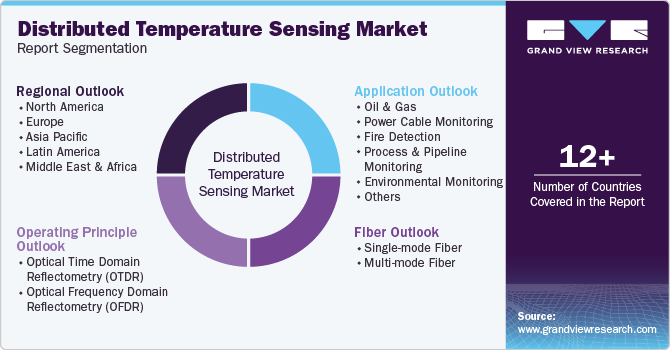

Distributed Temperature Sensing Market Size, Share & Trends Analysis Report By Operating Principle (Optical Frequency Domain Reflectometry), By Fiber, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-927-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

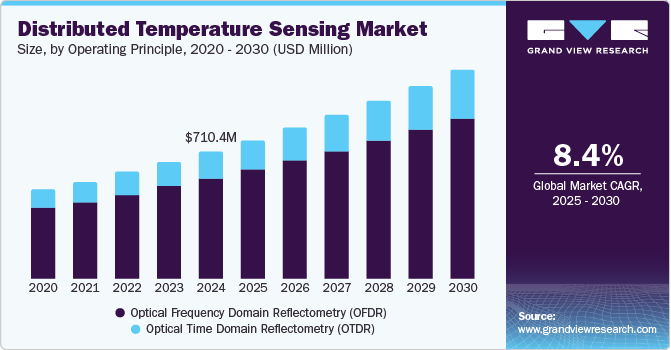

The global distributed temperature sensing market size was valued at USD 710.4 million in 2024 and is projected to grow at a CAGR of 8.4% from 2025 to 2030. Growth of this market is mainly driven by its increasing use in multiple application industries, including oil & gas, environmental monitoring, fire detection, and others. Growing awareness regarding workers’ safety has also contributed to the growth in demand for distributed temperature sensing (DTS) equipment.

DTS technology is extensively used by the oil & gas industry, primarily in petrochemical plants, pipeline structures, drilling, and storage tank areas for real-time temperature and vertical thermal profile monitoring. Its ability to perform and deliver accurate results even in harsh environments makes it a preferred choice by application industries. Upstream oil and gas operating businesses constantly seek safe and cost-efficient alternatives to remotely access and analyze real-time data related to offshore wells. Distributed temperature sensing technology assists these companies and professionals with its extraordinary capabilities associated with immunity to electromagnetic interferences and high performance even in extreme temperatures.

In the power and utility industry, reliable temperature monitoring of high-voltage transmission networks is critical in ensuring an uninterrupted power supply. Advanced optical fibers offered by numerous industry participants integrated in distributed temperature sensing technology assist providers and operators in maintaining safety and performance efficiency. Multimode fibers are often used for medium or lesser-range applications, while single-mode solutions are preferred for longer distances spanning up to 60 kilometers. In addition, it is extensively used in civil engineering applications such as the measurement of groundwater flow, subsurface heat transport, heat fluxes, and environmental monitoring.

Operating Principle Insights

Based on the operating principle, the Optical Frequency Domain Reflectometry (OFDR) segment dominated the global industry and accounted for a revenue share of 78.7% in 2024. This is attributed to enhanced capacities enabled by integrating OFDR with DTS, such as superior spatial resolution, accurate temperature measurements, and complex analysis required for real-time monitoring. It is utilized in oil and gas, power utilities, and environmental monitoring. Its ability to perform while maintaining immunity from electromagnetic noise has increased the growing demand.

The Optical Time Domain Reflectometry (OTDR) segment is anticipated to experience the fastest CAGR of 10.2% from 2025 to 2030. The OTDR principles, when integrated with DTS, assist users in monitoring temperatures over wide-ranging distances. In addition, using optical fibers for OTDR and DTS provides benefits such as cost efficiency, high sensitivity, and detection of minute temperature changes. Growing applications in industries such as oil and gas, power utility, critical infrastructure management, environmental monitoring, and others drive the demand for this segment.

Fiber Insights

The single-mode fiber segment held the largest revenue share in the global market in 2024. This is attributed to factors such as small core diameter, minimized modal dispersion, high-performance abilities, long-distance signal transmissions, and benefits such as higher resolution and immunity to electromagnetic interference. The application in areas such as fire detection, environmental monitoring, disaster management, oil and gas, and others primarily drives the demand for this segment.

The multi-mode fiber segment is expected to experience the fastest CAGR during the forecast period. This segment is mainly driven by increased use in short-range applications, cost-effectiveness and higher sensitivity in localized applications, ease of use and installation, and more. The growing utilization of leak detection, fire detection, industry process monitoring, and others mainly fuels the demand for the multi-mode fiber segment.

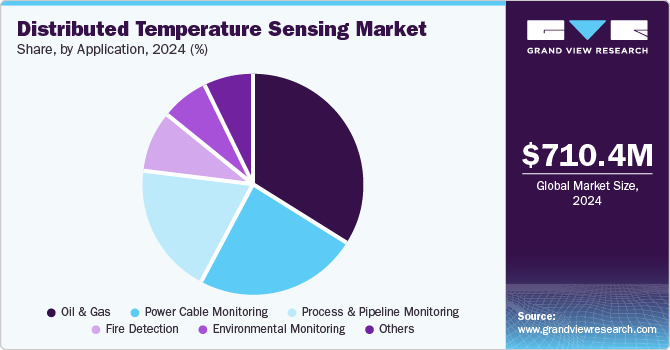

Application Insights

The oil and gas segment held the largest revenue share of the market in 2024, based on application. The growing need for safe alternatives for temperature monitoring, accurate data delivery, and cost-efficient solutions primarily drives this segment's growth. In addition, increasing awareness regarding the safety of employees who work in extreme conditions for longer hours also contributes to its growth.

The process & pipeline monitoring segment is projected to experience significant growth during the forecast period. DTS is extensively used in pipeline integrity assessment, downhole monitoring, leak identification, blockage identification, reactors and storage tank management in the chemical industry, measurement of groundwater flow, and more. Advantages such as real-time monitoring, cost efficiency, robustness, and others are generating an upsurge in the demand for this segment.

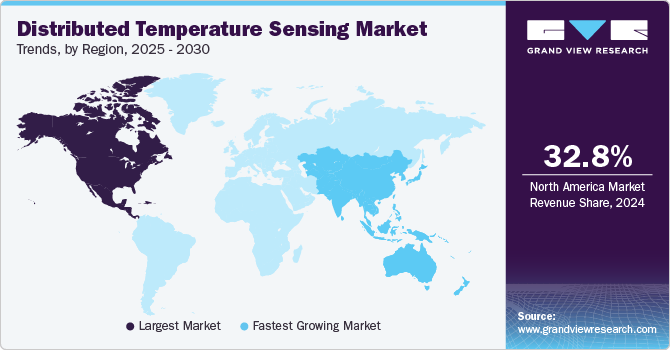

Regional Insights

The North America distributed temperature sensing market held the largest revenue share of global market at 32.8% in 2024 attributed to factors such as safety and environmental regulations, the oil and gas sector’s demand, increasing use in the power utility industry, the rise in adoption of industrial process monitoring, and the presence of key companies in the region.

U.S. Distributed Temperature Sensing Market Trends

The U.S. distributed temperature sensing market dominated the regional industry in 2024 mainly driven by aspects such as stringent regulations related to safety and continuous temperature monitoring in industries such as oil and gas and innovation and advancements in fiber optics technology. In the U.S. market, DTS technology is extensively used in leak detection, pipeline integrity assessments, and measurement of downhole temperatures.

Europe Distributed Temperature Sensing Market Trends

In 2024, Europe was identified as a lucrative region for the distributed temperature sensing market, driven by rising investment in sustainability initiatives to reduce carbon footprints, regulatory compliances, technology advancements, an increasing focus on worker safety, growing infrastructure investments, etc. Growing demand in industries with hostile working conditions is fueling the growth of this market.

Germany distributed temperature sensing market held significant revenue share of the regional industry in 2024. The robust chemical industry, large enterprises operating in the manufacturing and supply of chemicals with the presence of extremely versatile environments, innovation in fiber technology, and extensive use in the oil & gas sector are expected to boost the growth of this market from 2025 to 2030.

Asia Pacific Distributed Temperature Sensing Market Trends

Asia Pacific distributed temperature sensing market is projected to experience the fastest CAGR of 12.1% over the forecast period. This market is primarily driven by factors such as increasing demand from oil & gas industry applications, the presence of multiple industrial users in countries such as China and India, rise in fiber optics technology networks in the region, growth in construction activities, increasing new developments of public infrastructure and more.

India distributed temperature sensing market held noteworthy revenue share of the regional industry in 2024. This is attributed to increasing infrastructural enhancements in the country, growing use of temperature measurement sensing technology in the oil & gas industry, strict regulatory scenarios, and increasing awareness regarding workers' and professionals' safety in extreme environments.

Key Distributed Temperature Sensing Company Insights

Some of the key companies operating in the distributed temperature sensing market include SLB, OFS Fitel, LLC, Silixa Ltd, Yokogawa Electric Corporation, and others. To address the growing demand and competition, the key market participants are adopting strategies such as enhanced research and development, improved product portfolios, collaborations with other companies, and innovation.

-

Yokogawa Electric Corporation, one of the prominent companies operating in test measurements and industrial automation, offers the DTSX3000 Distributed Temperature Sensor, DTSX200 Distributed Temperature Sensor, Fiber Optic Temperature Sensor DTSX, and more. It mainly serves industries such as oil and gas, LNG supply chain, power, and renewable energy.

-

AP Sensing, a major market participant in the distributed temperature sensing industry, offers DAS (distributed acoustic sensing), DTS (distributed temperature sensing), and DVS (distributed vibration sensing) for applications including power cable monitoring, pipeline monitoring, LNG monitoring, and more.

Key Distributed Temperature Sensing Companies:

The following are the leading companies in the distributed temperature sensing market. These companies collectively hold the largest market share and dictate industry trends.

- AP Sensing

- Bandweaver

- HALLIBURTON

- NKT Photonics A/S

- OFS Fitel, LLC

- OPTROMIX

- SLB

- Silixa Ltd

- Yokogawa Electric Corporation

- Sumitomo Electric Industries, Ltd.

Recent Developments

-

In July 2024, VIAVI Solutions Inc. announced introducing an addition to its diversified portfolio. NITRO Fiber Sensing, comprising Distributed Temperature Sensing (DTS), Distributed Acoustic Sensing (DAS), and simultaneous temperature and strain sensing technology, is expected to assist its users with critical intelligence.

Distributed Temperature Sensing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 774.5 million |

|

Revenue forecast in 2030 |

USD 1160.2 million |

|

Growth rate |

CAGR of 8.4% from 2024 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Operating principle, fiber, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, South Africa |

|

Key companies profiled |

AP Sensing; Bandweaver; HALLIBURTON; NKT Photonics A/S; OFS Fitel, LLC; OPTROMIX; SLB; Silixa Ltd; Yokogawa Electric Corporation; Sumitomo Electric Industries, Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Distributed Temperature Sensing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global distributed temperature sensing market report based on operating principle, fiber, application, and region.

-

Operating Principle Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical Time Domain Reflectometry (OTDR)

-

Optical Frequency Domain Reflectometry (OFDR)

-

-

Fiber Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-mode Fiber

-

Multi-mode Fiber

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil and Gas

-

Power Cable Monitoring

-

Fire Detection

-

Process & Pipeline Monitoring

-

Environmental Monitoring

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."