- Home

- »

- Beauty & Personal Care

- »

-

Disposable Hygiene Products Market, Industry Report, 2033GVR Report cover

![Disposable Hygiene Products Market Size, Share & Trends Report]()

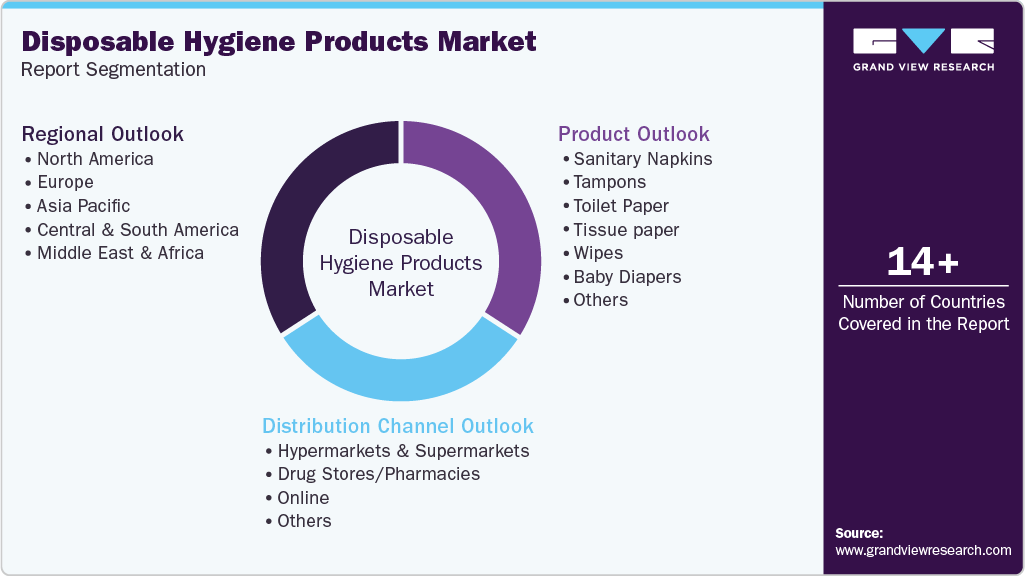

Disposable Hygiene Products Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Sanitary Napkins, Tampons), By Distribution Channel (Hypermarkets & Supermarkets, Drug Stores/Pharmacies, Online), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-144-8

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Disposable Hygiene Products Market Summary

The global disposable hygiene products market size was estimated at USD 240.62 billion in 2025 and is projected to reach USD 354.82 billion by 2033, growing at a CAGR of 5.0% from 2026 to 2033. The market for disposable hygiene products is experiencing sustained growth due to a structural shift in consumer attitudes toward health, cleanliness, and disease prevention.

Key Market Trends & Insights

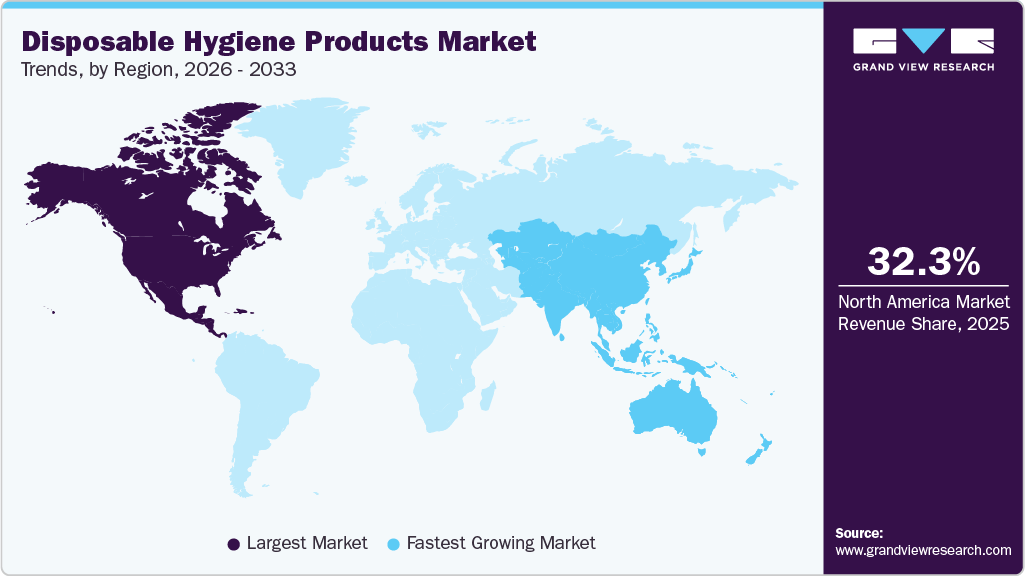

- North America dominated the global disposable hygiene products market with the largest revenue share of 32.3% in 2025.

- The disposable hygiene products industry in the U.S. accounted for the largest market revenue share in North America in 2025.

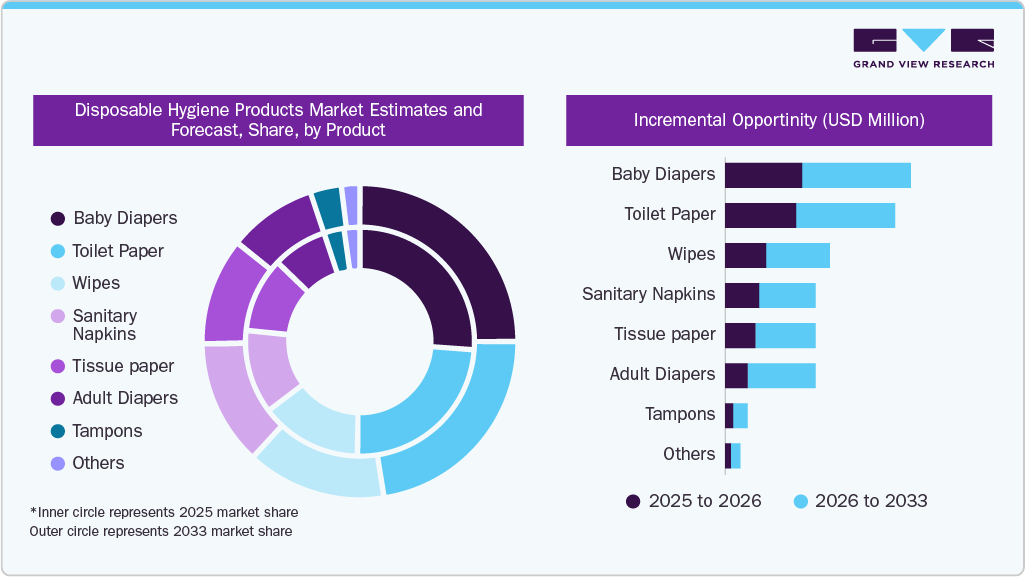

- By product, the baby diapers led the market with the largest revenue share of 26.1% in 2025.

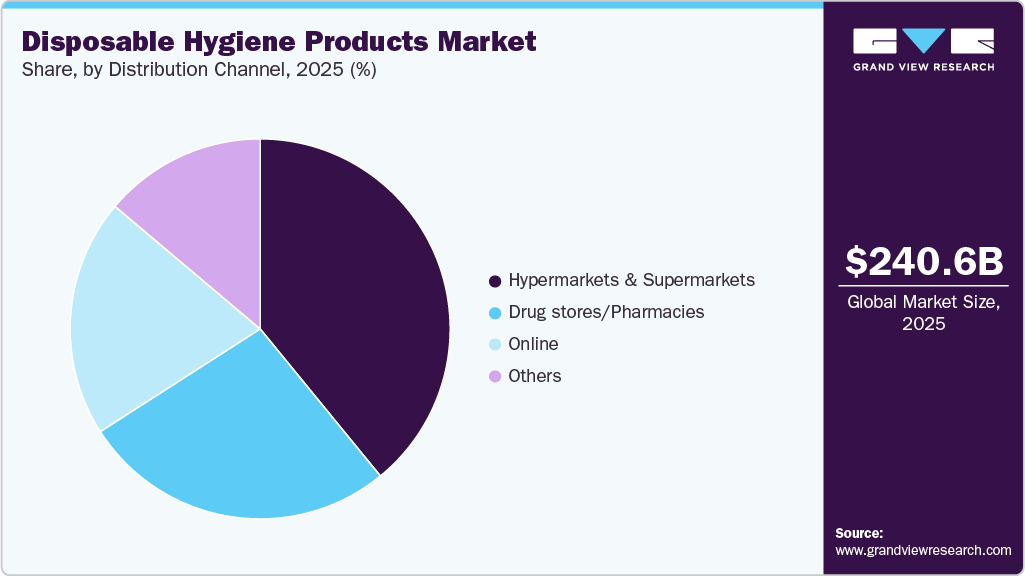

- By distribution channel, the hypermarkets & supermarkets led the market with the largest revenue share of 39.1% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 240.62 Billion

- 2033 Projected Market Size: USD 354.82 Billion

- CAGR (2026-2033): 5.0%

- North America: Largest revenue share in 2025

- Asia Pacific: Fastest growing market

Increased awareness of personal hygiene, accelerated during and after the COVID-19 pandemic, has reinforced the perception of disposable products as safer and more convenient alternatives to reusable options.This trend is particularly pronounced in urban areas, where fast-paced lifestyles and increasing female workforce participation favor ready-to-use hygiene solutions such as baby diapers, sanitary napkins, adult incontinence products, wipes, and tissues.

Consumer preferences in the hygiene products market are increasingly shaped by convenience, comfort, and perceived safety. Buyers favor products that offer high absorbency, leakage protection, odor control, and ease of disposal, while also being gentle on the skin. There is a growing preference for premium and dermatologically tested products, particularly among urban and middle-income consumers, driven by higher awareness of skin health and long-term comfort.

At the same time, environmental consciousness is influencing purchasing behavior, with a rising share of consumers seeking biodegradable, plant-based, or responsibly sourced disposable hygiene products. Digital channels play an important role in shaping preferences, as consumers rely on online reviews, product comparisons, and home delivery, especially for sensitive product categories such as feminine hygiene and adult incontinence.

Technological innovation has significantly enhanced the performance and acceptance of modern disposable hygiene products. Advances in absorbent core design, particularly the use of superabsorbent polymers and multi-layer fluid distribution systems, have enabled thinner, lighter products with superior moisture retention and reduced leakage. Manufacturers are also incorporating breathable back sheets, hypoallergenic linings, and alcohol-free or fragrance-free formulations to minimize skin irritation.

Government-led hygiene awareness and education campaigns have played a critical role in expanding the adoption of disposable hygiene products, particularly in emerging markets. In India, national initiatives such as the Menstrual Hygiene Scheme and the Swachh Bharat Mission have focused on improving access to sanitation infrastructure, promoting menstrual hygiene awareness, and encouraging safe disposal practices. These programs are complemented by school-based WASH (Water, Sanitation, and Hygiene) initiatives and state-level campaigns that address cultural taboos, behavioral change, and basic hygiene education.

Product Insights

The baby diapers segment led the market with the largest revenue share of 26.1% in 2025. Modern parents increasingly prefer disposable diapers for their convenience, time efficiency, and improved absorbency, especially in urban households with dual-income families. Advancements in diaper technology, such as ultra-thin cores, better leak protection, breathable materials, and skin-friendly designs, have further enhanced product appeal and reduced concerns around rashes and discomfort. In addition, rising per-capita income, improving access through supermarkets and e-commerce, and greater penetration in emerging markets are supporting higher adoption rates.

The adult diapers segment is expected to grow at the fastest CAGR of 7.1% from 2026 to 2033, due to rapid population aging, increasing life expectancy, and a growing prevalence of conditions such as urinary incontinence, mobility impairment, post-surgical recovery needs, and chronic diseases. Greater awareness and reduced stigma around incontinence care have encouraged more adults to adopt disposable solutions for daily comfort and dignity. In addition, product innovations such as thin, breathable designs, odor control, skin-friendly materials, and improved absorbency have enhanced user acceptance. The expansion of home healthcare, assisted living, and long-term care services, combined with wider availability through pharmacies and e-commerce channels, is further accelerating adoption, making adult diapers a fast-growing segment within the disposable hygiene products industry.

Distribution Channel Insights

The hypermarkets & supermarkets segment led the market with the largest revenue share of 39.1% in 2025, primarily due to their convenience, visibility, and value-driven purchasing environment. These retail formats offer consumers one-stop shopping, allowing them to purchase hygiene products such as diapers, sanitary napkins, wipes, and adult incontinence products alongside routine grocery items. Wide shelf space, in-store promotions, bulk discounts, and private-label options make hypermarkets and supermarkets particularly attractive for price-sensitive and family shoppers. In addition, strong brand presence, product comparability, and immediate product availability encourage impulse and repeat purchases.

The online segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. Consumers increasingly prefer e-commerce platforms for routine hygiene purchases as they offer home delivery, subscription options, and bulk buying, reducing the need for frequent store visits. Online channels also provide greater discretion, which is particularly important for products such as feminine hygiene, adult incontinence, and personal care wipes. In addition, digital platforms enable consumers to compare prices, access a wider range of brands and product variants, and take advantage of promotional discounts. The growing penetration of smartphones, improved logistics networks, and trust in online payments have further strengthened consumer confidence in purchasing disposable hygiene products online, supporting the sustained growth of this channel.

Regional Insights

North America dominated the global disposable hygiene products market with the largest revenue share of 32.3% in 2025. Increasing health and hygiene awareness, a growing aging population, and rising demand for convenience-driven products like wipes, diapers, and sanitary items are fueling consumption. In addition, higher disposable incomes and busy lifestyles support the use of single-use hygiene solutions. Innovations in product comfort, skin-friendliness, and sustainability, such as biodegradable or plant-based materials, are also attracting more consumers.

U.S. Disposable Hygiene Products Market Trends

The disposable hygiene products market in the U.S. accounted for the largest market revenue share in North America in 2025. Increased participation of women in the workforce, longer working hours, and urban living have boosted demand for time-saving, single-use hygiene solutions such as disposable wipes, feminine hygiene products, adult incontinence products, and paper-based personal care items. Rising public awareness of infection prevention following recent public health events has further reinforced consumer preference for disposable, touch-free, and contamination-reducing products, particularly in healthcare, childcare, and household applications, thereby supporting steady market growth across the U.S.

Europe Disposable Hygiene Products Market Trends

The disposable hygiene products market in Europe is expected to grow at a significant CAGR of 4.8% from 2026 to 2033. Increased health consciousness following the COVID-19 pandemic has reinforced regular use of disposable products such as sanitary napkins, baby diapers, adult incontinence products, wipes, and medical hygiene disposables, particularly in households, healthcare settings, and elderly care facilities. Europe’s aging population is a key demand driver, with the rising incidence of urinary incontinence and long-term care needs supporting sustained demand for adult hygiene products. In addition, urbanization and higher female workforce participation have increased the preference for convenient, time-saving disposable solutions. Product innovation focused on skin-friendly materials, biodegradable components, and sustainable packaging is also encouraging adoption, as manufacturers align offerings with Europe’s strong environmental and regulatory expectations.

Asia Pacific Disposable Hygiene Products Market Trends

The disposable hygiene products market in the Asia Pacific is expected to register at the fastest CAGR of 5.6% from 2026 to 2033. The disposable hygiene products industry in the Asia Pacific is rising rapidly due to a combination of population growth, urbanization, and improving hygiene awareness across both developing and emerging economies. Rising household incomes and expanding middle-class populations in countries such as China, India, Indonesia, and Vietnam are increasing the adoption of convenient, single-use hygiene solutions, including diapers, sanitary napkins, wipes, and adult incontinence products. In parallel, greater female workforce participation and changing lifestyles are driving demand for time-saving and portable hygiene products. In addition, government-led sanitation and public health initiatives, improved retail penetration, and strong growth in e-commerce and organized retail are enhancing product accessibility in urban and semi-urban areas.

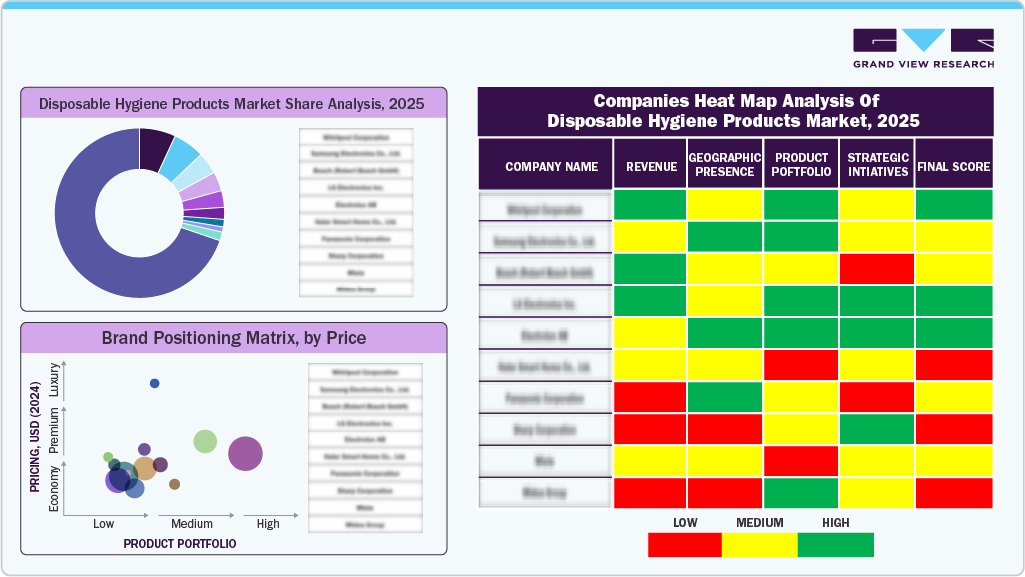

Key Disposable Hygiene Products Company Insights

The presence of a few established players and new entrants characterizes the market. Many big players are increasing their focus on the growing trend of the disposable hygiene products industry. Players in the market are diversifying their service offerings in order to maintain market share.

Key Disposable Hygiene Products Companies:

The following key companies have been profiled for this study on the disposable hygiene products market.

- Procter & Gamble

- Kimberly-Clark Corporation

- Johnson & Johnson Services, Inc.

- Essity AB

- Unicharm Corporation

- Ontex Group NV

- Domtar Corporation

- Kao Corporation

- Edgewell Personal Care Company

- Hengan International Group Co. Limited

Recent Developments

-

In October 2025, Charmin introduced the “Forever Roll,” an oversized toilet paper roll with about 1,700 sheets, designed to last up to a month in a two-person household, which is roughly 32 times larger than a standard roll and sold at major retailers like Walmart, Target, and Amazon with a 30-day money-back guarantee.

-

In September 2025, Tulips, a leading Indian personal hygiene brand, entered the adult hygiene segment with TULIPS Adult Diaper Pants and appointed actor Boman Irani as brand ambassador for its “Life par full control” campaign to destigmatize adult diaper use in India. The unisex pull-up diapers feature an aloe vera-coated inner sheet, up to 10-hour leak protection with ADL, odour lock technology, and tear-away side panels for comfort and dignity. At the same time, the campaign uses a short film to encourage seniors with urinary incontinence to maintain active, independent lives. The launch builds on Tulips’ innovation legacy, including 100% flushable wet wipes and India’s first Covid swabs, with over 60 million product units consumed annually in more than 17 countries.

Disposable Hygiene Products Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 251.66 billion

Revenue forecast in 2033

USD 354.82 billion

Growth rate

CAGR of 5.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Procter & Gamble; Kimberly-Clark Corporation; Johnson & Johnson Services, Inc.; Essity AB; Unicharm Corporation; Ontex Group NV; Domtar Corporation; Kao Corporation; Edgewell Personal Care Company; Hengan International Group Co. Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Disposable Hygiene Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global disposable hygiene products market report based on the product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sanitary Napkins

-

Tampons

-

Toilet Paper

-

Tissue paper

-

Wipes

-

Baby Diapers

-

Adult Diapers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Drug Stores/Pharmacies

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global disposable hygiene products market was estimated at USD 240.62 billion in 2025 and is expected to reach USD 251.67 billion in 2026.

b. The global disposable hygiene products market is expected to grow at a compound annual growth rate of 5.0% from 2026 to 2033 to reach USD 354.82 billion by 2033.

b. Baby diapers dominated the disposable hygiene products market with a share of 26.1% in 2025. Modern parents increasingly prefer disposable diapers for their convenience, time efficiency, and improved absorbency, especially in urban households with dual-income families.

b. Some of the key players operating in the disposable hygiene products market include Procter & Gamble; Kimberly-Clark Corporation; Johnson & Johnson Services, Inc.; Essity AB; Unicharm Corporation; Ontex Group NV; Domtar Corporation; Kao Corporation; Edgewell Personal Care Company; and Hengan International Group Co. Limited.

b. Key factors that are driving the disposable hygiene products market growth include the growing awareness regarding health and hygiene among consumers , government healthcare agencies have been implementing awareness campaigns focused on personal hygiene, coupled with the rising number of working women are increasingly opting for premium tampons, panty liners, and pads to meet their menstrual management requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.