- Home

- »

- Distribution & Utilities

- »

-

Distribution Boards Market Size, Share, Growth Report, 2030GVR Report cover

![Distribution Boards Market Size, Share & Trends Report]()

Distribution Boards Market (2024 - 2030) Size, Share & Trends Analysis Report By Voltage Rating (Low Voltage, Medium Voltage, High Voltage), By End User (Residential, Commercial, Industrial, Utilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-435-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Distribution Boards Market Size & Trends

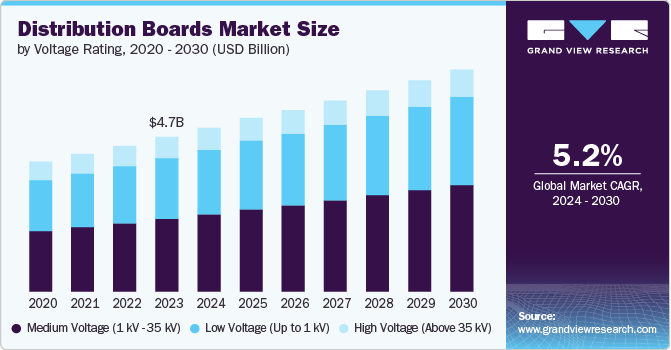

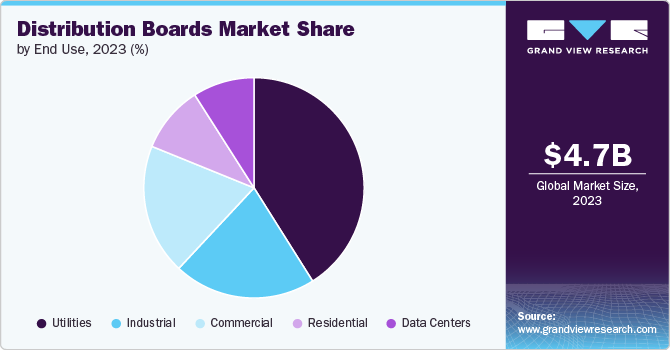

The global distribution boards market size was estimated at USD 4.72 billion in 2023 and is expected to expand at a CAGR of 5.2% from 2024 to 2030. An increasing demand for electricity across various sectors, including residential, commercial, and industrial applications is driving the demand for distribution boards, thus fueling the growth of the distribution boards market. As urbanization and industrialization continue to expand globally, the need for efficient and reliable power distribution systems has become paramount. Distribution boards play a crucial role in safely distributing electrical power throughout buildings and facilities, making them an essential component in modern electrical infrastructure.

Another crucial factor is the rising adoption of renewable energy sources and the integration of smart grid technologies. As countries strive to reduce their carbon footprint and enhance energy efficiency, there's a growing need for advanced distribution boards that can handle bidirectional power flow and support the integration of solar, wind, and other renewable energy sources. For instance, the European Union's ambitious targets for renewable energy adoption are driving the demand for sophisticated distribution boards capable of managing complex power distribution scenarios.

Technological advancements in distribution board design are also fueling market growth. Modern distribution boards are increasingly incorporating features such as remote monitoring, predictive maintenance, and enhanced safety mechanisms. These smart distribution boards offer benefits such as real-time energy consumption tracking, fault detection, and improved overall system reliability.

Voltage Rating Insights

Based on the voltage rating, the distribution boards market is segmented into low voltage, medium voltage, and high voltage. Medium voltage segment registered largest revenue market share of over 47.0% in 2023. Medium voltage distribution boards operate in the range of 1kV to 35kV. They are primarily used in larger industrial facilities, utility substations, and commercial complexes. These boards manage power distribution for heavy machinery, large-scale manufacturing processes, and other high-power applications.

Low voltage distribution boards typically handle voltages up to 1kV. They are commonly used in residential, commercial, and small industrial applications. These boards distribute electricity to various circuits within a building, providing protection through circuit breakers and fuses.

Moreover, high voltage distribution boards handle voltages above 35kV. They are utilized in power generation plants, major industrial complexes, and utility transmission systems. These boards play a crucial role in managing electricity distribution across long distances and for extremely high-power applications.

End user Insights

Based on the End user, the distribution boards market is segmented into residential, commercial, industrial, utilities, and data centers. The utilities end user segment accounted for the highest revenue market share of over 41.0% in 2023 and is expected to grow at a faster CAGR of 5.7% during the forecast period. Distribution boards used in utility applications are crucial components of electrical substations and distribution networks. They are designed for very high voltage and current capacities, often incorporating sophisticated protection and control systems. These boards play a vital role in managing the flow of electricity from power generation facilities to End users.

Industrial distribution boards are robust systems designed for high-power applications in factories, manufacturing plants, and other industrial facilities. They are built to withstand harsh environments and handle large electrical loads. Industrial boards often include additional features for motor control, power factor correction, and integration with industrial automation systems.

Moreover, commercial distribution boards are employed in office buildings, retail spaces, and other business establishments. They are designed to handle higher electrical loads and more complex circuit arrangements than residential boards. These boards often incorporate more advanced monitoring and control features to manage energy consumption efficiently.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of over 35.0% in 2023. Rising investments in renewable energy projects across the region are also boosting the distribution boards market. Countries such as Japan, South Korea, and Australia are expanding their solar and wind power capacities, which require sophisticated power distribution systems. This trend is further supported by government initiatives promoting clean energy adoption, such as China's commitment to achieving carbon neutrality by 2060.

China Distribution Boards Market Trends

China's rapid industrialization and urbanization have led to a surge in demand for electrical infrastructure. As new factories, commercial buildings, and residential complexes are constructed at an unprecedented rate, the need for distribution boards to manage and distribute electricity efficiently has skyrocketed in recent times in the country. For example, the development of megacities such as Shenzhen, which transformed from a fishing village to a metropolis of over 12 million people in just a few decades, has required massive investments in electrical systems, including distribution boards.

North America Distribution Boards Market Trends

The region's robust industrial sector and ongoing infrastructure development are major contributors. As manufacturing facilities expand and modernize, there's an increasing need for sophisticated power distribution systems. For example, automotive plants in the U.S. and Mexico are upgrading their electrical systems to accommodate advanced robotics and automation, necessitating more complex distribution boards. Similarly, the boom in data centers across cities such as Toronto, Dallas, and Phoenix is creating substantial demand for high-capacity, reliable power distribution solutions.

Europe Distribution Boards Market Trends

The region's aggressive push towards renewable energy and decarbonization is a major driver. Many European countries have set ambitious targets to reduce carbon emissions and increase the share of renewable energy in their power mix. This transition requires substantial upgrades to electrical infrastructure, including distribution boards that can handle bidirectional power flows from decentralized energy sources such as solar panels and wind turbines. For example, Germany's Energiewende (energy transition) policy has led to a surge in demand for smart distribution boards that can manage the integration of renewables into the grid.

Key Distribution Boards Company Insights

The competitive environment of the distribution boards market is characterized by the presence of key global and regional players, with market leaders including ABB, Siemens AG, Schneider Electric, and Eaton Corporation PLC. These companies have substantial market shares due to their extensive product portfolios, advanced technologies, and strong distribution networks. Market share is driven by factors such as innovation in smart distribution boards, energy-efficient solutions, and adherence to stringent safety regulations. Regional players in emerging markets are also gaining ground, focusing on cost-effective solutions and catering to local demand. The overall market remains fragmented, with competition intensifying due to the rise of renewable energy integration and the push for digitalization in electrical systems.

-

In March 2024, ABB introduced the Compact CU distribution boards, the latest addition to its ComfortLine series, designed for efficient installation in flush- and hollow-wall applications. These boards feature a sleek 15 mm frame that allows for plaster leveling up to 25 mm and a cabinet depth of 110 mm, facilitating easy integration into hollow walls. The installation process is streamlined with a new hollow wall set that requires only one cutout and includes knockouts for versatile cable insertion. In addition, the packaging is made from recycled cardboard, enhancing sustainability while protecting the product during installation. These distribution boards are suitable for various settings, including residential and commercial buildings, and are aimed at improving installation efficiency and reducing time on site.

-

In May 2023, Schneider Electric launched the FlexSeT, a new low voltage switchboard designed to enhance efficiency and reduce project risks for electrical professionals in Canada. This innovative solution features a modular design, flexible configurations, and improved installation and maintenance processes, significantly shortening lead times from weeks to days.

Key Distribution Boards Companies:

The following are the leading companies in the distribution boards market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- ABB

- Eaton Corporation PLC

- Larsen & Toubro Limited

- Schneider Electric

- Legrand SA

- Havells India Ltd.

- Alfanar Group

- Hager Group

- Honeywell International Inc.

- General Electric Company

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Rittal GmbH & Co. KG

Distribution Boards Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.01 billion

Revenue forecast in 2030

USD 6.78 billion

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Voltage rating, end user, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

Siemens AG; ABB; Eaton Corporation PLC; Larsen & Toubro Limited; Schneider Electric; Legrand SA; Havells India Ltd.; Alfanar Group; Hager Group; Honeywell International Inc.; General Electric Company; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; Rittal GmbH & Co. KG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Distribution Boards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global distribution boards market report on the basis of voltage rating, end user, and region:

-

Voltage Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage (Up to 1 kV)

-

Medium Voltage (1 kV - 35 kV)

-

High Voltage (Above 35 kV)

-

-

End user Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Utilities

-

Data Centres

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global distribution board market was valued at USD 4.72 billion in 2023 and is expected to reach USD 5.01 billion in 2024.

b. The global distribution board market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030, reaching USD 6.78 billion by 2030.

b. The utility end-user segment accounted for the highest revenue market share in 2023. Distribution boards used in utility applications are crucial components of electrical substations and distribution networks. They are designed for very high voltage and current capacities and often incorporate sophisticated protection and control systems.

b. Key players in the market include Siemens AG; ABB; Eaton Corporation PLC; Larsen & Toubro Limited; Schneider Electric; Legrand SA; Havells India Ltd.; Alfanar Group; Hager Group; Honeywell International Inc.; General Electric Company; Mitsubishi Electric Corporation; Rockwell Automation, Inc.; and Rittal GmbH & Co. KG.

b. The global distribution board market is increasing as the demand for clean electricity rapidly grows across the residential, commercial, and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.