Distributed Fiber Optic Sensor Market Size, Share & Trends Analysis Report By Application, By Technology (Rayleigh Effect, Brillouin Scattering), By Vertical (Oil & Gas, Power & Utility), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-462-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Distributed Fiber Optic Sensor Market Trends

The global distributed fiber optic sensor market size was estimated at USD 1.60 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The rising need amongst enterprises and corporations to engage in effective sensing operations of their machine systems is offering market growth opportunities. The application of optic sensing has increased substantially across the various business sectors, including automotive, aerospace, civil, energy, and others. Other types of sensing technologies, such as Raman Effect-based and Rayleigh’s effect-based sensing, also have distinct operational capabilities.

The high functionality of Distributed Fiber Optic Sensor (DFOS) is encouraging more enterprises to invest in the technology and engage in R&D practices. This results in the development of new products, thereby offering the company the opportunity to capture a larger market share. Corporations aim to optimize their production practices and regulate the efficiency to overtake all other substitutes of fiber optics technology. The high cost of deployment and installation of DFOS products further encourages companies to develop competitively priced optic inspection products that are more reliable.

Technologies such as Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR) characterize fiber optics by carrying out a quality inspection of accuracy, range, and resolution of the key trends observed in the market. The integration of advanced technologies such as Real-Time Thermal Rating (RTTR) and intelligent Distributed Acoustic Sensor (iDAS) technologies are other prominent technological trends. An increasing number of investments to carry out R&D activities to introduce innovative fiber cables and provide reliable connectivity at high speed and the lowest possible price trend in the market.

The virtue of the technology to offer optimum performance in challenging end uses is one of the significant market drivers. Optical fibers enable professionals to monitor and control heavy operations used in pipelines, border security, and civil engineering. The deployment of fiber optic cables offers companies better cost-saving opportunities than metal wires due to their high transmission capacity. The high efficiency and high speed of transmission capabilities in remote and inaccessible places encourage corporations to deploy the technology.

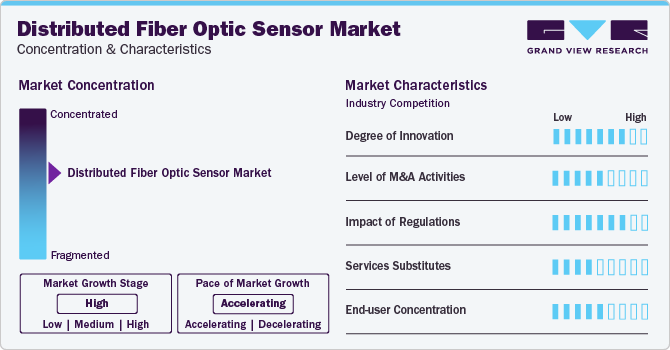

Market Concentration & Characteristics

The global market is in a vibrant phase of innovation. Driven by technological advancements like Brillouin scattering and Raman-based sensing, new applications and sensing capabilities are constantly emerging. Companies are actively investing in R&D, leading to improved accuracy, sensitivity, and cost-effectiveness of these sensors.

M&A activity in the market is moderate, with a mix of consolidations and strategic acquisitions. Established companies are acquiring smaller companies with niche technologies or expertise to expand their product portfolio and geographic reach. In addition, collaborations and partnerships between technology providers and system integrators are common, facilitating faster adoption of the technology across diverse industries.

Regulations play a significant role in shaping the market, particularly in safety-critical applications like oil and gas pipelines or nuclear power plants. Stringent quality standards and certification requirements can create entry barriers for new companies. However, these regulations also drive the development of reliable and high-performance sensors, ultimately boosting user confidence and market growth.

Although alternative sensing technologies like traditional electrical sensors exist, they often lack the long-distance coverage, immunity to electromagnetic interference, and multi-parameter sensing capabilities offered by distributed fiber optic sensors. However, in specific applications where cost is a primary concern, legacy technologies may still be viable substitutes.

The market is currently characterized by a moderate level of end-user concentration. While the oil & gas industry remains a prominent consumer, growing adoption in sectors like civil infrastructure, power & utilities, and aerospace is diversifying the user base. This trend is expected to continue, reducing dependence on any single market segment and strengthening the overall market stability.

Application Insights

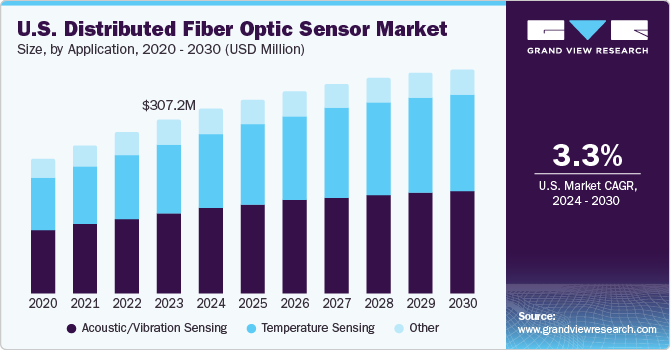

In terms of application, the temperature sensing segment led the market with the largest revenue share of 45.0% in 2023. DFOS sensors help to generate a continuous profile of strain, acoustics, temperature, or conditions along the entire length of the fiber. The DFOS market has been segmented into acoustic/vibration sensing, temperature sensing, and others based on application. The vibration/acoustic segment is anticipated to witness significant growth, owing to its increasing adoption across the security application segment.

Deploying distributed temperature sensing systems (DTS) enables enterprises and organizations to engage in effective temperature measurement practices in challenging scenarios. The high accuracy of the technology being used and the ability to be deployed in several industries such as oil & gas, industrial, civil engineering, and power & utility drive the market growth for the technology. Acoustic and vibration sensing also captured a 39.0% revenue share in 2022, thus showcasing the importance of the technology and application for various uses. However, the high cost of deployment and technological complexities act as refraining factors for the market.

Technology Insights

Based on technology, the raman effect technology segment led the market with the largest revenue share in of 36.4% in 2023. This can be accredited to the use of technology in critical situations such as the safety of large structures, coolant leak detection, and fire detection with uses in advanced data processing practices. Furthermore, the immunity of the technology to electromagnetic interference helps in continuous monitoring and prevents structural problems in extensive infrastructures such as rail tracks and bridges. Further Brillouin scattering, Raman Effect, Interferometric, and Bragg Grating technologies also significantly impact the market growth.

The rayleigh effect segment is expected to grow at the fastest CAGR over the forecast period. It is due to the technology's ability to measure almost all physical parameters such as strain and temperature. In this method, the scattering principle of light is used to track and highlight propagating effects, which aids in sensing physical parameters. Moreover, distributed sensing using Rayleigh scattering of light helps to turn optic fiber cable into an array of several virtual temperature and strains which can cover long distances.

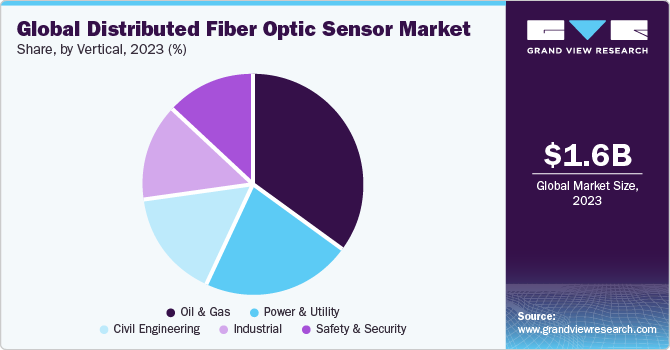

Vertical Insights

Based on vertical, the oil & gas segment led the market with the largest revenue share of 34.8% in 2023 Also, other verticals, including power and utility, safety and security, industrial and civil engineering, have a major impact on the market's growth. DFOS is essential in real-time and accurate downhole measurement for optimized performance, leading to real-time data-driven decision-making. The use of fiber optics for distributed temperature sensing (DTS) and distributed acoustic sensing (DAS) helps solve daily oil and gas field encounters, which is further offering an impetus to market growth.

The power & utility sector has gained significant revenue share due to increasing demand amongst electric utility companies for localization and hot spot detection, smart grid, and ampacity. The Brillouin scattering principle helps to detect strains and stresses in the machine system, which helps in monitoring and potentially mitigating risks. The primary reason behind the use of distributed sensors in this vertical is to detect hotspots, leakages, and ground movement monitoring.

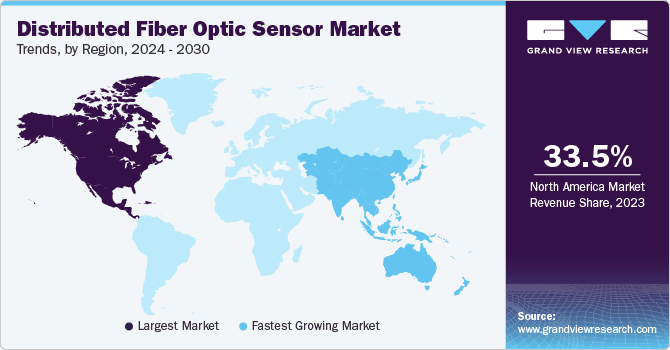

Regional Insights

North America dominated the distributed fiber optic sensor market with a revenue share of over 33.5% in 2023. This can be attributed to the significant oil and natural gas industry present in the U.S., facilitating higher adoption rates for distributed fiber optic cables. The U.S. produced nearly 34.4 trillion cubic feet of natural gas in 2020 using hydraulic fracturing and horizontal drilling techniques, both of which use high-performance optical fibers. The rising price of crude oil worldwide promotes oil & gas companies to deploy more affordable and efficient supporting systems to improve profit generation capability, which further improves the market growth opportunities.

U.S. Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor market in U.S. is expected to grow at the fastest CAGR of 3.3% during the forecast period, owing to a growing interest in DFOS technology in the U.S., especially in the energy sector. The ability to monitor pipelines and detect leaks in real time using DFOS technology is particularly appealing to oil and gas companies, who are always looking for ways to improve safety and reduce the risk of environmental damage.

Europe Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor market in Europe is expected to witness the significant CAGR during the forecast period. Technological advancement in fiber optical sensing in European countries improves the aerospace and medical sector. The European union has provided funding for several large-scale research projects focused on developing and testing new DFOS applications. For instance, the European Commission funded a project called "Fibre optic sensor network for distribution of point sources of pollution" (FODIAC), which aimed to develop DFOS technology for monitoring environmental pollution in groundwater and surface water.

The UK distributed fiber optic sensor market accounted with the significant share in the European region. The UK government has provided funding for DFOS research and development through its Innovate UK program, which supports innovative projects with the potential to drive economic growth. For example, Innovate UK has provided funding for projects to improve the safety and efficiency of rail and highway infrastructure using DFOS technology.

Asia Pacific Distributed Fiber Optic Sensor Market Trends

The distributed fiber optic sensor market in the Asia Pacific region is anticipated to grow at the fastest CAGR during the forecast period. Asian countries like China and India are expanding economies and focusing on industrialization, which has given rise to industrial and domestic construction. DFOS can be used for safety and monitoring purposes. Countries like Japan are often victims of several natural disasters. Optical sensors can detect seismic vibrations and strain in civil structures such as bridges & buildings and help avoid casualties during natural calamities.

The India distributed fiber optic sensor market accounted with the significant revenue share in the Asia Pacific region. The Indian government's Department of Science and Technology (DST) has funded several research projects on DFOS technology, particularly in structural health monitoring and environmental monitoring. For instance, DST has provided funding for research on DFOS-based monitoring of landslides, dams, and bridges and for developing DFOS systems for oil and gas pipeline monitoring.

Key Distributed Fiber Optic Sensor Company Insights

Key distributed fiber optic companies include Halliburton, Schlumberger Limited, Yokogawa Electric Corporation, and OFS Fitel, LLC. Rising R&D activities and increasing investments made by service providers to accelerate innovation and provide better service offerings offer an impetus to market growth. This has helped users engage in data-driven decision-making and closely administer machine systems to mitigate potential risks. Furthermore, service providers are also engaging in partnerships and collaborations to drive business practices and enhance revenue generation. For instance, in March 2023, Yokogawa Electric and Otsuka Chemical announced the formation of Syncrest Inc. This joint company would function as a contract R&D and production organization for middle molecular medicines.

Key Distributed Fiber Optic Sensor Companies:

- Halliburton

- Schlumberger Limited

- Yokogawa Electric Corporation

- OFS Fitel, LLC

- Qinetiq Group PLC

- Omnisens SA

- Brugg Kable AG

- Luna Innovations Incorporated

- AP Sensing GmbH

Recent Developments

-

In March 2023, Yokogawa Electric and Otsuka Chemical joined forces to create Syncrest Inc. This partnership aims to revolutionize the middle-molecule pharmaceuticals field through comprehensive research, development, and production

-

In May 2022, Fiber Bragg Grating pressure sensors paired with AP Sensing’s cutting-edge Distributed Temperature Sensing was incorporated by the China National Petroleum Corporation. The technology was deployed across three horizontal wells within two oilfield sites to monitor downhole conditions, assess casing integrity, and sniff out potential leaks behind the casing

-

In April 2022, Schlumberger and Sintela joined forces in a strategic move to develop cutting-edge fiber-optic solutions for various industries. With Schlumberger spearheading the energy, CCS, and geothermal markets, the collaboration leverages both companies' expertise: Sintela's DFOS technology and Opti Schlumberger's IP in fiber-optic solutions

Distributed Fiber Optic Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.74 billion |

|

Revenue forecast in 2030 |

USD 2.53 billion |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, technology, vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country scope |

US; Canada; Mexico; Germany; UK; China; Japan; India; Brazil |

|

Key companies profiled

|

Halliburton; Schlumberger Limited; Yokogawa Electric Corporation; OFS Fitel; LLC; Qinetiq Group PLC; Omnisens SA; Brugg Kable AG; Luna Innovations Incorporated; AP Sensing GmbH |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

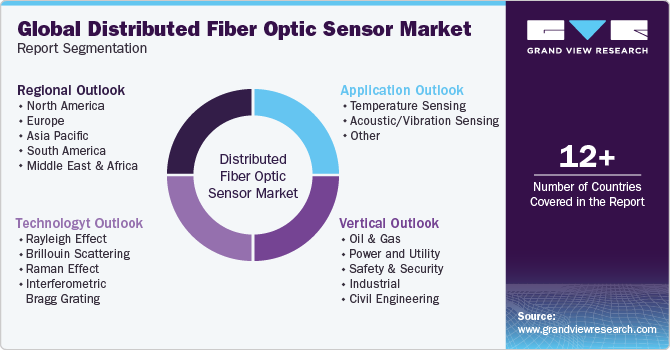

Global Distributed Fiber Optic Sensor Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global distributed fiber optic sensor market report based on application, technology, vertical, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Temperature Sensing

-

Acoustic/Vibration Sensing

-

Other

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Rayleigh Effect

-

Brillouin Scattering

-

Raman Effect

-

Interferometric

-

Bragg Grating

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Power and Utility

-

Safety & Security

-

Industrial

-

Civil Engineering

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global distributed fiber optic sensor market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 1.74 billion in 2024.

b. The global distributed fiber optic sensor market is expected to grow at a compound annual growth rate of 6.5 % from 2024 to 2030 to reach USD 2.53 billion by 2030.

b. North America dominated the global distributed fiber optic sensor market in 2023 with a revenue share of 33.5%. This can be attributed to the significant oil and natural gas industry present in the U.S., facilitating higher adoption rates for distributed fiber optic cables.

b. Some key players operating in the distributed fiber optic sensor market include Halliburton; Schlumberger Limited; Yokogawa Electric Corporation; OFS Fitel, LLC; Qinetiq Group PLC; Omnisens SA; Brugg Kable AG; Luna Innovations Incorporated; and AP Sensing GmbH.

b. Key factors that are driving the DFOS market growth include significant demand from the civil engineering vertical and rising adoption in the oil & gas sector.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. DFOS Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Million)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Industry Opportunities

3.4.4. Industry Challenges

3.4.5. Key Small-Sized Edtech Companies, By Region/Country

3.4.6. Key Company Ranking Analysis, 2023

3.5. Distributed Fiber Optic Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. DFOS Market: Application Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. DFOS Market: Application Movement Analysis, USD Million, 2023 & 2030

4.3. Temperature Sensing

4.3.1. Temperature Sensing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4. Acoustic/Vibration Sensing

4.4.1. Acoustic/Vibration Sensing Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5. Other

4.5.1. Other Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 5. DFOS Market: Technology Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. DFOS Market: Technology Movement Analysis, USD Million, 2023 & 2030

5.3. Rayleigh Effect

5.3.1. Rayleigh Effect Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Brillouin Scattering

5.4.1. Brillouin Scattering Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5. Raman Effect

5.5.1. Raman Effect Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.6. Interferometric

5.6.1. Interferometric Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.7. Bragg Grating

5.7.1. Bragg Grating Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. DFOS Market: Vertical Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. DFOS Market: Vertical Movement Analysis, USD Million, 2023 & 2030

6.3. Oil & Gas

6.3.1. Oil & Gas Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. Power and Utility

6.4.1. Power and Utility Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. Safety & Security

6.5.1. Safety & Security Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Industrial

6.6.1. Industrial Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.7. Civil Engineering

6.7.1. Civil Engineering Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. DFOS Market: Regional Estimates & Trend Analysis

7.1. DFOS Market Share, By Region, 2023 & 2030, USD Million

7.2. North America

7.2.1. North America DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.2. U.S.

7.2.2.1. U.S. DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.2.3. Canada

7.2.3.1. Canada DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.2. UK

7.3.2.1. UK DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.3.3. Germany

7.3.3.1. Germany DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.2. China

7.4.2.1. China DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.3. Japan

7.4.3.1. Japan DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4.4. India

7.4.4.1. India DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. South America

7.5.1. South America DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. Middle East and Africa

7.6.1. Middle East and Africa DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Recent Developments & Impact Analysis by Key Market Companies

8.2. Company Categorization

8.3. Company Market Positioning

8.4. Company Market Share Analysis

8.5. Company Heat Map Analysis

8.6. Strategy Mapping

8.6.1. Expansion

8.6.2. Mergers & Acquisition

8.6.3. Partnerships & Collaborations

8.6.4. New Product Launches

8.6.5. Research And Development

8.7. Company Profiles

8.7.1. Halliburton

8.7.1.1. Company Overview

8.7.1.2. Financial Performance

8.7.1.3. Product Benchmarking

8.7.1.4. Recent Developments

8.7.2. Schlumberger Limited

8.7.2.1. Company Overview

8.7.2.2. Financial Performance

8.7.2.3. Product Benchmarking

8.7.2.4. Recent Developments

8.7.3. Yokogawa Electric Corporation

8.7.3.1. Company Overview

8.7.3.2. Financial Performance

8.7.3.3. Product Benchmarking

8.7.3.4. Recent Developments

8.7.4. OFS Fitel, LLC

8.7.4.1. Company Overview

8.7.4.2. Financial Performance

8.7.4.3. Product Benchmarking

8.7.4.4. Recent Developments

8.7.5. Omnisens SA

8.7.5.1. Company Overview

8.7.5.2. Financial Performance

8.7.5.3. Product Benchmarking

8.7.5.4. Recent Developments

8.7.6. Brugg Kable AG

8.7.6.1. Company Overview

8.7.6.2. Financial Performance

8.7.6.3. Product Benchmarking

8.7.6.4. Recent Developments

8.7.7. Luna Innovations Incorporated

8.7.7.1. Company Overview

8.7.7.2. Financial Performance

8.7.7.3. Product Benchmarking

8.7.7.4. Recent Developments

8.7.8. AP Sensing GmbH

8.7.8.1. Company Overview

8.7.8.2. Financial Performance

8.7.8.3. Product Benchmarking

8.7.8.4. Recent Developments

List of Tables

Table 1 Distributed fiber optic sensor market - Industry snapshot & key buying criteria, 2017 - 2030

Table 2 Global distributed fiber optic sensor market, 2017 - 2030 (USD Million)

Table 3 Global distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 4 Global distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 5 Global distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 6 Global distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 7 Key market driver impact

Table 8 Key market restraint impact

Table 9 Key Company Analysis

Table 10 Global temperature sensing distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 11 Global acoustic/vibration sensing distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 12 Global other distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 13 Global rayleigh effect distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 14 Global brillouin scattering distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 15 Global raman effect distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 16 Global interferometric distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 17 Global bragg grating distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 18 Global oil & gas distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 19 Global power and utility distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 20 Global safety & security distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 21 Global industrial distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 22 Global civil engineering distributed fiber optic sensor market, by region, 2017 - 2030 (USD Million)

Table 23 North America distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 24 North America distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 25 North America distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 26 U.S. distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 27 U.S. distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 28 U.S. distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 29 Canada distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 30 Canada distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 31 Canada distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 32 Mexico distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 33 Mexico distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 34 Mexico distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 35 Europe distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 36 Europe distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 37 Europe distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 38 UK distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 39 UK distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 40 UK distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 41 Germany distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 42 Germany distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 43 Germany distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 44 Asia Pacific distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 45 Asia Pacific distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 46 Asia Pacific distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 47 China distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 48 China distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 49 China distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 50 Japan distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 51 Japan distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 52 Japan distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 53 India distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 54 India distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 55 India distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 56 South America distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 57 South America distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 58 South America distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 59 Brazil distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 60 Brazil distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 61 Brazil distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

Table 62 MEA distributed fiber optic sensor market, by application, 2017 - 2030 (USD Million)

Table 63 MEA distributed fiber optic sensor market, by technology, 2017 - 2030 (USD Million)

Table 64 MEA distributed fiber optic sensor market, by vertical, 2017 - 2030 (USD Million)

List of Figures

Fig. 1 DFOS Market Segmentation

Fig. 2 Technology landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot (1/2)

Fig. 9 Segment Snapshot (2/2)

Fig. 10 Competitive Landscape Snapshot

Fig. 11 EdTech- Market Size and Growth Prospects (USD Million)

Fig. 12 DFOS Market: Industry Value Chain Analysis

Fig. 13 DFOS Market: Market Dynamics

Fig. 14 DFOS Market: PORTER’s Analysis

Fig. 15 DFOS Market: PESTEL Analysis

Fig. 16 DFOS Market Share by Application, 2023 & 2030 (USD Million)

Fig. 17 DFOS Market, by Application: Market Share, 2023 & 2030

Fig. 18 Temperature Sensing Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 19 Acoustic/Vibration Sensing Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 20 Others Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million

Fig. 21 DFOS Market Share by Technology, 2023 & 2030 (USD Million)

Fig. 22 DFOS Market, by Technology: Market Share, 2023 & 2030

Fig. 23 Rayleigh Effect Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 24 Brillouin Scattering Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 25 Raman Effect Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 26 Interferometric Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 27 Bragg Grating Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 28 DFOS Market Share by Vertical, 2023 & 2030 (USD Million)

Fig. 29 DFOS Market, by Vertical: Market Share, 2023 & 2030

Fig. 30 Oil & Gas Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 31 Power and Utility Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 32 Safety & Security Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 33 Industrial Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 34 Civil Engineering Market Estimates & Forecasts, 2017 - 2030 (Revenue, USD Million)

Fig. 35 DFOS Market Revenue, by Region, 2023 & 2030 (USD Million)

Fig. 36 Regional Marketplace: Key Takeaways

Fig. 37 Regional Marketplace: Key Takeaways

Fig. 38 North America DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 39 U.S. DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 40 Canada DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 41 Europe DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 42 UK DFOS Market Estimates and Forecasts, 2017 - 2030,) (USD Million)

Fig. 43 Germany DFOS Market Estimates and Forecasts (2017 - 2030,) (USD Million)

Fig. 44 Asia Pacific DFOS Market Estimates and Forecast, 2017 - 2030 (USD Million)

Fig. 45 China DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 46 Japan DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 47 India DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 48 South America DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 49 MEA DFOS Market Estimates and Forecasts, 2017 - 2030 (USD Million)

Fig. 50 Key Company Categorization

Fig. 51 Company Market Positioning

Fig. 52 Key Company Market Share Analysis, 2023

Fig. 53 Strategic Framework

Market Segmentation

- Distributed Fiber Optic Sensor Application Outlook (Revenue, USD Million, 2017 - 2030)

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Distributed Fiber Optic Sensor Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Distributed Fiber Optic Sensor Vertical Outlook (Revenue, USD Million, 2017 - 2030)

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Distributed Fiber Optic Sensor Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- North America Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- North America Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- U.S.

- U.S. Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- U.S. Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- U.S. Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- U.S. Distributed Fiber Optic Sensor Market, By Application

- Canada

- Canada Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Canada Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Canada Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Canada Distributed Fiber Optic Sensor Market, By Application

- Mexico

- Mexico Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Mexico Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Mexico Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Mexico Distributed Fiber Optic Sensor Market, By Application

- North America Distributed Fiber Optic Sensor Market, By Application

- Europe

- Europe Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Europe Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Europe Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Germany

- Germany Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Germany Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Germany Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Germany Distributed Fiber Optic Sensor Market, By Application

- UK

- UK Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- UK Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- UK Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- UK Distributed Fiber Optic Sensor Market, By Application

- Europe Distributed Fiber Optic Sensor Market, By Application

- Asia Pacific

- Asia Pacific Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Asia Pacific Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Asia Pacific Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- China

- China Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- China Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- China Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- China Distributed Fiber Optic Sensor Market, By Application

- Japan

- Japan Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Japan Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Japan Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Japan Distributed Fiber Optic Sensor Market, By Application

- India

- India Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- India Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- India Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- India Distributed Fiber Optic Sensor Market, By Application

- Asia Pacific Distributed Fiber Optic Sensor Market, By Application

- South America

- South America Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- South America Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- South America Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Brazil

- Brazil Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Brazil Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Brazil Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Brazil Distributed Fiber Optic Sensor Market, By Application

- South America Distributed Fiber Optic Sensor Market, By Application

- Middle East & Africa

- Middle East & Africa Distributed Fiber Optic Sensor Market, By Application

- Temperature Sensing

- Acoustic/Vibration Sensing

- Other

- Middle East & Africa Distributed Fiber Optic Sensor Market, By Technology

- Rayleigh Effect

- Brillouin Scattering

- Raman Effect

- Interferometric

- Bragg Grating

- Middle East & Africa Distributed Fiber Optic Sensor Market, By Vertical

- Oil and Gas

- Power and Utility

- Safety and Security

- Industrial

- Civil Engineering

- Middle East & Africa Distributed Fiber Optic Sensor Market, By Application

- North America

Distributed Fiber Optic Sensor Market Dynamics

Drivers: Significant Demand from Civil Engineering Vertical

The civil engineering vertical has been experiencing growth in recent years, owing to technological improvements and innovations. Evolving population demographics and growing urbanization have resulted in the need for superior and faster infrastructure development. Sensor-embedded roads, tunnels, buildings, geopolymer concrete, and green buildings are expected to stimulate civil engineering and infrastructure growth. Increasing demand for sophisticated infrastructure, and rising per capita income is predicted to lead to industrial automation, urban mobility, and growth in high-end residential projects. Various governments are focusing on conserving their prevailing infrastructure and developing new ones. They are under constant pressure to provide the necessary infrastructure, amenities, and connectivity to people. This has enabled increased spending on projects such as roads, railways, and dams.

Rising Adoption in the Oil & Gas Sector

DFOS are transparent and flexible fibers that work on the principle of total internal reflection of light. They are made of great-quality glass, plastic, and silica. Elaborative research & development in the sector of optical technology has resulted in numerous innovations, allowing the utilization of optical fibers for numerous purposes in oil & gas, medical, utilities, and defense sectors. DFOS find novel usages across the security industry and are utilized for light conduction and illumination, flexible bundling, and laser delivery systems. Oil & gas is among the core industries and carries out a crucial role in persuading economic decision-making. Surging population, industrialization, and emerging economies, such as India and China, are anticipated to boost the oil & gas sector. Enhancing standards of living and rising income levels are predicted to surge the sales of bikes and cars, consequently resulting in a rise in the oil & gas industry, as they are complementary markets.

Restraint: High Initial Acquisition & Installation Costs of Optical Technology

An optical fiber system comprises a variety of components such as optical cables, sensors, and receivers, and so on. Installation of the entire system is a labor-intensive process, especially the installation of a network for underground and undersea connections, which is one of the costliest and most tedious procedures. Fiber optics has overtaken copper cable transmission. However, the installation process of an optical fiber is costly and is expected to hamper the market growth. Raw materials, such as high-quality glass, plastic, and silica, used for manufacturing fiber optic cables are costly. Undersea connections require the cables to be extremely robust and durable to ensure a reliable and efficient connection, thus increasing the cost of fiber optic cables. Additionally, continuous research and development activities to find effective alternatives for fiber optic communication, owing to its high costs and expensive and complex installation procedures, are predicted to create an obstruction for a secure market, thus hampering the growth of the overall DFOS market.

What Does This Report Include?

This section will provide insights into the contents included in this distributed fiber optic sensor market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Distributed fiber optic sensor market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Distributed fiber optic sensor market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

Research Methodology

A three-pronged approach was followed for deducing the distributed fiber optic sensor market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for distributed fiber optic sensor market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of distributed fiber optic sensor market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Distributed Fiber Optic Sensor Market Categorization:

The distributed fiber optic sensor market was categorized into four segments, namely application (Temperature Sensing, Acoustic/Vibration Sensing), technology (Rayleigh Effect, Brillouin Scattering, Raman Effect, Interferometric, Bragg Grating), vertical (Oil & Gas, Power and Utility, Safety & Security, Industrial, Civil Engineering), and regions (North America, Europe, Asia Pacific, South America, Middle East & Africa).

Segment Market Methodology:

The distributed fiber optic sensor market was segmented into application, technology, vertical, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-

Demand estimation via analyzing paid database, and company financials either via annual reports or paid database.

-

Primary interviews for data revalidation and insight collection.

Market research approaches: Top-down

-

Used extensively for new product forecasting or analyzing penetration levels.

-

Tool used invoice product flow and penetration models Use of regression multi-variant analysis for forecasting Involves extensive use of paid and public databases.

-

Primary interviews and vendor-based primary research for variable impact analysis.

Market research approaches: Combined

- This is the most common method. We apply concepts from both the top-down and bottom-up approaches to arrive at a viable conclusion.

Regional Market Methodology:

The distributed fiber optic sensor market was analyzed at a regional level. The global was divided into North America, Europe, Asia Pacific, South America, and Middle East & Africa, keeping in focus variables like consumption patterns, export-import regulations, consumer expectations, etc. These regions were further divided into nine countries, namely, the U.S., Canada, Mexico, Germany, the UK., China, India, Japan, Brazil.

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

Distributed fiber optic sensor market companies & financials:

The distributed fiber optic sensor market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

-

Schlumberger Limited , Schlumberger Limited is among the leading providers of technology associated with the processing of oil & gas industry, production, drilling, and reservoir characterization. The company incorporated in 1926 and headquartered in Houston, U.S.; ‘Schlumberger’ offers an extensive range of products and services varying from exploration to integrated pore-to-pipeline solutions for hydrocarbon recovery, which optimize the reservoir performance. Schlumberger also provides fiber optic sensing solutions. The distributed fiber optic technology helps in monitoring environment temperature measurements for extended intervals. The Schlumberger fiber optic technology is highly sensitive and provides accurate data for identifying changes in the source.

-

Halliburton , Halliburton, an American company, provides products, services, and solutions for oil and gas production, development, and exploration. It is one of the biggest providers of goods and services in the energy industry and has operations in around 70 countries. The company is headquartered at Houston, U.S. The company provides oilfield services in the oil & gas industry. These services comprise drilling evaluation and fluid services, providing production, optimization, and oilfield consulting & drilling software. The company consists of 14 Product Service Lines (PSLs) which are divided into two segments, namely Drilling & Evaluation and Completion & Production. PSLs are majorly responsible for technology development, people development, strategy, process development, and capital allocation.

-

Yokogawa Electric Corporation , Yokogawa Electric Corporation is a Japanese software and electrical engineering company. It develops, manufactures, and sells Information Technology (IT) solutions. The company also provides control and measuring equipment, electronic components, and semiconductors. The product segment of the company comprises flowmeters, data recorder, analyzers, and adaptors for Alternating Currents (AC), switching power supply, and Information Technology (IT) controllers. Distributed Optical Fiber Sensing/Sensors (DOFS) instruments are used for the measurement of temperature distribution across the length of fiber-optic cable. These optical fibers are accurate and have a spatial resolution. The technology is used for fire detection, pipeline leak detection, and kilometer (km) scale distributed temperature measurements in the civil, oil, and gas industries.

-

OFS Fitel, LLC , OFS Fitel, LLC, an American company, manufactures and provides fiber optic cables, connectivity, and solutions related to the optical fiber telecommunication. OFS Fitel, LLC was founded in 2001 and is based in Norcross, Georgia. It has facilities in China, Denmark, Germany, the Russian Federation, and the U.S. As of 2001, the company operated as a subsidiary of Furukawa Electric Co., Ltd. The company provides services such as designing and manufacturing and provides fiber optic cable and connectivity. The company also provides optical fiber solution for the government, aerospace, telecommunications, medical, industrial networking, and defense industries. The company’s primary products include optical fibers, optical connectivity products, fiber laser components, fusion splicers, and professional services. It serves municipalities, home developer, network operators, and service providers.

-

Qinetiq Group PLC , Qinetiq Group PLC (Pronounced as “kinetic”) operates as an engineering and science company, majorly focusing on the security, aerospace, and defense markets. The company was incorporated in 2001 and is headquartered at Hampshire, UK. The company provides services to de-risk aerospace programs to test aircraft and evaluate solutions on them. It also offers research and training services to land, maritime, and weapons. Moreover, the company offers secure communication networks, training, and cybersecurity services to the government. Additionally, the company develops and produces military protection products, military robots, and fiber sensing solutions to deliver data for decision making in different verticals. The company also offers space products such as satellites, ground station services, and payload instruments.

-

Omnisens SA , Omnisens SA, a Switzerland-based company, provides measurement systems for oil & gas, energy, pipeline, civil engineering, Geotech, and testing & measurement industries. The company was incorporated in 1999 and is headquartered at Morges, Switzerland. It has its operations worldwide. The company deals with asset integrity and a wide range Distributed Temperature Sensing (DTS) solution for ground movement detection, railway & road infrastructure monitoring, pipeline integrity monitoring, and structural health monitoring solutions for tunnels, dams, nuclear plants, and other civil engineering projects. The company also provides Distributed Fiber Optic (DFO) interrogators such as temperature analyzers, distributed strain, and Distributed Acoustic Sensing (DAS) analyzers.

-

Brugg Kable AG , Brugg Kable AG, a Switzerland-based company, manufactures and distributes cables and cable systems. The company was established in 1896 and is headquartered at Brugg, Switzerland, with branch offices in China, Czech Republic, Germany, Austria, Benelux, India, Italy, Kuwait, Poland, the UAE, and the U.S. It operates as a subsidiary of Kabelwerke Brugg AG Holding. The company manufactures small and medium voltage cables, fiber optic cables, and accessories for industrial plants and distribution networks. The industrial application of these cables includes machine and plant manufacturing, renewable energy, monitoring systems, and lifting equipment for detecting pressure, temperature, vibration, and strain.

-

Luna Innovations Incorporated , Luna Innovations Incorporated is a research and development firm which develops, manufactures, and endorses fiber optic sensing & measurement and tests products around the globe. It was established in 1990 and is headquartered at Roanoke, Virginia. The company operates in two segments, namely technology development and products & licensing. The latter consists of product measurement and fiber optic sensing to observe the integrity of fiber optic network components. The technology development segment provides research for end users in areas such as adhesives, nanomaterial, and bio-engineered materials. Potential buyers of the company are defense agencies, telecommunications companies, Original Equipment Manufacturers (OEMs), and researchers.

-

AP Sensing GmbH , AP Sensing GmbH is a German-based company which offers Distributed Fiber Optical Sensing (DFOS) technology in Distributed Temperature Sensing (DTS), Distributed Acoustic Sensing (DAS), and Distributed Vibration Sensing (DVS). AP Sensing GmbH was incorporated in 2007 and is headquartered at Boeblingen, Germany. The company operates in fire detection, well and reservoir monitoring, LNG & pipeline monitoring, power cable monitoring, and geological & hydrological applications industry. Services provided by the company include project engineering, concept and design, and training.

Value chain-based sizing & forecasting

Supply Side Estimates

-

Company revenue estimation via referring to annual reports, investor presentations, and Hoover’s.

-

Segment revenue determination via variable analysis and penetration modeling.

-

Competitive benchmarking to identify market leaders and their collective revenue shares.

-

Forecasting via analyzing commercialization rates, pipelines, market initiatives, distribution networks, etc.

Demand side estimates

-

Identifying parent markets and ancillary markets

-

Segment penetration analysis to obtain pertinent

-

revenue/volume

-

Heuristic forecasting with the help of subject matter experts

-

Forecasting via variable analysis

Distributed Fiber Optic Sensor Market Report Objectives:

-

Understanding market dynamics (in terms of drivers, restraints, & opportunities) in the countries.

-

Understanding trends & variables in the individual countries & their impact on growth and using analytical tools to provide high-level insights into the market dynamics and the associated growth pattern.

-

Understanding market estimates and forecasts (with the base year as 2023, historic information from 2017 to 2023, and forecast from 2024 to 2030). Regional estimates & forecasts for each category are available and are summed up to form the global market estimates.

Distributed Fiber Optic Sensor Market Report Assumptions:

-

The report provides market value for the base year 2023 and a yearly forecast till 2030 in terms of revenue/volume or both. The market for each of the segment outlooks has been provided on region & country basis for the above-mentioned forecast period.

-

The key industry dynamics, major technological trends, and application markets are evaluated to understand their impact on the demand for the forecast period. The growth rates were estimated using correlation, regression, and time-series analysis.

-

We have used the bottom-up approach for market sizing, analyzing key regional markets, dynamics, & trends for various products and end-users. The total market has been estimated by integrating the country markets.

-

All market estimates and forecasts have been validated through primary interviews with the key industry participants.

-

Inflation has not been accounted for to estimate and forecast the market.

-

Numbers may not add up due to rounding off.

-

Europe consists of EU-8, Central & Eastern Europe, along with the Commonwealth of Independent States (CIS).

-

Asia Pacific includes South Asia, East Asia, Southeast Asia, and Oceania (Australia & New Zealand).

-

Latin America includes Central American countries and the South American continent

-

Middle East includes Western Asia (as assigned by the UN Statistics Division) and the African continent.

Primary Research

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

-

Report/Market scope: If the market study is global, we send questionnaires to industry experts across various regions, including North America, Europe, Asia Pacific, Latin America, and MEA.

-

Market Penetration: If the market is driven by technological advancements, population density, disease prevalence, or other factors, we identify experts and send out questionnaires based on region or country dominance.

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."