Distributed Denial Of Service Protection Market Size, Share, & Trends Analysis Report By Component, By Application, By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-412-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global distributed denial of service protection market size was estimated at USD 4.31 billion in 2023 and is expected to grow at a CAGR of 14.8% from 2024 to 2030. The rising frequency and sophistication of distributed denial of service (DDoS) attacks play a significant role in driving market growth. Attackers have developed more advanced techniques to overwhelm and disrupt these systems as businesses and critical infrastructure become more reliant on digital systems. Modern DDoS attacks often involve large-scale botnets and sophisticated methods to bypass traditional security measures, necessitating more advanced protection solutions. This constant evolution in attack methods creates a persistent demand for cutting-edge DDoS protection technologies.

Moreover, the growing awareness among organizations about the financial and reputational damage that can result from a successful DDoS attack fuels market growth. High-profile service outages and data breaches have highlighted the importance of robust security measures. As a result, companies across various industries are increasingly investing in DDoS protection solutions to safeguard their operations, enhance customer trust, and avoid the substantial costs associated with downtime and recovery. This heightened awareness drives both increased adoption and expenditure on DDoS protection services.

In addition, regulatory and compliance requirements push organizations to enhance their cybersecurity measures, including DDoS protection. Increasingly stringent regulations and industry standards mandate businesses implement adequate security controls to protect sensitive data and ensure uninterrupted service. Compliance with these regulations often involves adopting advanced DDoS protection solutions, thus driving market growth.

Component Insights

The services segment accounted for the largest market share of 41.4% in 2023. Many organizations are opting for managed DDoS protection services as they seek to leverage the expertise and resources of specialized service providers. Managed services offer several advantages, including 24/7 monitoring, dedicated support, and expertise in dealing with complex attacks. This demand for outsourced solutions, driven by the need for specialized skills and cost efficiency, is contributing to the expansion of the DDoS protection service market.

The software solutions segment is expected to grow at a CAGR of 14.7% during the forecast period. The rapid advancements in software technology play a crucial role in the growth of this segment. Modern DDoS protection software leverages artificial intelligence (AI) and machine learning innovations to enhance threat detection and response capabilities. These technologies enable software solutions to analyze patterns, identify anomalies, and respond to real-time attacks, improving their effectiveness. Continuous updates and improvements in software capabilities ensure that organizations have access to the latest defense mechanisms against evolving DDoS threats, further fueling the demand for sophisticated software solutions.

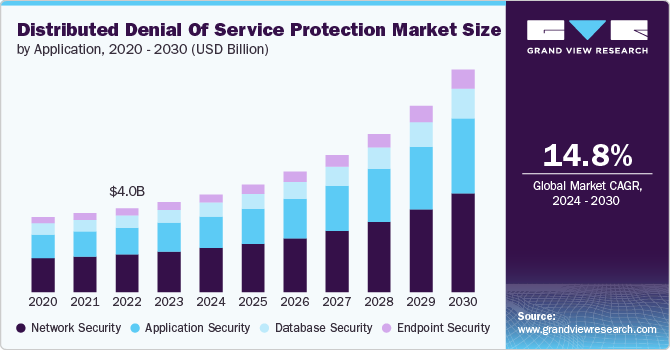

Application Insights

The network security segment held a market share of over 44% in 2023 and is expected to dominate the market over the forecast period. The widespread shift to remote work, accelerated by the COVID-19 pandemic, and the ongoing digital transformation across industries have also contributed to the growth of DDoS protection for network security applications. With more employees accessing corporate networks remotely, the attack surface has expanded, making it easier for cybercriminals to launch DDoS attacks. Moreover, as businesses continue to digitize their operations, integrating cloud services and online platforms, their network security requirements have become more complex. There is an increased demand for robust DDoS protection solutions to secure these increasingly distributed and digitalized networks.

The application security segment is expected to grow at a CAGR of 15.5% over the forecast period. The increasing prevalence of application-layer DDoS attacks is driving the market's growth. Unlike traditional DDoS attacks that target network infrastructure, application-layer attacks focus on specific web applications, aiming to exhaust server resources by overwhelming them with seemingly legitimate requests. These attacks are insidious because they mimic regular user behavior, making them harder to detect and mitigate with traditional network-based defenses.

Deployment Insights

The cloud segment held a significant market share in 2023 and is expected to dominate the market up to 2030. The widespread adoption of cloud computing across various industries is a major driver for the growth of cloud-based DDoS protection. As more organizations migrate their operations, applications, and data to the cloud, securing these environments from DDoS attacks has become critical. Cloud environments, while offering numerous benefits such as scalability and flexibility, are also exposed to a broader range of cyber threats. As a result, organizations are increasingly turning to cloud-based DDoS protection solutions designed to safeguard cloud infrastructure and applications from potential attacks. This trend is accelerating as businesses embrace cloud services as part of their digital transformation strategies.

The hybrid segment is expected to grow at a CAGR of 14.3% over the forecast period. The hybrid approach combines the best aspects of on-premise and cloud-based DDoS protection. On-premise solutions provide rapid response capabilities, low latency, and direct control over security measures, crucial for immediate threat mitigation and compliance with regulatory requirements. In contrast, cloud-based solutions offer scalability, redundancy, and the ability to handle large-scale attacks that exceed the capacity of on-premise infrastructure. By integrating these two approaches, hybrid solutions ensure organizations have a layered defense strategy capable of addressing localized and widespread threats. This comprehensive coverage is a significant advantage, driving the adoption of hybrid DDoS protection in various industries.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 64% in 2023. Maintaining customer trust and ensuring business continuity are paramount for large enterprises. A successful DDoS attack that disrupts services can lead to customer dissatisfaction, loss of confidence, and potential customer churn. Large enterprises recognize the importance of safeguarding their operations against such threats and are investing in DDoS protection to ensure that their services remain uninterrupted.

The SMEs segment is expected to grow at a CAGR of 15.1% over the forecast period. Compared to larger enterprises, the increasing frequency of targeted cyberattacks against smaller businesses drives market growth. Historically, SMEs were not considered primary targets for DDoS attacks, which were more commonly directed at larger enterprises. However, cybercriminals have increasingly recognized that SMEs often lack the sophisticated security infrastructure of larger organizations, making them easier targets. As a result, DDoS attacks on SMEs have risen, prompting these businesses to invest in protection solutions to safeguard their operations.

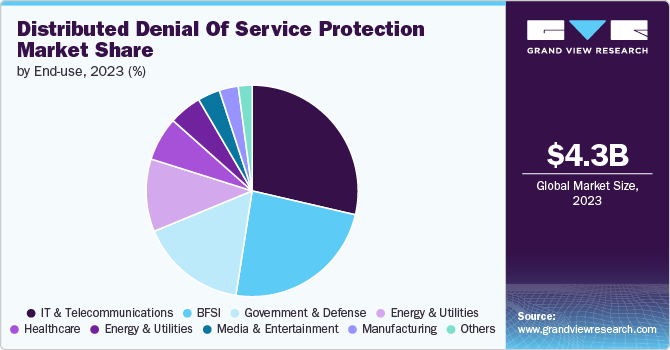

End-use Insights

The BFSI segment accounted for the largest market share of over 23% in 2023. The need to protect sensitive financial data fuels the adoption of DDoS in the BFSI sector. Financial institutions handle vast amounts of susceptible information, including personal customer details, payment card data, and transaction records. A DDoS attack that disrupts the availability of financial services could expose this data to unauthorized access, leading to data breaches and economic loss. The potential impact of such incidents on the institution and its customers has led to an increased focus on securing data through comprehensive DDoS protection measures that prevent service disruptions and protect data integrity.

The retail and e-commerce segment is expected to grow at a CAGR of 16.3% during the forecast period. Adopting omnichannel retail strategies, where businesses integrate their online and offline operations to provide a seamless customer experience, also drives the need for robust DDoS protection. In an omnichannel environment, online service disruptions can have ripple effects on other parts of the business, such as inventory management, in-store services, and customer support. Ensuring the continuous availability of digital platforms is essential for maintaining the smooth operation of these interconnected systems. As more retailers embrace omnichannel strategies, the importance of comprehensive DDoS protection becomes increasingly apparent.

Regional Insights

North America held the largest market share of over 37% in the distributed denial of service (DDoS) protection market in 2023. The rapid expansion of the Internet of Things (IoT) in North America significantly contributes to the growth of DDoS protection. The increasing number of connected devices in industries such as manufacturing, healthcare, and smart cities has created new opportunities for cybercriminals to launch DDoS attacks by exploiting vulnerabilities in IoT networks.

U.S. Distributed Denial Of Service Protection Market Trends

The distributed denial of service (DDoS) protection platform market in the U.S. is growing significantly at a CAGR of 13.4% from 2024 to 2030. The integration of DDoS protection with broader cybersecurity strategies is fueling growth in the U.S. By integrating DDoS protection with other security measures, such as firewalls, intrusion detection systems, and security information and event management (SIEM) solutions, businesses create a comprehensive defense strategy that addresses a wide range of cyber threats. This integrated approach underscores the importance of DDoS protection as a critical component of overall cybersecurity efforts.

Asia Pacific Distributed Denial Of Service Protection Market Trends

The distributed denial of service (DDoS) protection market in Asia Pacific is growing significantly at a CAGR of 16.2% from 2024 to 2030. The Asia Pacific region has experienced significant internet and mobile penetration growth over the past decade. This rapid digital expansion has increased reliance on online platforms and services, making businesses more vulnerable to DDoS attacks. As the number of digital users and online transactions rises, the need for effective DDoS protection solutions becomes more pressing to ensure the security and availability of these critical digital assets.

Europe Distributed Denial Of Service Protection Market Trends

The distributed denial of service (DDoS) protection platform market in Europe is growing significantly at a CAGR of 14.3% from 2024 to 2030. Ongoing investment in technology and infrastructure upgrades in Europe significantly drives the growth of DDoS protection. As businesses and governments modernize their IT infrastructure and adopt new technologies, such as cloud computing and Internet of Things (IoT) devices, the need for adequate DDoS protection becomes more apparent.

Key Distributed Denial Of Service Protection Company Insights

The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Nokia unveiled advanced countermeasures to maintain protection against distributed denial-of-service (DDoS) attacks, particularly those originating from botnets and targeting application-level vulnerabilities. The new solutions leverage the Nokia 7750 Defender Mitigation System, which utilizes an advanced countermeasures engine to detect and mitigate real-time DDoS attacks. By employing sophisticated analytics and machine learning, the system can identify abnormal traffic patterns and automatically deploy targeted defenses, significantly reducing the impact of attacks on critical services.

-

In April 2024, Lightpath launched its enhanced DDoS protection solution, the LP DDoS Shield, designed to safeguard networks against the increasing sophistication and scale of distributed denial-of-service (DDoS) attacks. The system utilizes advanced detection and mitigation technologies from Radware, a recognized leader in cybersecurity solutions. The LP DDoS Shield employs AI-powered algorithms to identify and neutralize zero-day attacks effectively-those without prior data-along with various other threats, including IoT-based attacks and phantom floods.

Key Distributed Denial Of Service Protection Companies:

The following are the leading companies in the distributed denial of service protection market. These companies collectively hold the largest market share and dictate industry trends.

- A10 Networks, Inc.

- Akamai Technologies

- Cloudflare, Inc.

- Corero

- F5, Inc.

- Fortinet, Inc.

- Imperva

- NETSCOUT

- Radware

- TransUnion LLC.

Distributed Denial Of Service Protection Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.68 billion |

|

Revenue forecast in 2030 |

USD 10.69 billion |

|

Growth rate |

CAGR of 14.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, deployment, enterprise size, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

A10 Networks, Inc.; Akamai Technologies; Cloudflare, Inc.; Corero; F5, Inc.; Fortinet, Inc.; Imperva; NETSCOUT; Radware ; TransUnion LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Distributed Denial Of Service Protection Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For the purpose of this study, Grand View Research has segmented the global distributed denial of service protection market report based on component, enterprise size, deployment, application, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Security

-

Application Security

-

Database Security

-

Endpoint Security

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecommunications

-

Government & Defense

-

Energy and Utilities

-

Manufacturing

-

Retail and E-commerce

-

Media & Entertainment

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global distributed denial of service protection market size was estimated at USD 4.31 billion in 2023 and is expected to reach USD 4.68 billion in 2024.

b. The global distributed denial of service protection market is expected to grow at a compound annual growth rate of 14.8% from 2024 to 2030 to reach USD 10.69 billion by 2030.

b. Network security segment dominated the distributed denial of service (DDoS) protection market with a share of over 44% in 2023. The widespread shift to remote work, accelerated by the COVID-19 pandemic, and the ongoing digital transformation across industries contributed to the growth of DDoS protection for network security applications.

b. Some key players operating in the DDoS protection market include A10 Networks, Inc.; Akamai Technologies; Cloudflare, Inc.; Corero; F5, Inc.; Fortinet, Inc.; Imperva; NETSCOUT; Radware; TransUnion LLC.

b. The growing awareness among organizations about the financial and reputational damage that can result from a successful DDoS attack fuels market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."