DNA-based Skin Care Products Market Size, Share & Trends Analysis Report By Product (Creams, Serums, Others), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-341-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

DNA-based Skin Care Products Market Trends

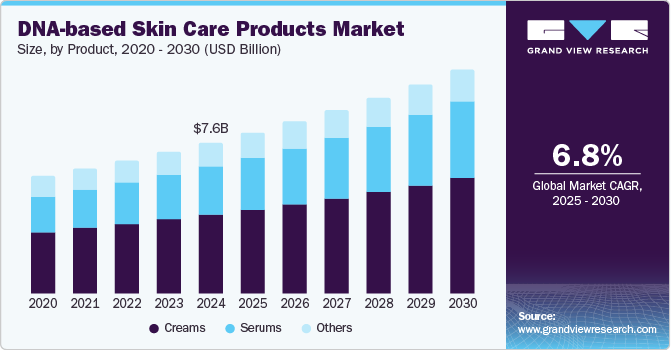

The global DNA-based skin care products market size was valued at USD 7.61 billion in 2024 and is expected to expand at a CAGR of 6.8% from 2025 to 2030. The growth can be attributed to several factors, including the rising prevalence of skin conditions such as acne and atopic dermatitis and growing consumer interest in personalized skincare solutions. In addition, advancements in genomics and biotechnology have facilitated the development of these products, making them more accessible and effective.

Furthermore, increasing consumer spending on health & wellness products is expected to drive the industry growth. As people increasingly invest in their personal care routines, a growing demand for high-quality skincare solutions offering tangible benefits increases. This trend is particularly evident among millennials and Gen Z consumers, who prioritize skincare as part of their overall wellness routine. The willingness to invest in premium products that promise personalized results has led to a surge in the popularity of DNA-based skincare offerings.

Moreover, the ongoing advancements in DNA testing technology are likely to enhance product development and consumer engagement in this industry. As testing becomes affordable and widely available, more consumers are expected to opt for personalized skincare solutions tailored to their genetic makeup. This trend is evident with the rise of home DNA testing kits that provide insights into individual skin health, enabling brands to offer targeted products based on specific genetic markers.

Product Insights

The creams segment dominated the industry with the largest revenue share of 52.1% in 2024 due to their versatility and effectiveness in addressing various skin concerns. Creams are widely favored for their ability to provide hydration, anti-aging benefits, and protection against environmental damage, making them essential in many skincare routines. Their rich formulations often include beneficial ingredients such as hyaluronic acid, retinol, and vitamins, which cater to diverse skin types and conditions.

The serums segment is expected to grow at the highest CAGR over the forecast period, owing to increasing consumer awareness about targeted skincare solutions and the rising popularity of personalized beauty products. Innovative serums that address specific concerns such as aging, hyperpigmentation, and hydration are attracting consumers looking for new formulations with targeted results. This trend is particularly evident among young consumers prioritizing effective and efficient skincare routines. In addition, advancements in formulations have led to the development of innovative serums that incorporate high concentrations of active ingredients, making them more effective than traditional moisturizers.

Distribution Channel Insights

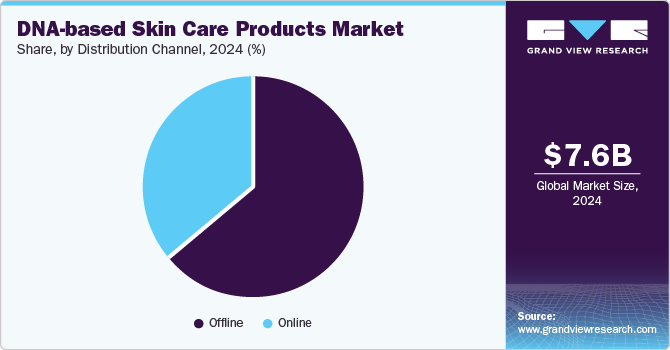

The offline segment dominated the industry with the largest revenue share in 2024, as consumers prefer purchasing skincare products in physical stores after personalized advice and recommendations from trained staff. This face-to-face interaction enhances the confidence of customers in the process of purchasing of DNA-based skincare, which often requires more explanation regarding their benefits and usage. In addition, shopping offline allows consumers to examine product packaging and the list of ingredients. Obtaining products without waiting for shipping also contributes to the popularity of the offline segment, as consumers appreciate the convenience of instant access to their skincare solutions.

The online segment is expected to grow at the highest CAGR over the forecast period due to increasing consumer preference for convenience and accessibility in shopping. The rise of e-commerce platforms allows consumers to browse various products from the comfort of their homes, making it easier to find specialized items, including DNA-based skincare solutions. In addition, the growing influence of social media and digital marketing has heightened awareness and interest in personalized skincare, driving traffic to online retailers in the industry. For instance, brands such as EpigenCare, SkinDNA, and Genetic Beauty use online platforms to offer tailored skincare recommendations based on individual skin profiles, enhancing consumer engagement. This shift in shopping behavior, combined with advancements in payment technologies and delivery services, is expected to favor the growth of the online segment industry in the coming years.

Regional Insights

The North America DNA-based skin care products market dominated the global market with the largest revenue share of 38.4% in 2024, primarily due to the high consumer demand for personalized skincare solutions and strong purchasing power. Consumers in North America are increasingly seeking products tailored for specific skin problems, driven by growing awareness of the benefits of DNA analysis in formulating effective skincare regimens. In addition, numerous established brands and innovative startups in this market foster a competitive landscape that encourages product development and marketing efforts. Furthermore, the accessibility of these products through both online and offline channels enhances their visibility and availability, contributing to market growth. This combination of factors positions North America as a leader in the DNA-based skincare sector.

U.S. DNA-based Skin Care Products Market Trends

The U.S. DNA-based skincare products market dominated North America on account of its strong emphasis on personalized beauty solutions and consumer awareness regarding advanced skincare solutions. American consumers are increasingly seeking products tailored to their unique genetic profiles, which enhances their effectiveness in addressing specific skin concerns. This trend is supported by the availability of cutting-edge technologies that allow for detailed genetic analysis, enabling brands to offer customized skincare regimens. The U.S. market has benefitted due to high purchasing power and robust retail infrastructure, including online and offline channels, that facilitate easy access to such innovative products.

Asia Pacific DNA-based Skin Care Products Market Trends

The Asia Pacific DNA-based skincare products market is expected to grow at the highest CAGR over the forecast period due to rising consumer demand for personalized skincare solutions and increasing disposable income. As consumers become aware of the benefits of DNA analysis in tailoring skincare regimens, there is a rising demand for products that address individual skin concerns based on genetic makeup. Furthermore, social media and beauty influencers promoting personalized skincare trends are expected to positively impact the adoption of such products among the young population.

China DNA-based skincare products market dominated the Asia Pacific, due to increasing disposable income among Chinese consumers, which has led to increased demand for premium and personalized skincare solutions. The rising popularity of using skincare products that are customized based on genetic analysis is expected to favor the market. Advancements in biotechnology and genomics have facilitated the development of sophisticated DNA testing methods in the country, making personalized skincare more accessible.

Europe DNA-based Skin Care Products Market Trends

Europe's DNA-based skincare products market is expected to grow significantly over the forecast period. Rising consumer demand for personalized skincare solutions and easy availability is driving this trend as individuals increasingly seek products tailored to their unique genetic profiles. This trend is fueled by advancements in DNA testing technology, which have made genetic analysis more accessible and affordable. Furthermore, upscale beauty salons and premium skincare brands in Europe facilitate DNA-based products, as these establishments often promote innovative and scientifically backed solutions.

Key DNA-based Skin Care Products Company Insights

IMAGENE LABS PTE. LTD.; Caligenix, Inc.; EpigenCare Inc.; Evergreen Life Ltd., The Skin Dna; SKINSHIFT; DNA Skin Institute; Anake.; RGR Pharma Ltd.; and LifeNome Inc. are among the key players in the DNA-based skin care products market. These companies in the DNA-based skin care products market employ various strategies to maintain a competitive edge, including launching innovative products that offer personalized skincare solutions based on genetic analysis. They focus on sustainable practices by using eco-friendly ingredients and packaging to meet the growing demand for clean beauty.

-

Caligenix, Inc. specializes in personalized skincare solutions that leverage advanced genetic analysis to address individual skin concerns. The company provides tailored product recommendations based on a user’s unique genetic profile. By integrating cutting-edge technology with AI-driven insights, Caligenix empowers consumers with scientifically validated information that can enhance their skincare routines, effectively blending beauty & biotechnology to optimize skin health.

-

EpigenCare Inc. is known for its personalized skincare testing and product recommendations based on epigenetic analysis. The company offers the SKINTELLI test, which evaluates an individual's skin quality through epigenetic markers. This test provides insights that help consumers select products best suited to their skin's current condition.

Key DNA-based Skin Care Products Companies:

The following are the leading companies in the DNA-based skin care products market. These companies collectively hold the largest market share and dictate industry trends.

- IMAGENE LABS PTE. LTD.

- Caligenix, Inc.

- EpigenCare Inc.

- Evergreen Life Ltd.

- The Skin Dna

- SKINSHIFT

- DNA Skin Institute

- Anake.

- RGR Pharma Ltd.

- LifeNome Inc.

View a comprehensive list of companies in the DNA-based Skin Care Products Market

Recent Developments

-

In October 2024, SkinBB launched the skincare metaverse, integrating artificial intelligence technology with dermatological expertise to empower consumers in their skincare journey. This innovative platform allows users to engage in personalized skincare consultations within a virtual environment, where they can receive recommendations based on their skin type and concerns. The metaverse also provides an interactive space for users to explore various skincare solutions, fostering a community focused on health and beauty.

-

In April 2021, Anake launched its Skin DNA test kit, which analyzes over 15 genetic markers using a simple swab test. This kit provides consumers with a comprehensive report detailing their skin's unique characteristics and offers a blueprint for future skin care. In addition, Anake incorporates AI-powered consultations to further customize beauty regimens based on individual DNA analysis.

DNA-based Skin Care Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.12 billion |

|

Revenue forecast in 2030 |

USD 11.29 billion |

|

Growth rate |

CAGR of 6.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, South Africa |

|

Key companies profiled |

IMAGENE LABS PTE. LTD., Caligenix, Inc., EpigenCare Inc., Evergreen Life Ltd., The Skin Dna, SKINSHIFT, DNA Skin Institute, Anake., RGR Pharma Ltd., LifeNome Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global DNA-based Skin Care Products Market Report Segmentation

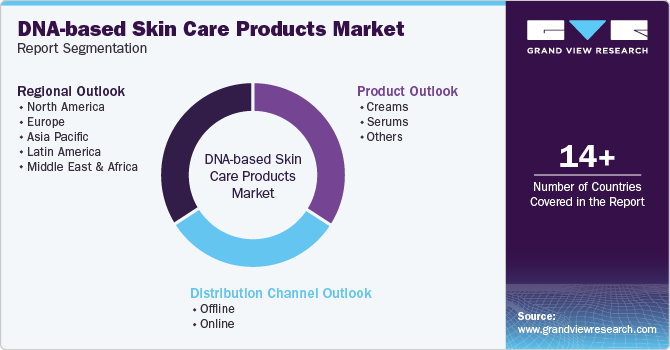

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DNA-based skin care products market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Creams

-

Serums

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."