- Home

- »

- Distribution & Utilities

- »

-

Distributed Natural Gas Fueled Generation Market, 2030GVR Report cover

![Distributed Natural Gas Fueled Generation Market Size, Share & Trends Report]()

Distributed Natural Gas Fueled Generation Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Internal Combustion Engine, Turbine), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-156-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global distributed natural gas fueled generation market size was valued at USD 102.59 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Increasing energy demand and growing climate concerns are the key factors driving growth for this industry. As decentralization of energy production allows on-site power production, reduction in transmission losses and increased energy efficiency, it is also expected to assist this market in terms of growth. Growing technological advancements in energy sector and renewable natural gas integration have led to increased adoption of natural gas. Microgrids and energy storage, along with rising government initiatives and investments, are likely to propel market growth.

The increasing demand for cleaner energy sources is a significant factor driving the adoption of natural gas as a preferred alternative to coal and oil. Natural gas leaves lesser footprint, producing fewer emissions of pollutants and greenhouse gases compared to other fossil fuels, making it an attractive option for both small-scale and large-scale energy generation. The expanding industrial sector and increasing population are raising the demand for reliable and efficient power solutions, making natural gas-distributed energy a more attractive option. Natural gas is often seen as an alternative to coal and fossil fuels for the generation of electricity owing to its lower carbon emission and supporting sustainability goals. For instance, electricity generated through natural gas accounts for more than 25% of total power generation worldwide, and the demand is likely to increase in the near future to meet various ambitious goals, such as the Paris Agreement's commitment to cut down greenhouse gas emissions by over 40% by the end of 2030.

Another growth factor is technological advancements in natural gas generation systems, such as more efficient gas turbines and modular gas generators that have improved engine efficiency, emissions reduction, and automation, making distributed natural gas-fueled generation more viable. Furthermore, the development of new applications, such as microgrids and energy storage integration, expands the potential for distributed natural gas-fueled generation. These aspects are expected to generate lasting growth for this market in approaching years.

Type Insights

Internal combustion engine gas segment dominated the global industry and accounted largest revenue share of 67.4% in 2023. The increasing adoption of internal combustion engines powered by natural gas in the automotive industry is becoming increasingly popular owing to its operational efficiency and lower emissions compared to diesel engines. Natural gas combustion produces fewer pollutants and greenhouse gases, making it a cleaner option for distributed energy generation, which aligns with environmental goals and stringent government regulations such as the U.S. Environmental Protection Agency (EPA) GHG emission act, which aims to reduce carbon footprints and improve air quality. Furthermore, advancements in internal combustion engine technology have significantly enhanced the performance and reliability of gas-powered generators. In addition, the increasing focus on energy resilience and decentralized power generation plays a crucial role in the growth of the ICE gas segment.

The turbine gas segment is anticipated to witness the fastest CAGR during the forecast period. The growing emphasis on reducing greenhouse gas emissions and improving energy efficiency is contributing to the growth of gas turbines. Gas turbines powered by natural gas produce fewer emissions compared to traditional fossil fuel-based power generation methods. Gas turbines offer superior efficiency and performance compared to other distributed generation technologies, which makes them a first choice among various end users seeking high-performance energy. Moreover, gas turbines come in a wide range of sizes and configurations, allowing for customization to meet varying power needs, from small-scale applications to larger industrial installations. As the demand for flexible and scalable energy solutions increases, gas turbines are expected to capture a significant market share in the coming years.

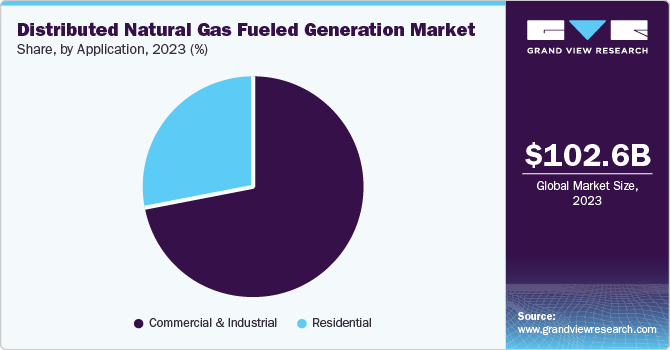

Application Insights

The commercial & industrial application segment dominated the market in 2023. The increasing emphasis on energy efficiency, economic advantage, and environmental sustainability are the key growth factors for the dominance of the segment. Commercial and industrial entities often require continuous energy for their processes, machinery, and overall operational efficiency. Distributed generation systems powered by natural gas, such as gas turbines and internal combustion engines, offer higher reliability and have ability to offer backup power to meet this demand. Moreover, natural gas is typically more cost-effective than other fuels, such as diesel or heavy oil, owing to its relatively lower prices and greater availability, which contributes to its appeal in commercial and industrial sectors, seeking to optimize their energy expenditure and improve overall efficiency. Furthermore, the scalability and flexibility of natural gas systems are well suited to the diverse needs of commercial and industrial applications, as these systems are scaled to match varying power requirements, from small-scale installations for individual commercial buildings to large-scale systems for industrial facilities.

The residential application segment is expected to experience the fastest CAGR over the forecast period. Increasing urbanization, the growing trend of smart homes and energy management systems, and climate concerns are driving the growth of this segment. Rising energy costs are driving homeowners to consider alternative sources of energy, such as distributed natural gas-fueled generation, as natural gas is more affordable than other fuels, including electricity or heating oil. The rising consumer awareness and advances in natural gas distributor systems further drive segment growth, such as modern natural gas and combine and heat power (CHP) units that are more compact and user-friendly, which makes them suitable for residential installation. Furthermore, supportive policies and incentives from governments encourage the adoption of distributed natural gas generation in residential settings.

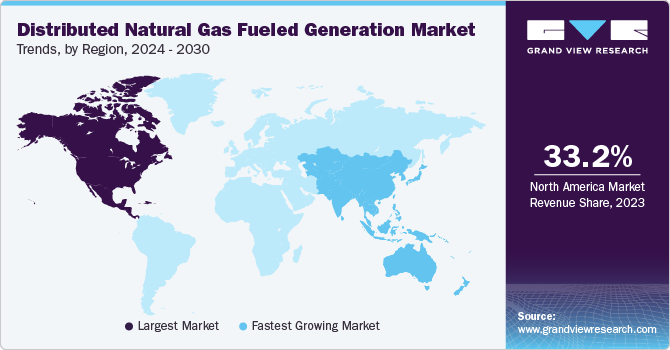

Regional Insights

North America distributed natural gas fueled generation market dominated the market and accounted for revenue of 33.2% in 2023. North America dominated the distributed natural gas-fueled generation market. The growth of this region is influenced by robust gas pipeline network and well-established infrastructure for distributed generation. Moreover, the increasing demand for reliable and efficient power, particularly in remote areas, has driven the growth of the region. In addition, government policies and incentives such as tax credits and net metering laws have encouraged the adoption of distributed natural gas fuel generation in the region.

U.S. Distributed Natural Gas Fueled Generation Market Trends

The U.S. distributed natural gas fueled generation market held largest revenue share of regional industry in 2023. The growth of the region is attributed to the presence of substantial natural gas reserves, robust technology advancements, and supporting regulatory standards. The rising energy demand in the U.S. further drives the need of sustainable energy sources such as natural gas. Furthermore, according to the U.S. Energy Information Association (EIA), natural gas was the top source for generation of electricity in year 2023.

Europe Distributed Natural Gas Fueled Generation Market Trends

Europe distributed natural gas fueled generation market held a significant share in 2023. The increasing demand for reliable and efficient power, along with the EU's commitment to reducing carbon emissions and increasing the share of renewable energy sources, are the primary factors for region growth. The increasing automotive industry and advancements in natural gas technology are fueling the market growth. Increasing government policies and incentives in countries such as Russia, the UK, Germany, and Italy are driving the adoption of natural gas to meet rising energy demand and to achieve net zero goals.

The Russia distributed natural gas-fueled generation market dominated in 2023. Vast natural gas reserves, extensive pipeline networks, and robust investments in natural gas drive the growth of the region. Russia has the largest natural gas reserves worldwide(proved), estimated at nearly 1,688 trillion cubic feet, which provides a significant advantage in terms of fuel availability and cost. Furthermore, the extensive pipeline network, such as the Gazprom-operated grid and Nord Stream, enables efficient transportation of natural gas to different power generations. Moreover, the strategic partnerships and investments made by the Russian government have played a crucial role in driving growth in the distributed natural gas-fueled generation market.

Asia Pacific Distributed Natural Gas Fueled Generation Market Trends

Asia Pacific distributed natural gas-fueled generation is anticipated to witness the fastest CAGR during the forecast period. Rapid industrialization, urbanization, and a growing focus on reducing carbon emissions are the key factors fueling the growth of regional market. Countries such as India, China, and Japan are driving the energy demand in the region, creating a need for efficient and reliable power generation. China and India are the first and third largest consumers of energy worldwide and are mainly dependent on fossil fuels such as coal and oil. The growing focus of the region on reducing carbon and shift towards other sources of energy, including natural gas-fueled generation, is expected to drive the region's growth. Furthermore, strong infrastructure, growth in gas pipeline network, and strategic partnerships to boost the natural gas sector are likely to further support the market growth. For instance, in 2023, Oil and Natural Gas Corporation Limited (ONGC), one of the prominent companies in energy industry, announced that it aims to achieve net zero emissions by 2038 and declared investment plans for the same until 2030.

China distributed natural gas fueled generation market held significant revenue share of the regional industry in 2023. Rising economic growth, rapid urbanization, and infrastructural development fueled the region's growth. Increasing urbanization and industrialization have led to a rise in demand for energy, translating to the adoption of natural gas power generation. Furthermore, the robust natural gas pipeline network and strategic partnerships and investments ensured a steady supply of fuel, driving the region's growth.

Key Distributed Natural Gas Fueled Generation Company Insights

Some key companies involved in the distributed natural gas-fueled generation market include Wärtsilä, MITSUBISHI HEAVY INDUSTRIES, LTD., Rolls-Royce, and Kawasaki Heavy Industries, Ltd., among others. To address the growing competition, the key industry participants are adopting the strategies such as collaborations, enhanced investments in embracing advanced technologies, facility improvements, network expansions and more.

-

MITSUBISHI HEAVY INDUSTRIES, LTD., a multinational engineering, electrical equipment, and electronics company, caters to various sectors such as power systems, industry and infrastructure, aircraft and defense, and others. The company manufactures a wide range of products and services, including nuclear reactors, gas turbines, steam turbines, and industrial machinery, among others.

-

Wärtsilä, a Finnish international corporation that specializes in providing solutions and services for the marine and energy markets, operates in more than 280 locations across over 79 countries. It focuses on different segments of business including Wärtsilä Energy and Wärtsilä Marine, providing a broad range of products and services such as power generation and distribution solutions, ship design, energy storage systems, and others.

Key Distributed Natural Gas Fueled Generation Companies:

The following are the leading companies in the distributed natural gas fueled generation market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Siemens

- Caterpillar

- Rolls-Royce

- Wärtsilä

- Cummins Inc.

- MAN Energy Solutions

- Kawasaki Heavy Industries, Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD. (Mitsubishi Power, Ltd.)

- Doosan Corporation

Recent Developments

-

In August 2024, Mitsubishi Power received an order for an M701F gas and steam turbine for a 500-megawatt (MW) combined cycle power plant in Sarawak, Malaysia. The M701F gas turbine is capable of co-firing fuel containing up to 30% hydrogen and is scheduled to commence commercial operation in 2027.

-

In May 2024, Wärtsilä Power announced involvement in the UK renewable project as provider of critical grid balancing services. It plans to supply a 48 MW peaking power plant to the UK to support the country’s rising use of renewable energy, which aims to achieve the ambitious net zero goal and reduce dependency on fossil fuels.

-

In March 2024, Rolls Royce supplied 12 mtu gas generator sets to a state-of-the-art oil and gas production site in Oman. The generator sets include eight mtu containerized gas generator sets and four additional mtu 20V 4000 L64 FNER engines. Each of the 12 generator sets produces 2 MW of power, ensuring an efficient and uninterrupted power supply in meeting the demand of the facility.

Distributed Natural Gas Fueled Generation Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 108.60 billion

Revenue Forecast in 2030

USD 160.18 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, Russia, UK, Spain, Italy, France, China, Japan, South Korea, India, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

General Electric Company; Siemens; Caterpillar; Rolls-Royce; Wärtsilä; Cummins Inc.; MAN Energy Solutions; Kawasaki Heavy Industries, Ltd.; MITSUBISHI HEAVY INDUSTRIES, LTD. (Mitsubishi Power, Ltd.); Doosan Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

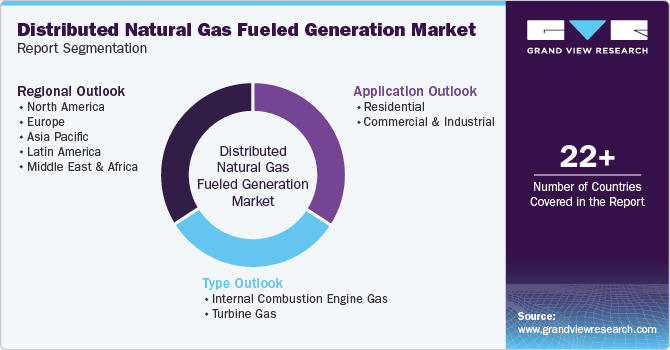

Global Distributed Natural Gas Fueled Generation Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global distributed natural gas fueled generation market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Combustion Engine Gas

-

Turbine Gas

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial & Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Russia

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.