabilities as they are pulled from these registries, ensuring that security issues are identified before the containers are deployed into production environments. By integrating with cloud-based registries, Dynatrace enables organizations to proactively manage security risks throughout the software development lifecycle, aligning with DevSecOps best practices. These updates strengthen Dynatrace's comprehensive observability and security platform, helping organizations maintain secure, high-performing, and compliant containerized applications in multi-cloud and hybrid environments.

Docker Monitoring Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,109.2 million |

|

Revenue forecast in 2030 |

USD 3,579.8 million |

|

Growth rate |

CAGR of 26.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; and South Africa |

|

Key companies profiled |

AppDynamics; BMC Software; Broadcom; Datadog; Dynatrace; Elastic; IBM; New Relic; SolarWinds; Splunk |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Docker Monitoring Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global docker monitoring market report based on component, deployment, enterprise size, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Integration and Implementation

-

Consulting

-

Training and Support

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Healthcare

-

Retail & E-commerce

-

IT & Telecom

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global docker monitoring market size was estimated at USD 889.5 million in 2024 and is expected to reach USD 1,109.2 million by 2025.

b. The global docker monitoring market is expected to grow at a compound annual growth rate of 26.4% from 2025 to 2030 to reach USD 3,579.8 million by 2030.

b. The solution segment accounted for the largest revenue share of over 63% in 2024. The solution segment dominates the docker monitoring market primarily due to the increasing need for comprehensive, automated tools that provide real-time visibility, performance analysis, and security monitoring for containerized environments.

b. The key players operating in the docker monitoring market include AppDynamics, BMC Software, Broadcom, Datadog, Dynatrace, Elastic, IBM, New Relic, SolarWinds, and Splunk

b. The market growth is driven by the increasing adoption of containerization technologies across industries as organizations modernize their IT infrastructure and the rising complexity of IT environments.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."