Distributed Fiber Optic Sensor In Oil & Gas Market Size, Share & Trends Analysis Report By Type (Distributed Temperature Sensing, Distributed Acoustic Sensing), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-183-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

DFOS In Oil & Gas Market Size & Trends

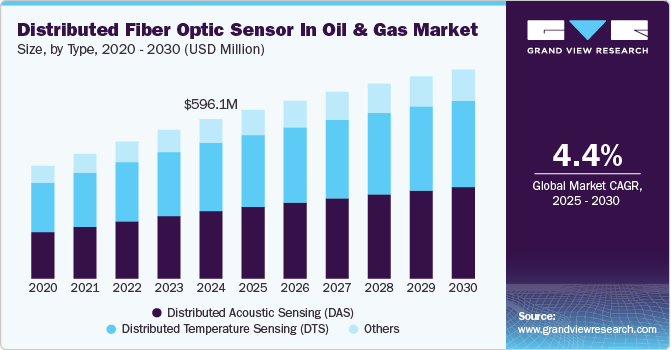

The global distributed fiber optic sensorin oil & gas market size was estimated at USD 596.1 million in 2024 and is expected to grow at a CAGR of 4.4% from 2025 to 2030. The growth is attributable to the surge in demand for continuous asset monitoring, emphasizing enhanced safety and security measures. Companies are increasingly adopting distributed fiber optic sensor (DFOS) technology to ensure uninterrupted operations, leveraging advancements in sensing technology for more accurate and sensitive monitoring of parameters like temperature and strain. The industry is also focusing on the cost efficiency and return on investment of DFOS solutions in oil & gas while ensuring compliance with regulatory standards.

The efficiency and cost-effectiveness offered by remote oversight significantly contribute to market expansion. DFOS reduces the necessity for constant on-site monitoring, optimizing resource allocation, and trimming operational costs. The growing adoption of remote surveillance aligns with industry demands for streamlined operations, making DFOS an attractive solution for companies seeking to enhance efficiency without compromising safety standards.

The oil and gas business has always been on the cutting edge of technical innovation, always looking for new ways to improve efficiency, safety, and environmental sustainability. Distributed fiber optic sensing (DFOS) is one such technique that has garnered significant traction in recent years. This cutting-edge technology can transform how oil and gas firms monitor and manage their assets by providing unmatched real-time data and insights that can enable smarter decision-making and optimize operations.

Distributed fiber optic sensing is a cutting-edge technique that employs light pulses to monitor numerous characteristics along the length of a fiber optic cable, such as temperature, pressure, and strain. Unlike standard point sensors, which only offer data at specific points, DFOS enables continuous monitoring over long distances, often up to tens of kilometers. As a result, it is an excellent choice for monitoring important infrastructure in the oil and gas industry, such as pipelines, wellbores, and offshore platforms.

DFOS's real-time monitoring capabilities enable the rapid detection of anomalies, leaks, or structural irregularities in distant or challenging locations, facilitating immediate responses and interventions. This proactive approach significantly reduces the likelihood of potential hazards or accidents, ensuring a safer operational environment. By continuously monitoring operations without geographical limitations, DFOS aids in preemptive risk mitigation and contributes to the industry's safety culture, aligning with stringent regulatory standards and fostering uninterrupted operations even in high-risk settings. Ultimately, the capacity of DFOS for remote surveillance embodies a critical asset in enhancing safety measures, preventing incidents, and maintaining a proactive stance toward safety within the Oil and gas industry.

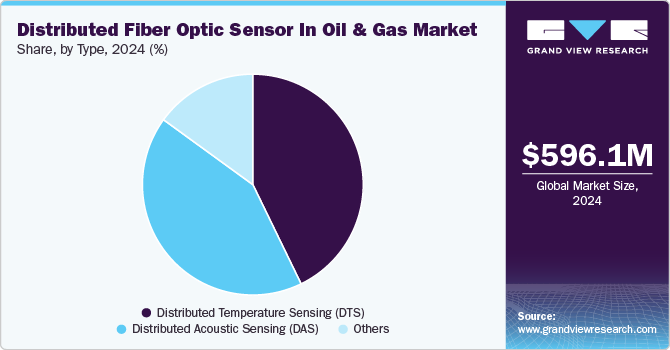

Type Insights

The Distributed Temperature Sensing (DTS) segment dominated the market with a revenue share of 42.8% in 2024. The demand for increased surveillance and security of infrastructure, such as oil and gas pipelines, transportation networks, power grids, and military facilities, is rapidly growing. In the oil and gas industry, DFOS systems play an essential role in monitoring pipelines for incursions and leaks, assuring the safety of both the environment and the neighboring populations.

The benefits of distributed temperature sensors, including accurate monitoring of operations such as drilling, well abandonment, and well completion, are expected to continue to drive their demand. Distributed Fiber Optic Sensing (DFOS) has transformed monitoring and surveillance systems in the oil and gas industry. The distributed temperature sensing (DTS) section of DFOS technology has emerged as a vital component for temperature monitoring over the full length of optical fibers. Factors such as advances in sensing technology and the growing focus of businesses on operational optimization are likely to drive the adoption of DTS in the oil and gas industry.

Distributed Acoustic Sensing (DAS) segment accounted to register a significant CAGR over a forecast period. Distributed acoustic sensing is being increasingly employed for monitoring and controlling pipeline systems. Well and reservoir monitoring are the primary types with the greatest potential to increase the penetration of distributed fiber optic sensing in the oil and gas sector. The significant use of distributed sensing techniques in the oil and gas sector is also influencing the increased use of distributed pressure and strain monitoring systems. The integration of DAS with smart automation and control systems is becoming more popular. This connection enables real-time reaction mechanisms based on acoustic data analysis, enabling prompt action in the event of abnormalities, or detected risks, thereby reducing operation and response times.

Regional Insights

North America DFOS in oil & gas market accounted for the highest share of 38.9% of the global revenue in 2024. The growing adoption of advanced technologies across a constantly increasing set of Types across industries in North America is driving the expansion of Distributed Fiber Optic Sensor (DFOS) technology. This trend fuels ongoing advancements in fiber optics and sensing technologies, resulting in the evolution of increasingly sophisticated and effective DFOS systems. These continual improvements are likely to stimulate the adoption of DFOS within the oil and gas sector, which may help businesses gain enhanced monitoring capabilities and optimize their operational efficiency. Moreover, North America has a well-established oil and gas infrastructure and expertise to integrate and leverage DFOS technology effectively, driving its growth within the sector.

U.S. DFOS in Oil & Gas Market Trends

The DFOS in oil & gas market in the U.S. held a dominant position in 2024. Technology’s ability to provide real-time monitoring and enhance operational efficiency is making it an attractive option for industries focused on safety and cost-effectiveness. Furthermore, advancements in fiber optic technology are facilitating the development of more sophisticated DFOS systems, positioning North America as a leader in this evolving market landscape.

Europe DFOS in Oil & Gas Market Trends

Europe DFOS in oil & gas market is also growing. The versatility of DFOS applications, which include aerospace, defense, and environmental monitoring, underscores its strategic importance in enhancing operational efficiency and risk management. As European industries increasingly adopt DFOS solutions, the region is solidifying its position as a significant player in the global sensing landscape.

Asia Pacific DFOS in Oil & Gas Market Trends

The DFOS in oil & gasmarket in Asia Pacific is anticipated to grow at a significant CAGR from 2025 to 2030. The region’s push toward digitalization and sustainable energy practices has boosted the adoption of DFOS, allowing for more cost-effective maintenance and minimizing the environmental impact of oil and gas operations. Governments and private companies are investing in advanced monitoring technologies as part of their infrastructure modernization plans, contributing to DFOS's significant growth potential in the region.

Key Distributed Fiber Optic Sensor In Oil & Gas Company Insights

The market is characterized by strong competition, with a few major worldwide competitors owning a significant market share. The major focus is developing new products and collaborating among the key players.

-

Luna Innovations specializes in fiber optic-based technology, offering advanced solutions in the Distributed Fiber Optic Sensing (DFOS) industry. The company focuses on developing products for sensing, test and measurement, monitoring, and control, tailored to meet the specific needs of its clients. With a commitment to safety, security, and connectivity, Luna leverages its expertise to enhance operational performance across various sectors. Their core values emphasize ownership, integrity, creativity, enthusiasm, and a results-oriented approach, ensuring that they consistently deliver innovative and effective solutions to their customers.

-

OFS Fitel, LLC manufactures and provides fiber optic cables, connectivity services, designing and manufacturing services, and solutions related to optical fiber telecommunication. The company also offers oil & gas Distributed Temperature Sensing (DTS) and high-strength fiber cables for various industrial, indoor, and outdoor applications. In addition, it provides optical fiber solutions for industries and sectors such as government, aerospace, medical, industrial networking, telecommunications, and defense.

Key Distributed Fiber Optic Sensor In Oil & Gas Companies:

The following are the leading companies in the distributed fiber optic sensor in oil & gas market. These companies collectively hold the largest market share and dictate industry trends.

- Bandweaver

- Brugg Kable AG

- Halliburton

- Luna Innovations Inc.

- OFS Fitel, LLC

- Omnisens SA

- SLB

- Yokogawa Electric Corporation

Recent Developments

-

In August 2024, OFS announced the expansion of its global manufacturing capabilities to meet the rising demand for ultra-high fiber count (UHFC) cables in hyperscale markets, driven by the growth of artificial intelligence (AI) applications. This strategic enhancement reinforces OFS's commitment to providing high-capacity connectivity solutions, including a diverse range of fiber optic products designed for both Outside Plant and Inside Plant applications.

-

In December 2023, Yokogawa Electric Corporation, through its subsidiaries Yokogawa Solution Service and Yokogawa Digital, announced a collaboration with Cosmo Oil Co., Ltd. to drive digital transformation in the refining industry. The collaboration aimed to forge a path to a fully digitized refinery future, with robot-driven inspection and maintenance as a key cornerstone.

-

In February 2023, Gyrodata Incorporated, a company specializing in gyroscopic wellbore tracking and survey technology, was bought by SLB. With this transaction, both companies were able to improve wellbore quality and lower drilling risks in order to unlock complicated and remote reserves. Moreover, SLB technology can be combined with three-axis solid-state gyro measurements to improve drilling efficiency.

Distributed Fiber Optic Sensor In Oil & Gas Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 630.9 million |

|

Revenue forecast in 2030 |

USD 781.2 million |

|

Growth rate |

CAGR of 4.4% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Market revenue in USD million & CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

Bandweaver; Brugg Kable AG; Halliburton; Luna Innovations Inc., OFS Fitel, LLC; Omnisens SA; SLB; Yokogawa Electric Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Distributed Fiber Optic Sensor In Oil & Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global distributed fiber optic sensor in oil & gas market report based on type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distributed Temperature Sensing (DTS)

-

Distributed Acoustic Sensing (DAS)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global distributed fiber optic sensor in oil & gas market size was estimated at USD 596.1 million in 2024 and is expected to reach USD 630.9 million in 2025.

b. The global distributed fiber optic sensor in oil & gas market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 781.2 million by 2030.

b. North America dominated the DFOS in Oil & Gas market with a share of 39.3% in 2024. The growing adoption of advanced technologies across a constantly increasing set of Types across industries in North America is driving the expansion of Distributed Fiber Optic Sensor (DFOS) technology.

b. Some key players operating in the distributed fiber optic sensor in oil & gas market include: Bandweaver; Brugg Kable AG; Halliburton; Luna Innovations Inc.; OFS Fitel, LLC; Omnisens SA; SLB; Yokogawa Electric Corporation

b. The factors driving the market growth include, the efficiency and cost-effectiveness offered by remote oversight significantly contribute to market expansion. DFOS reduces the necessity for constant on-site monitoring, optimizing resource allocation, and trimming operational costs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."