DLIF & XLIF Implants Market Size & Trends

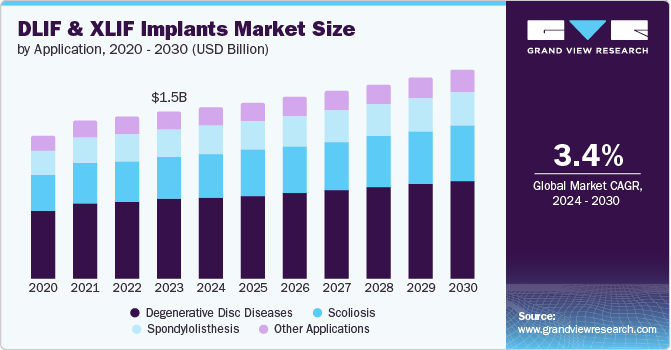

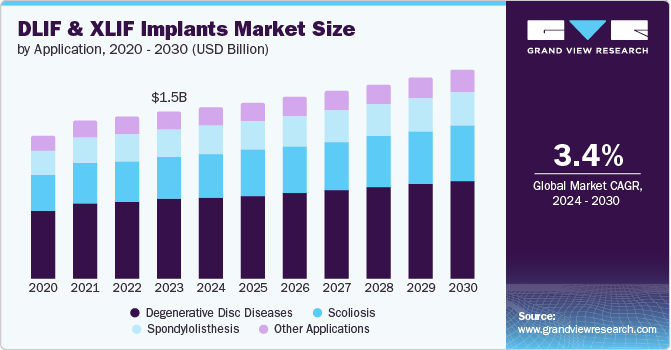

The global DLIF & XLIF implants market size was valued at USD 1.54 billion in 2023 and is expected to grow at a CAGR of 3.4% from 2024 to 2030. This growth is attributable to the rising incidence of spinal diseases such as degenerative disc diseases and spondylolisthesis. These conditions require minimally invasive surgical techniques including direct lateral interbody fusion (DLIF) and extreme lateral interbody fusion (XLIF) implants. Such techniques allow access to the intervertebral disc space through lateral approaches, minimize tissue disruption, reduce recovery time, and enhance patient outcomes.

The DLIF and XLIF treat spinal disorders without requiring nerve root retraction or contact with major blood vessels, resulting in shorter operative times and minimal blood loss. These surgeries help avoid Lumbosacral transitional vertebrae (LSTV), a structural anomaly associated with low back pain, which can lead to misidentification of vertebral levels during pre-operative planning. Such factors thereby contribute to the growth of the market.

In addition, healthcare professionals and patients have become progressively aware of spinal conditions and available treatment options. This has encouraged the increased adoption of DLIF and XLIF implants. These procedures are designed with robotic navigation systems that create 3D maps of the patient’s spine, allowing precise implant placements and reduced complications.

Application Insights

Degenerative Disc Diseases (DDD) led the market with a dominant share of 47.6% in 2023. The increasing prevalence of DDD among the elderly population owing to age-related wear and tear, sedentary lifestyles, and genetic predisposition has primarily fueled the market. Furthermore, improved awareness has led patients to increasingly recognize symptoms such as back pain, radiculopathy, or spinal instability. They sought medical attention, driving demand for treatments including DLIF and XLIF implants.

Scoliosis is expected to emerge substantially at the fastest CAGR over the forecast period. This condition is characterized by abnormal lateral curvature of the spine, owing to genetic predisposition, growth spurts during adolescence, and lifestyle shifts. It has become increasingly prevalent. Moreover, the rising awareness about conditions such as spinal asymmetry, pain, and posture changes have led healthcare professionals and the public to seek medical attention. This has further propelled the demand for treatments including DLIF and XLIF implants.

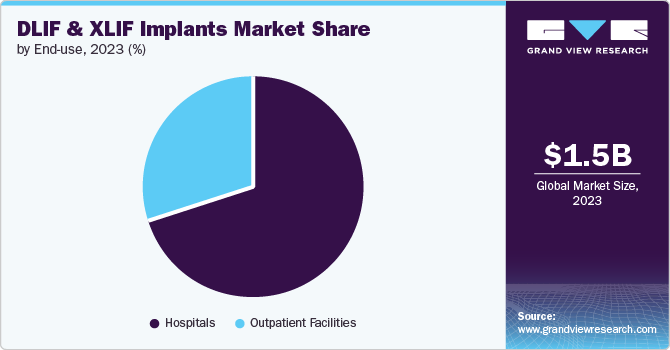

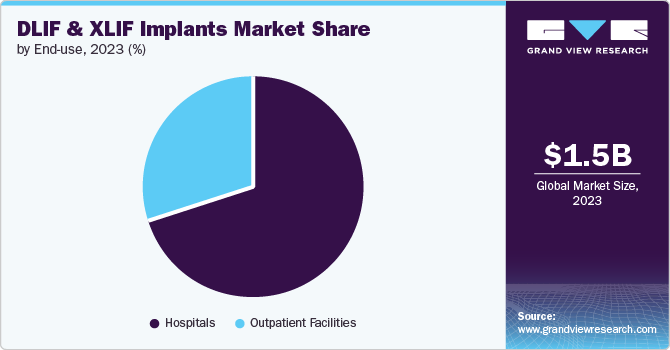

End-use Insights

Hospitals have dominated the market with the largest global revenue share in 2023. Hospitals cater to patients with state-of-the-art equipment that enhances surgical precision and accuracy. This includes robotic-assisted surgery that offers accurate precision compared to traditional manual techniques. Moreover, these robotic systems can navigate complex anatomical structures with pre-operative imaging data for high precision, reducing the risk of human error during DLIF and XLIF procedures.

Outpatient facilities are expected to emerge substantially at a CAGR of 4.1% over the forecast period owing to the rapid healthcare infrastructure development. These widely accessible and cost-effective services have significantly catered to the elderly patients who require specialized care for spinal conditions without overnight hospital stays through minimally invasive procedures such as DLIF and XLIF surgeries. Moreover, the market has witnessed significant shifts in patient demands. They have increasingly favored routine checkups and preventive care from outpatient facilities which emphasize value-based patient outcomes.

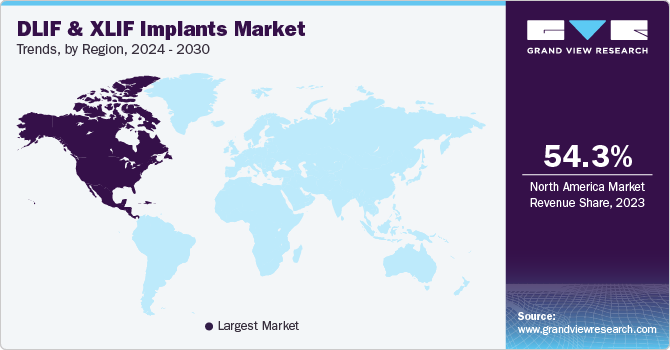

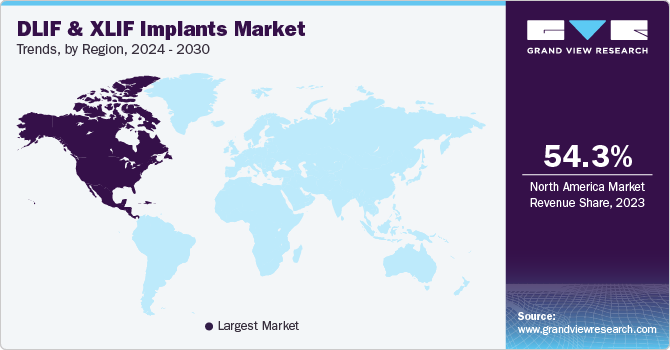

Regional Insights

The North America DLIF and XLIF implants market secured the largest revenue share with 54.3% in 2023. This growth can be attributed to the rising incidence of spinal injuries and diseases among the aging population. In addition, surgeons in North America increasingly embraced cutting-edge robotic technologies owing to abundant resources and supportive regulatory frameworks.

U.S. DLIF and XLIF Implants Market Trends

The U.S. DLIF and XLIF implants market was propelled by the increasing adoption of robotic-assisted surgery across various medical specialties. The region boasts a well-established healthcare infrastructure, advanced surgical centers, and a favorable reimbursement environment. Major medical device companies have introduced robotic systems specifically designed for spine surgeries, including DLIF and XLIF procedures.

Europe DLIF and XLIF Implants Market Trends

The DLIF and XLIF implants market in Europe held 23.5% of the market share in 2023. The region witnessed a significant interest in robotic-assisted surgery, particularly for spine procedures. Several European countries including Germany and France have successfully implemented robotic systems in specialized spine centers and larger hospitals. However, some countries have faced budget constraints or regulatory challenges that impact the widespread adoption of robotic-assisted surgery.

Asia Pacific DLIF and XLIF Implants Market Trends

The Asia Pacific DLIF and XLIF implants market accounted for 12.2% of the market share in 2023 owing to the rising geriatric population which drove the demand for spinal treatments. Moreover, the region has witnessed a growing adoption of innovative medical technologies. As a result, minimally invasive procedures, such as DLIF and XLIF, have gained significant popularity due to their effectiveness and faster recovery times.

Key DLIF & XLIF Implants Company Insights

The global DLIF and XLIF implants market is influenced by key industry players such as Medtronic, NuVasive, Globus Medical, DePuy Synthes (Johnson & Johnson), and others. Their strategies include developing new technologies, investing in research and development, improving product quality, and engaging in acquisitions and mergers to drive market growth.

-

DePuy Synthes, a part of the Johnson & Johnson Medical Devices group, develops and markets products under several brands, including Codman, DePuy Mitek, DePuy Orthopedics, and DePuy Spine. The company holds a comprehensive portfolio spanning joint reconstruction, trauma, craniomaxillofacial, spinal surgery, and sports medicine.

-

Medtronic is a global medical device company with a diverse portfolio that addresses 70 health conditions, including cardiac devices, cranial and spine robotics, insulin pumps, surgical tools, and patient monitoring systems. The company leverages advanced technology including AI-enhanced cancer screening.

Key DLIF & XLIF Implants Companies:

The following are the leading companies in the DLIF & XLIF Implants market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Stryker

- NuVasive, Inc.

- Globus Medical

- Medtronic Plc.

- DePuy Synthes (Johnson & Johnson)

- Zimmer Biomet

- Orthofix Medical Inc.

- ATEC Spine, Inc

- Captiva Spine, Inc.

Recent Developments

-

In April 2024, DePuy Synthes launched the TriALTIS Spine System - the next generation posterior thoracolumbar pedicle screw system. It offers a comprehensive range of implants and advanced instrumentation designed for seamless integration with enabling technologies. By combining the TriALTIS Spine System with TriALTIS Navigation Enabled Instruments, DePuy Synthes aims to address unmet clinical needs across complex spine conditions, including degenerative disorders, tumors, trauma, and deformities.

-

In October 2023, Orthofix Medical Inc. launched OsteoCove. This advanced bioactive synthetic graft is available in both putty and strip configurations. OsteoCove has been meticulously designed to offer exceptional bone-forming capabilities while maintaining best-in-class handling characteristics. It serves a wide range of applications in spine and orthopedic procedures.

DLIF & XLIF Implants Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 1.59 billion

|

|

Revenue forecast in 2030

|

USD 1.94 billion

|

|

Growth Rate

|

CAGR of 3.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Report updated

|

September 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application, end-use, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; MEA

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

Medtronic; Stryker; NuVasive, Inc.; Globus Medical; DePuy Synthes (Johnson & Johnson); Medtronic Plc.; Zimmer Biomet; Orthofix Medical Inc.; ATEC Spine, Inc; Captiva Spine, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

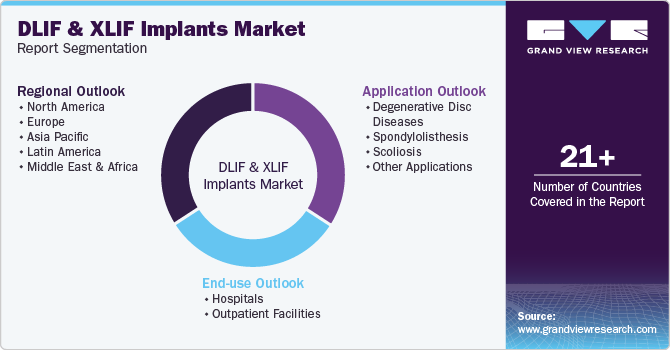

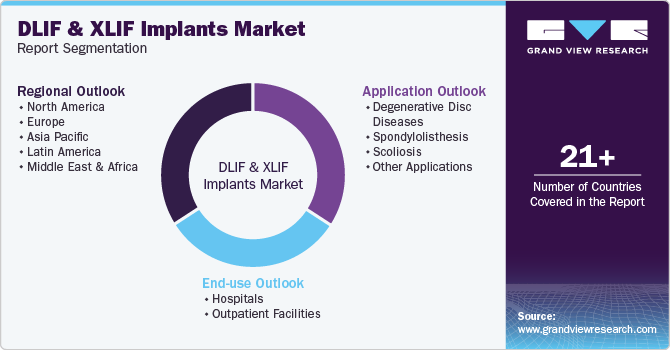

Global DLIF & XLIF Implants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global DLIF and XLIF implants market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)