- Home

- »

- Biotechnology

- »

-

DNA And Gene Chip Market Size And Share Report, 2030GVR Report cover

![DNA & Gene Chip Market Size, Share & Trends Report]()

DNA & Gene Chip Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Consumables), By Type (Oligonucleotide), By Application (Cancer Diagnosis & Treatment), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-591-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

DNA And Gene Chip Market Size & Trends

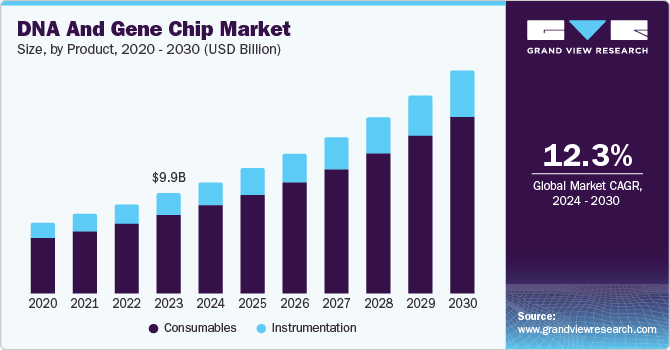

The global DNA and gene chip marketsize was valued at USD 9.96 billion in 2023 and is projected to grow at a CAGR of 12.3% from 2024 to 2030. This growth is attributed to the increasing demand for personalized cancer treatment, advancements in genomic research, and the growing application of microarray technology in various fields, including agriculture and drug discovery. In addition, technological innovations in gene expression analysis and the rising prevalence of genetic disorders further contribute to market growth.

A DNA microarray is a collection of microscopic DNA spots lying on a solid surface. Doctors use DNA microarrays to measure the expression levels for large numbers of genes at the same time or genotype of multiple areas of a genome. Several factors fuel the market growth of DNA & gene chips, such as technological developments in robotics, computational proficiencies, and fabrication approaches for microarrays.

In addition, microarrays support diagnosing gene discovery, disease, toxicological research, and medicine development. DNA and gene chip is an integration of technologies that are used to concurrently detect expression levels of at least ten thousand DNA sequences named genes using a slide with DNA spots joined to it.The increasing demand for biochips leads to the demand of the market. These procedures can separate cancer cells from blood samples and allow major profiling of cancer cells' genes, assisting medical help to target tumors and execute treatments efficiently. Therefore, this factor lifts the growth of the market with the constant development of new apparatuses to aid and increase the reliability of DNA microarray technology. The availability and inexpensive reagents and other ancillary devices is another aspect that has assisted market growth.

Furthermore, technical innovations such as enhancements in robotics, computational capabilities, and fabrication procedures have catalyzed the implementation of DNA microarrays in clinical laboratories. People's rising awareness of early cancer detection is a major growth aspect, as DNA and gene chips are significant for ascertaining genetic and epigenetic markers in cancer cells. Hence, widespread use in genomics, drug discovery, and gene expression studies continues to boost market growth.

Product Insights

Consumables dominated the market and accounted for the largest revenue share of 78.8% in 2023 owing to the increased accessibility of various reagents and other aiding components required for executing microarray procedures. Furthermore, this can be associated with cost savings resulting from increased technological advancements and the inception of new equipment with great computing speed that improves the efficacy of microarray procedures.

The instrumentation is projected to grow at a CAGR of 11.9% over the forecast period.The advancements in microarray technologies, rising demand for high-throughput analysis, enhanced sensitivity and accuracy, more focus on personalized medicine and other diagnostics, as well as increasing demand in data analysis software and bioinformatics tools, all factors together drive the adoption and enhancement of new instrumentation technologies, leading to market growth.

Type Insights

The oligonucleotide DNA microarray held a significant revenue share in 2023 driven by several key factors, such as its cost-effectiveness and huge capability for monitoring the expression of each gene in the genome. In addition, it provides several benefits over cDNA microarrays, offering controlled specificity of hybridization and creating a more powerful tool for the analysis of single nucleotide polymorphisms, further escalating the oligonucleotide DNA microarray demand in the market.

The complementary DNA microarray market is projected to grow significantly over the forecast period. Several key factors are driving the market demand. First, advancements and developments in microarray technology enhance the sensitivity, specificity, and throughput of cDNA microarrays, making them more competent and reliable for different applications. Moreover, the wide use of cDNA microarrays in clinical diagnostics, mainly for cancer profiling, genetic testing, and prenatal screening, fuels the demand.

Application Insights

Cancer diagnosis and treatment dominated the market and accounted for the largest revenue share of 28.8% in 2023 pertaining to the supporting targeted cancer therapies while minimizing the extremely painful biopsies that provide a better patient’s genomic outline. In addition, the increasing prevalence of cancer and the rising demand for personalized therapies enhance the market's appeal. Furthermore, advancements in gene expression technologies and favorable research funding support innovative cancer diagnostics. Genetic chips facilitate a comprehensive understanding of a patient's genomic profile, enabling more effective treatment strategies and targeted therapies, thereby boosting market growth significantly.

Drug discovery is projected to grow at a CAGR of 12.8% over the forecast period. Drug Discovery employs gene chips to identify possible drug targets. This growth is driven by the increasing adoption of genomic chip arrays for optimizing traditional drug discovery processes. These chips facilitate disease pathway identification, validation, compound screening, and clinical trials, enhancing efficiency and accuracy in drug development. Furthermore, the rising need for personalized medicine and the growing prevalence of chronic diseases further propel the demand for innovative drug discovery solutions using DNA and gene chips.

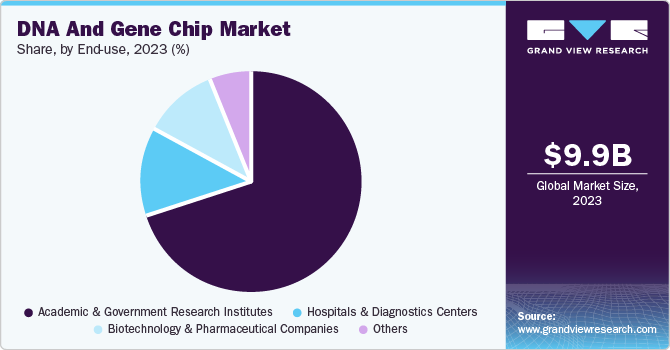

End Use Insights

The academic & government research institutes led the market and accounted for the largest revenue share of 70.2% in 2023 attributed to the increasing government and private investments in genomic and technological developments. These institutions use gene chips to study and analyze genetic variations in humans and other organisms.Furthermore, growing partnerships among academic institutions, biotechnology companies, and government initiatives promoting genetic research boost market growth.

Hospitals and diagnostic centers are expected to grow at a CAGR of 12.2% over the projected years, owing to the increasing adoption of these technologies for early disease detection and personalized treatment. Gene chips enable non-invasive diagnostics, reducing the need for painful procedures such as biopsies. Furthermore, the rising prevalence of genetic disorders and the growing demand for targeted therapies propel the adoption of DNA and gene chips in clinical settings, fueling market expansion in this segment.

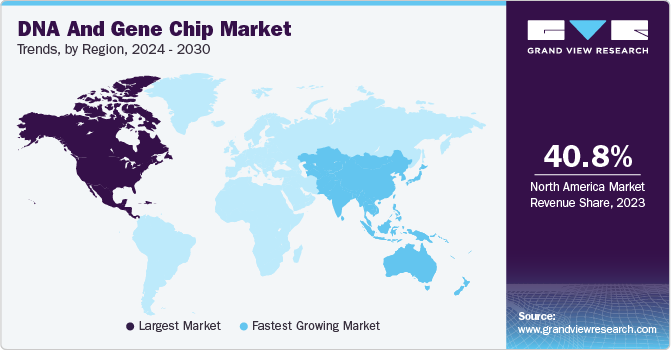

Regional Insights

North America DNA and gene chip market dominated the global market with a commanding market share of 40.8% in 2023. This growth is attributed to the rising incidence of different diseases, such as cancer or genetic disorders, in the region. The advantages and multipurpose applications of DNA & gene chips with increasing investment in advanced medical technology for improved results are driving market demand.

U.S. DNA And Gene Chip Market Trends

The DNA & chip market in the U.S. dominated the North American market with a share of 78.0% in 2023. This growth is driven by the growing demand in terms of biopharmaceutical research and development for drug discovery, target identification, and biomarker discovery. In addition, the robust expansion of the healthcare industry due to the increasing adoption of DNA microarrays in hospitals for activities such as cancer diagnosis, infectious disease detection, and prenatal genetic screening driven by patient demands and healthcare expenditure, drives the market growth.

Asia Pacific DNA And Gene Chip Market Trends

The Asia Pacific DNA & gene chip market is anticipated to grow at a CAGR of 13.2% over the forecast period. This growth is driven by expanding healthcare expenditures and the rapidly evolving biotechnology industry, with investments from the public and commercial sectors aligned with demand for enhanced and improved results.

China DNA and gene chip market growth is expected to witness continued expansion over the projected years, driven by the need for precision healthcare and the application of genomics in various fields, including diagnostics, drug discovery, and agriculture.

The Japan DNA and gene chip market is expected to grow substantially, owing to the rising emphasis on precision medicines and augmented demand for personalized medicines. In addition, advancements in healthcare and the use of DNA microarrays in diagnostics have contributed to market growth. Furthermore, the availability of high-tech microarrays, such as sophisticated throughput platforms, better data analysis tools, and automation, enhances performance and competencies.

Europe DNA And Gene Chip Market Trends

The Europe DNA & gene chip market experienced substantial growth over the forecast years. This growth is driven by ongoing technological advancements, expanding DNA and gene chip applications, and rising healthcare investments in the country.

The DNA and gene chip market in the UK is expected to grow significantly owing to the rising adoption of medical tools and devices in healthcare, increasing demand for quick and precise DNA analysis techniques. In addition, the growing implementation of precision medicine is boosting market growth in the country.

Key DNA And Gene Chip Company Insights

Some of the key companies in the DNA and gene chip market include Thermo Fisher Scientific Inc., Agilent Technologies, Illumina, Inc., Revvity, Arrayit Corporation, Macrogen, Inc., Asper Biotech, CapitalBio Technology Co., Ltd., Greiner Bio-One International GmbH, Microarrays Inc., and Biodiscovery LLC. These companies are focusing on continuous development and innovation to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Thermo Fisher Scientific Inc. provides a wide range of innovative technologies, products, and services to its customers. The company’s offerings cater to various industries such as pharmaceuticals, biotechnology, life sciences, diagnostics, and applied markets.

-

Revvity, formerly known as PerkinElmer Inc., is a provider of products, services, and solutions for the diagnostics, life sciences, and applied markets. The company offers a wide range of instruments, assay platforms, reagents, and software to support various applications, including cell imaging and analysis, molecular spectroscopy, chromatography, DNA/RNA isolation, in vivo imaging, atomic spectroscopy, and protein analysis and detection.

Key DNA & Gene Chip Companies:

The following are the leading companies in the dna & gene chip market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Agilent Technologies

- Illumina, Inc.

- Revvity

- Arrayit Corporation

- Macrogen, Inc.

- Asper Biotech

- CapitalBio Technology Co., Ltd.

- Greiner Bio-One International GmbH

- Microarrays Inc.,

- Biodiscovery LLC

- Oxford Gene Technology IP Limited

- TOSHIBA HOKUTO ELECTRONICS CORPORATION

- Savyon Diagnostics

- Applied Micro Arrays

- BIOMÉRIEUX

Recent Developments

-

In January 2024, Galapagos NV collaborated with Thermo Fisher Scientific to enhance its distributed CAR-T manufacturing network in the U.S., in the San Francisco area. Effective January 2024, Thermo Fisher is expected to provide GMP manufacturing and logistics services for Galapagos’ CAR-T clinical program. This partnership follows a previous agreement with Landmark Bio for similar services in Boston, aiming to expedite the delivery of CAR-T therapies to patients while improving clinical trial support.

-

In May 2023, Revvity, Inc. announced a new license agreement with AstraZeneca for its innovative Pin-point base editing technology, a modular gene editing platform designed for safety and precision. This collaboration aims to advance cell therapies targeting cancer and immune-mediated diseases. The Pinpoint system offers efficient single and multiplex gene editing, enhancing therapeutic applications while minimizing unintended effects on cell viability, marking a significant step in gene therapy development.

DNA And Gene Chip Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.15 billion

Revenue forecast in 2030

USD 22.37 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Agilent Technologies; Illumina, Inc.; Revvity; Arrayit Corporation; Macrogen, Inc.; Asper Biotech; CapitalBio Technology Co., Ltd.; Greiner Bio-One International GmbH; Microarrays Inc.; Biodiscovery LLC; Oxford Gene Technology IP Limited; TOSHIBA HOKUTO ELECTRONICS CORPORATION; Savyon Diagnostics; Applied Micro Arrays; BIOMÉRIEUX

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global DNA And Gene Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA and gene chip market report based on product, type, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Instrumentation

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oligonucleotide DNA Microarrays

-

Complementary DNA Microarrays

-

BAC Clone Chips

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer Diagnosis & Treatment

-

Gene Expression

-

Genotyping

-

Genomics

-

Drug Discovery

-

Agricultural Biotechnology

-

Others

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Government Research Institutes

-

Hospitals and Diagnostics Centers

-

Biotechnology and Pharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.